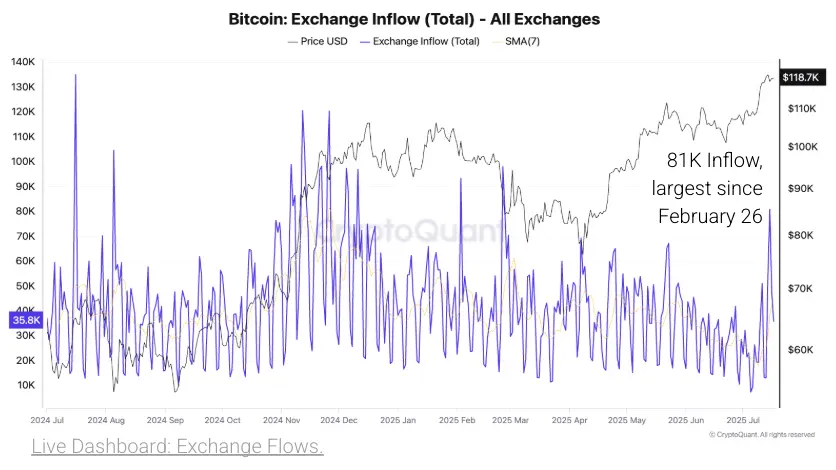

Cryptoquant’s Weekly Crypto Report reveals that total daily bitcoin exchange inflows surged dramatically from 19,000 bitcoin a week prior to 81,000 BTC on July 15, marking the largest single-day deposit since February 26. Cryptoquant researchers attribute this spike primarily to activity from “whales,” entities holding large amounts of bitcoin.

Source: Cryptoquant report.

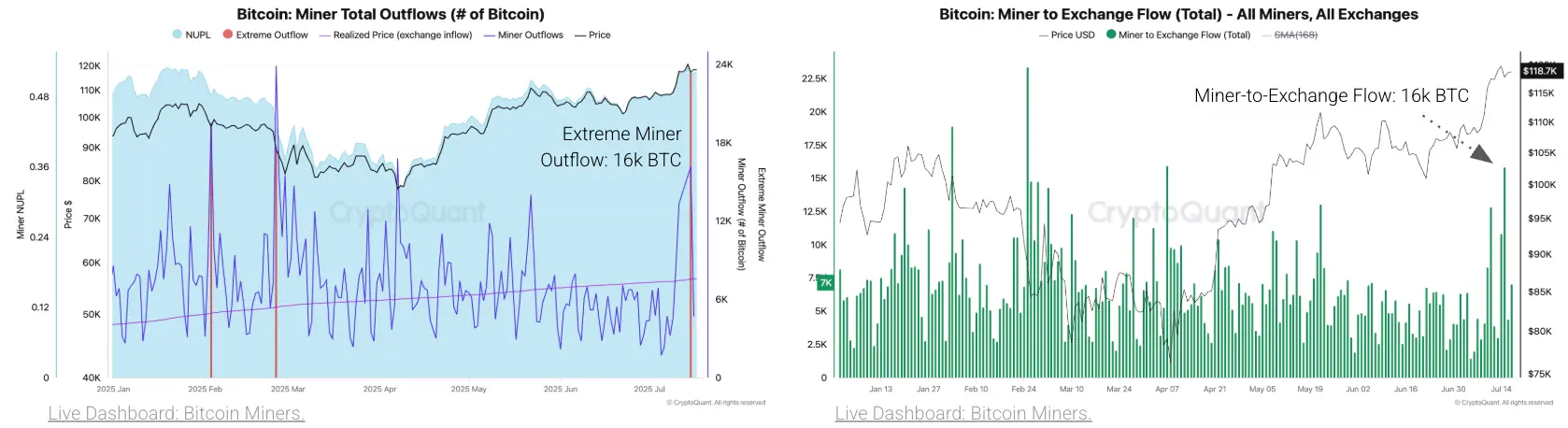

Transfers from these large holders to exchanges jumped from 13,000 BTC to 58,000 BTC within the same timeframe, indicating substantial profit-taking. Bitcoin miners also emerged as major sellers, Cryptoquant data shows. Miner outflows – bitcoin ( BTC) transferred out of miners’ wallets – spiked to 16,000 BTC on July 15. Cryptoquant metrics classified this as an “extreme outflow,” the largest since April 7.

Source: Cryptoquant report.

Crucially, Cryptoquant noted that virtually all of this bitcoin flowed directly into exchanges, reinforcing the conclusion that miners were actively selling at the peak price. Simultaneously, ethereum ( ETH) experienced its own surge in exchange deposits. Cryptoquant reported daily ETH inflows nearly reached 2 million ETH on July 16, doubling from the previous week and hitting the highest level since February 26.

This surge follows a 131% rally in ETH since early April, Cryptoquant analysts noted in the analysis. In stark contrast, Cryptoquant observed that selling pressure for altcoins remains notably low. Daily transactions sending altcoins to exchanges totaled just 31,000, far below peaks of around 120,000 seen during prior market tops in March and December 2024.

Cryptoquant researchers highlighted that this muted activity suggests altcoin investors are not rushing to sell despite the broader market rally. Cryptoquant‘s analysis indicates that increased exchange inflows, particularly from large entities and miners, often precede heightened price volatility. The significant divergence between the heavy bitcoin and ether selling and the subdued altcoin activity presents a complex market picture, according to the firm’s latest report.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。