A good channel for cashing out.

Written by: Yue Xiaoyu

Many project teams have started to create Crypto Cards (U Cards) because Crypto Cards directly address the biggest pain point in the crypto space: cashing out, which means converting crypto back to fiat currency.

Since cashing out is very susceptible to money laundering, the cash-out process is often prone to card freezes, making it more difficult than depositing, with higher wear and tear. Some stable and reliable cash-out channels typically charge around 6% in fees.

However, with the emergence of Crypto Cards, the issue of small cash-outs for crypto users has been directly resolved. This card can be directly linked to third-party payment channels (such as WeChat & Alipay) for daily consumption, and in China, it is treated like a normal foreign currency card.

Let’s take a closer look at how U Cards actually operate.

1. What exactly is a Crypto Card?

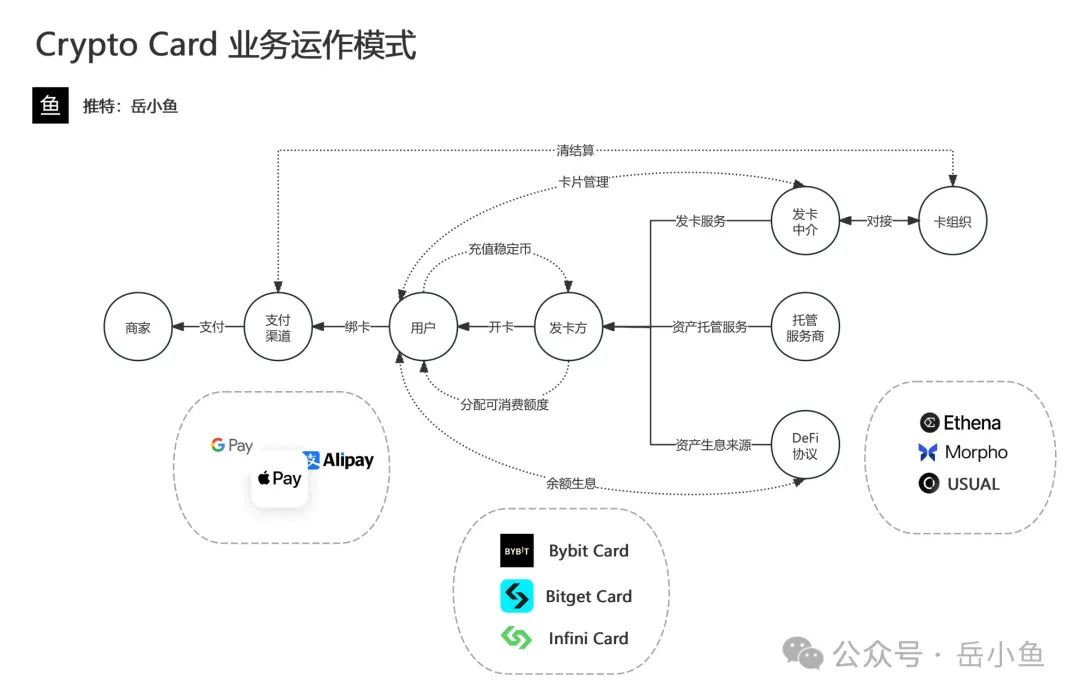

A Crypto Card is essentially a prepaid card. The issuer has a bank account with Visa/MasterCard, and users send stablecoins to the issuer, who then allocates a spending limit to your card.

U Cards are similar to the recharge cards issued by supermarkets; they can only be used for payments and cannot be transferred. There is no fiat currency balance on the card.

The Crypto Card business operates in a centralized model where users send stablecoins to the platform, and the platform provides you with a card limit. When the funds held by the platform are substantial enough, there is a significant incentive for the platform to abscond with the funds.

Issuing cards is not a particularly difficult task; in fact, there are already many card-issuing intermediaries that can achieve "one-click card issuance."

The role of card-issuing intermediaries is to connect businesses with card organizations, preparing everything necessary before the project team issues the cards.

This is the biggest advantage of card-issuing intermediaries: they have access to channels for connecting with card organizations, which requires strong qualifications to accomplish.

Moreover, card-issuing intermediaries have access to consumption data, so all risk control related to bank cards is managed by the intermediaries, who directly handle issues related to card freezes and closures.

We see that various Crypto Cards are actually issued based on card-issuing intermediaries, and their core focus is on building brands and channels, engaging in traffic conversion business.

The commercial income of the issuer mainly consists of two parts: card issuance fees and exchange fees, along with profits from fund operations.

The funds are divided into three parts: asset custody (liquid funds to meet user withdrawal requests), asset interest (assets used to generate returns, placed in CeFi or DeFi), and asset advances (paid to card-issuing intermediaries in exchange for actual fiat currency limits).

In summary, the Crypto Card market is highly homogeneous, and the various cards we see may be operated by the same card-issuing intermediaries.

At this point, choosing a Crypto Card issued by a large platform is very important, as it significantly reduces the risk of absconding.

2. Market Gap

The first wave of popular U Cards was the OneKey Card.

OneKey's main business is hardware wallets, and it later ventured into the Crypto Card business.

OneKey has a good reputation in the industry, and coupled with a great product experience for U Cards, OneKey quickly gained popularity, with almost everyone in the Chinese crypto community having a U Card.

However, after a period of operating the Card business, OneKey first suspended KYC certification for users in mainland China, meaning that users from the mainland could no longer register.

Subsequently, they completely shut down the Card business, which indicates that compliance pressures were very high.

On the other hand, it can also be seen that due to the lack of new users coming in, the Card business itself was not developing well. Initially, it attracted a large number of users and brand exposure, but now it has become a burden, and the Card business's historical mission for OneKey has ended.

However, it cannot be denied that cashing out has always been the biggest and most painful demand in the crypto industry; otherwise, the OneKey Card would not have been so popular initially.

The key issue for OneKey Card's lack of continued operation is the compliance and operational costs, and project teams with strong resource backgrounds are best suited to undertake this business.

Project teams need sufficient resources to support the Crypto Card business.

Crypto Cards are low-margin projects that require a large volume of transactions and asset accumulation to be profitable, but as the scale of the business expands, compliance and operational costs will significantly increase. Therefore, being able to scale up is crucial.

For many Web3 companies, the Crypto Card business should not be treated as a core business but can be attempted as a side business, ideally creating a synergistic effect with the main business.

After OneKey Card ceased operations, a market gap emerged, and projects like Bitget Exchange and Infini Card are filling this gap.

Bitget's main business is as an exchange, with ample resources, project capabilities, compliance capabilities, and user traffic, making it naturally suitable for the U Card business.

Infini Card, on the other hand, takes a different approach by integrating DeFi features, providing users with automatic interest-earning services, attracting a large wave of users with high annualized returns.

These two projects are typical representatives in the U Card space.

3. Business Matrix

Wallets engaging in the Crypto Card business represent a very good combination.

As a place for users to store assets, the next demands are trading, wealth management, and cash flow in and out.

(1) Trading: This is divided into on-chain trading and centralized exchange trading. Currently, centralized exchanges still hold a significant share, but the scale of on-chain trading is also growing. Most wallets will engage in DEX, and trading fees are one of the core revenue streams for wallets.

(2) Wealth Management: This essentially involves packaging various DeFi products and staking products.

(3) Cash Flow: Given the current lack of smooth channels for exchanging fiat and cryptocurrencies, cashing out can be considered the primary necessity in the crypto space, and the profit margins in between are naturally very high.

This generally involves cooperation with OTC service providers, which have high KYC requirements, while Crypto Cards serve as a good supplement, allowing for small cash-outs indirectly.

Therefore, for wallets, Crypto Cards represent a promising business direction with synergistic effects.

This is why many wallets have started to create U Cards, such as the domestic wallet OneKey, Bitget Wallet, and overseas wallets like MetaMask.

Wallets are a very important infrastructure with a high ceiling, as they serve as the entry point to the Web3 world. When users and their assets are here, many subsequent activities can be conducted.

4. Summary

U Cards are essentially a centralized model where users send stablecoins to the platform, and the platform allocates limits to the user's card. When the funds held by the platform are substantial enough, there is a significant incentive for the platform to abscond with the funds or become a target for hackers.

Therefore, for users, the risk of U Cards is relatively high, and it is recommended to only store small amounts of funds intended for daily consumption.

On the other hand, it is best to choose a Crypto Card issued by a large platform or one with a strong background, as this significantly reduces the risk of absconding. If issues arise, the platform will also compensate users.

A typical example is the recent theft incident involving Infini Card, where nearly $50 million was stolen, but the owner was still willing to personally compensate users.

This highlights the importance of project qualifications and background.

In summary, Web3 is a dark forest; only by surviving long enough can one go far. Be cautious with every operation!

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。