Due to the slowdown in the U.S. economy, uncertainty surrounding Trump's policies, and negative sentiment in the cryptocurrency market, the prices of Bitcoin and other cryptocurrencies have plummeted, leading investors to remain cautious about market prospects.

Author: Blockhead

Translation: Baihua Blockchain

The uncertainty surrounding U.S. tariffs, following last week's $1.5 billion Ethereum hacking incident on the Bybit trading platform, has exacerbated the loss of confidence among cryptocurrency investors, causing Bitcoin to fall below $90,000 and reach its lowest point since November 18 on Tuesday.

Bitcoin dropped over 7% to around $87,200, a decline of more than $20,000 from the peak of over $109,000 set on Donald Trump's inauguration day last week.

1. Market Macro Environment

As signs of a weakening U.S. economy emerge, recession fears are returning.

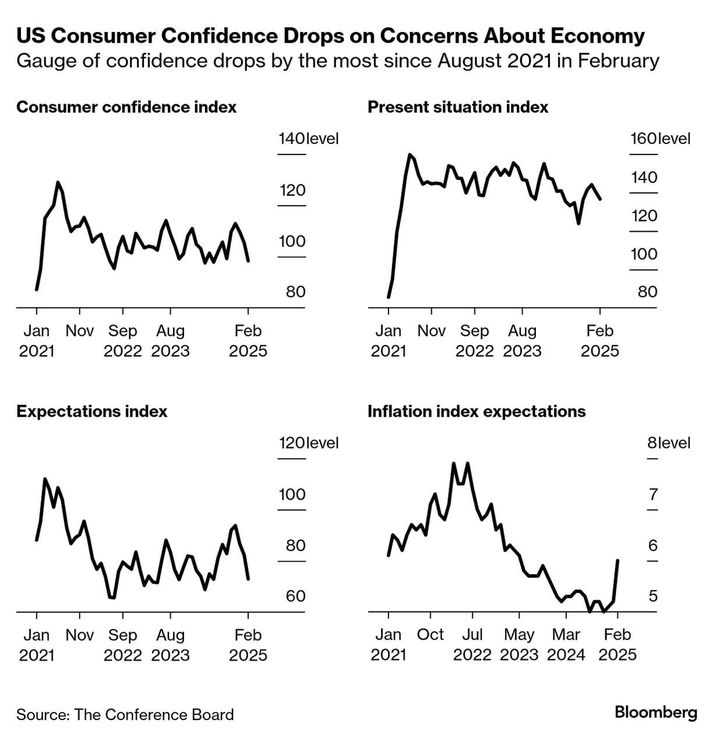

There is increasing evidence that uncertainty surrounding President Trump's policies is heightening Americans' anxiety about the future of the economy. U.S. consumer confidence plummeted last month, marking the largest decline since August 2021.

Americans are cutting back on spending: According to a recent survey by Wells Fargo, more than half of consumers have postponed significant life decisions due to concerns about the economic outlook and the consequences of Trump's tariff threats.

One-sixth of respondents have delayed plans for further education, one-eighth have postponed retirement plans, and about one-third have delayed home-buying plans.

As a reflection of recession concerns, the prices of safe-haven government bonds have surged, with yields dropping to their lowest point in two months.

Adding to these worries, Trump reiterated on Monday, ahead of the deadline, that he would impose a 25% tariff on imports from Canada and Mexico, a move that had been postponed last month.

Smaller cryptocurrencies have been hit much harder than Bitcoin, which has dropped about 8% in the past week. According to CoinGecko, the values of Dogecoin, Solana, and Cardano Token have decreased by about 20%.

Since the beginning of the year, sentiment in the cryptocurrency market has been generally bleak, particularly in recent weeks due to volatility surrounding meme coins and the recent Bybit hacking incident, further intensifying this pessimistic atmosphere. The recent drop in cryptocurrency prices following the largest hacking incident in history is not surprising.

The current macroeconomic situation is also putting pressure on crypto investments. A greater concern is the emergence of a small but troubling trend among risk assets that could trigger a larger sell-off in the cryptocurrency market. Wall Street is also not optimistic, as the "seven giants" stocks have entered a correction phase.

Tuesday was a turbulent moment for the U.S. stock market, which has fluctuated at record levels for most of 2025. The seven major companies that have driven a 54% rise in the U.S. stock market over the past two years have seen significant declines.

On Tuesday, the Bloomberg "seven giants" index fell by 3.4%, now down over 10% from its all-time high set on December 17. During this period, the total market capitalization of these seven companies has shrunk by $1.6 trillion. Tesla is one of the companies with the largest decline, down 37%.

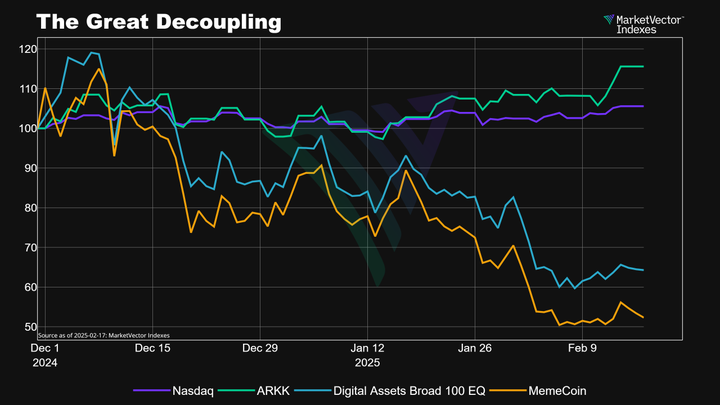

Despite the stock market decline, we have seen a significant decoupling between cryptocurrencies and U.S. stocks. This year, the correlation between Bitcoin and the Nasdaq has significantly decreased, with overall market sentiment towards cryptocurrencies being negative.

"The crypto market is deeply entrenched in negative sentiment, primarily due to a series of meme coin scandals and exit scams," said Martin Leinweber, head of digital asset research and strategy at MarketVector Indexes and author of "Mastering Crypto Assets." He added, "High-profile scams like the Libra Coin incident in Argentina, Trump Coin, and other meme tokens have severely undermined investor confidence, leading to significant price drops for Solana and other altcoins."

Although Solana remains one of the most scalable, low-cost, and fast blockchains, it is now referred to as the "Memecoin chain." Due to various FUD (fear, uncertainty, and doubt), a significant amount of capital has flowed from Solana to Ethereum and other networks. However, Solana's core advantages still exist: it is not just a gathering place for meme coins but also supports DeFi, AI applications, real-world assets (RWA), and next-generation financial tools.

Meanwhile, before the crash on Tuesday, Bitcoin's price had been fluctuating in a narrow range below $100,000, leading many traders to believe that the crypto bull market has ended, prompting them to sell Bitcoin.

But is this really accurate?

Source: Total Return Index (Benchmark 100), MarketVector Indexes

The failure of changes in U.S. cryptocurrency policy to meet expectations has exacerbated the shift in market sentiment, and the "decoupling" between cryptocurrencies and traditional stock markets is also intensifying. Leinweber stated, "The break in correlation between cryptocurrencies and the stock market is quite unusual, especially given that the current macroeconomic environment still favors risk investments."

As the dollar weakens, the head of MarketVector Indexes expects cryptocurrencies and other risk assets to benefit as they have in the past. He stated, "Given this situation, cryptocurrencies are unlikely to remain in a depressed state for long. Capital that flows into the stock market will eventually return to the digital asset market."

2. Cryptocurrencies at the Bottom: Have We Hit the Bottom?

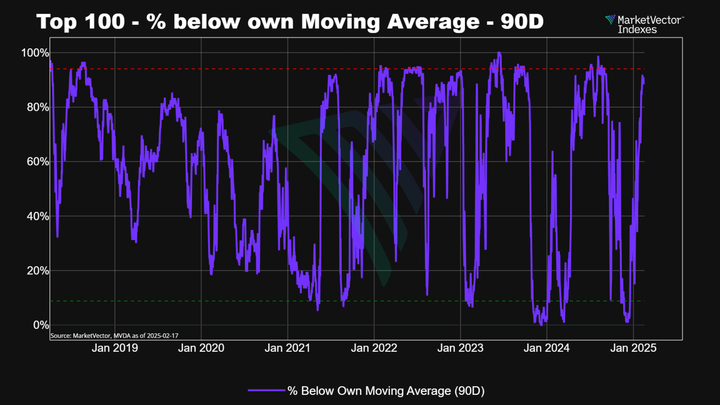

Leinweber noted that currently, over 93% of the top 100 cryptocurrency tokens are trading below their 90-day moving average. This severe market condition typically appears before a market bottom, rather than persisting for the long term.

The market indicator tracking social media activity, volatility, trends, and prices—the Crypto Fear and Greed Index—recently fell to a five-month low of 25, reflecting increasingly pessimistic market sentiment. As uncertainty surrounding Trump's tariff policies continues, cryptocurrency prices continue to decline.

Some analysts are beginning to wonder if it is time to "buy the dip." In the long term, Geoffrey Kendrick, global head of digital asset research at Standard Chartered, stated that Bitcoin may benefit from the decline in U.S. Treasury yields, a change stemming from last Friday's PMI report that shifted market sentiment towards risk aversion, with a rebound expected in the medium term.

"But now is not the time to buy the dip; the market may fall to around $80,000," Kendrick added.

Bernstein analysts reiterated their prediction that Bitcoin's year-end price will reach $200,000, with traders closely monitoring upcoming U.S. inflation data for potential bullish signals, especially as the data trends towards the Federal Reserve's targets.

However, Trump's policies have begun to negatively impact crypto assets and the broader risk market. The uncertainty surrounding tariffs as a negotiation strategy or an actual threat is unsettling many investors.

Bank of America strategist Michael Hartnett stated, "Doubts about the trajectory of the S&P 500 are increasing" as market risks continue to rise.

Even so, Wall Street's benchmark index is only 2.6% away from the all-time high set last week.

In an interview with Bloomberg TV today, Hartnett warned that if stock prices fall another 6%, the government may take action to prevent such a decline.

Meanwhile, Elon Musk's "Department of Government Efficiency" continues to actively seek government positions and budget cuts in Washington. Investors are trying to quantify the impact of this cleansing on the Federal Reserve's interest rate trajectory, and market pessimism is quite evident.

Bloomberg economist Anna Huang stated that if DOGE could achieve a $100 billion budget cut, it would be enough to lower the consumer price index by 0.2 percentage points. If the cut were larger, reaching $600 billion, it would equate to a reduction of 0.8 percentage points. She believes that if such a scenario occurs, the Federal Reserve will have to further cut interest rates. "The expected rate cuts in 2026 underestimate Elon," Anna said.

Following Trump's latest tough rhetoric on tariffs and Beijing, concerns about stricter chip restrictions on China have led to a sharp decline in semiconductor stock prices. Intel and Nvidia's stock prices fell by 1.5%, while ASML and ASMI in the Netherlands dropped by 2%. Tokyo Electron in Japan fell by 4.9%. Stocks related to cryptocurrencies are also declining as Bitcoin's price fell below $90,000, marking its lowest point since mid-November. This reverses some of the stock market gains made after Trump's re-election. Microstrategy's stock price fell over 6%, and Coinbase dropped over 5%.

3. Analysis of U.S. Treasury Yields

During Trump's first term, the stock market was the most important indicator for the former real estate mogul turned president. However, as Trump's second term enters its second month, the White House's focus has shifted to a new indicator: the 10-year Treasury yield.

Musk and Treasury Secretary Scott Bessenet mentioned lowering market borrowing costs as a goal, reminiscent of policies during President Bill Clinton's administration.

They need to pay attention to the Treasury market, especially the 10-year Treasury yield, as it directly affects borrowing costs for homebuyers and large U.S. corporations. It remains unclear how the market will respond to Bessenet's proposal for deficit reduction and Musk's criticism of government bureaucracy. Investors still maintain some expectations for success.

In recent weeks, U.S. Treasuries have outperformed interest rate swaps of the same duration. However, most creditors are still looking for observable, substantive results.

Currently, the trend of risk aversion remains, and overall macroeconomic dynamics are showing some pressure.

Article link: https://www.hellobtc.com/kp/du/02/5690.html

Source: https://www.blockhead.co/2025/02/26/will-cryptos-underperformance-last-2/

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。