Author: Frank, PANews

Recently, amidst a quiet market, the lesser-known project Rayls officially launched its TGE on December 1. This project, which had previously garnered little attention, received support from two leading overseas exchanges known for their compliance and risk control, Coinbase and Kraken, during its initial phase, and also simultaneously listed on multiple exchanges including Binance Alpha, Gate, and Bitget.

This has inevitably drawn curious glances from the market towards Rayls. What kind of background and resources could attract the favor of compliant exchanges? This project, which attempts to bridge the gap between "permissioned chains" and "public chains" while holding a ticket to the Brazilian Central Bank's DREX pilot, is it truly ushering in a new era for RWA, or is it merely "old wine in new bottles"?

Endorsement from the Brazilian Central Bank, Latin American resources attract Tether investment

Rayls is targeting the enterprise-level compliant blockchain sector, which is not a new narrative. As early as a decade ago, concepts like Hyperledger Fabric and R3 Corda emerged and began operating. However, the sacrifice of global liquidity led most of these private or consortium chains to become data islands.

Rayls has once again entered this market, attracting the attention of major players, with its development company Parfin providing deep industry resources and technical accumulation. Parfin was established in 2019, with headquarters in London, UK, and Rio de Janeiro, Brazil. Before launching Rayls, Parfin had been operating for years as a Web3 infrastructure provider, offering custody, trade execution, and asset management solutions to banks, fintech companies, and crypto exchanges. This "business-first, public chain-later" development path allowed Rayls to have an existing customer base from the outset, including top financial institutions like Santander and Itaú.

Additionally, Tether recently announced its investment in Rayls' development company Parfin to promote the adoption of USDT in the Latin American region and among institutions. Meanwhile, Rayls has gone live on Núclea, Brazil's largest financial market infrastructure provider, which is also one of the co-investors in Rayls' Series A funding.

The attention Rayls has garnered from institutions and companies like Tether is largely due to its rich operational experience in the Latin American region. Among these endorsements, the most significant comes from the Brazilian Central Bank. In 2024, the Brazilian Central Bank initiated a pilot project for a central bank digital currency called DREX. Rayls successfully participated in two rounds of testing and provided privacy solutions for the project. Furthermore, in 2024, Rayls was selected for JPMorgan's Project EPIC's Kinexys project, also leveraging privacy and identity solutions as its main advantages.

This resource-driven model makes Rayls more practical compared to previous enterprise-level blockchain networks. From Rayls' operational route, its main goal is to use privacy solutions as a breakthrough to deeply engage in the issuance process of various countries' central bank digital currencies, thereby establishing its own moat. In November, Rayls announced its participation in the Bank of England and the Bank for International Settlements' London Center DLT Innovation Challenge. Previously, it secured second place in the 2023 G20 TechSprint hosted by the BIS.

However, this focus on institutional operations inevitably results in Rayls lacking presence in the eyes of ordinary investors.

Public chain + private chain, technological breakthrough or old wine in new bottles

The solution proposed by Rayls does not seem particularly novel, resembling the subnet concept of Avalanche.

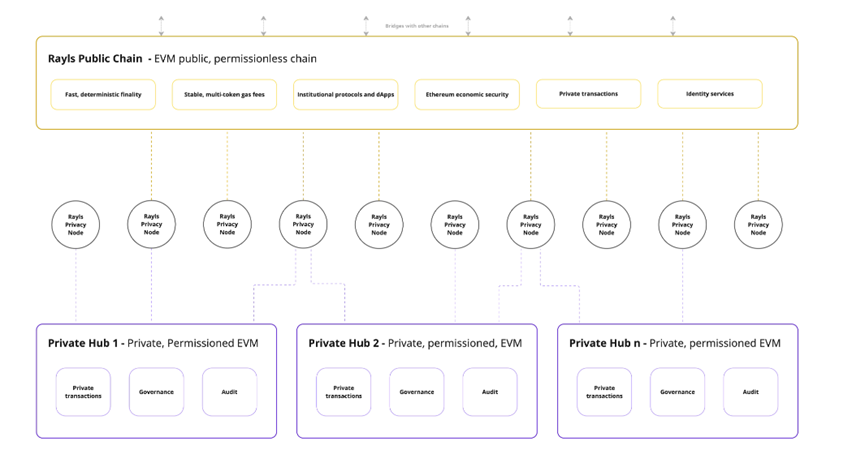

Rayls' overall architecture can be summarized as an Ethereum L2 + EVM-compatible private chain model. It consists of three main components: Rayls Public Chain (RPC), Rayls Private Networks (VENs), and Rayls Privacy Node.

Rayls Public Chain (RPC) is the public chain part of Rayls, an Ethereum L2. However, although this is a permissionless public chain, any wallet address wishing to interact with the Rayls public chain must first undergo decentralized identity (DID) verification to prove it is not a sanctioned entity. From a certain perspective, this may limit some users' willingness to participate. However, for Rayls, the ultimate goal is to achieve a completely "clean" DeFi environment, making this restriction seem necessary, both a drawback and a moat.

Rayls Private Networks (VENs) is the part primarily engaged by banks and other institutions, featuring a private chain with complete privacy protection mechanisms. Financial institutions can establish their own private subnets and operate their privacy ledgers on these subnets. On one hand, due to single-node operation, optimal performance can be achieved. On the other hand, VENs incorporate the Enygma privacy protocol, combining zero-knowledge proofs (ZKPs) and fully homomorphic encryption (FHE) technology to meet institutions' privacy needs.

Rayls Privacy Node serves as the linking software between the two. As a blockchain specifically designed for banks and financial institutions, performance is particularly critical. According to Rayls' white paper, the public chain part can achieve sub-second speeds, while the private chain's single-node throughput can exceed 10,000 TPS.

However, Renato Dias de Brito Gomes, the Deputy Governor of the Brazilian Central Bank, revealed in a 2025 speech that in Rayls' technical solution, the "Real-Time Gross Settlement System (RTGS) can process 300 transactions per second, while the unprivileged Drex system processes 150 transactions per second, and the Drex system with the privacy solution enabled drops to less than 10 transactions per second." This indicates that Rayls still faces challenges in balancing privacy and performance.

According to a report by Messari, the mainnet V1 version of Rayls will not be launched until the first quarter of 2026. In the second quarter of 2026, they plan to release the V3 version of the privacy node supporting multi-network connections, and in the third quarter of 2026, deploy Enygma to the public chain. Before the mainnet goes live, Rayls will prioritize deploying privacy nodes in financial institutions, achieving integration with private networks, and optimizing the onboarding process for institutional clients.

Retail investors not buying in? Community accuses airdrop rules of being fishy

On November 19, the well-known research institution Messari released a research report on Rayls, marking the beginning of public interest in Rayls.

Currently, the most discussed topics regarding Rayls in the market are the TGE and the attention brought by the Messari report. In terms of token economics, the total issuance of the token RLS is 10 billion, with an initial supply of 1.5 billion after launch. Pre-market data from Whales Market showed that the pre-market price peaked at $0.084, but after the launch, the price fell sharply. As of December 1, it dropped from an opening price of $0.068 to $0.017, a decline of about 75%. As of December 2, RLS's circulating market cap was approximately $38 million, with a fully diluted market cap of about $250 million. Based on FDV, its market cap level is close to Sonic, and according to circulating market cap, its ranking is near the bottom of L1.

The reasons for this price collapse at launch may stem from two aspects: on one hand, Rayls had a low presence in the crypto space, leading retail investors to lack understanding. On the other hand, the low total airdrop amount and seemingly unfair rules disappointed the community.

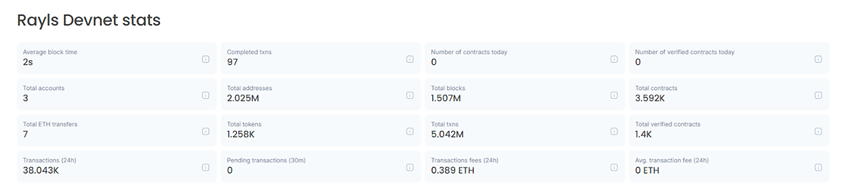

On November 10, Rayls announced that 200,000 people had built projects on the Rayls testnet, completing 1.6 million transactions. As of December 1, the testnet data showed a total of 5.04 million transactions, with over 2.025 million total addresses.

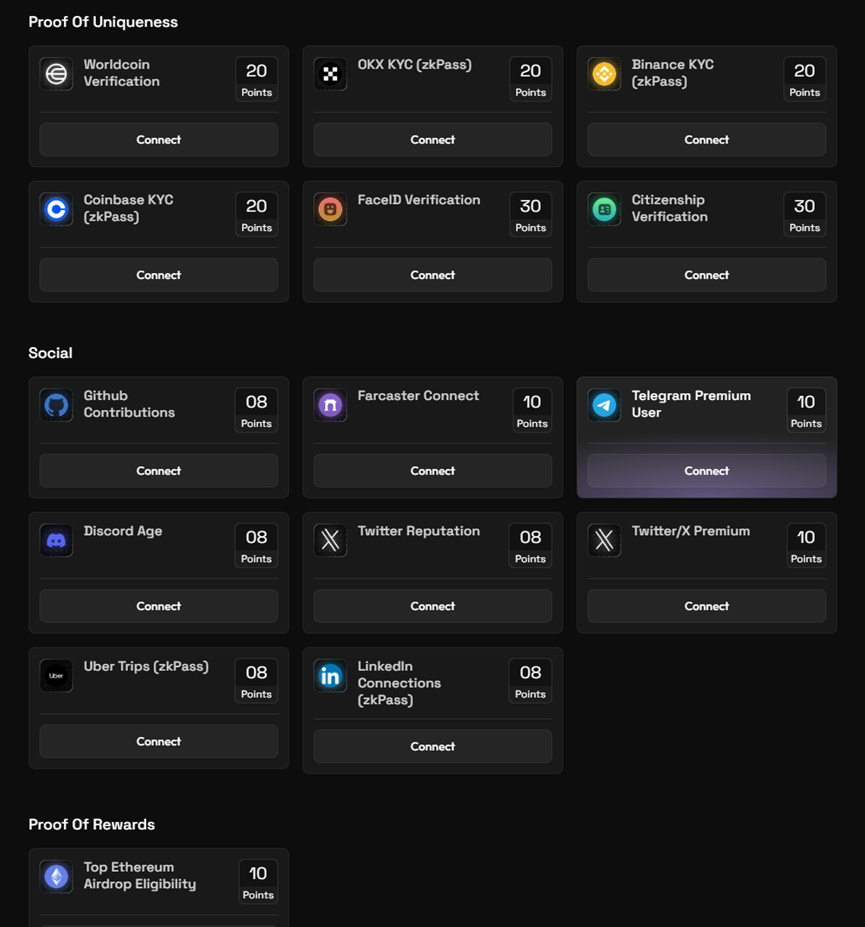

Before the launch, Rayls initiated a verification experiment called "Proof of Humanity," where users could complete KYC through on-chain identity verification and receive a Rayls-certified NFT upon completion. According to official data, over 150,000 identity verifications were completed, indicating that Rayls' performance is fairly standard.

Before the launch, Rayls initiated a verification experiment called "Proof of Humanity," where users could complete KYC through on-chain identity verification and receive a Rayls-certified NFT upon completion. According to official data, over 150,000 identity verifications were completed, indicating that Rayls' performance is fairly standard.

At the same time, community feedback indicated that the airdrop was disappointingly small, with some users stating that despite investing significant time to complete tasks and increase participation, the final airdrop amount was less than that of Binance Alpha users, with only about 700 tokens received. One user bluntly stated, "Rayls needs to answer a question: what actual value is provided to those who supported this project from the very beginning?"

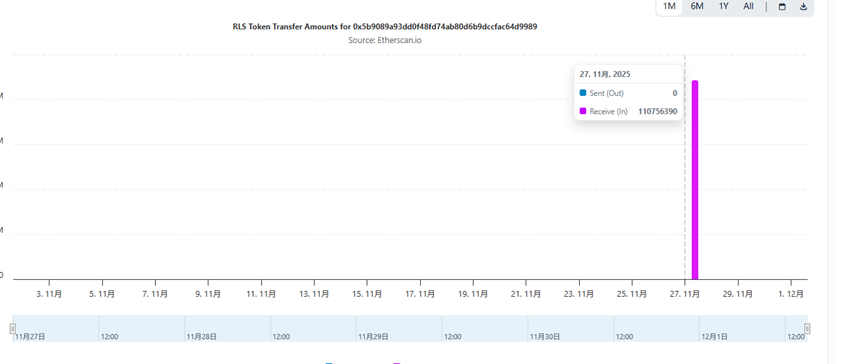

According to on-chain data analysis by PANews, the airdrop contract account on Rayls received a total of 110 million tokens, which, at an estimated price of $0.0186, gives this portion of the airdrop a total value of about $2.04 million.

Rayls' certification task list

Overall, Rayls' core lies in its precise targeting of the pain point that traditional financial institutions desire to embrace DeFi while fearing compliance risks. However, as a public chain primarily serving institutional clients, its appeal from the perspective of ordinary users or retail investors is not particularly high. Especially when every user logging into the network must undergo KYC, the concept of "permissionless" indeed raises questions, significantly dampening the enthusiasm of ordinary users to enter. Whether Rayls' proposed privacy-compliant technical solution can operate stably under the pressure of billions of daily transactions from banks remains an unknown.

Rayls presents a grand vision: bringing banks onto the chain. But before that, it must first prove that it can not only gain the compliance endorsement of regulatory bodies but also withstand the challenges of decentralized market fluctuations and technical pressures. Until the mainnet V1 is officially launched and performance bottlenecks are resolved, RLS may still be viewed as an expensive entry ticket for institutions rather than an alpha for retail investors.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。