Author: Nianqing, ChainCatcher

Editor: TB, ChainCatcher

A new consensus is becoming increasingly strong: the PvP era has temporarily come to an end.

Pump.fun's revenue in the past 24 hours has dropped over 90% compared to its historical peak of $15.38 million on January 25. The celebrity token craze has become the last push of the accelerator before the memecoin crazy ride goes out of control. The Libra incident may mark the end of the grand era of memecoins; the key point is that the player mentality has changed, and the small players can no longer "P" (pump) as they used to.

As a result, Bitcoin has returned to the $8,000 range, and altcoins have collectively plummeted. There is a saying that ambition temporarily fades, and preserving oneself has become the current priority. This statement is particularly fitting for the current investment strategy in the crypto market. If the bull market's rising phase saw the market chasing hot money, in a downturn, investors prefer more stable annual yield products and prudent hedging strategies.

Although DeFi veteran Andre Cronje believes that those participating in meme coins are a group that is completely uninterested in DeFi or even blockchain, so meme coins have not stolen any attention. However, after the end of PvP, funds are indeed looking for other high-yield opportunities, and DeFi is beginning to show signs of recovery.

Sonic has achieved a rapid increase in its on-chain TVL from $0 to about $700 million in just two months since its launch at the end of December last year. Its ecological Dex project, Shadow Exchange, has rapidly attracted capital through high annualized mining rewards, with token prices soaring from a few dollars to hundreds of dollars.

Launching high APY DeFi arbitrage has almost become one of the recent strategies for new public chains. According to Defillama data, besides Sonic, emerging high-performance public chains focused on DeFi, such as Berachain, Sei, and Soneium, have seen an increase in TVL in the past week despite the overall market downturn, thanks to high annual yield accumulation strategies. Additionally, yield products from protocols like Pendle and Morpho are also in high demand.

Shadow Exchange: The "Golden Shovel" of the Sonic Ecosystem

The success of Shadow is attributed not only to Sonic's ecological incentives and subsidies but also to the innovative gameplay it has introduced. During the last DeFi Summer, AC proposed the ve(3,3) model, and this time, Shadow has improved upon the ve(3,3) model by introducing x(3,3).

In simple terms, (3,3) is an agreement for everyone to work together to grow stronger:

- You buy tokens and lock them up, helping the platform by providing liquidity and supporting development;

- The longer you lock, the more rewards you receive, and the platform becomes more valuable due to your support;

- Theoretically, if you lock up together with others, when the token price rises, everyone profits.

However, ve(3,3) has a problem: the locking period is too rigid, requiring years to achieve high returns, which poses significant risks and inflexible rules. Thus, Shadow's x(3,3) adds some new twists to the old mechanism, with the core being "flexibility + incentives":

- Locking for Tickets: You take Shadow's token $SHADOW to lock on the platform and exchange it for $xSHADOW. $xSHADOW acts like a "membership card"; with it, you can share in the platform's profits (like transaction fees) and vote on how the platform operates.

- Exit Anytime, But at a Cost: The old mechanism requires years to unlock, but x(3,3) is different; you can retrieve your $SHADOW whenever you want. The cost is that if you don't lock for a certain period, there will be penalties, which will be distributed to those who continue to lock up as "honest people."

- The Longer, The More You Earn: The longer you lock, the higher the "value" of $xSHADOW, and the more rewards you receive.

- "Re-basing" Incentives for Long-term Participants: The penalties paid by those who exit will allow those who stay to earn more, which is called "re-basing," motivating those who remain.

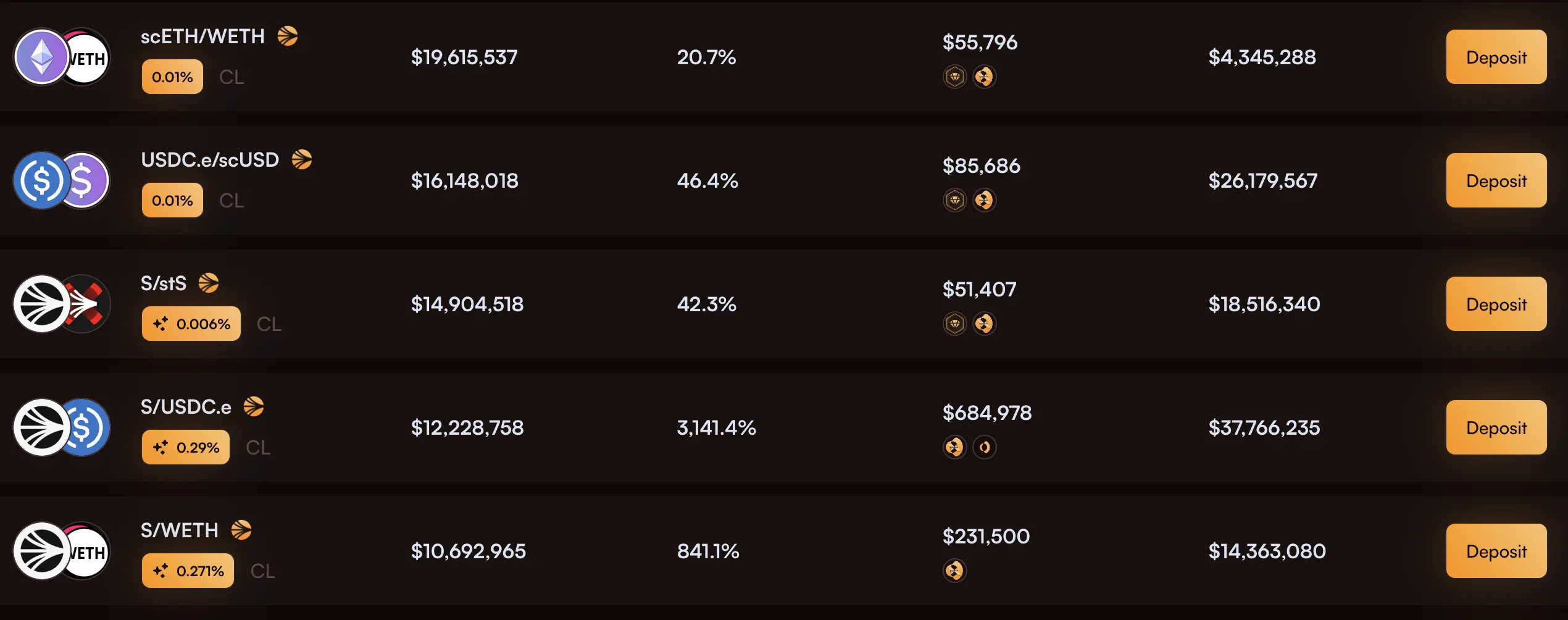

Currently, Shadow has validated the explosive potential of the x(3,3) model in the liquidity track, with trading volume on the platform exceeding $1.4 billion in the past week and TVL surpassing $130 million. The liquidity pools have approached 2,000, with some early pools having APR rates that are outrageous.

So, how is the high APY of Shadow's staking pools achieved?

Shadow's high APY pools mainly attract users by distributing reward tokens $xSHADOW. Initially, to incentivize more people to mine, the rewards were in a "high emission" phase, leading to high annualized returns, sometimes reaching hundreds or even thousands of percentage points. Additionally, Shadow uses Uniswap V3's concentrated liquidity mechanism. The narrower the range of provided liquidity, the more concentrated the rewards, making the APY appear higher. However, as more participants and capital enter, the rewards become gradually diluted, and the APY naturally declines.

Moreover, there is quite a bit of "water" behind the high APY. The staking rewards of $xSHADOW actually have unlocking restrictions, with some rewards requiring a 6-month lock to be fully withdrawn. Additionally, you need to bear the risk of impermanent loss. If the pool's price fluctuates significantly, large holders selling off can also lead to losses. Furthermore, some users have complained that the APY displayed on Shadow's front end is calculated based on the narrowest price range, making it difficult for many investors to understand the actual returns, leading to potential deception by "inflated" figures.

Shadow has been online for less than two months and is still in its early stages. Coupled with Sonic's ecological subsidies and airdrop expectations, it is challenging for the high APY to be sustained for long. As the locked amount (TVL) increases and more participants join, the rewards will be diluted. Investors also need to consider risks such as unlocking discounts, impermanent loss, and price fluctuations. Therefore, stablecoin trading pairs on Shadow are more popular due to lower impermanent loss, but the APY is relatively lower.

It is worth mentioning that the DeFi protocol Solidly, which initially applied the ve(3,3) model, failed to sustain itself due to issues with its release mechanism and liquidity management. Although its model has been improved by protocols like Velodrome, the sustainability flaws of the (3,3) economic model still exist.

Infrared: The "Liquidity Engine" of Bear Chain

Before introducing Stride, it is necessary to mention the overall situation of the current Bear Chain (BeraChain) DeFi ecosystem. Bear Chain went live on its mainnet on February 6, and within just 20 days, its DeFi ecosystem has rapidly risen, with its TVL exceeding $3 billion, surpassing public chains like Base, Arbitrum, and Sui. Several DeFi protocols on Bear Chain, such as Infrared, Stride, BEX (Berachain Exchange), Bend, Berps, and Honeypot, have launched high APY liquidity staking pools.

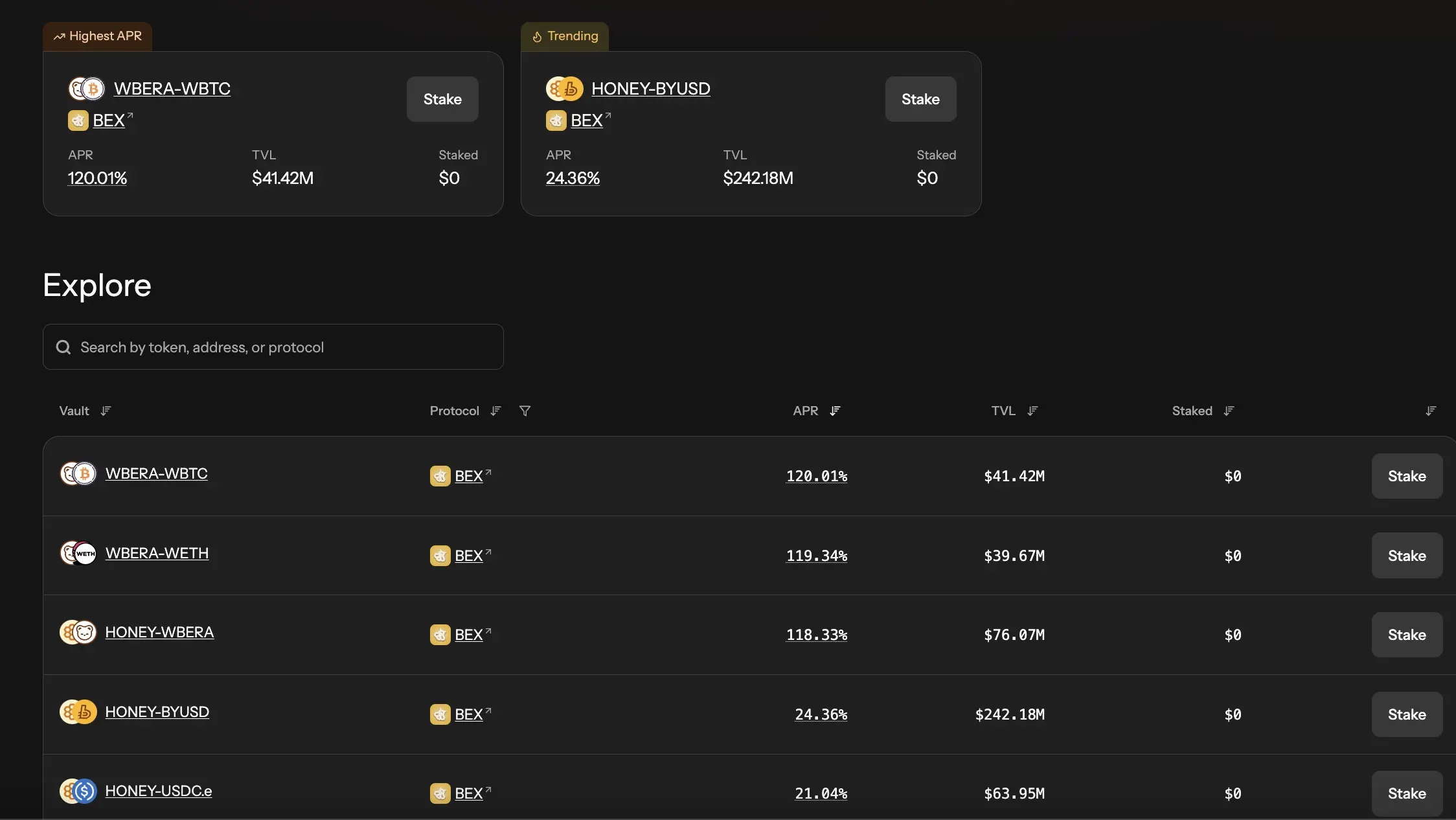

Additionally, Berachain has designed a BGT incentive system around its core consensus mechanism, PoL, aimed at incentivizing users, validators, and project parties to participate together through BGT (Bera Governance Token, the governance token of Bear Chain). When the mainnet first launched, only a few pools on the official DEX BeraHub could earn BGT, such as WBERA/HONEY and USDC.e/HONEY. These are "default vaults" that lay the foundation for the ecosystem. It is still in the first phase of governance, where PoL is fully opened, allowing any project to apply for its pool to earn $BGT. Voting rights are held by BGT holders. Currently, it still belongs to the early participation stage, where returns and subsidies are relatively high. As more pools join, the distribution of BGT will gradually dilute.

Currently, the leading liquidity staking protocol on Bear Chain is Infrared, with an on-chain TVL exceeding $1.4 billion, and the highest liquidity pool's APY is 120%.

Infrared's explosive growth and high APY are closely tied to the "capital-absorbing effect" during the mainnet's dividend period. Berachain's governance token BGT is "soul-bound," meaning it cannot be bought or sold, only earned through providing liquidity. Infrared acts as the ticket office for Bear Chain; by depositing liquidity (like BEX's LP tokens) into the vault, users can exchange for iBGT and also receive $BGT rewards. Additionally, Infrared collaborates with multiple DeFi protocols within the ecosystem to ensure the liquidity and nested returns of iBGT throughout the ecosystem.

Moreover, Infrared is a Build-a-Bera incubation project supported by the Berachain Foundation, which received investment from YZi Labs (Binance Labs) last June.

Currently, Infrared continues to grow through official token distribution, validator dividends, and leveraged strategies. However, all high APY projects carry risks, and like Shadow, Infrared users also face high risks such as dilution of benefits, impermanent loss, and price fluctuations.

Yei Finance: The "Stablecoin Mining Artifact" of the Sei Ecosystem

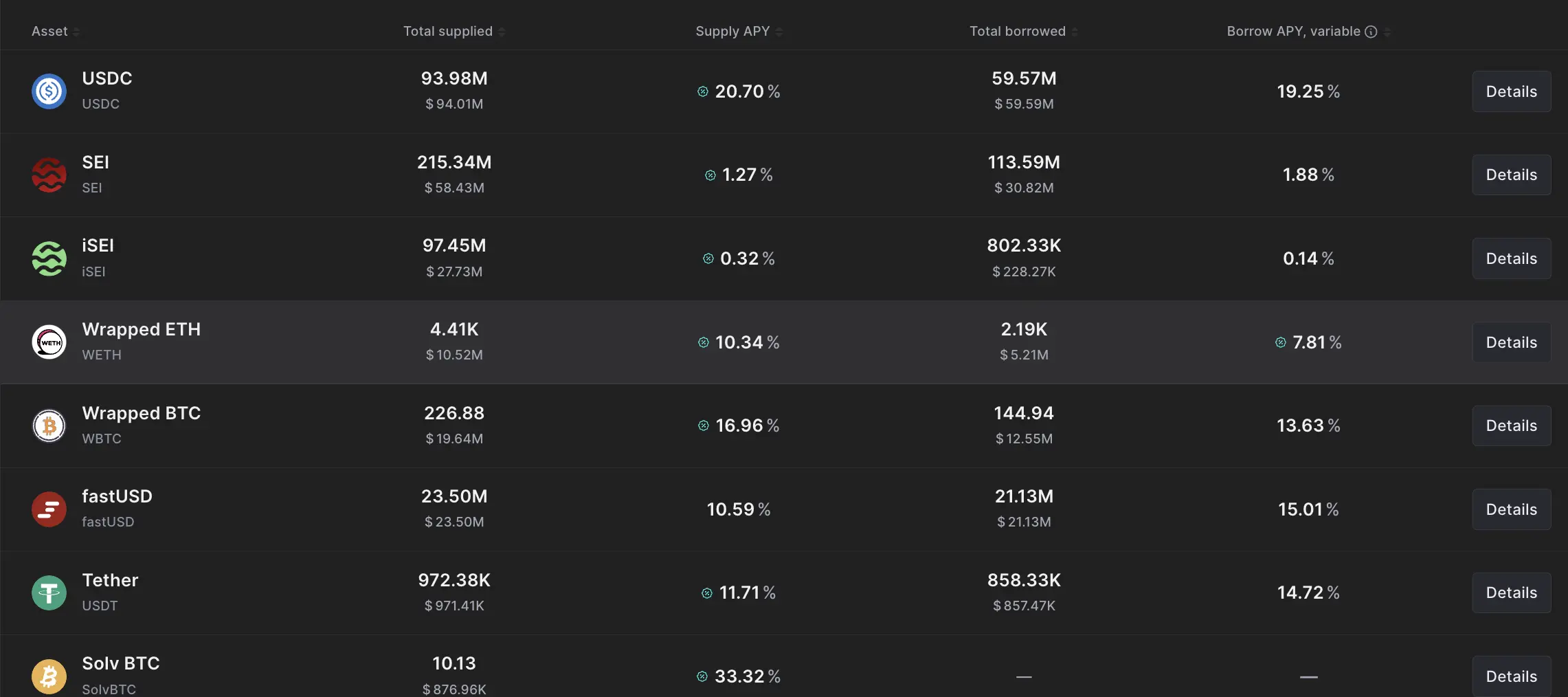

Although Yei Finance's APY is not particularly high compared to the previous protocols, its robust investment still attracts many conservative investors to mine.

Yei is the leading lending protocol in the Sei ecosystem, primarily focusing on mining with USDC, while also offering WSEI (wrapped SEI) rewards. Its positioning is as Sei's "yield aggregator." Recently, Yei also launched the SolvBTC pool, providing Bitcoin yield opportunities, which is relatively rare in DeFi.

The APY of the USDC pool on Yei exceeds 20% (of which about 5.7% is stablecoin yield, and 14.9% is WSEI), making it the largest pool on the platform. The "stability + high yield" combination has attracted a large number of conservative investors.

In December last year, Yei Finance completed a $2 million seed round of financing, led by Manifold, with participation from DWF Ventures, Kronos Research, Outlier Ventures, Side Door Ventures, and WOO.

Sonex: The DeFi Hub on Sony Chain

Soneium is an Ethereum Layer-2 blockchain jointly developed by Sony's Sony Block Solutions Labs and Startale, built on the Optimism OP Stack. Soneium officially launched its mainnet on January 14, 2025. According to L2Beat data, Soneium's TVS (Total Value Secured) has exceeded $70 million (the SolvBTC asset is subject to double counting).

Similar to Bear Chain, as an early-launch ecosystem, Soneium has a rich array of incentives and subsidy activities for its ecosystem. For example, Soneium launched the Soneium OG Badge at the beginning of February, with the event ending at 12:00 PM Beijing time on February 27. Participants who complete 45 transactions on Soneium (why 45 transactions? Because Soneium launched on January 14, and the event ends on February 27, which is exactly 45 days) can earn a soul-bound badge, which will provide numerous benefits, such as ecosystem airdrops.

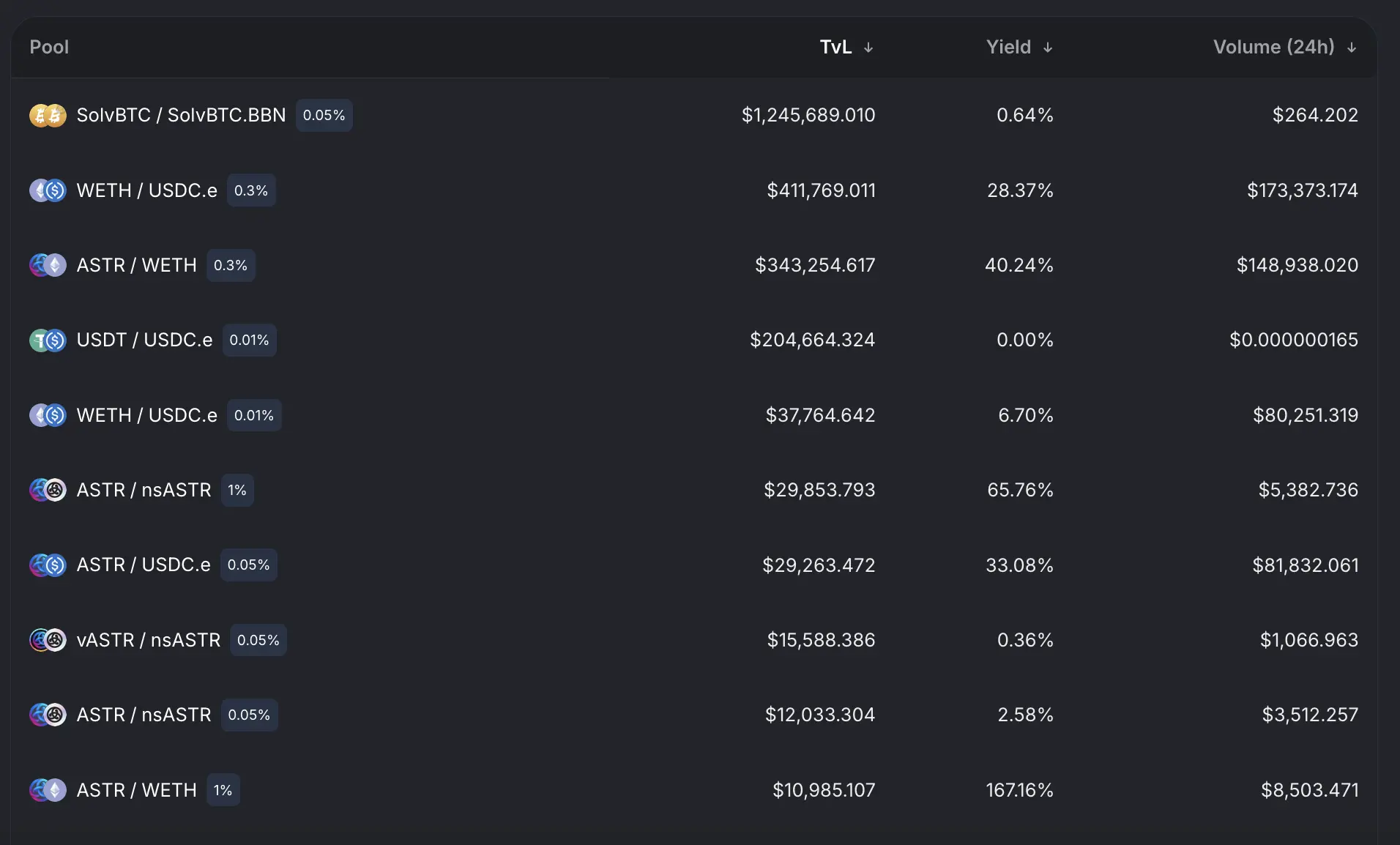

Sonex is the leading DeFi project in the Soneium ecosystem, supported by Sony Block Solutions Labs and Startale. It is positioned as an AI-driven DEX and an all-in-one DeFi platform, being one of the first projects incubated on the Soneium mainnet, which went live on January 28, and it has been less than a month since its launch. Last month, Sonex announced that it successfully raised $1 million in seed funding in less than 60 days, led by Outliers Fund, with participation from Baboon VC, Taisu Ventures, Nonagon Capital, Flow Traders, Gate Ventures, and Lootex.

Sonex's staking pools currently feature several high APY liquidity pools, primarily focused on stablecoins and ETH. Recently, Sonex launched the Astar Contribution Score (ACS) event, which runs from February 20 to May 30, allowing participants to earn dual incentives of tokens and points by staking ASTR on Sonex.

Morpho: Multi-chain DeFi "Smart Fund"

On February 27, Coinbase announced the launch of MORPHO. Morpho was initially a lending protocol on the Ethereum network, centered around "optimizing lending pools," adding a layer of "smart matching" on top of traditional protocols like Aave and Compound. In simple terms, it aims to match borrowers and lenders as closely as possible (P2P), reducing idle funds and increasing yields. However, as a relatively older DeFi protocol, its recognition is far less than that of Aave and Compound since it builds on other protocols.

In early 2024, Morpho launched a new decentralized lending infrastructure called Morpho Blue, shifting from a pure DeFi protocol to DeFi infrastructure. The lending market of Morpho Blue is independent. Unlike multi-asset pools, the liquidation parameters of each market can be set without considering the highest-risk assets in the basket. Therefore, suppliers can lend at a higher LLTV while bearing the same market risks as when supplying to multi-asset pools with lower LLTV. Collateral assets are not lent to borrowers. This alleviates the liquidity requirements needed for normal liquidation operations on current lending platforms and allows Morpho Blue to offer higher capital utilization rates.

Additionally, Morpho Blue is fully autonomous, eliminating the need to introduce fees to pay for platform maintenance, risk managers, or code security experts. Notably, Morpho Blue features permissionless asset listing, allowing anyone to create custom lending markets, such as assets, interest rates, liquidation rules, etc., making its ecosystem's financial efficiency simple and effective. Blue also supports permissioned markets, enabling broader use cases, including RWA and institutional markets.

Morpho Stack has been deployed on several new chains, including Polygon POS, Arbitrum, Optimism, Scroll, Ink, World Chain, Fraxtal, Unichain, Mode, Hemi, Corn, Sonic, etc. (It is important to note that deployments under the multi-chain framework are limited to infrastructure; these new chains have not yet launched the Morpho App and will not receive MORPHO rewards).

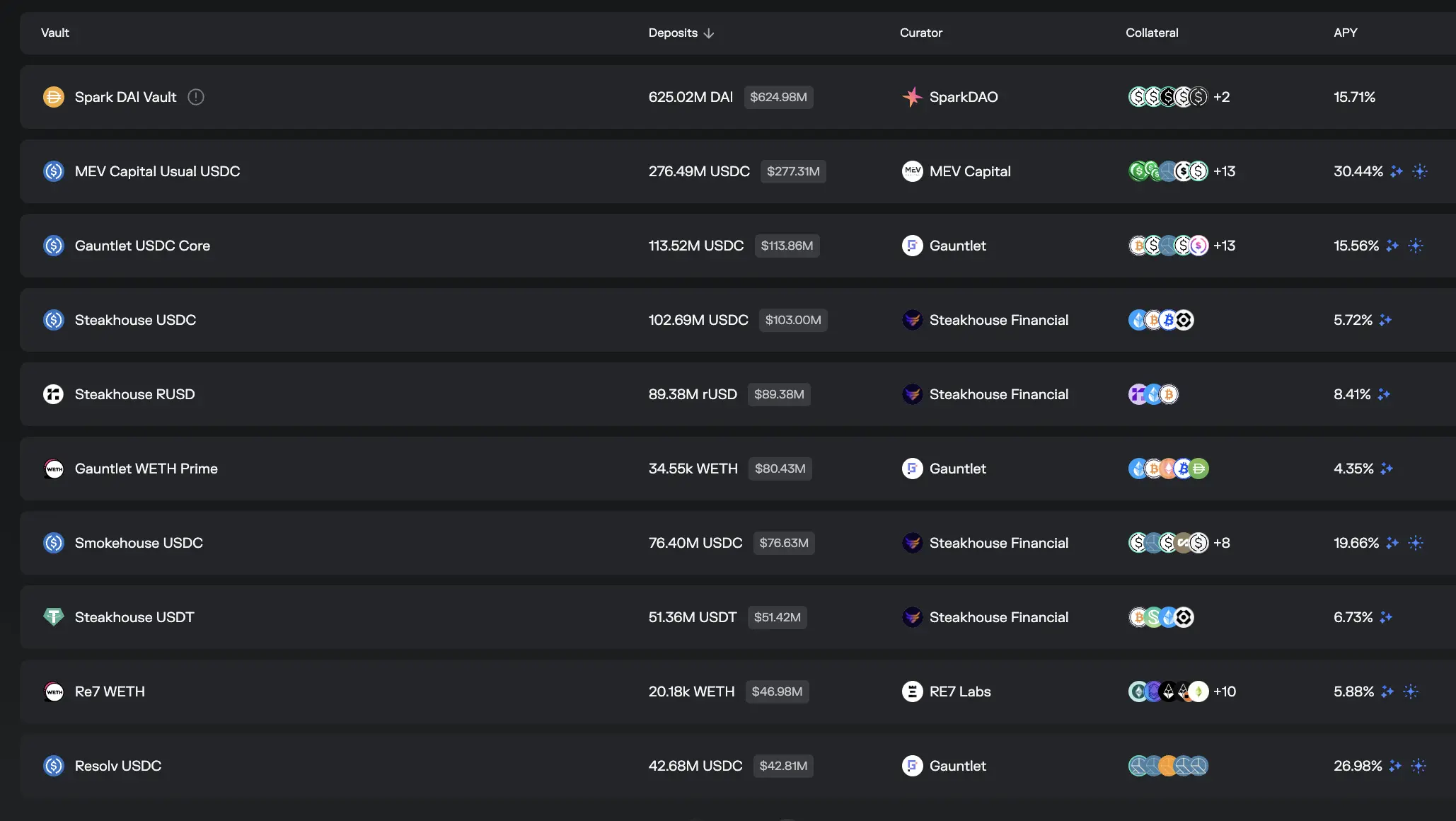

Currently, Morpho has total deposits exceeding $5.3 billion. According to DefiLlama data, Morpho Blue's total TVL has rapidly increased in recent months and is now approaching $3 billion. There are multiple asset pools on Morpho Blue, with popular pools still primarily consisting of stablecoins.

Pendle: The Bond Market of DeFi

Pendle is a DeFi protocol that allows users to tokenize and trade the future yields of yield-generating assets. By separating the principal and yield portions of an asset, Pendle employs more advanced yield management strategies, including fixed income, speculation on future yield fluctuations, and unlocking liquidity from staked assets, bringing traditional financial concepts (such as interest rate derivatives) into the DeFi space.

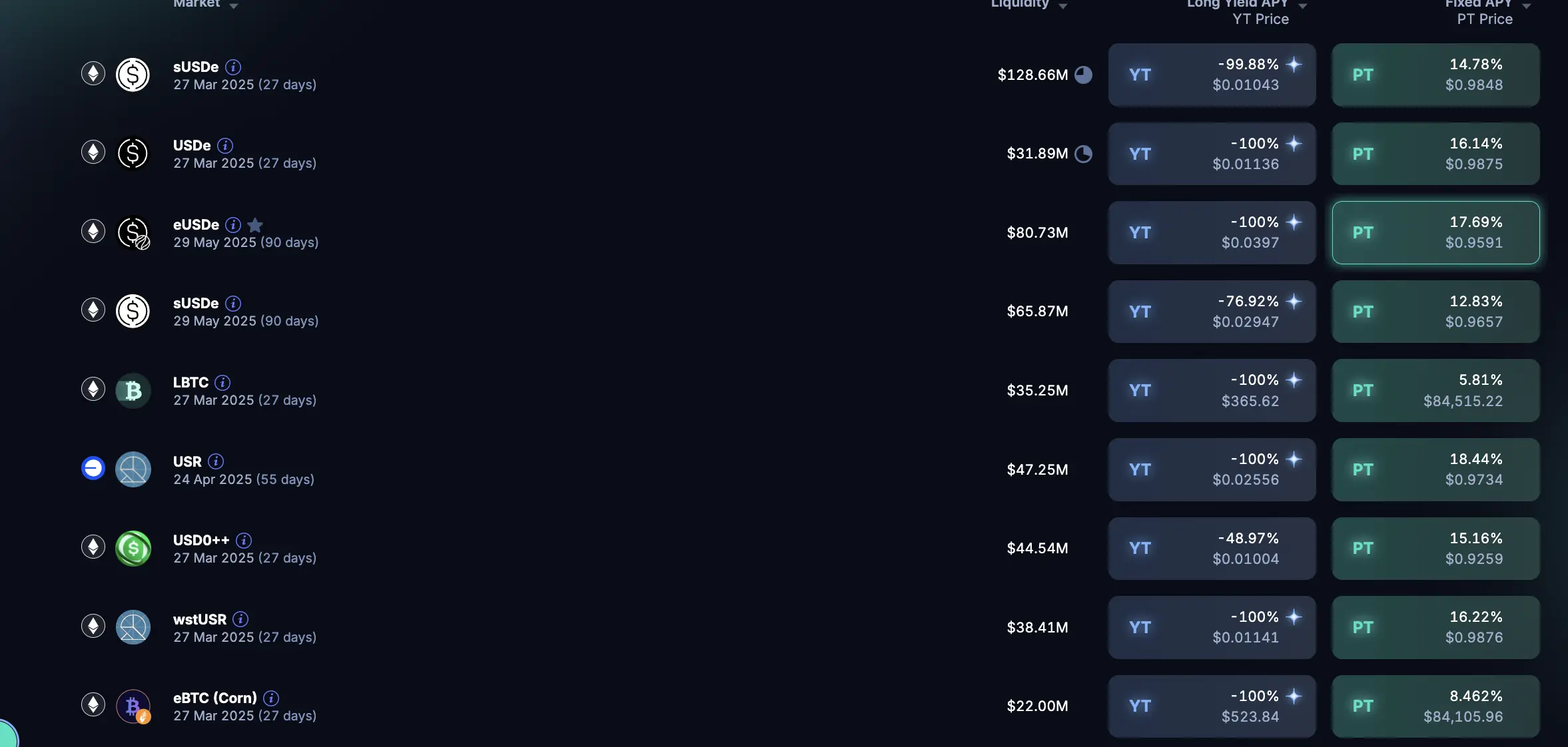

In simple terms, compared to other exchanges that primarily trade coin prices, Pendle trades more like "APY," meaning "using future yields to play now." It allows users to split yield-generating assets into "Principal Tokens" (PT) and "Yield Tokens" (YT), which can then be traded separately. For example, if you have stETH (Lido's staked ETH), you can use Pendle to split it into PT (to get back the principal at maturity) and YT (to earn future yields), and then trade them freely. This flexibility allows users to lock in fixed income while speculating on yield expectations.

Pendle established a fixed income market last year, achieving a 20-fold increase in its TVL, which is now approaching $5 billion.

Currently, Pendle offers many arbitrage opportunities, such as arbitraging PT discounts. In the market, PTs are typically traded at prices lower than their maturity value (trading at a discount). You can buy PTs at a low price, hold them until maturity, and earn the difference; YT is the yield token that earns the future yields of the underlying asset. If the market expects yields to rise, you can buy YTs at a low price, betting to earn high yields; in addition, there are arbitrage opportunities in the PT-YT price spread. Relatively safer is staking mining, where you can also participate in U-based PT pool arbitrage, with APYs usually exceeding 10%. However, all arbitrage activities need to consider risks such as impermanent loss, long lock-up periods, and price fluctuations.

(Investment involves risks; readers should approach with caution and rationality. This article does not constitute any investment advice.)

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。