The Way of Trading: Go with the Trend

Hello everyone, I am trader Gege. "Unless you really know what you are doing, don't do anything." Many investment moguls have said similar things, but do you truly understand? Everyone knows the big principles, but small emotions are hard to control. Trading itself is a matter of probability; under conditions of favorable win rates and profit-loss ratios, use capital management to expand profits, while also having a risk control awareness. Always remember, profits and losses come from the same source.

Investment giants like Buffett and Soros have also had their missteps. Do you think it's possible to pursue a 100% accuracy rate? Recognize yourself, concentrate your strengths, and let yourself gradually become wealthy; that is the right approach. Don't be brainwashed by the legendary stories of getting rich quickly around you or on the internet. Such stories exist, but they are also the result of "timing, location, and harmony."

When we enter the market, we face the fluctuating prices of candlesticks, especially when you are entering a trade; it can stir your emotions the most. It tests you constantly because your assets are changing, either expanding or shrinking. The short-term fluctuations in the market can stir your heart, making you want to understand the reasons behind every movement, but this is not very meaningful. Market fluctuations are the result of all investors working together; the smaller the capacity, the more easily it is influenced by capital, leading to independent trends.

For those who often rely on news for trading, I suggest ignoring some minor news. Minor news may affect ultra-short-term fluctuations, but it won't cause significant changes. More often, you should follow the technical and market sentiment. When the market returns to calm, the traces left after the tug-of-war between bulls and bears can be more easily grasped through the technical patterns reflected in candlesticks. Therefore, making money in the trading market is not easy; cherish every step.

My current state is more focused on swing trends, which is a bit easier. I've mentioned the reasons before, so I won't elaborate. In the future, I will try to adjust and update the speed of my articles, as short-term trading is not difficult for me. Enough small talk, let's discuss the market for Bitcoin.

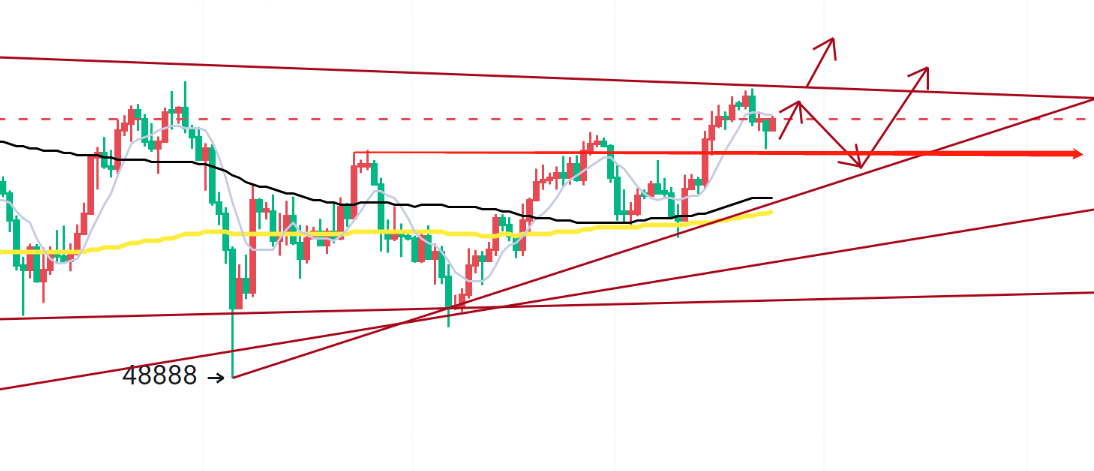

First, let's look at the weekly chart for Bitcoin. This time, the market faced resistance again at the 69,500 level and retreated, not making a strong push to break and stabilize above 70,000. Regarding the prediction for the weekly K-line's larger cycle, I still maintain my previous view: as long as it breaks and stabilizes above 70,000, the probability of breaking the previous high and reaching a historical new high is over 90%. The reasons have been discussed in previous articles, which you can refer back to. Today is Thursday, and there are still 3 days left for the weekly close, so we need to pay attention to what kind of shape the weekly K-line will close in. If it maintains the status quo or dips after touching above 70,000, then the probability of continued retreat and adjustment next week will increase. If this week can continue to close positively and stabilize at 70,000, then the market will become clearer.

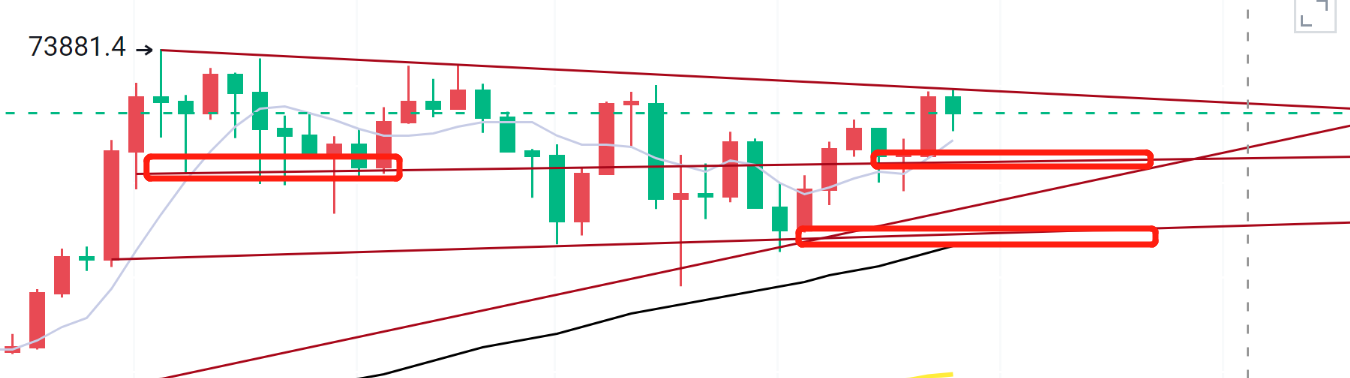

On the daily chart for Bitcoin, we first need to see if the market can stabilize at the 68,000 level. The support range below is the previous K-line's spike at around 65,000. If it breaks below, we need to pay attention to the support trend line in the 64,000-63,000 range. The subsequent short-term estimate will likely touch the 70,000 level again or even briefly break the 70,000 mark before retreating near the trend line to initiate a strong rebound. For short-term trading, it is advisable to use the 65,000 level as a support reference. If it does not break, consider entering long positions in the 65,600-66,500 range. If an unexpected drop occurs, wait for a stop at the 64,000-63,000 range before re-entering. If the daily close does not retreat and instead closes above 68,000, then the market will first test the upper resistance. Currently, the market has entered a critical area, so pay more attention to the closing situation of the K-line, try to observe more and act less, and wait for the tug-of-war between bulls and bears to leave us with more definite traces to grasp, which will increase our chances of success.

The suggestions are for reference only. Ensure proper risk control when entering the market, and manage your profit and stop-loss space accordingly. Specific strategies should be based on real-time conditions, and you can consult for advice.

Alright, friends, we will say goodbye until next time. I wish everyone continued success in the crypto space! More real-time advice will be sent internally. Today's brief update ends here. For more real-time advice on Bitcoin, find Gege.

Written by / I am trader Gege, a friend willing to accompany you in your resurgence.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。