What impact will it have on the market when the largest BTC holder does not buy and even sells BTC?

Written by: Umbrella, Deep Tide TechFlow

As the publicly listed company holding the most BTC globally, Strategy (MicroStrategy) announced on December 1, 2025, that it has raised funds through the sale of Class A common stock to establish a reserve of $1.44 billion.

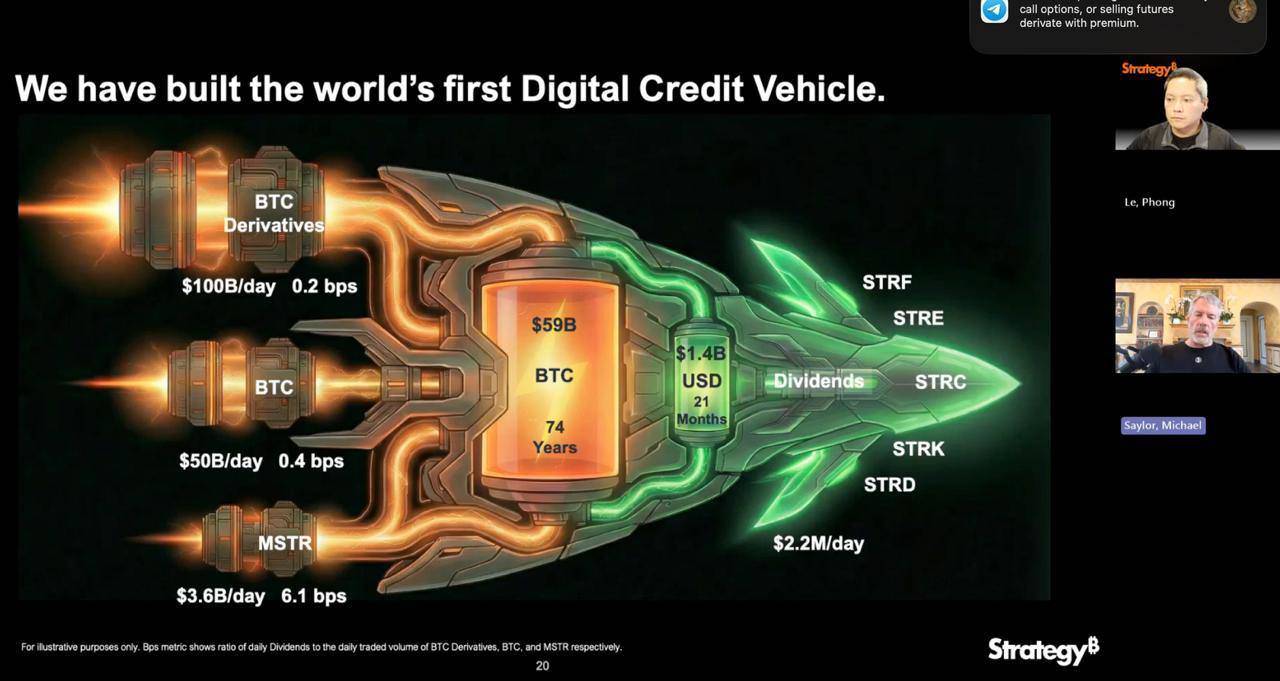

The official statement indicated that this move aims to support the payment of preferred stock dividends and interest on outstanding debt over the next 21 to 24 months, reinforcing its commitment to credit investors and shareholders.

This company, regarded as the "BTC shadow ETF," has had an extremely simple and aggressive core strategy over the past few years: to finance at the lowest possible cost and convert the funds into Bitcoin as soon as they arrive.

Under Michael Saylor's grand narrative of "Cash is Trash," the fiat currency on Strategy's balance sheet is typically kept at a minimum to meet daily operational needs.

This clearly contradicts its recent statement, and against the backdrop of BTC prices recently retreating from highs and increased market volatility, Strategy's actions have once again caused market panic. What impact will it have on the market when the largest BTC holder does not buy and even sells BTC?

Strategic Turn

The most significant meaning of this event is that it marks the first public acknowledgment by Strategy of the possibility of selling its held BTC.

Company founder and executive chairman Michael Saylor has long been hailed as a staunch advocate for Bitcoin, with his core strategy being "always buy and hold." However, company CEO Phong Le explicitly stated in a podcast that if the company's mNAV metric (the ratio of enterprise value to the value of its held cryptocurrency assets) falls below 1, and the company cannot finance through other means, it will sell Bitcoin to replenish its dollar reserves.

This attitude breaks the market's impression of Strategy "going all in on BTC," and is interpreted by the market as a significant turning point in the company's strategy, raising doubts about the sustainability of its business model.

Market Reaction

Strategy's strategic adjustment immediately triggered a severe negative chain reaction in the market.

After the CEO hinted at a possible sale of BTC, Strategy's stock price plummeted by as much as 12.2% during trading, reflecting investors' panic over its strategic shift.

Following the announcement, BTC prices also fell by over 4%. This decline may not be entirely caused by MicroStrategy's actions, but the largest holder's pause in aggressive buying is clearly a dangerous signal that the market has picked up on.

This expectation of major funds shifting to a wait-and-see approach has amplified the market's risk-averse pullback.

Compared to the "surface crises" of stock prices and BTC prices, a deeper crisis comes from the statements of investment institutions.

Data shows that in the third quarter of 2025, several top investment institutions, including Capital International, Vanguard, and BlackRock, have actively reduced their exposure to MSTR, with a total reduction of approximately $5.4 billion.

This data indicates that as more direct and compliant investment channels like BTC spot ETFs emerge, Wall Street is gradually abandoning the old investment logic of "MSTR as a BTC proxy."

Among various DAT companies, mNAV is a key indicator for understanding their business models.

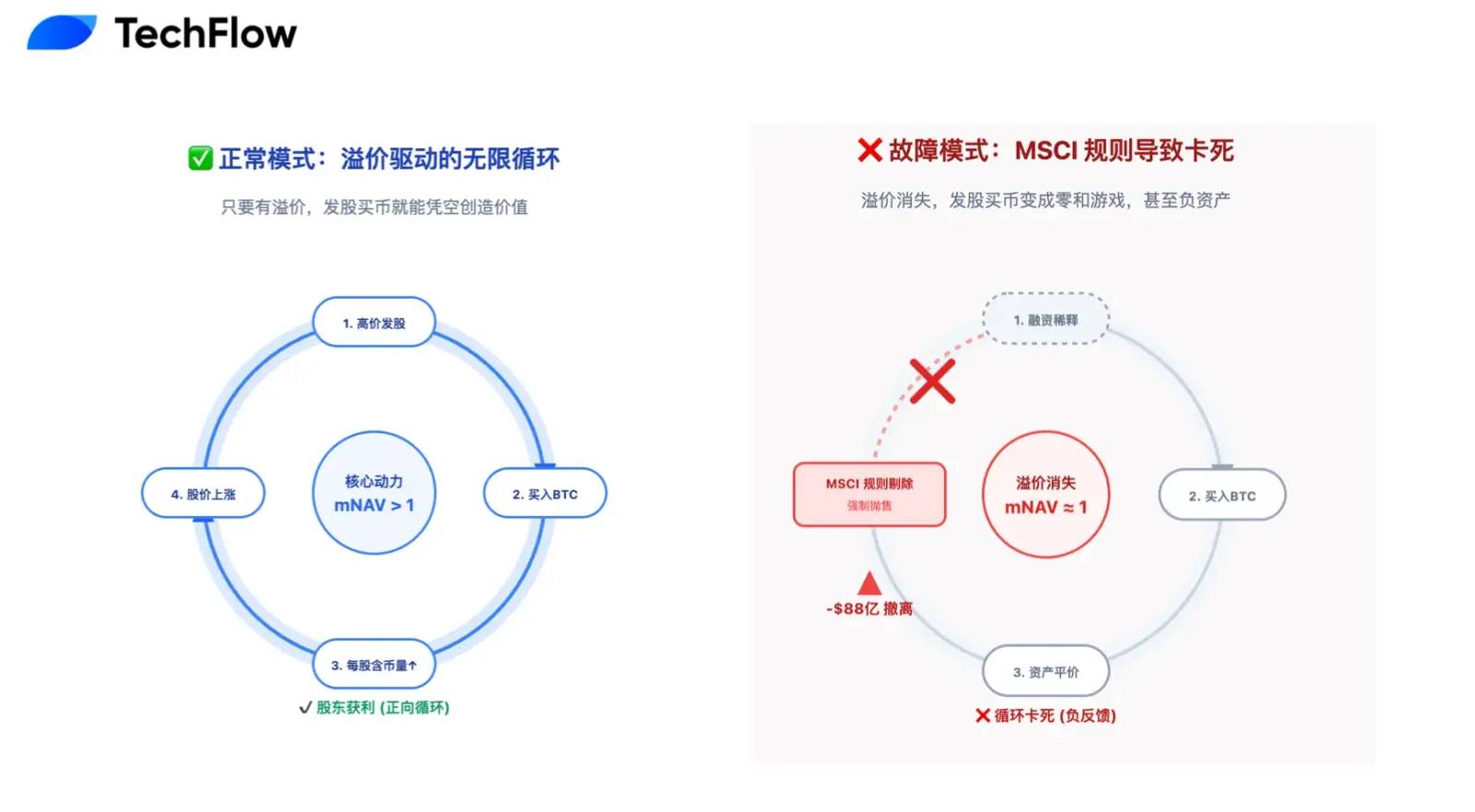

In a bull market, the market is willing to pay a high premium for MSTR (with mNAV far exceeding 1, peaking at 2.5), allowing it to create value through a "stock issuance → Bitcoin purchase → stock price rises due to premium" flywheel model.

However, as the market cools, its mNAV premium has essentially disappeared, dropping to around 1.

This means that issuing stock to buy Bitcoin has become a zero-sum game that does not help enhance shareholder value, and its core growth engine may have already stalled.

The Broken Narrative of the Perpetual Motion Machine

From a short-term and rational financial perspective, the market's current bearish outlook on Strategy is not unfounded.

This $1.44 billion cash reserve effectively announces the collapse of the once-obsessive "buy BTC perpetual motion machine" narrative. The market's previous fascination with the "issue stock to buy BTC" logic was based on the optimistic assumption that stock prices would always be higher than the conversion price of convertible bonds.

Strategy currently carries up to $8.2 billion in convertible bonds, with S&P Global clearly rating its credit as "B-", a junk rating, and warning of potential liquidity crises.

The core of the crisis lies in the fact that if stock prices remain depressed, bondholders will refuse to convert their bonds into stock at maturity (facing greater losses by converting), and will instead demand full cash repayment of the principal. Notably, one of the bonds worth $1.01 billion may face redemption as early as 2027, creating clear and rigid mid-term cash flow repayment pressure.

In this context, the establishment of the reserve is not merely for paying interest but also to address potential "runs," but with the mNAV premium at zero, this funding primarily comes from the dilution of existing shareholder equity.

In other words, the company is overdrawn on shareholder value to fill the debt gap from the past.

If debt pressure is a chronic illness, then being removed from the MSCI index is a potentially fatal acute condition.

With Strategy's increasingly aggressive accumulation over the past two years, the proportion of BTC in its total assets has soared to over 77%, far exceeding the 50% red line set by index compilers like MSCI.

Related Reading: Countdown to $8.8 Billion Exodus, MSTR is Becoming a Pariah in Global Index Funds

This raises a fatal classification issue, as MSCI is considering reclassifying it from an "operating company" to an "investment fund." This administrative reclassification could trigger catastrophic chain reactions.

Once deemed a fund, MSTR would be removed from mainstream stock indices, triggering mandatory liquidations of trillions of dollars tracking these indices.

According to estimates by JPMorgan, this mechanism could trigger passive sell-offs of up to $8.8 billion, which, for MSTR with an average daily trading volume of only a few billion dollars, would create a liquidity black hole, likely leading to a cliff-like drop in stock prices, with no fundamental buying support to absorb it.

Expensive but Necessary Premium

In the cyclical industry of the crypto market, if we extend the time dimension, Strategy's seemingly "self-inflicted" defensive measures may indeed be an expensive but necessary premium for winning the ultimate victory.

"Staying at the table is the most important thing."

Past cycles of bull and bear markets have proven this point; the culprit that leads investors to "zero" is not the drop in coin prices, but the reckless "all-in" approach that ultimately forces them off the table due to an unexpected event, leaving no hope for a comeback.

From this perspective, the $1.44 billion cash reserve established by Strategy is also to ensure that it can stay at the table at the lowest possible cost.

By sacrificing short-term shareholder equity and market premiums, it seeks to gain leverage over the next two years, which is a form of strategic wisdom—battening down the hatches before the storm, and when the next cycle of liquidity flooding arrives and the weather clears up again, Strategy, holding 650,000 BTC, will still be the irreplaceable "leading stock in the crypto circle."

The ultimate victory does not belong to those who live more splendidly, but to those who live longer.

Beyond ensuring its own longevity, the deeper significance of Strategy's actions lies in exploring a viable compliance path for all DAT companies.

If Strategy continues its previous "all-in" behavior, it will likely face a collapse, and the annual narrative of "public companies holding virtual currencies" will be thoroughly discredited, potentially bringing an unprecedented storm of bad news to the crypto circle.

Conversely, if it can successfully find a balance between the high volatility of BTC and the financial stability of public companies by introducing the traditional financial "reserve system," it will no longer be just a company hoarding coins but will carve out a new path.

This transformation is, in fact, Strategy's declaration to S&P, MSCI, and traditional Wall Street funds: not only is there fervent belief, but also the ability to conduct professional risk control in extreme environments.

This mature strategy may be the ticket for it to be accepted by mainstream indices and obtain lower-cost financing in the future.

The large ship of Strategy carries the hopes and funds of countless players in the crypto industry. Rather than how fast it can sail in clear weather, it is more important to focus on whether it can weather the storm.

This $1.44 billion reserve is both a correction of past unilateral betting strategies and a declaration of intent to face future uncertainties.

In the short term, this transformation is fraught with growing pains: the disappearance of mNAV premiums, passive dilution of equity, and the temporary halt of the growth flywheel are all costs of growth that must be paid.

But in the long term, this is a hurdle that both Strategy and countless DAT companies in the future must go through.

To touch heaven, one must first ensure that their feet are firmly planted on the ground.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。