Trump’s GENIUS Act May Boost the Bullish IPO Launch

Bullish IPO Aligns with Trump-Era GENIUS Act Crypto Momentum

Peter Thiel-backed cryptocurrency exchange has submitted an Initial Public Offering application to the SEC.

This submission is a big milestone for the company and the larger cryptocurrency sector, which has enjoyed a boost in confidence since President Donald Trump recently signed the GENIUS Act.

Source: Wu Blockchain

The Exchange Expands Trading as CEO Farley Eyes Growth with Bullish IPO

In a letter to investors in Friday's filing, Farley stated, "We plan a Bullish IPO because we believe that the digital assets industry is beginning its next leg of growth." "We consider compliance and transparency to be defining characteristics of our operations, and we think those values are in line with the open capital markets," he stated.

Although the exchange, which is headed by CEO Tom Farley, provides cryptocurrency spot trading, margin trading, and derivatives trading, its margins and derivatives products aren't yet accessible in the US or to US consumers.

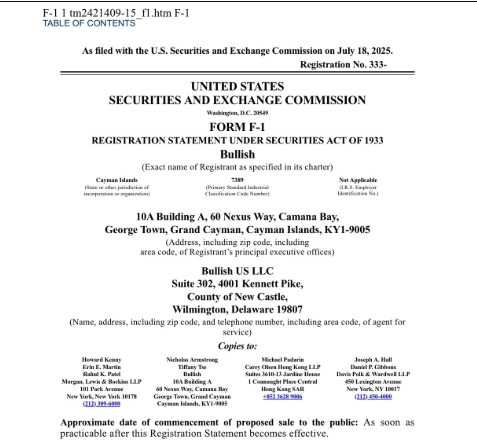

Bullish IPO Files with SEC Backed by Peter Thiel

Source: X

Peter Thiel-backed cryptocurrency exchange Bullish IPO in an attempt to take advantage of the increased interest among cryptocurrency investors during Trump's administration. Follows Circle’s $1.1B Initial Public Offerings and Gemini’s filing —signaling a wave of crypto firms heading to public markets amid growing regulatory openness under the Trump administration

Bullish IPO Details: $BLSH Ticker, NYSE Listing, Key Underwriters

→ Ticker: $BLSH

→ Exchange: NYSE

→ Offering: Ordinary Shares

→ Underwriters: JPM, Jefferies, Citi, DB, Cantor

→ Owns CoinDesk, holds 24K+ BTC

→ Net income 2024: $80M

→ Filing date: July 18, 2025

Reports $348.6M Q1 Loss After Failed 2021 SPAC Attempt

In contrast to last year's profit of $104.8 million, it recorded a net loss attributable of $348.6 million for the three months ending March 31 in its filing with the U.S. securities commission. A regulatory crackdown and an abrupt increase in interest rates in 2022 caused the Peter Thiel-backed business's 2021 effort to go public through a special purpose acquisition company to fail.

Investor Backing Includes Block.one and VC Groups

In 2023, It paid an unknown sum to Digital Currency Group to acquire the media portal CoinDesk. According to the filing, it's largest investors are Alexander See, Pu Luo Chung VC Private Ltd., Brendan Blumer, the CEO of Block.one, and their affiliates. The corporation postponed its 2021 announcement that it would go public through a special purpose acquisition vehicle. JPMorgan Chase & Co., Jefferies Financial Group Inc., and Citigroup Inc. are spearheading the offering. The business intends to use the symbol BLSH when it debuts on the New York Stock Exchange.

As part of a broader trend of cryptocurrency companies going public, the Bullish IPO has registered with the SEC and plans to list on the NYSE. With increased regulatory clarity, project is positioning itself to capitalize on the growing institutional and retail interest in digital banking.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。