Recently, Bank of America CEO Brian Moynihan revealed in an interview with the Economic Club of Washington, D.C. that the bank plans to launch a dollar-backed stablecoin, pending regulatory approval. This statement not only marks a significant shift in the attitude of the second-largest bank in the U.S. towards cryptocurrency but also indicates that Wall Street financial institutions are accelerating their embrace of digital assets, supported by the Trump administration.

From Cautious Observation to Proactive Layout

Bank of America has long maintained a low profile in the cryptocurrency space, appearing conservative compared to peers like JPMorgan and Citigroup, which have actively explored blockchain technology. Moynihan admitted that the bank has "always been in a secondary position" in the crypto industry. However, he clearly stated that once U.S. lawmakers pass relevant legislation, Bank of America will quickly launch its own dollar stablecoin, tentatively named "Bank of America Coin." He likened the function of stablecoins to that of money market funds or bank accounts, emphasizing that its essence is a "digital currency" that can seamlessly connect with traditional dollar deposits, enabling two-way flow of funds.

"If they legalize it, we will enter that business," Moynihan said in an interview with David Rubenstein. "Clearly, there will be a fully dollar-backed stablecoin… We want customers to be able to freely convert between deposits and stablecoins." This vision not only reflects Bank of America's recognition of the payment potential of stablecoins but also suggests its intention to carve out a share in the digital finance sector.

Trump Administration's New Crypto Policy

Bank of America's strategic adjustment is closely related to the policy shift following the Trump administration's rise to power. Since Trump officially took office on January 20, 2025, his administration has shown strong support for cryptocurrency, promising clearer regulatory guidance for the industry. The newly appointed White House cryptocurrency and AI czar, David Sacks, stated that Congress will pass stablecoin-related legislation within the first 100 days of Trump's presidency (by the end of April). This timeline has received support from the Republican-controlled Congress, with Senator Tim Scott and Representative Patrick McHenry publicly stating that stablecoin legislation is a priority.

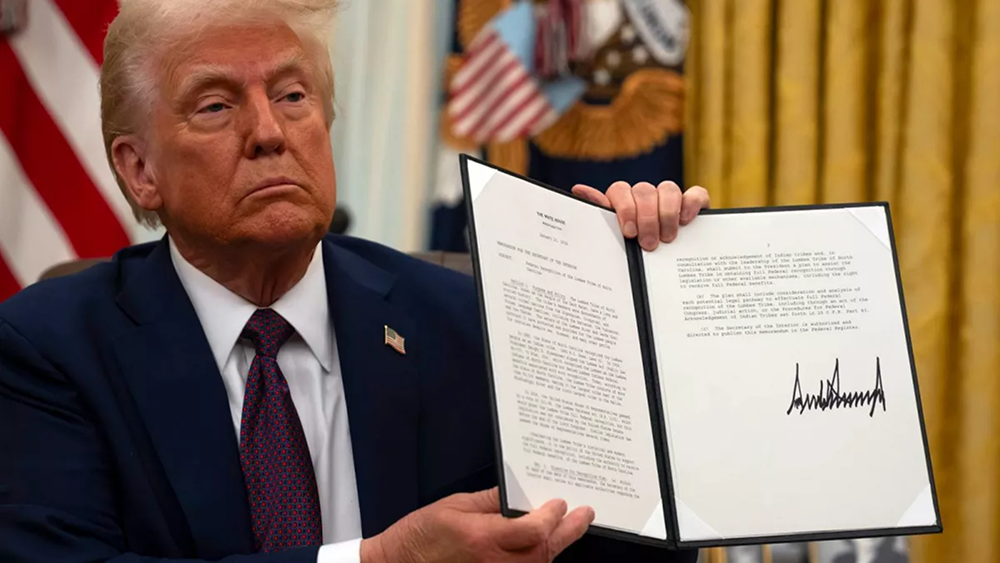

In late January, Trump signed an executive order establishing a digital asset working group led by Sacks, aimed at developing a comprehensive regulatory framework to support blockchain innovation and maintain the global dominance of the dollar. The order explicitly opposes the issuance of central bank digital currencies (CBDCs) and encourages the private sector to develop dollar-backed stablecoins. Sacks stated in a recent speech, "Stablecoins are the future of the dollar's digitization and will solidify America's leadership in global finance." This stance sharply contrasts with the previous Biden administration, during which the SEC's tough enforcement on the crypto industry deterred many financial institutions.

Bipartisan Struggle Over Stablecoin Legislation

Stablecoins, which are pegged to the value of fiat currencies like the dollar and exhibit low volatility, have become important tools in payments and transactions. According to Visa, global stablecoin transaction volume exceeded $33 trillion in the past year, surpassing the combined total of Visa and Mastercard. However, their rapid development has also raised regulatory concerns, including money laundering risks and reserve transparency issues.

To address these challenges, the U.S. Congress has made several attempts in recent years to legislate stablecoins. The "Lummis-Gillibrand Payment Stablecoin Act," introduced in 2024, requires issuers to hold 1:1 cash or highly liquid assets in support and undergo regular audits. In early February 2025, Senator Bill Hagerty, along with several other lawmakers, proposed the "U.S. Stablecoin Innovation Guidance Act" (GENIUS Act), which further clarifies that the Office of the Comptroller of the Currency (OCC) will regulate non-bank issuers and requires reserve assets to include dollars, treasury bonds, and more.

There is both consensus and divergence in the bipartisan attitude towards stablecoins. Republicans believe that stablecoins can enhance the international influence of the dollar, promote financial innovation, and even indirectly lower long-term interest rates by increasing demand for treasury bonds. Democrats, on the other hand, are concerned that they may be used for illegal activities and advocate for stronger anti-money laundering (AML) and know your customer (KYC) requirements. Although Republicans currently control Congress, analysts point out that the final bill may require bipartisan compromise to ensure broad acceptance. Earlier this month, a group of lawmakers pledged to pass legislation within the first 100 days of Trump's presidency, and this goal is accelerating.

Intensifying Competition on Wall Street

Bank of America's stablecoin plan is not an isolated event but a reflection of the growing interest in cryptocurrency on Wall Street. JPMorgan launched JPM Coin as early as 2019 for internal payment settlements; Citigroup is exploring blockchain applications for cross-border payments. Meanwhile, another traditional financial institution, Charles Schwab, recently hired a digital asset chief, indicating a trend of moving from observation to action. The anticipated regulatory easing under the Trump administration further catalyzes this competitive landscape, potentially prompting more banks to join the stablecoin race.

The rise of stablecoins poses a challenge to traditional payment giants. The $33 trillion transaction volume indicates that stablecoins are not just tools for the crypto market but an important part of the global payment ecosystem. Visa and Mastercard may need to accelerate innovation to respond to the impact of this emerging technology. At the same time, the prosperity of stablecoins also provides new opportunities for institutions like Bank of America, especially in the areas of cross-border payments and decentralized finance (DeFi).

Potential and Risks Coexist

If Bank of America launches a stablecoin, it may bring the following impacts:

- Improved payment efficiency: Stablecoins can enable low-cost, real-time cross-border transactions, optimizing the international remittance experience.

- Enhanced customer loyalty: Providing digital asset services may attract the younger generation and high-net-worth clients.

- Strengthened dollar status: With 98% of global stablecoins denominated in dollars, their development will reinforce the dollar's international influence.

However, risks cannot be ignored. First, regulatory uncertainty remains. Although the Trump administration has promised support, the implementation of specific rules may be delayed due to market fluctuations or political resistance. Second, reserve management is crucial. Tether (USDT) was fined due to reserve controversies, and Bank of America must ensure the transparency and liquidity of its stablecoin's assets to address potential run risks. Additionally, the widespread use of stablecoins may trigger systemic risks, requiring close monitoring by regulatory agencies.

Industry Expert Opinions

Crypto analyst James Rickards stated, "Bank of America's entry will mark the transition of stablecoins from the margins to the mainstream, and the integration of traditional finance with digital assets will be irreversible." Philip Gradwell, chief economist at blockchain consulting firm Chainalysis, pointed out, "The support from the Trump administration provides a golden window for stablecoins, but the balance of regulatory details will determine their success or failure."

Conclusion

Bank of America's plan to launch a dollar stablecoin is the latest testament to the transformation of traditional financial giants in the wave of cryptocurrency. With the support of the Trump administration, stablecoin legislation is expected to be implemented in the first half of 2025, injecting new vitality into the industry. This trend may not only reshape the competitive landscape on Wall Street but also solidify the dollar's position in the digital age. However, regulatory uncertainty and potential risks remind us that this transformation must be approached with caution. For the global financial market, this step by Bank of America may just be the prelude to a larger change.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。