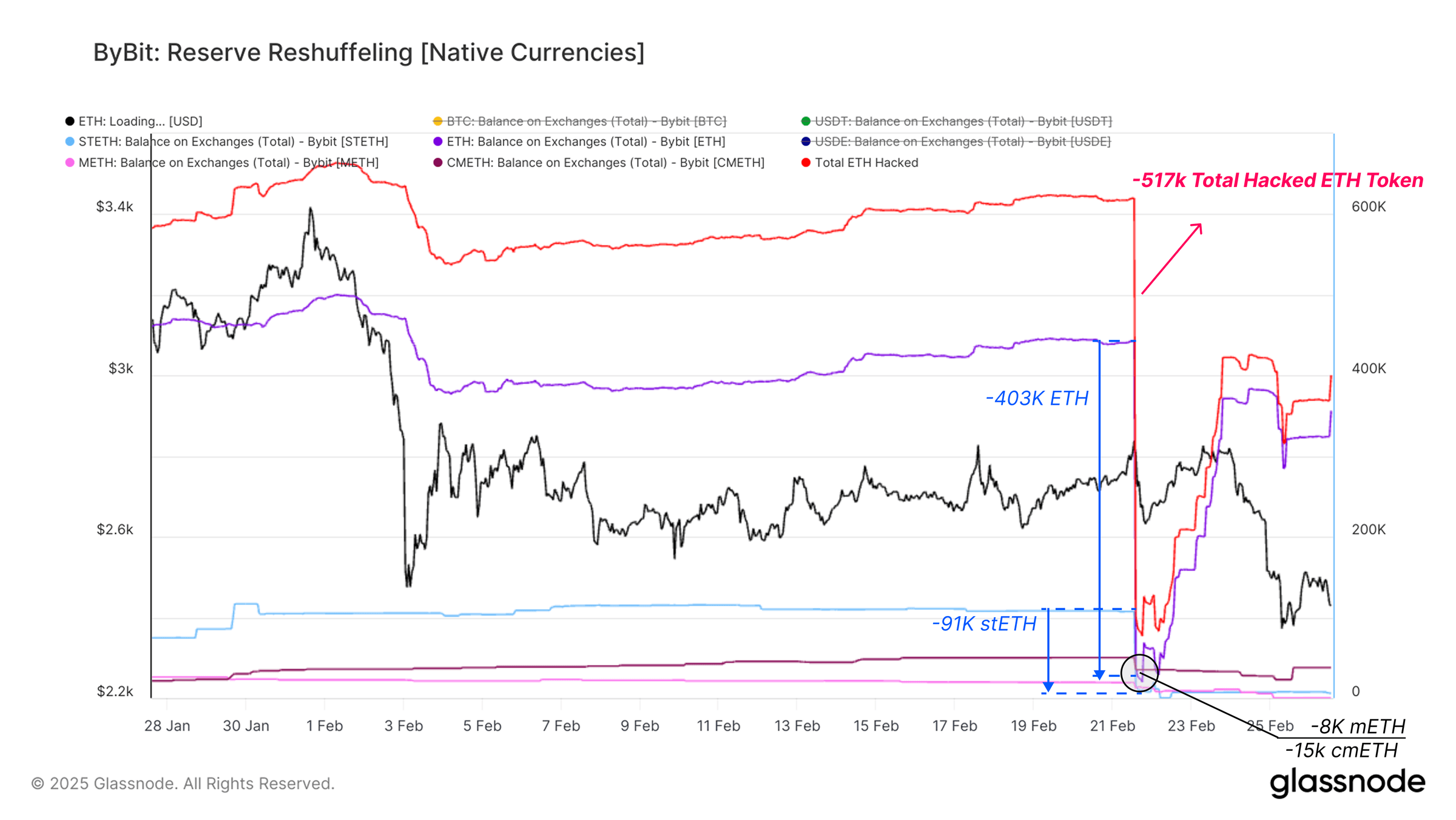

The breach, researchers noted in the post-mortem report, pushed bitcoin (BTC) 20% below its all-time high and intensified losses for short-term investors, the blockchain analytics firm stated. Glassnode’s analysis revealed that attackers drained 403,996 ETH from Bybit’s cold wallets using a “Musked UI” deception, as described by CEO Ben Zhou.

The breach triggered $4.3 billion in total exchange outflows across bitcoin, ethereum, and stablecoins, with Bybit’s reserves dropping by billions within days. Researchers noted the incident marked one of “the largest exchange hacks in crypto history.” Glassnode reported that the market reaction was severe. bitcoin’s monthly performance fell 13.6%, while ethereum and solana dropped 22.9% and 40%, respectively.

Source: Glassnode onchain report.

The Meme Coin Index (MCI) collapsed 36.9%, erasing gains dating back to April 2024. Glassnode researchers Cryptovizart and Ukuria OC highlighted that the sell-off pushed bitcoin into a “realized supply air gap” between $70,000 and $88,000—a low-liquidity zone amplifying volatility. Bybit’s reserves subsequently saw steep declines, with 21,248 BTC ($2.47 billion) and $1.76 billion in USDT exiting the platform, per Glassnode figures.

Ethereum reserves partially recovered to $1.19 billion after strategic inflows, but subsequent outflows indicated lingering investor unease. The exchange’s ETH price fell to $2,490, down 22.9% monthly. Short-term holders faced acute pressure, Glassnode’s onchain report further emphasized. The STH-MVRV ratio—measuring investor profitability—fell 15.8% below its quarterly median, signaling widespread unrealized losses. The STH-SOPR metric, tracking profit/loss ratios, dropped to -0.04, reflecting accelerated loss realization.

Historically, such conditions precede “seller exhaustion,” but demand stagnation risks prolonging the downturn, researchers warned. Glassnode’s report cautioned that bitcoin’s drops to foundational levels—5% below short-term holders’ cost basis—could trigger further sell-offs without demand recovery. The analytical firm’s data showed the market’s momentum now mirrors April 2024 levels, with macroeconomic uncertainties compounding risks.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。