Altcoins Poised for Breakout as Adoption and Liquidity Strengthen

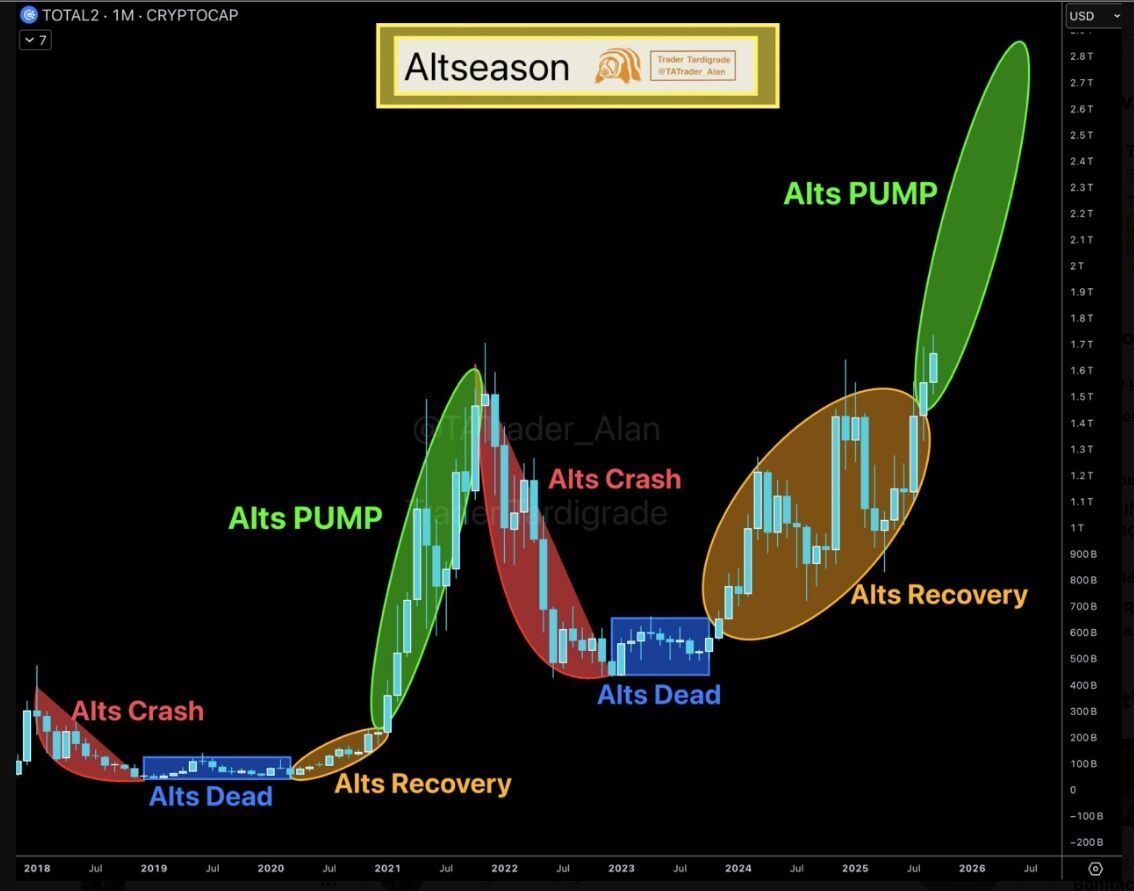

Altseason is back in focus as altcoins break from recovery into an early pump cycle. Market cap momentum now points toward the $2.5T level, echoing past explosive rallies.

Additionally, the monthly chart for Total2, which excludes Bitcoin’s cap, highlighted that altcoins are breaking from recovery into a new expansion phase. Having consolidated to the tune of $1.6T, the market is constructing higher lows, showing evident strength signals. Resistance is close at $1.8T, with support at around $1.5T. This pattern is similar to a rounded bottom breakout, as it was with historical accumulation zones before big rallies.

TOTAL2 1M CHART | SOURCE: X

Moreover, cycles in the altcoin market remain consistent. Each phase began with a pump before it collapsed into a crash, drifting in a “dead” range. Recovery followed, and finally, another breakout set up a new cycle .

Nevertheless, in 2018, altcoins stagnated before a steep upward trend to new heights in 2021. The same trend repeated in 2022-23, resulting in the current recovery. Both liquidity and momentum have improved, indicating that the market has gone into its second pump stage.

Further, this case is reinforced by analysts' comparisons. While, altcoin Trader Tardigrade observed the transition to the expansion stage of altcoins, while analyst Ardizor pointed to similarities in structure to that of 2017 cycle. Technical patterns, rounded bottoms, downward channels, and breakout boxes, in all instances, indicated increased dominance and capital rotation into alts . All these cues point to the increasing belief that the past might be recurring.

ALTSEASON CHART | SOURCE: X

Geopolitics Fuel Altcoin Market Expansion

Price action is closely associated with the acceptance and regulation changes. Spillover liquidity from other tokens is being generated by institutional inflows in Bitcoin via ETFs and corporate treasury flows.

At the same time, more capital is being invested into decentralized ecosystems due to geopolitical pressures surrounding AI chips and blockchain infrastructure. Similarities to the 2017 cycle point to a technical similarity and a fundamentally expanding nature that offers deeper roots to this cycle.

Altcoins Poised for Breakout as Adoption and Liquidity Strengthen

Growth in the real-world utility is evident in several sectors. Smart contract platforms integration with enterprise systems is on the rise, while institutional level liquidity gets attracted to DeFi protocols.

In addition, network efficiency enhanced by staking and cross-chain solutions has improved valuation potential. These, together with high liquidity and better infrastructure, provide a base to sustainable growth.

Altcoins have both upward and downward aspects in the short run. A decisive breakout higher than $1.8T might help trigger a trend to a higher level of $2.5T and more. On the other hand, inability to maintain support at $1.5T will result in another consolidation.

Also, market cycles indicate that the subsequent growth stage is underway, yet macro forces such as the U.S. monetary policy or a change in Bitcoin dominance may affect the rate. For now, momentum, adoption, and liquidity argue that the pump phase has only just started.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。