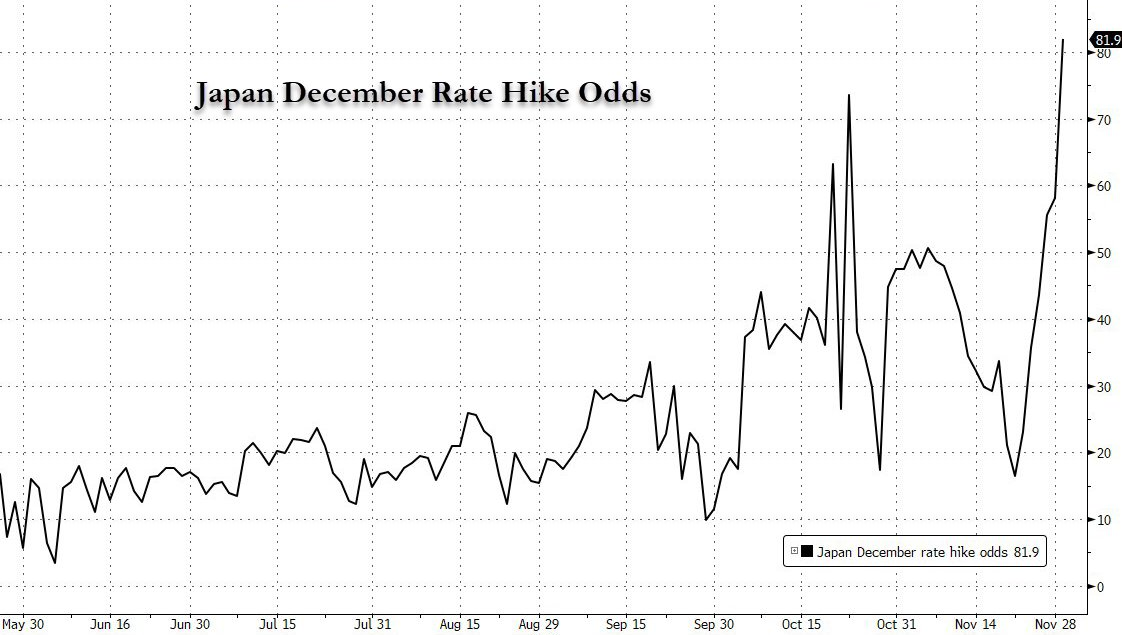

On December 1, Bank of Japan Governor Kazuo Ueda, in a rare speech, directly mentioned the upcoming monetary policy meeting scheduled for December 18-19, stating that decisions would be made "as appropriate." This statement was interpreted by investment banks as a strong signal of a policy shift, leading to a sharp increase in market expectations for a rate hike by the bank in December—pricing for the possibility of a rate hike surged from 20% ten days ago to 80%.

Japanese government bond yields rose across the board to recent highs, and the narrowing of the US-Japan interest rate differential pushed the USD/JPY exchange rate down. Bitcoin, as a barometer of "carry trades," almost completely retraced its gains from the past ten days within hours. The potential actions of the Bank of Japan are becoming another straw on the back of the cryptocurrency market, with concerns growing that if the Bank of Japan unexpectedly raises rates on Christmas Eve, it could trigger a market shock similar to the "carry trade massacre" of December 2022.

The "Detonator" of Yen Carry Trades

The so-called yen carry trade is based on the core logic of utilizing the long-term low or even negative interest rates of the yen. Investors borrow yen at extremely low costs and invest in higher-yielding risk assets such as Bitcoin, high-yield bonds, and tech stocks, profiting from both interest rate differentials and asset appreciation. For decades, the Bank of Japan's loose monetary policy has provided fertile ground for such trades, and a large amount of low-cost yen funding has become one of the important forces supporting liquidity in the cryptocurrency market.

Although Governor Ueda had previously hinted at hawkishness, this direct reference to specific meeting dates is interpreted as the clearest signal of a policy shift since he took office. The market reacted immediately; as expectations heated up, Japan's two-year government bond yields climbed to their highest level since 2008, and the yen appreciated against the dollar, indicating that the financing cost of the yen is rising rapidly, sharply compressing the profit margins of carry trades.

For investors, when financing costs exceed expected asset returns, closing out carry trades becomes an inevitable choice—selling off risk assets like Bitcoin to repay yen loans. This concentrated liquidation is translating into selling pressure in the cryptocurrency market. As Jasper De Maere from cryptocurrency trading firm Wintermute stated, "Japan's low interest rates facilitated carry trades, and now these trades are being unwound, leading to a sell-off of all risk assets."

Bitcoin Faces "Liquidity Withdrawal" Impact

The wave of unwinding yen carry trades is undoubtedly adding insult to injury for the Bitcoin market, which is already in a liquidity contraction cycle. On December 1, Bitcoin almost completely retraced its gains from the past ten days within hours, ultimately falling 4.52% in a single day. This volatility resonated precisely with the policy signals from the Bank of Japan and the global bond market sell-off. This is not an isolated event but a concentrated manifestation of the logic of capital withdrawal—when low-cost funds begin to flow back to Japan, the cryptocurrency market is experiencing a "bloodletting" impact, especially as liquidity tends to dry up at the end of the year, further amplifying the effects of this capital withdrawal.

This impact is reflected in two aspects: on one hand, there is direct selling pressure. A large number of institutions and individual investors participating in carry trades are concentrating their sales of Bitcoin, leading to a rapid price decline. On December 1, Bitcoin fell below $86,000 during trading, a result of this concentrated selling and the triggering of stop-loss orders in algorithmic trading. Data shows that the total liquidation amount across all cryptocurrency contracts on that day reached as high as $788 million, with over 80% of the liquidations being long positions, indicating a chain reaction triggered by the unwinding of carry trades.

On the other hand, there is further liquidity depletion. Since November, the Bitcoin market has faced multiple liquidity shocks:

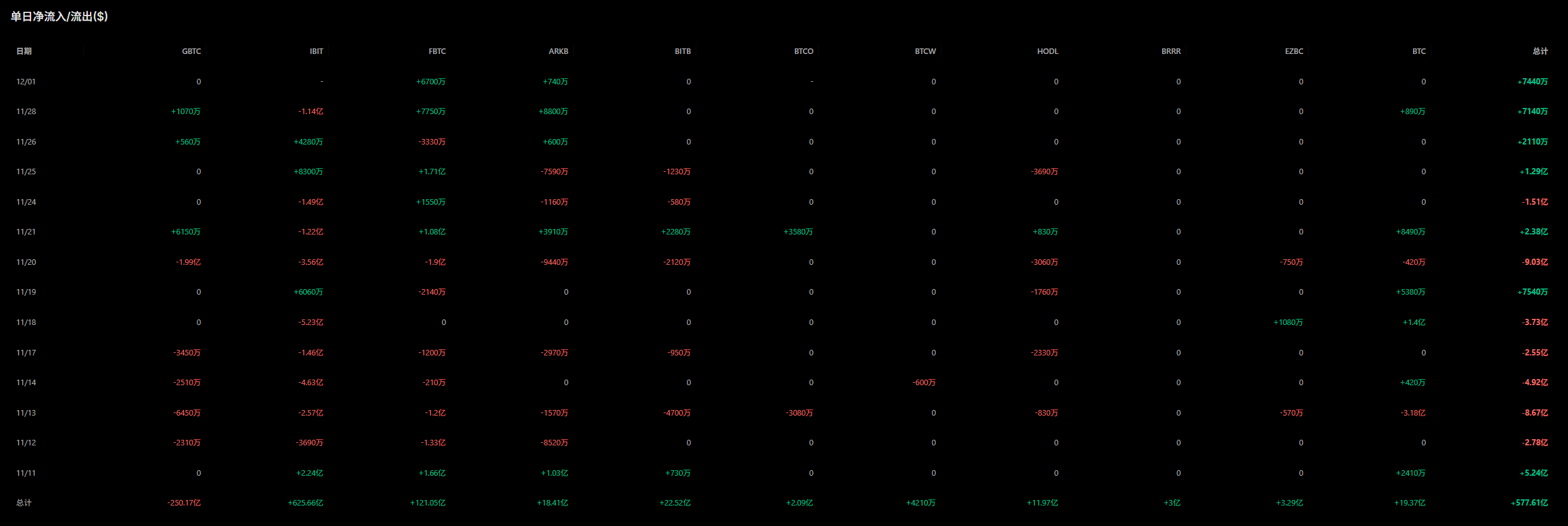

The US spot Bitcoin ETF recorded a net outflow of $3.5 billion in November, marking the largest monthly negative flow since the beginning of the year. Since October 31, Bitcoin ETFs have seen net outflows for four consecutive weeks, totaling $4.34 billion. BlackRock's IBIT, the largest Bitcoin ETF by net asset size, experienced an outflow of $2.34 billion in November and recorded its largest single-day outflow since inception on November 18, amounting to $523 million.

The withdrawal of funds from yen carry trades is equivalent to pulling out a crucial amount of funding from an already tight liquidity pool. When market buying pressure is insufficient, even a small amount of selling can trigger significant price fluctuations. The 4.52% drop in Bitcoin on December 1, despite the absence of major negative news, is a direct reflection of this liquidity vulnerability.

What is even more concerning is that this impact is not a short-term one-time event. As long as expectations for a rate hike by the Bank of Japan do not cool down, the unwinding process of carry trades may continue. If the Bank of Japan indeed announces a rate hike on December 18-19, confirming a long-term trend of policy shift, it could trigger a repeat of the "carry trade massacre" of December 2022, leading to a larger-scale return of yen funds and significantly escalating the selling pressure on Bitcoin.

How Long Will Bitcoin's "Winter" Last?

The impact of the Bank of Japan's rate hike expectations on Bitcoin is particularly significant due to the current market being in a fragile state characterized by multiple negative factors. In addition to the unwinding of yen carry trades, uncertainties surrounding Federal Reserve policies, capital withdrawals by institutions, and technical breakdowns are collectively forming a "pressure matrix" for Bitcoin.

From a macro perspective, the Federal Reserve's stance of "maintaining high rates for longer" is still reverberating. Although there are some expectations for a rate cut by the Fed in December, the core PCE inflation rate in the US remained above the 2% target in October, and Powell's previous statement that "rates will remain high for a longer time" has shattered market fantasies of rapid rate cuts. In this context, Bitcoin, as an asset without any actual value anchoring, struggles to compete for capital favor against tech stocks that have profit support, while the capital inflow triggered by the Bank of Japan's rate hike further exacerbates this "capital drought."

From a market structure perspective, both the technical and sentiment indicators for Bitcoin are currently weak. Bitcoin has fallen from its peak of $126,000 in October to around $86,000, with technical indicators sending clear bearish signals—while the Relative Strength Index (RSI) is close to the oversold zone, the MACD line remains in deep negative territory, confirming that the downward momentum has not yet reversed. The sentiment indicator "Fear and Greed Index" has dropped to the 20 range, indicating "extreme fear," and this panic sentiment amplifies the selling pressure from the unwinding of carry trades, creating a vicious cycle of "selling—decline—more panic."

However, the market is not without opportunities. Data shows that the Bitcoin MVRV ratio (market cap to realized cap ratio) has dropped to 1.76, a low range since 2023, and historical data indicates that this ratio often accompanies phase rebounds when it is below 2; some long-term holders have begun to accumulate in the $92,000-$95,000 range, indicating that bottom-fishing capital is gradually entering the market. But whether these positive signals can translate into a trend reversal largely depends on macro policy variables—especially the outcomes of the Bank of Japan's December meeting and subsequent statements from the Federal Reserve.

Survival Logic of Cryptocurrencies Under Policy Shift

The wave of unwinding carry trades triggered by expectations of a rate hike from the Bank of Japan is essentially a microcosm of the tightening global liquidity environment in the cryptocurrency market. The era of relying on low-cost funds to drive up asset prices is coming to an end; whether it is the Federal Reserve's "prolonged high rates" or the Bank of Japan's "exit from easing," both are reshaping the flow of global capital. For Bitcoin, this means the market will shift from being "liquidity-driven" to "value-driven," and speculative logic that solely relies on capital speculation is becoming ineffective, while crypto assets with practical application scenarios may stand out in the differentiation.

In the short term, Bitcoin will still need to endure the dual pressures of unwinding yen carry trades and uncertainties surrounding Federal Reserve policies, with the $85,000 support level becoming a key defense line. For investors, in this macro policy-driven market volatility, abandoning short-term speculative thinking and focusing on the underlying value of assets and long-term trends may be the core strategy to navigate the current "winter." The "retreat" of yen carry trades is making the true ecology of the cryptocurrency market increasingly clear.

Join our community to discuss and grow stronger together!

Official Telegram community: https://t.me/aicoincn

AiCoin Chinese Twitter: https://x.com/AiCoinzh

OKX benefits group: https://aicoin.com/link/chat?cid=l61eM4owQ

Binance benefits group: https://aicoin.com/link/chat?cid=ynr7d1P6Z

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。