Conclusion First: The next three years will be a major bull market led by institutions, marking the formal and comprehensive entry of crypto and blockchain technology into Wall Street's balance sheets, with mass adoption finally achieved through a top-down revolution.

The mass adoption of crypto will not be the de-centralization revolution originally envisioned by Satoshi Nakamoto, but rather a global financial infrastructure upgrade from the top down.

Retail investors are the tide, institutions are the sea.

The tide may recede, but the sea will not.

Looking Back at 2025: Why is this Bull Market the "Institutional Year"?

The reason is upfront: Almost all funds for BTC/ETH come from institutions, while retail investors have turned to trading meme coins and altcoins.

In 2025, mainstream coins all hit historical highs: BTC 126k, ETH 4953, BNB 1375, SOL 295.

1. The Explosion of ETFs and Institutional Channels (like DAT)

Large inflow events for ETFs in 2024-2025.

In 2024-2025, net inflows into digital asset funds reached $44.2 billion, while the holdings of spot BTC ETFs reached 1.1–1.47 million BTC (accounting for 5.7%–7.4% of total circulating supply).

This is the first time in history that the Bitcoin entry has been monopolized by ETFs, with retail investors not participating in the main upward trend of the bull market.

2. Where Did Retail Investors Go?

Structural data from TheBlock:

In 2025, institutions accounted for 67% of BTC/ETH allocations.

Retail investors only accounted for 37%, mainly turning to memecoins and short-term assets with no substantial value.

Retail investors did not buy BTC/ETH; it was institutions that drove the BTC bull market.

3. How the Bull Market Formed

Let's look at some data:

Exchange BTC balances fell to a 6-year low: 2.45–2.83 million BTC.

ETF and custody movements led to a 6.6% reduction in "tradable supply".

Large funds (> $1 million) accounted for a historic high proportion of on-chain flow.

This is a typical "liquidity shock bull market," where a small number of tradable chips + continuous institutional buying = a very strong trend.

Why Will Institutions Fully Enter the Market in 2025?

Conclusion first: Regulations are in place and institutional demand is high.

Clear U.S. Regulations, First Opening of "Legal Institutional Entry"

Stablecoin legislation and regulatory framework: Banks can legally use USDC/TUSD-like stablecoins for settlement.

ETF approvals: This completely opens the floodgates for pension funds and insurance companies.

The underlying regulatory changes allow institutions to enter crypto assets legally, compliantly, and at scale.

Institutional Demand Far Exceeds Supply: Structural Imbalance is Amplifying

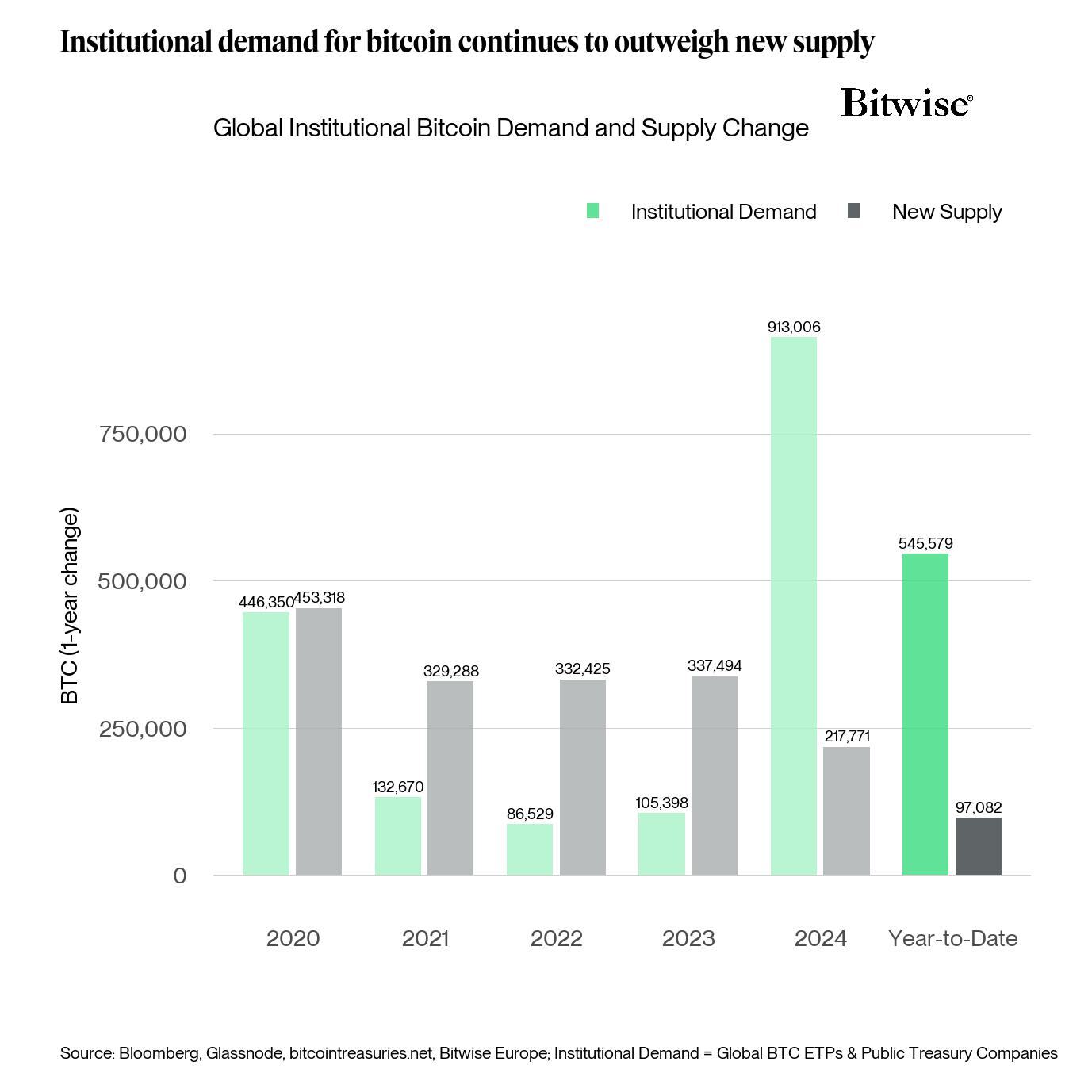

Overview of institutional demand and supply for BTC from 2020-2025, with a supply-demand reversal starting in 2024.

Core data from Bitwise:

By 2025, institutional effective demand for BTC is about $976 billion, while the actual sellable supply is only $12 billion, resulting in a supply-demand ratio of 80:1.

This means that without retail participation, prices can be easily driven up several times.

How Will Institutional Funds Continue to Enter the Next Bull Market?

If the 2025 market validates the "institution-led bull market" prototype, the next three years will be the period of full explosion of this trend. To understand this, we must start from the structure of traditional financial assets.

Let's look at the total assets in traditional finance and then see the proportion managed by institutions to estimate the potential inflow of funds.

The Asset Distribution in Traditional Finance Determines Who Holds the "Real Money"

Global investable asset scale (2024 data):

Asset Class | Size --- | --- Global Real Estate (financializable portion) | ~$330T Global Bond Market | ~$130T Global Stock Market | ~$110T Private Credit / Private Equity | ~$12T Bank Deposits and Cash Equivalents | ~$40T Total | >$600T

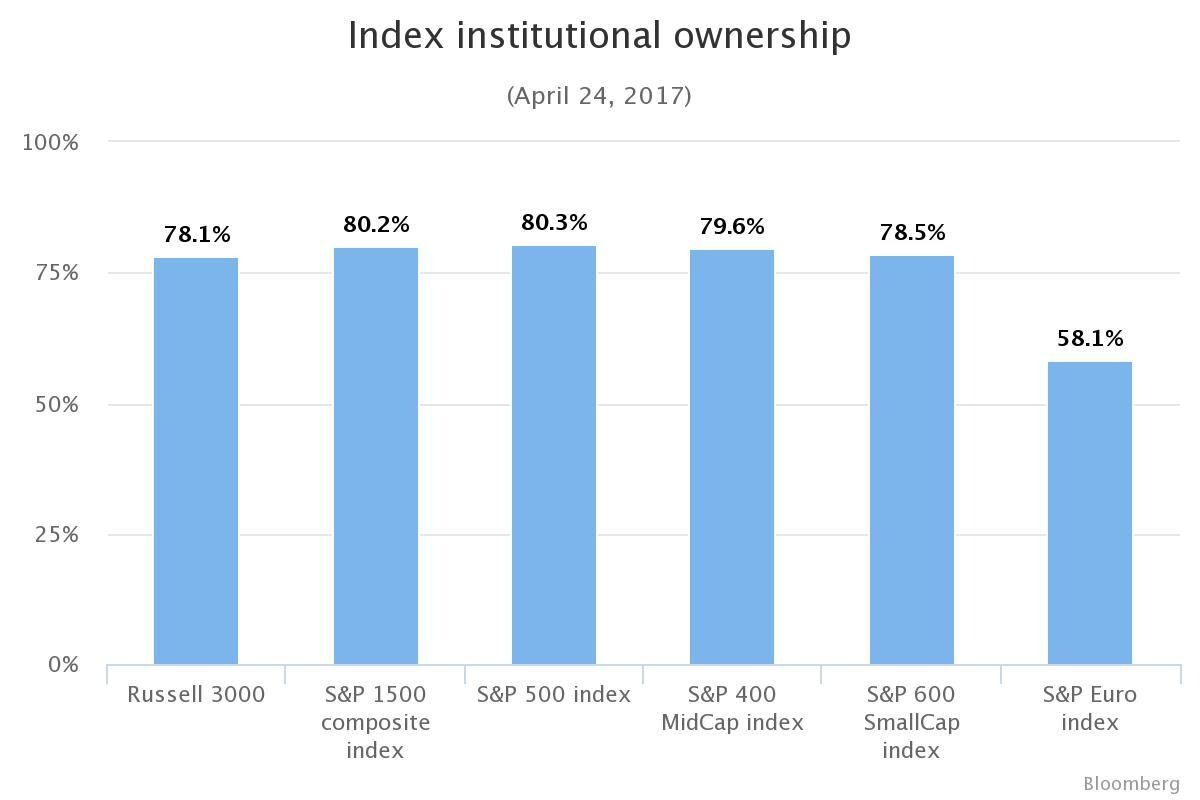

Among them, 70%–80% is held by institutions (pension funds, sovereign funds, insurance, banks, hedge funds, asset management companies).

Proportion of equity assets held by institutions (2017 data).

Proportion of equity assets held by institutions (2017 data).

When the underlying infrastructure of crypto accommodates over $400 trillion (for comparison, the current market cap of BTC is $1.8 trillion) of traditional assets, the scale of inflows will no longer be the past tens of billions driven by retail sentiment.

Every 1% adjustment in asset allocation = tens of trillions of dollars in capital migration = BTC market cap doubling.

This is why ETF/RWA = the core narrative of the next bull market.

Long-term Impact on Mainstream Assets

In simple terms, BTC will become "digital gold," and ETH will become "equity-like."

BTC: Institutional Reserve Asset

ETF holdings continue to rise, liquidity keeps decreasing.

Prices will become increasingly institutionalized, trend-driven, and slow-bull.

BTC will become the true "digital gold," with central banks starting to reserve it.

ETH: The "Equity Asset" of the Global On-chain Economy

Unlike BTC's "commodity-like asset," ETH has attributes closer to "equity":

ETH has a mixed inflation/deflation tendency towards deflation.

ETH staking rewards are the "dividends" of the on-chain economy.

The value of ETH is positively correlated with the entire on-chain GDP.

The pricing logic of ETH comes from "network scale × usage."

The long-term value of ETH = market cap of the global on-chain economy × ETH's tax rate model.

This is stronger than the stocks of tech giants because it represents "financial infrastructure-level equity."

How Will the Role of Retail Investors Change Completely?

In simple terms, they will shift from narrative creators to price followers (only regarding mainstream tracks; trading meme coins is another story), with retail investors no longer creating bull markets but merely hitching a ride.

Characteristics of an institution-led market:

Trends are more stable (long-term funds).

Emotional impact is reduced.

Liquidity is thinner (buy-sell orders dominated by whales).

Therefore, retail investors must adjust their strategies:

From emotional trading → to trading with large funds.

From searching for hundredfold coins → to finding structurally long-term tracks.

From short-term trading → to cross-cycle trading.

Where Are the Opportunities for VCs and Entrepreneurs?

The most certain tracks for VCs in the next three years:

1. Enterprise Blockchain

Simply put, no one wants pension funds and bank deposits on Ethereum or Solana, so there need to be solutions tailored to enterprise needs.

Enterprise-level requirements include:

Privacy (public chains cannot achieve this).

Compliance (KYC, AML, etc.).

Controllability (governance can be upgraded and revoked).

Low cost & stability.

Therefore, institutions cannot use public chains for core business but will use some enterprise-level blockchain solutions (though it sounds like consortium chains) such as Hyperledger Fabric and R3 Corda.

Institutions will not run core business on Ethereum but will buy BTC/ETH on ETFs, DAT, and RWA. Assets are on public chains, business is on enterprise chains, and bridging is completed by DeFi; this is the future architecture.

2. Bridging + ZK (private ↔️ public)

Cross-chain.

Cross-market.

Cross-regulatory zones/countries.

Cross-assets (RWA ↔️ public chain assets).

Enterprise-level blockchains need to communicate data with public chains, so bridging is needed as a bridge from institutional private chains to public chains, and ZK technology may be a potential technical solution; I won't comment further as I'm not an expert in this area.

3. MPC, Custody, Asset Management Tools

Growth of companies like Fireblocks, Copper, and BitGo will be geometric.

4. RWA & Settlement Layer

Government bonds.

Private credit.

Commodities.

Foreign exchange.

Settlement layer (similar to an on-chain version of the SWIFT network; this part involves payments and is very complex, warranting a separate article).

VCs, take note: this is a trillion-dollar opportunity.

Conclusion

The next bull market is not a victory for crypto, but a victory for Wall Street.

In the next three years, you will see:

JPM, BlackRock, and Citi's on-chain scale surpassing most L1s.

The price influence of retail investors on mainstream coins dropping to historical lows.

Tens of trillions of dollars flowing on-chain through ETFs, RWA, and enterprise chains.

Web3 transitioning from a narrative economy to becoming a global financial infrastructure.

The mass adoption of crypto has already occurred, but it is not a replacement for central banks; it is an upgrade revolution of financial infrastructure.

Final Thoughts:

Retail investors are dead; institutions must rise.

Rather than fantasizing about hundredfold coins, it is better to understand the logic of capital. The next bull market will be priced by institutions, driven by enterprises, and determined by infrastructure. Retail investors still have opportunities, but the methods have changed; understanding structural trends and positioning yourself where institutions are about to arrive is key.

Quoting a trader I admire, cryptocred: "Do not go against the dominant trend; be a friend of the trend."

Next issue preview: How to establish a systematic long-term investment logic for BTC, ETH, and BNB, and prepare for the layout. Follow the frontline investor and entrepreneur, https://x.com/chelsonw_, for regular cutting-edge industry analysis.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。