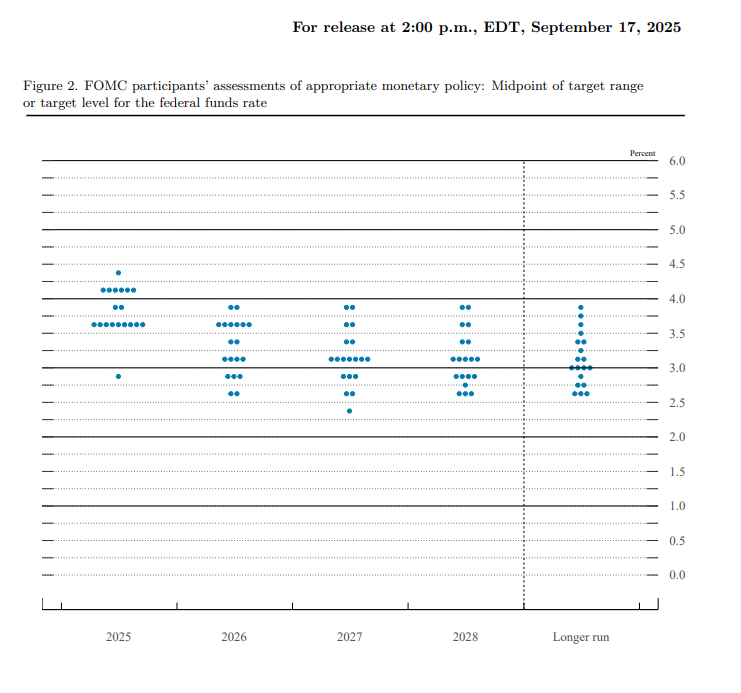

Today's homework is not easy to write. The Federal Reserve's interest rate meeting and dot plot have a significant impact on the market. After the data was released, both the U.S. stock market and $BTC experienced nearly an hour of decline. It was only towards the end of Powell's speech that there was a slight easing and a rebound, but the rebound has not yet returned to today's high, indicating that investors are quite worried about the Federal Reserve's interest rate cuts, mainly concerned about whether the economy will really decline.

However, today is not without good news. The next two meetings are very likely to have two consecutive interest rate cuts, which reduces the risk of economic downturn for the market. For the Federal Reserve, this can be considered a defensive interest rate cut, but the magnitude of this cut is too different from what the market or Trump’s faction has conveyed to the market. This has also led to Trump losing badly in the first round against Powell and the conservatives.

This time, besides Milan, who is clearly at the core of Trump and executing his orders, other Federal Reserve officials seem to be more united. Even Waller and Bowman have rationally chosen a 25 basis point cut this time, at most just playing with the dot plot, which also highlights Milan's awkward position. However, Powell's term lasts until May 2026, and the new Federal Reserve chair will take office in April.

Counting this year, there are meetings in October and December, and next year in January, March, and April, a total of five interest rate meetings. If there are more than three rate cuts among these five, it would already be good, but the actual impact will not be very large. Of course, Trump will definitely be very angry, very angry.

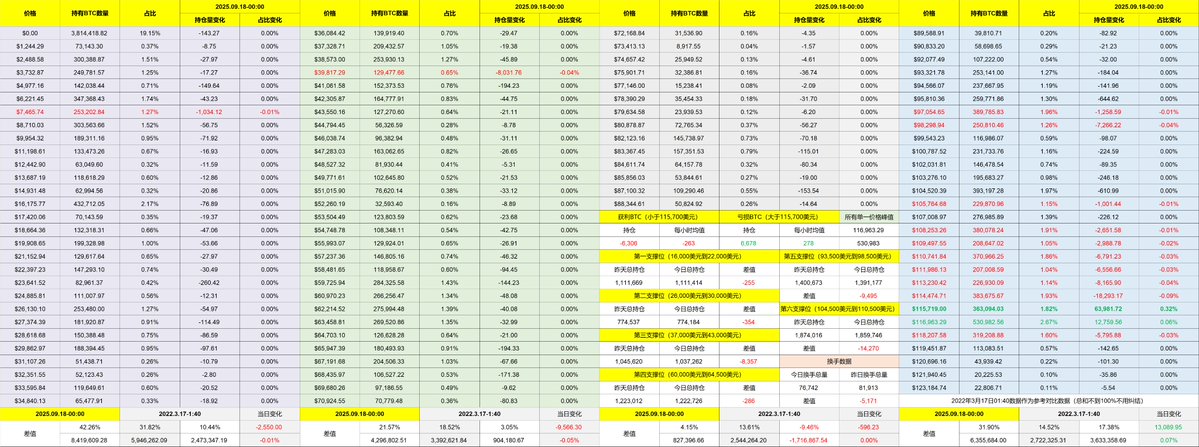

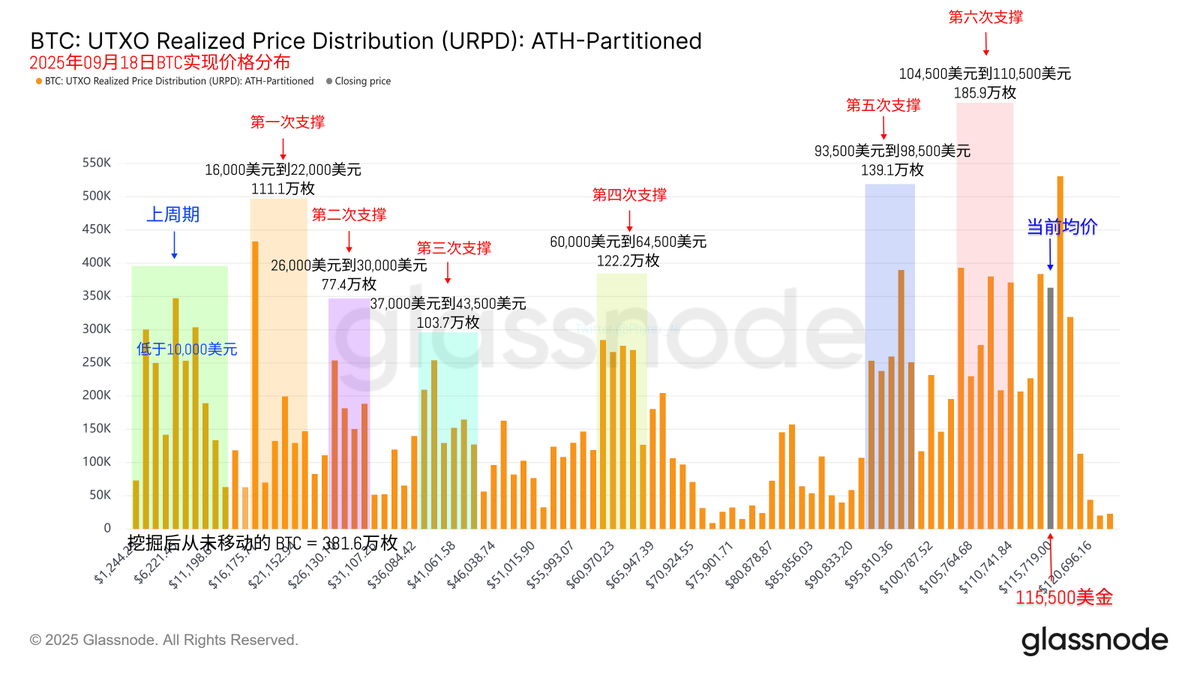

Looking back at Bitcoin's data, today is more critical, and the price volatility is greater, but in fact, the turnover rate is lower, indicating that most investors are still focused on the results of the interest rate meeting, waiting for the outcome. This is also why I say not to bet on the result, but to determine your investment direction based on the result. This time, the outcome is likely to occur within my predictions, so I follow my strategy and do nothing.

Because I plan to see what kind of counterattack actions Trump will take, and my 20% long position is still held. It is a good opportunity to test the waters. From the performance of the U.S. stock market, it is also quite stable, with only a slight decline until the close. Tomorrow, I will continue to observe the Asian market's reaction.

This article is sponsored by #Bitget | @Bitget_zh

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。