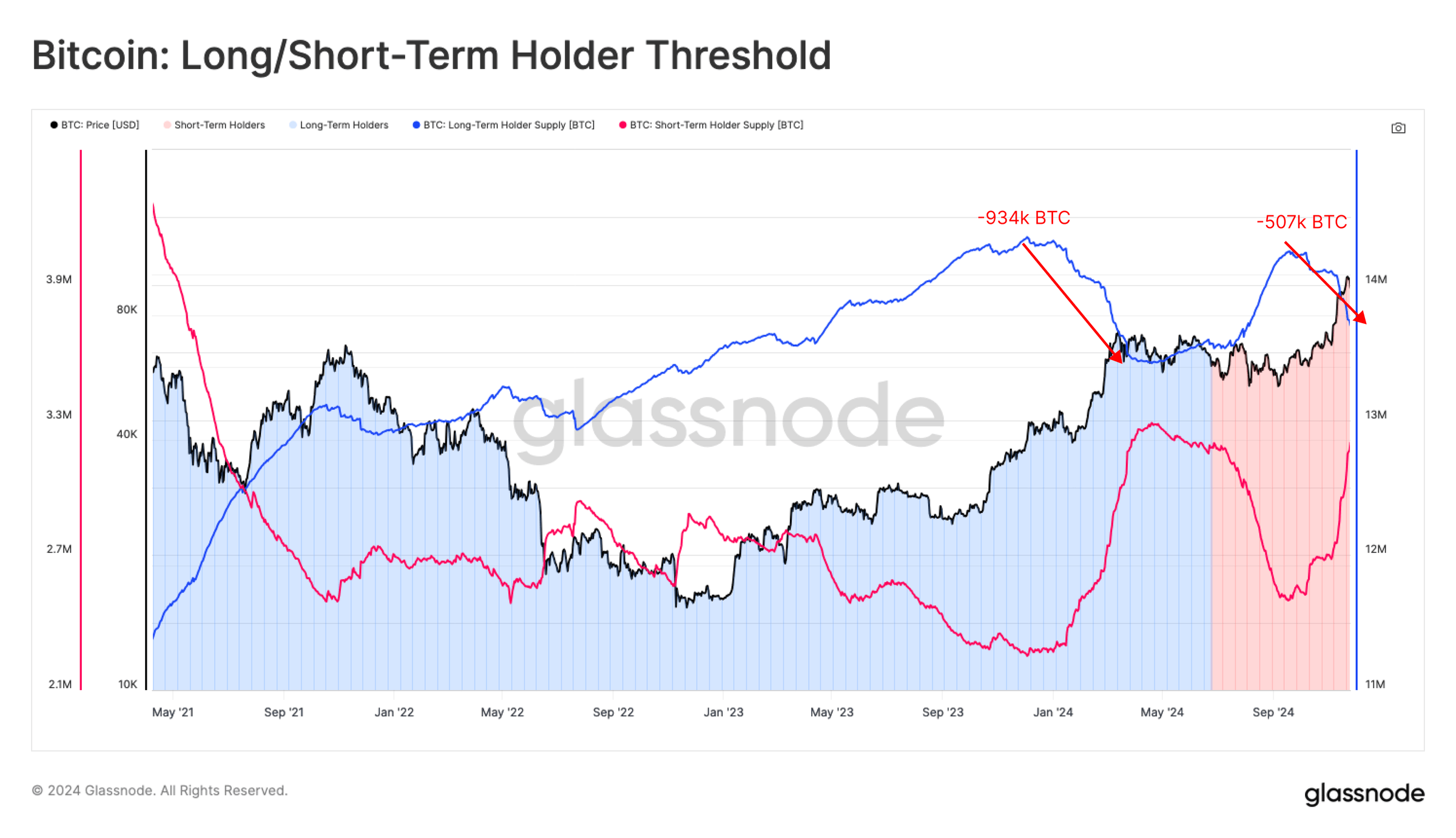

As bitcoin (BTC) prices edge closer to six figures, long-term holders are actively redistributing their holdings. Since the peak supply held by this group in September, over 507,000 BTC has been sold. Although this figure is lower than the 934,000 BTC distributed during the March 2024 rally, it signals a decisive uptick in activity. “Coins aged between 6 months and 1 year dominate the prevailing sell-side pressure, accounting for 35.3% of the total,” Glassnode states in its onchain report.

Glassnode’s data shows that long-term holders are realizing daily profits of $2.02 billion—a new all-time high. This surge in realized profits underscores a strong demand side, capable of absorbing the increased liquidity. The Sell-Side Risk Ratio, a metric analyzing profit and loss relative to the market’s realized capitalization, is approaching historically high levels, the analysts Ukuria OC and Cryptovizart note.

However, current figures remain below the peaks seen in prior bull markets, suggesting the market retains the capacity for further growth. The researchers highlight a critical gap in bitcoin’s price discovery process. Rapid gains have left little trading activity in the $76,000 to $88,000 range, creating an “air gap” that may influence market corrections. For sustained upward momentum, a period of consolidation and reaccumulation is necessary.

Glassnode emphasizes in its report that while younger bitcoin supplies dominate current sell-side activities, older holders remain measured, potentially awaiting even higher price thresholds. This cautious behavior suggests that the market, despite heightened activity, is far from overheated. As bitcoin flirts with $100,000, the latest insights from Glassnode’s researchers illuminate the complexities underpinning this historic rally, providing a clearer picture of the market’s evolving dynamics.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。