Written by: Sunny, Messari Research

Translated by: Alex Liu, Foresight News

In the past few years, traditional finance (TradFi) has gradually lost its growth narrative. Artificial intelligence has been overhyped, and software companies are no longer as full of imaginative potential as they were in the 2000s and 2010s.

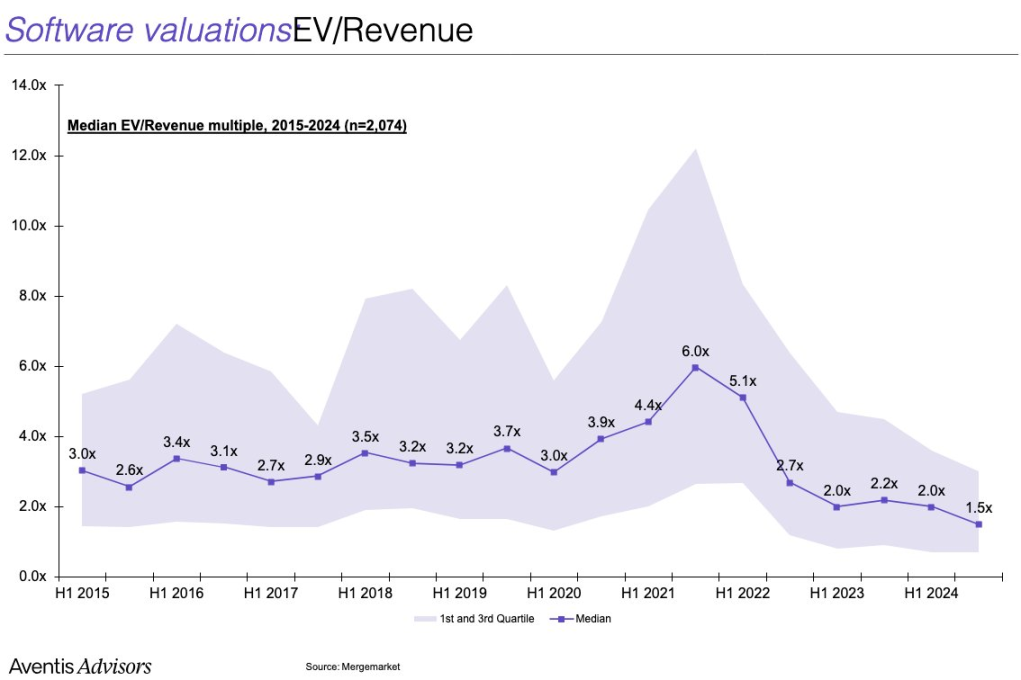

For growth investors who raised funds to bet on disruptive innovation narratives, the reality is that AI asset valuations are generally inflated, and other "growth stories" are hard to tell anew. Once-dominant FAANG stocks are now gradually transforming into mediocre "compound growth stocks" focused on maximizing profits. The median price-to-sales ratio (enterprise value/sales) of current software companies has dropped below 2 times.

As a result, cryptocurrency has stepped back into the spotlight.

Bitcoin has broken historical highs; the U.S. President has "strongly advocated" for crypto assets at a press conference; a series of regulatory tailwinds have provided this asset class with an opportunity to return to the mainstream for the first time since 2021.

Unlike the last cycle's NFTs and Dogecoin, the protagonists of this round are digital gold, stablecoins, "tokenization," and payment system reforms. Stripe and Robinhood have declared that the next phase will focus on crypto business; Coinbase has successfully been included in the S&P 500 index; Circle has presented a sufficiently attractive growth narrative to capital markets, causing investors to overlook valuation multiples and focus on potential stories once again.

But what does all this have to do with ETH?

For crypto natives, the battlefield of smart contract platforms has long been fragmented: Solana, Hyperliquid, and countless high-performance new chains and Rollup platforms pose a real threat to Ethereum's dominance.

We know that Ethereum has not truly solved the value capture problem, and we also know it is facing structural challenges.

But Wall Street is not aware of these issues. In fact, most Wall Street practitioners know almost nothing about Solana. In terms of recognition, established coins like XRP, LTC, LINK, ADA, and DOGE may have a stronger presence in their minds than SOL. After all, these individuals have almost completely faded from the crypto market in recent years.

What they know is that ETH is "lindy" — it has stood the test of time; it has been tested through multiple market fluctuations; for a long time, it has been the main "Beta" asset outside of Bitcoin. They see that ETH is currently one of the only two crypto assets with a spot ETF. What they prefer is a relatively cheap asset with a clear target price that is about to see a catalyst, rather than chasing a coin that is "already too late" on a chart.

In their eyes, Coinbase, Kraken, and Robinhood have all chosen to build products on Ethereum. With a little due diligence, they can see that Ethereum has the largest on-chain stablecoin pool. They start doing "moon landing calculations" — and then find that Bitcoin has reached a new high, while Ethereum is still over 30% away from its 2021 peak.

For them, this "relative undervaluation" is not a risk, but an opportunity. They are more willing to buy an asset that is still at a low level and has a clear target price, rather than chasing a coin that has already peaked on a chart.

And they may have already entered the market. Now, compliance restrictions on institutional investment are no longer a major issue. As long as there are sufficient incentives, any fund can strive to allocate crypto assets. Although crypto Twitter (CT) has sworn over the past year to "never touch ETH again," the market performance since the beginning of this year shows that ETH has outperformed other mainstream assets for more than a month.

As of now, SOL/ETH has fallen nearly 9% this year; Ethereum's market cap share, after hitting a low in May, has begun its longest rise since mid-2023.

So the question arises: if the entire crypto community believes ETH is a "cursed coin," how can it still outperform?

The answer is: it is attracting new buyers.

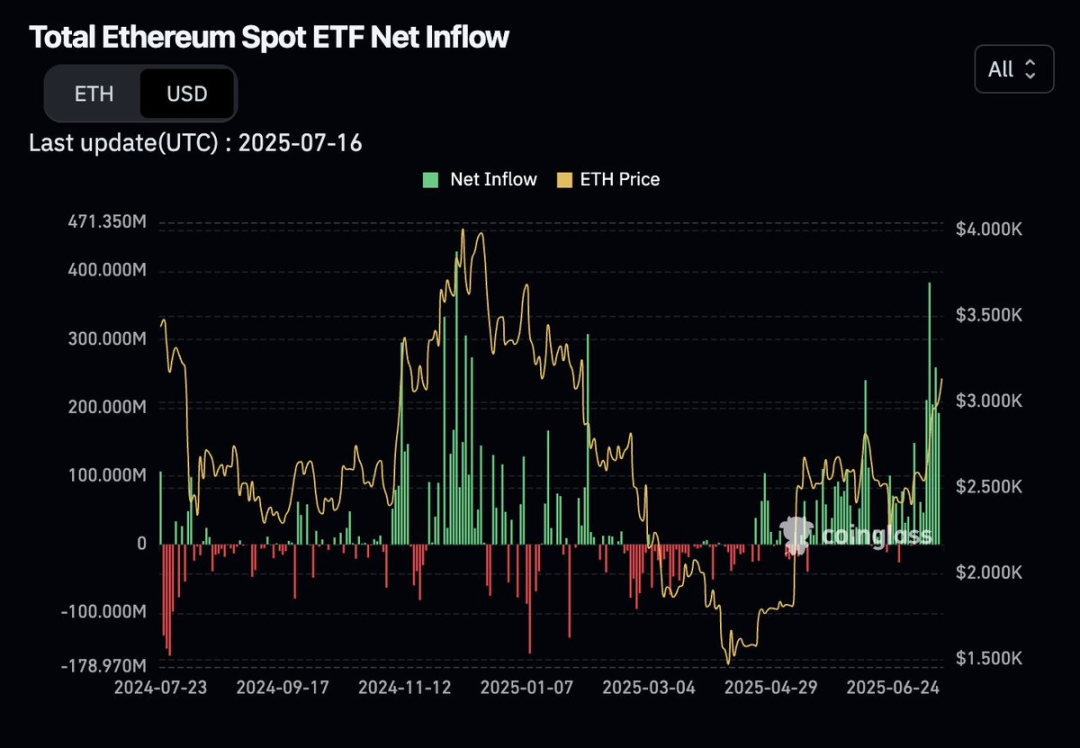

Since March, the net inflow data for Ethereum spot ETFs has been in an "up only" mode, rising without falling.

(Data source: Coinglass)

Ethereum "accumulators" mimicking the MicroStrategy model are seeing their stock prices soar, injecting structural leverage into the market.

At the same time, some crypto-native users may have realized their under-allocation and started to transfer funds from BTC and SOL, which have already surged in the past two years.

It is important to clarify that we are not saying that the Ethereum ecosystem has solved its problems. Rather, the asset ETH is beginning to gradually "decouple" from the Ethereum network.

External buyers are reshaping the market narrative around ETH, shifting from "decline is certain" to a paradigm of "valuation reassessment." The shorts will eventually be squeezed out, and at that point, native funds may also join the rally, leading us to a market frenzy centered around ETH, which may peak at some moment.

If this happens, the historical high for ETH may not be far off.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。