Original Title: Liquidations, liquidations everywhere!

Original Author: threesigmaxyz

Original Translation: zhouzhou, BlockBeats

Editor's Note: This article explores the significant gap between liquidation data reported by CEX and actual liquidation activities. By comparing the transparent liquidation data from Hyperliquid with the reported data from CEX, it reveals that CEX may underreport liquidation data to obscure market volatility or manage public perception. The article also emphasizes the importance of transparency in understanding market risk and systemic risk, noting that exchanges like Bybit are taking more open measures to publish liquidation data, pushing the industry towards greater transparency.

The following is the original content (reorganized for readability):

Traders face liquidations, with billions of dollars evaporating. But what if the real liquidation numbers are 19 times higher than reported? We pulled the data, and the results are worse than you think.

1. Liquidations

The world of trading is becoming increasingly accessible to the average person, whether through the flashy courses of so-called "mentors" or as an alternative to traditional jobs. Trading offers the allure of potentially earning substantial income from home with just a computer.

However, this is far from easy; if it were that simple, everyone would succeed. In fact, most people who enter trading end up losing money and ultimately blowing up their accounts. So, what leads to these losses? Typically, it all boils down to a decisive event that every trader fears: liquidation.

Liquidation is a key mechanism in leveraged trading that occurs when a trader's margin is insufficient to cover the losses of their open positions. In this case, the exchange intervenes and automatically closes the positions to ensure that the trader or platform does not incur further losses.

Depending on the severity of the margin shortfall and the platform's risk management mechanisms, liquidations can take different forms. These forms can be broadly categorized into two types:

· Partial liquidation: Involves reducing a trader's position partially, while the remaining portion remains active. This allows the trader to stay in the market while reducing associated risks.

· Full liquidation: The entire position is closed, completely eliminating the trader's exposure risk. Full liquidations are more common in high-leverage environments, where even small price fluctuations can wipe out a trader's margin.

Key Factors Behind Liquidations

The reasons for liquidations are multifaceted, all revolving around the delicate balance between risk and margin:

· Leverage: Leverage allows traders to control larger positions with less capital, but this potential amplification of profits comes with higher risks. The higher the leverage, the smaller the price movement required to trigger a liquidation. For example, with 50x leverage, a mere 2% adverse price movement can result in a total loss of margin. This makes risk management crucial in leveraged trading.

· Maintenance margin: Each exchange sets a minimum margin requirement that traders must maintain to keep their positions open. This maintenance margin acts as a safety buffer. When losses cause the margin to fall below this threshold, the exchange will liquidate positions to prevent further losses. Ignoring or failing to monitor these requirements can quickly lead traders to face forced liquidations.

· Market volatility: Sudden extreme price fluctuations are a trader's greatest enemy, especially in highly leveraged positions. Volatility can rapidly deplete available margin, leaving traders with little time to react. Additionally, periods of high volatility often lead to cascading liquidations, where one liquidation triggers a series of others, further driving prices in the wrong direction.

Squeezes

Squeezes are one of the most intense and rapid triggers for liquidations, typically occurring during sharp price movements that force counter-traders in the market to close their positions. Such events are often driven by high leverage and low liquidity, creating a snowball effect that accelerates price movements and exacerbates market volatility.

When prices rise rapidly, traders holding short positions find themselves in a bind as their margin is insufficient to support their trades. To avoid further losses, they are forced to close their positions by buying back assets, which adds upward pressure to prices. This dynamic can quickly evolve into a series of liquidation events, where one trader's liquidation pushes prices higher, forcing others to liquidate as well.

Conversely, when prices suddenly drop, traders holding long positions face the same risks. As their margins shrink, they are compelled to sell positions to meet maintenance margin requirements, further intensifying downward momentum. This selling pressure amplifies the price decline, triggering more liquidation events and creating a downward spiral.

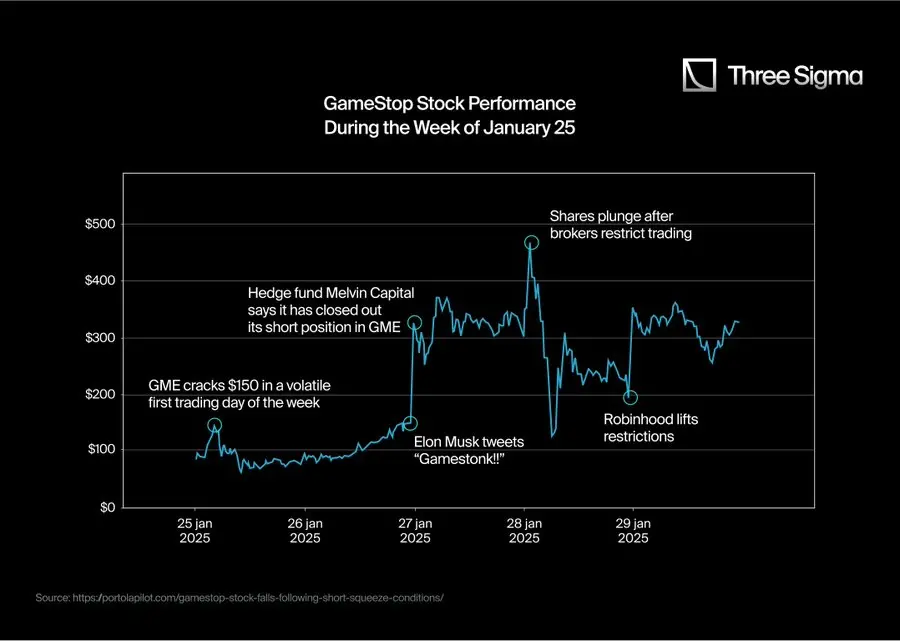

However, coordinated buying by retail traders, particularly driven by communities like WallStreetBets on Reddit, can cause stock prices to surge unexpectedly. As prices rise, short sellers are forced to buy back stocks, and with prices continuously climbing, this further drives the price upward.

This feedback loop ultimately evolved into a historic event, with GameStop's stock price soaring from about $20 in early January 2021 to an intraday high of $483 by the end of the month. This squeeze event resulted in billions of dollars in losses for many institutional investors caught in short positions.

2. API and Liquidations

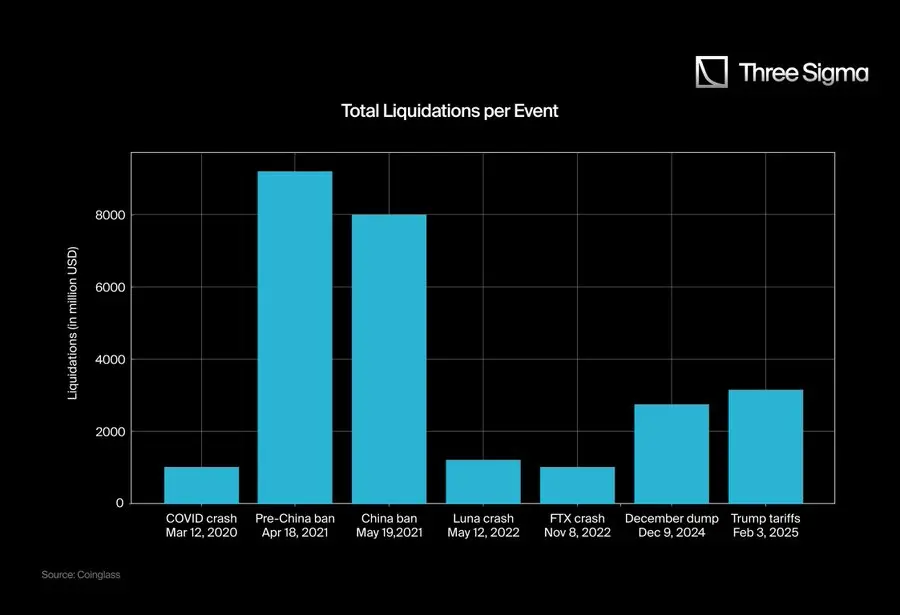

In the cryptocurrency space, there have been several notable liquidation events throughout history. However, the most memorable and impactful are often the "long squeezes" that occur in down markets. These events tend to be larger in scale and have more profound effects on traders and the market.

Here are some of the largest liquidation events in cryptocurrency history:

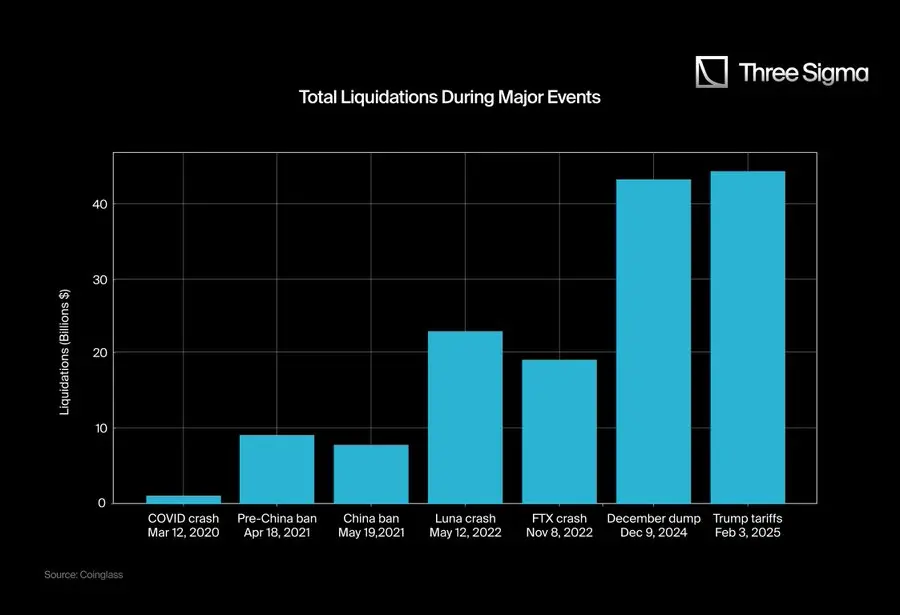

Notice anything unusual, anonymous? Do you think the FTX collapse or the Luna crash caused more damage than the liquidation events we've seen this year? Well, you're not wrong.

The recent liquidation events have been more severe than the FTX or Luna collapses due to three key factors:

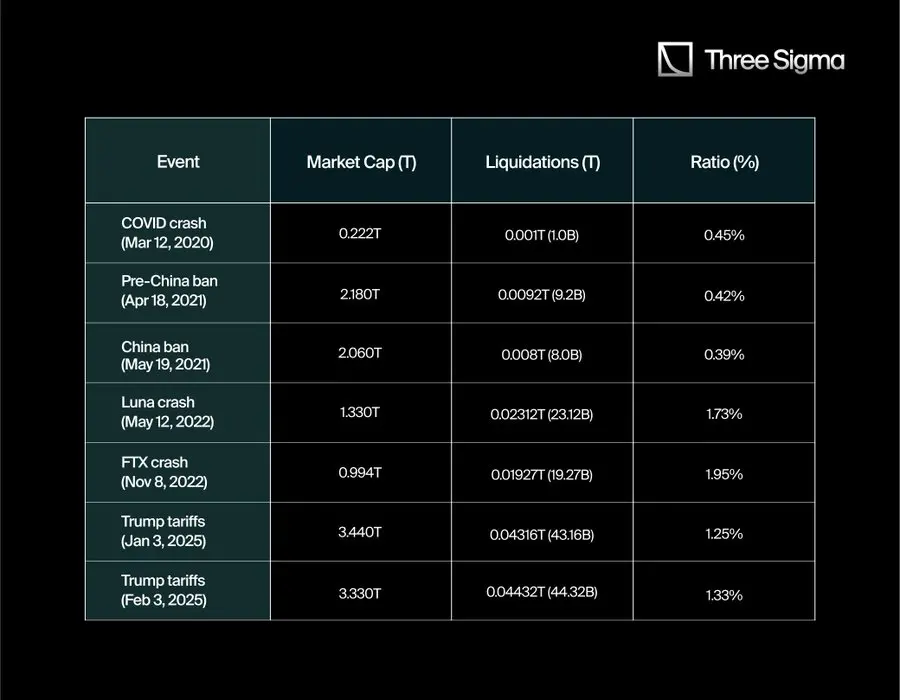

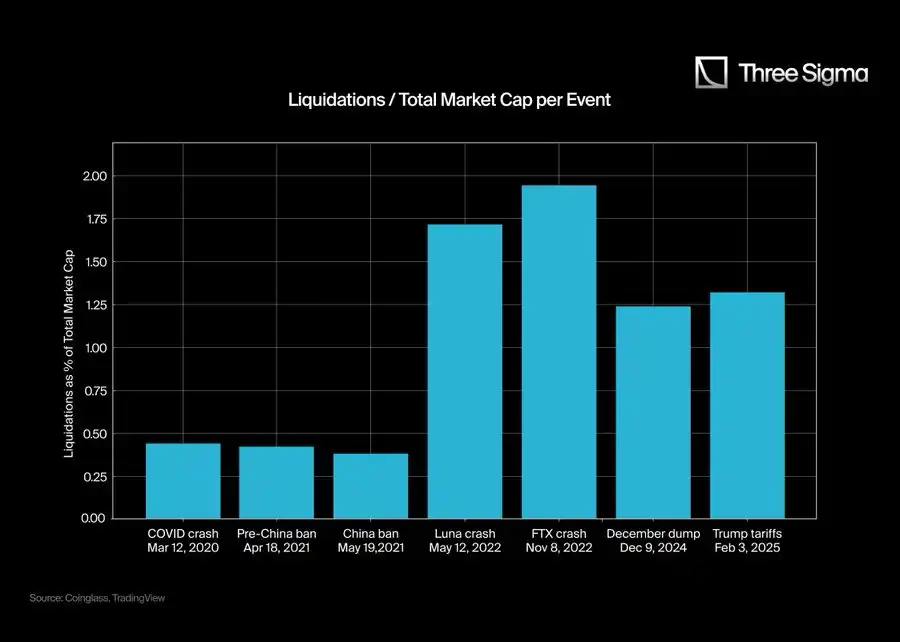

Total Market Capitalization

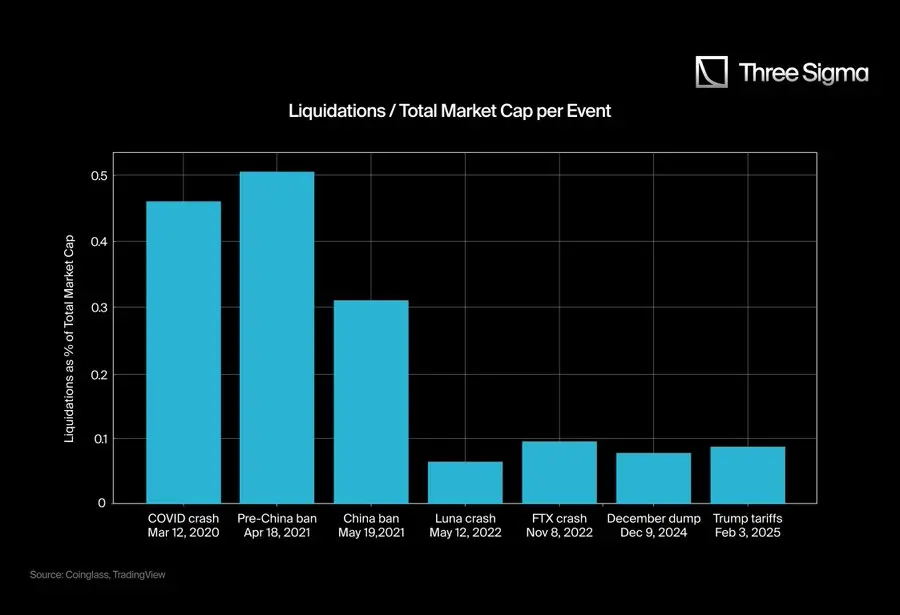

In March 2020, the total market capitalization reached $266 billion, while by 2025, the peak market capitalization had reached $3.71 trillion. To truly understand the scale of these liquidation events, we should consider the ratio of liquidations to market capitalization, rather than just looking at the absolute numbers of liquidations. Pure numbers may make recent liquidations appear more severe than they actually are.

This chart gives us a clearer view of the scale and impact of liquidations, but some data still does not reflect reality; this is where the second issue lies.

CEX WebSocket

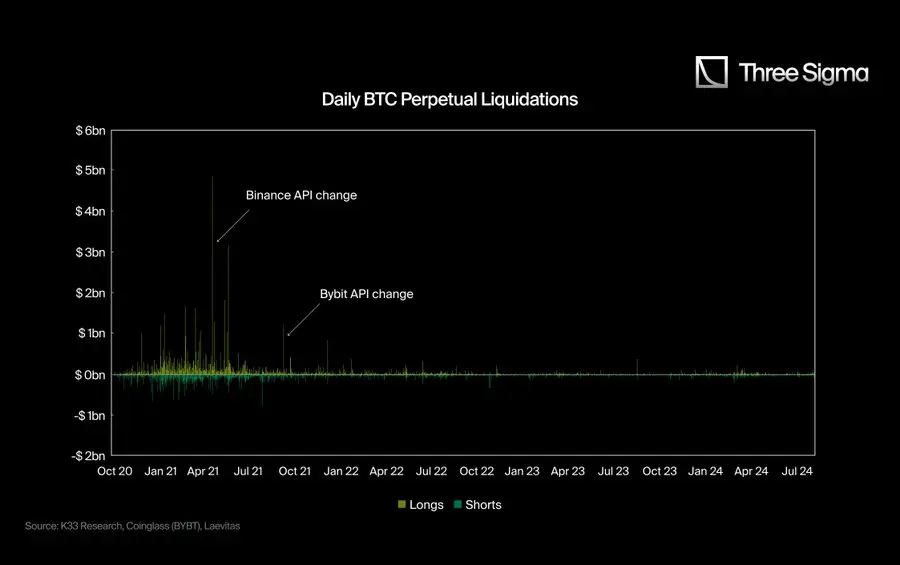

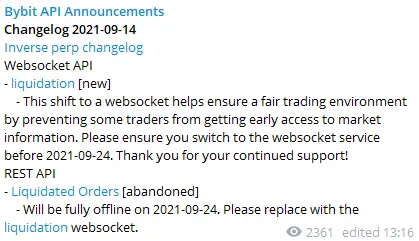

Until the second quarter of 2021, most CEX provided accurate liquidation data through APIs, reporting every liquidation. However, starting in 2021, they introduced restrictions, limiting liquidation data to one liquidation per second, regardless of how many liquidations actually occurred.

This change significantly reduced the reported liquidation numbers, making the data from late 2021 appear smaller and less impactful than that from before 2021.

@K33Research wrote a research article explaining this situation and illustrated it with two simple yet powerful charts:

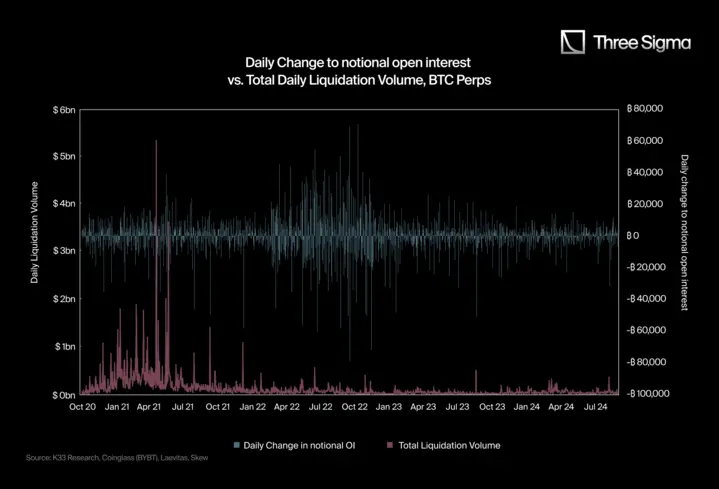

In the first chart, you can see that after the API changes, the number of liquidations noticeably slowed down, even though the total market capitalization far exceeded that of 2021, the liquidation data remained at low levels.

In the second chart, the author compared the total liquidation volume with the daily nominal open interest (OI) changes.

The significant intraday fluctuations in nominal open interest typically trigger a large number of liquidations, but as we see in the chart, after the second quarter of 2021, there was no noticeable spike in liquidations on days with such large OI fluctuations.

The official reason behind these API changes was: "to provide a 'fair trading environment' (Bybit, September 2021) and to 'optimize user data flow' (Binance, April 2021)," but some believe this was merely for public relations reasons to avoid causing excessive panic, while also retaining the actual data for themselves.

Hyperliquid as a Real Platform

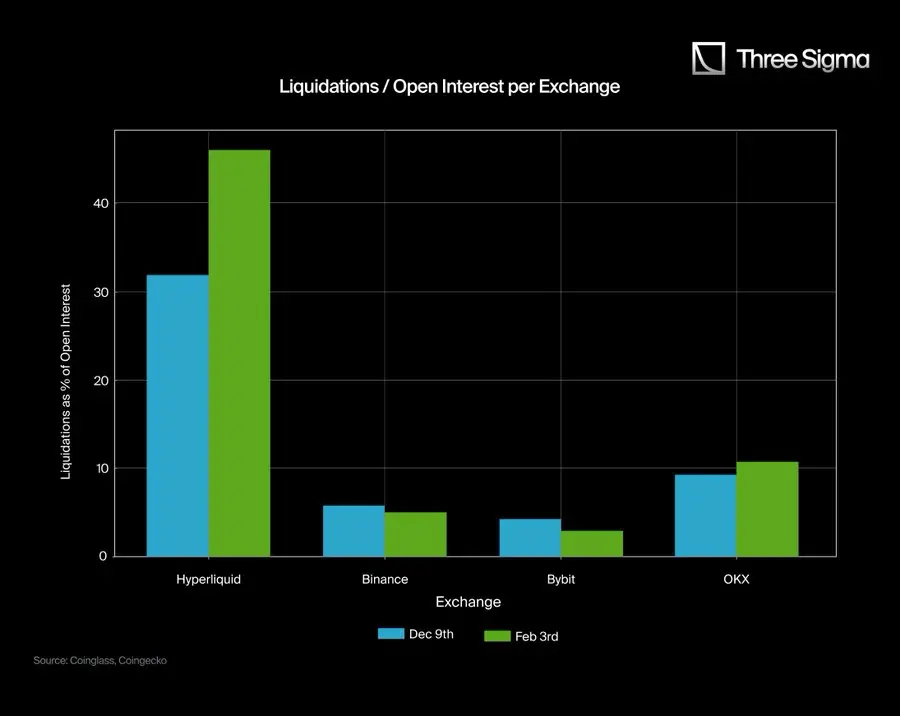

Hyperliquid is the first Layer 1 blockchain perpetual DEX to achieve sufficient trading volume to compete with CEX. Unlike CEX, Hyperliquid provides fully transparent and unrestricted reporting of all liquidation events, as its data is public.

This creates a unique environment where, on one hand, CEX's liquidation data is restricted (due to reporting limitations), while on the other hand, Hyperliquid's data is unrestricted. As a result, the total reported liquidation data significantly increases, thanks to Hyperliquid's transparency.

This transparency has a significant impact on the broader trading ecosystem, where liquidation data in traditional centralized exchanges is often selectively reported or aggregated, limiting traders' ability to analyze market dynamics in real-time. Hyperliquid ensures that every liquidation event is publicly visible, providing a more accurate and comprehensive understanding of leveraged trading activities.

For traders, this means a better understanding of market conditions, enabling them to identify potential squeeze situations, monitor risk levels, or gauge market sentiment. Researchers and analysts also benefit from the unfiltered on-chain liquidation data, which provides valuable insights into volatility patterns, risk behaviors, and market reactions to liquidations.

This unrestricted access to data fosters a fairer and more efficient trading environment where all participants can equally access information. By setting new transparency standards for perpetual trading, Hyperliquid not only challenges the opacity of CEX but also enhances the overall reliability of liquidation data, enabling traders to operate with greater trust and richer market insights.

3. Real Liquidation Data

3.1 Calculating Hyperliquid Ratios

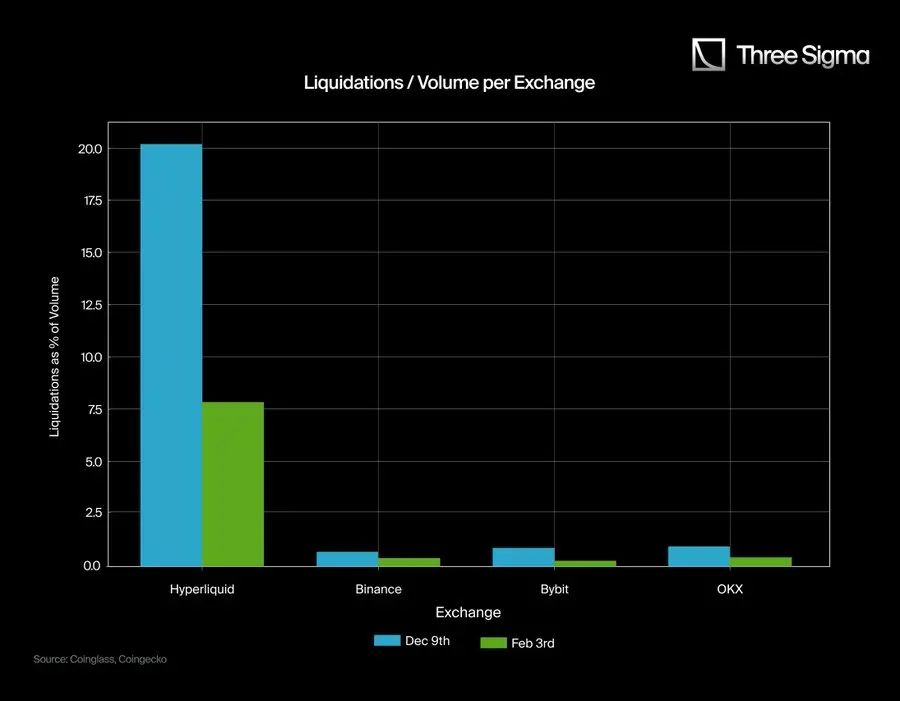

The transparency and extensive metrics of Hyperliquid allow us to see what has occurred over a long period, while the derivatives sections of CEX have failed to report numbers aligned with reality due to API restrictions. The discrepancies in the data seen in the charts further confirm this issue; despite CEX having far greater open interest and trading volume than Hyperliquid, the liquidation numbers they report remain unrealistically low.

Thanks to Hyperliquid, we now have a verifiable and accurate dataset to compare the distortion of CEX liquidation reports.

Data provided to the media often presents an incomplete picture, as it is based on limited APIs that fail to capture the full extent of liquidations. In contrast, Hyperliquid's unrestricted reporting provides a transparent and detailed record of all liquidation events, demonstrating that CEX liquidation activities may be far higher than the publicly disclosed figures.

3.2 Adjusting CEX Liquidation Data Using Hyperliquid Ratios

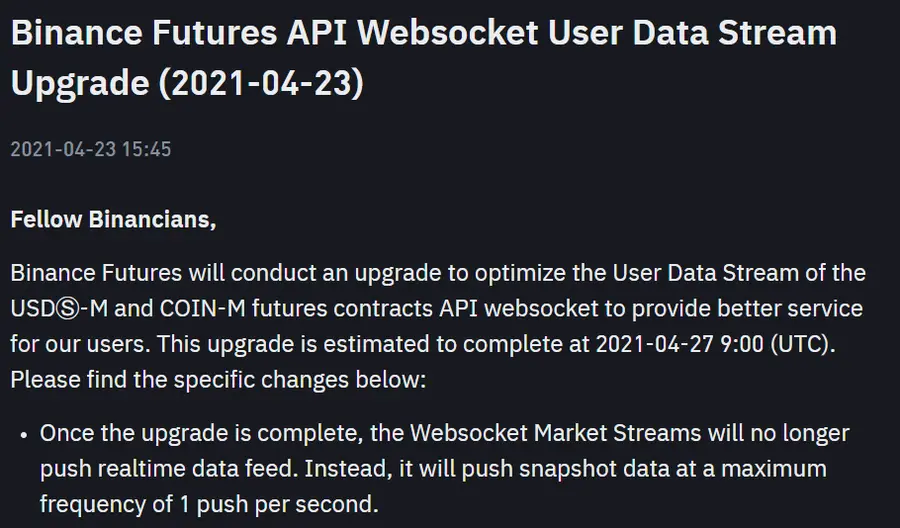

To estimate the "real" liquidation numbers for CEX, we use Hyperliquid's liquidation/trading volume ratio and liquidation/open interest ratio as benchmarks. We then compare these ratios with the data reported by CEX on two specific dates (December 9 and February 3) to derive an adjustment factor.

Calculating Hyperliquid's Average Ratios:

Liquidation / Open Interest (Hyperliquid)

December 9: 1.07B / 3.37B ≈ 0.3175

February 3: 1.42B / 3.08B ≈ 0.461

Average ≈ 0.389 (38.9%)

Liquidation / Trading Volume (Hyperliquid)

December 9: 1.07B / 5.30B ≈ 0.2021

February 3: 1.42B / 18.0B ≈ 0.0789

Average ≈ 0.14 (14%)

We use these figures (38.9% and 14%) as reference points to assess what the liquidation data might look like if other exchanges followed ratios similar to Hyperliquid.

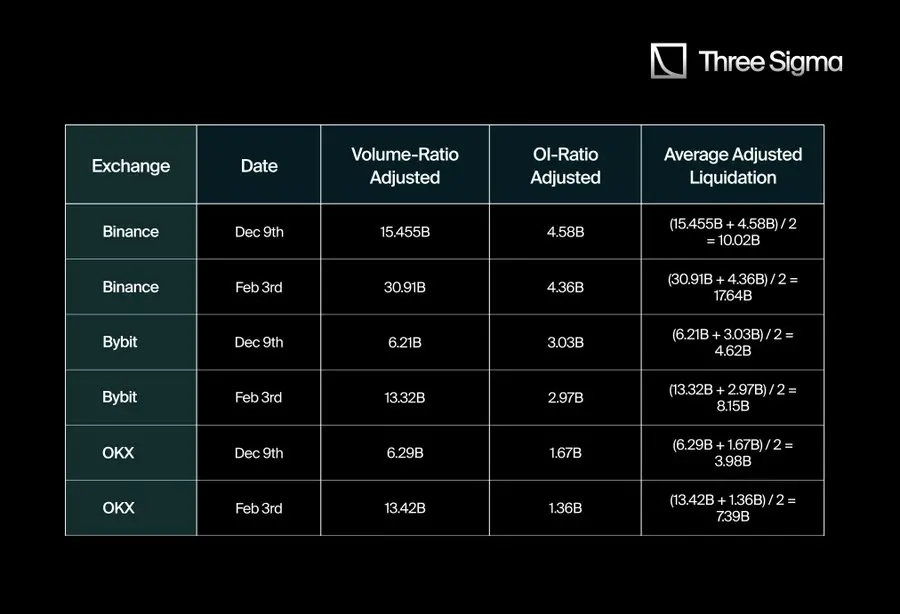

Applying These Ratios to Binance, Bybit, and OKX:

For each CEX, we calculate two sets of "adjusted" liquidation data:

Using Hyperliquid's liquidation/trading volume ratio

Using Hyperliquid's liquidation/open interest ratio

Then, we take the average of these two adjusted results for each date.

Thus, the liquidation data reported by CEX (often in the hundreds of millions) is far lower than the billions implied by the Hyperliquid ratios.

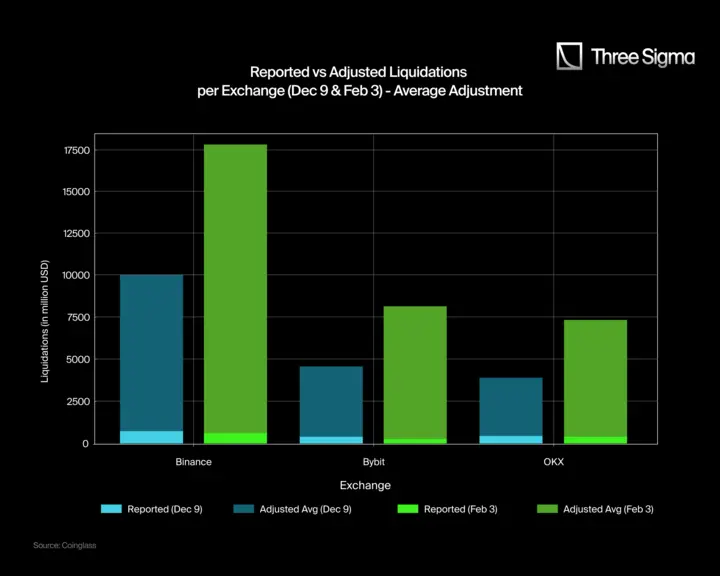

Below are the reported and adjusted liquidation data charts for December 9 and February 3. Each exchange has two bars, with light blue and light green representing reported liquidation data, and dark blue and dark green representing adjusted liquidation data.

The adjusted values are calculated using the average of Hyperliquid's liquidation/trading volume ratio and liquidation/open interest ratio as a benchmark. While this provides a clearer perspective on potential differences in liquidation data, there may still be some variability due to differences in market structure, retail participation, and market maker activity across exchanges.

Key Comments:

Binance, Bybit, and OKX's liquidation data is severely underreported: The reported liquidation data (light blue/light green) is far lower than the adjusted data (dark blue/dark green), indicating that the actual liquidation data may be much higher than the publicly disclosed figures.

Binance should report approximately 17,640M in liquidation data: The adjusted data suggests that Binance's true liquidation data on February 3 should be close to 17,640M, rather than the reported 611M, highlighting a significant discrepancy. On December 9, Binance should report 10,020M instead of 739M.

Bybit and OKX follow the same pattern: Bybit's adjusted liquidation data on February 3 is 8,150M, not the reported 247M; on December 9, it is 4,620M instead of 370M. OKX also shows significant discrepancies, with adjusted liquidation data of 7,390M on February 3 and 3,980M on December 9, while its reported figures are 402M and 425M, respectively.

3.3 Major Liquidation Events and Their "Real" Estimates

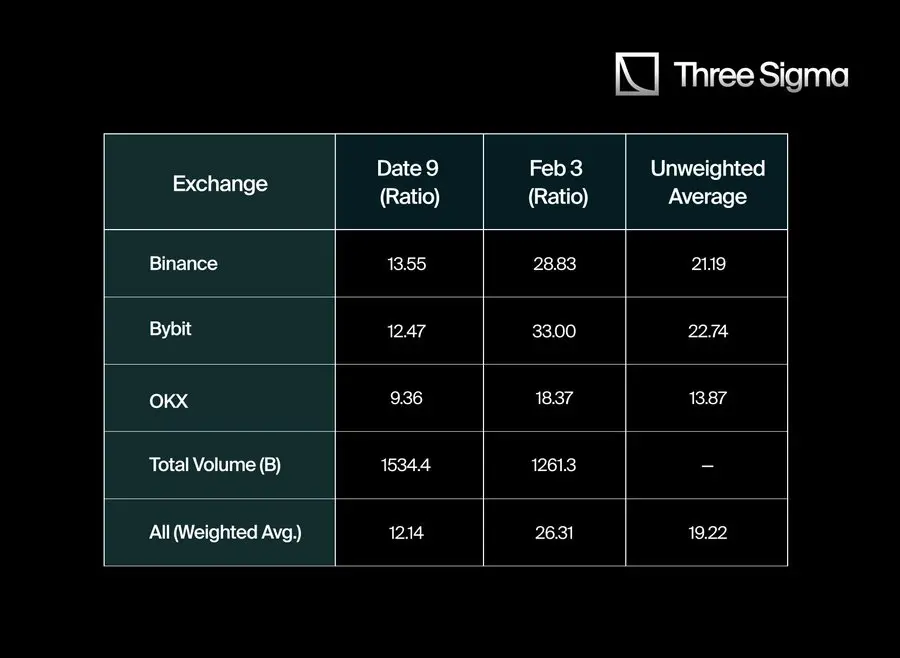

After comparing Hyperliquid's liquidation data with the limited data reported by major CEXs, we found significant discrepancies. To quantify this difference, we collected the reported data from Binance, Bybit, and OKX on December 9 and February 3, specifically analyzing their liquidation/trading volume and liquidation/open interest ratios.

To estimate the real liquidation data, we calculated the average ratio of liquidation/trading volume for Hyperliquid and then applied these ratios to the CEX data. We did not use a simple arithmetic average but instead weighted the liquidation ratios based on each exchange's trading volume on each date. This method provides a more accurate reflection of overall market liquidation activity.

When we first calculated the adjustment multiples for each exchange (Binance: 21.19, Bybit: 22.74, OKX: 13.87), the simple average global adjustment multiple was 19.27 times. However, after considering the weighted differences in trading volume across exchanges, the more accurate weighted average is 19.22 times.

This indicates that the real liquidation data for CEX may be approximately 19 times higher than the officially reported figures, or at least 19 times higher than the data disclosed through their restrictive APIs.

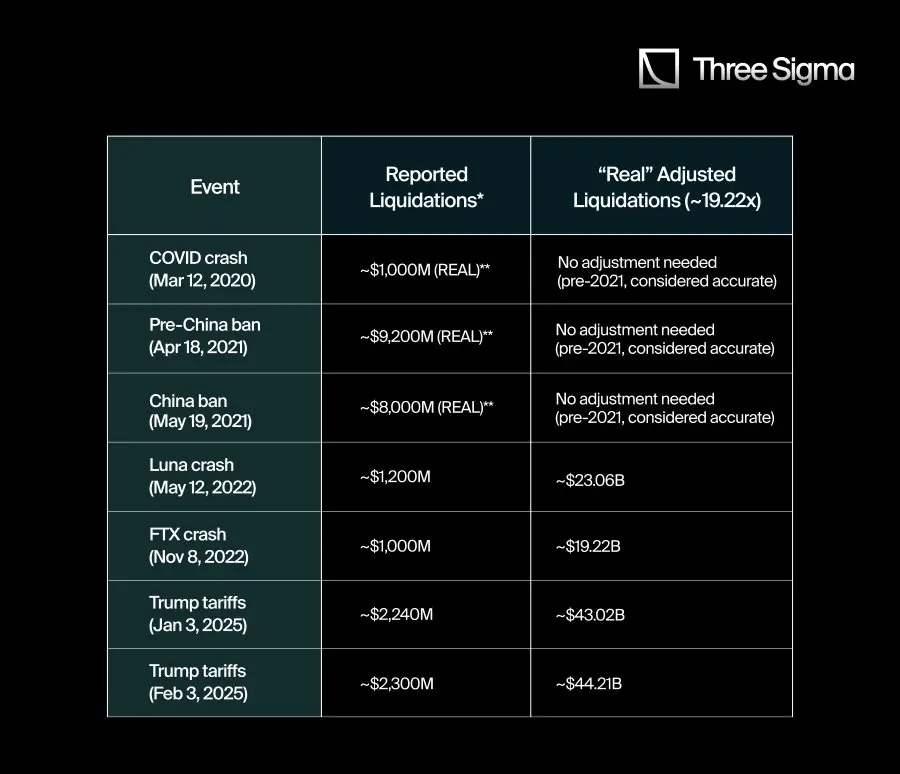

With this 19.22 times adjustment multiple, we analyzed some significant liquidation events in crypto history to estimate what their real liquidation data might be if they had the same transparency as Hyperliquid. The following table compares common liquidation amounts with the adjusted values using the modified 19.22 times multiplier:

"Reported" refers to the numbers published on aggregators, social media, or limited APIs.

For events prior to the second quarter of 2021, the liquidation data is much more reliable due to the absence of API restrictions.

As this chart emphasizes, many of the liquidation numbers derived from CEX reports after 2021 may significantly underestimate the actual situation. By applying the multiplier derived from Hyperliquid's complete transparency, the scale of liquidations for these events is much larger than what the official numbers suggest.

3.4 Comparing Liquidations with Total Market Capitalization

To provide more context, we compare the total "real" liquidations of these events with the total market capitalization at the time. The ratio calculation formula is: (Liquidation Amount / Market Capitalization) × 100.

By comparing the "real" liquidation data with the broader cryptocurrency market capitalization, we can gain a more nuanced understanding of each event's impact on market dynamics. This not only showcases the scale of capital that vanished in a short time but also reflects how market sentiment can change dramatically when leverage is unwound.

In many cases, the adjusted ratios are even more pronounced, indicating that participants may be exposed to greater systemic risks than initially apparent. Therefore, understanding these liquidation-to-capitalization ratios can provide a clearer perspective, helping us comprehend how market psychology and liquidity conditions shift during extreme volatility.

4. Conclusion

From all the data and comparisons above, a clear pattern emerges: the numbers publicly reported by CEX are often far lower than the "real" liquidation activities. When adjusted to match Hyperliquid's transparent ratios, events like the Luna and FTX collapses reveal a greater impact than indicated by official data, further reinforcing the notion that CEX may underreport liquidation data to obscure volatility or manage public perception.

This comparison is especially evident when considering historical events: the COVID crash in 2020, while a significant market event at the time, now appears relatively small due to the lower leverage participation then. As leverage has become more prevalent, both the absolute and relative scale of liquidations have grown, but the limitations of official data streams may distort traders' and analysts' perceptions of systemic risk.

Moreover, exchanges often cite "optimizing data flow" or "ensuring fair trading conditions" as reasons, but it is not difficult to see that restricting the release of real-time liquidation data can serve broader interests. Underreporting liquidation data can reduce fear among new retail investors while also allowing exchanges to gain exclusive insights into overall market risk exposure.

While these measures may help narrow the gap between reported data and actual liquidation activities, Hyperliquid's fully on-chain, unrestricted reporting still highlights how crucial true transparency is for anyone looking to navigate leveraged crypto trading.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。