Will Bitcoin Surge Amid Trump EU Tariff Threat?

Trump EU Tariff Pushes Plan Ahead of August Deadline

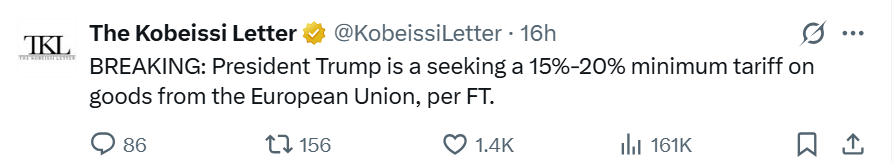

According to the Financial Times, President Trump EU Tariff is advocating for a 15–20% minimum tax on all goods imported from the European Union, with threats to escalate it to 30% if no trade deal is finalized by August. This is on top of all the other Trump EU tariff that had previously been announced.

Trump reportedly rejected EU offers to reduce auto tariffs, planning to maintain a steep 25% duty on automobiles. The move builds on previously imposed tax on steel and aluminum, and carries potential for a sweeping trade conflict.

Source: FT

Trump has frequently criticized the Europe Union's 198 billion euro ($231 billion) goods trade imbalance with the United States. Negotiations between the two countries seem to have stopped with less than two weeks until Trump's deadline on August 1 . The United Kingdom's agreement, which kept a 10% baseline tariff with some industry exemptions, was what the Country had hoped for.

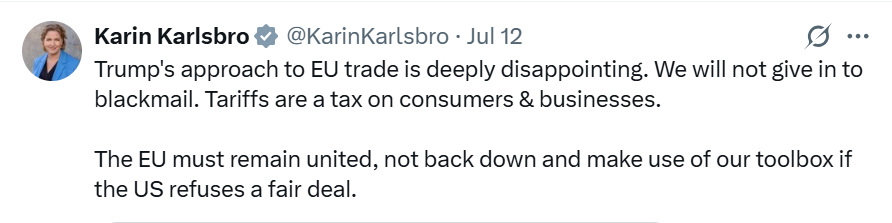

Europe Officials and Parliament Slam Trump’s Tariffs Tactics

According to representatives of the European Union, trade is considerably more balanced when investments and services are taken into consideration. To close the trade imbalance, they have also promised to buy more gas and oil.

Source : X

Karin Karlsbro, a member of the European Parliament, previously criticized Trump EU tariff, stating that this is a tax on consumers and businesses. She urges Europe to remain united and not back down if the US refuses a fair deal, and condemns the US's decision to impose 30% tariffs on goods, urging the Nation to defend its interests and uphold fair, rules-based trade.

FoodDrinkEurope Warns Trump EU Tariff Will Hurt Farmers, Raise U.S. Prices

The trade group FoodDrinkEurope issued a warning this week that any increase in tariffs, which are typically paid by the importer, would hurt European producers and farmers while reducing choice and raising prices for American consumers. The Nation’s food and drink trade with the U.S. is valued at nearly 30 billion euros. Businesses have suffered even from the 10% U.S. import tax that was put in place in April.

Economists Warn Tariffs May Fuel U.S. Inflation Surge

Source: The Kobeissi Letter

Wide-ranging tariffs increase input prices and worsen inflation , according to economists. The Federal Reserve may decide to implement stricter monetary policy if the United States' inflation rate starts to rise. There may then be a spike in Treasury rates, which would put pressure on riskier assets and reduce investor risk tolerance.

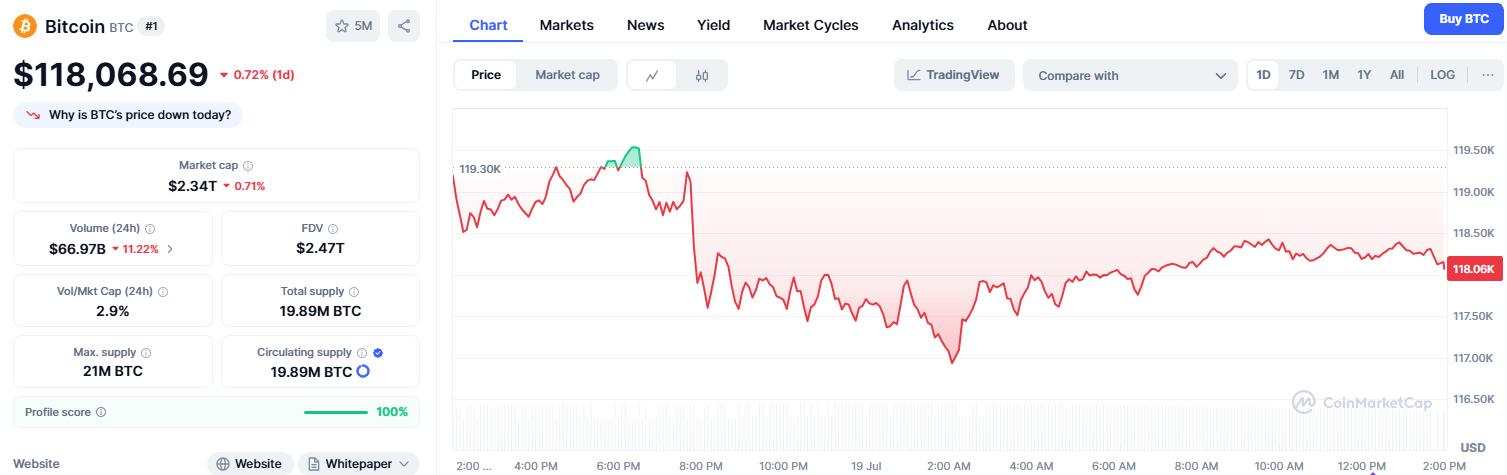

Bitcoin Slides Amid Tariff-Linked Market Volatility

Source: Coinmarketcap

The current price of Bitcoin is $118,144 USD. Bitcoin has decreased by 0.84% in 24 hours. Trump EU tariff announcements have historically caused volatility in digital assets, particularly Bitcoin, leading to intensified price shocks across BTC and altcoins. Inflation from tariffs may revive the argument that Bitcoin serves as a "digital gold," as demand for decentralized assets can grow in inflationary environments. Corporate and institutional crypto players may recalibrate based on yield and fiat strength, with elevated yields drawing capital away from leveraged crypto positions. However, if inflation remains elevated, some funds may double-down on crypto as a long-term hedge.

Final Thoughts

Trump EU tariff proposed on goods have sparked cross-asset tremors, impacting equities, bond yields, and risk assets like Bitcoin. Crypto markets experienced sharp price swings and liquidations. However, crypto's evolving identity as an inflation hedge and institutional asset could transform its ability to weather macro shocks. Key indicators to monitor include bond yields, fiat strength, regulatory developments, and geopolitical maneuvering. Crypto stands at a crossroads: riding macro volatility into a stronger financial role or buckling under policy-driven headwinds.

Also read: WLFI Token to Debut with $16B Valuation in Late August免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。