A recent agreement in the U.S. Senate not only brings a glimmer of hope to end the 40-day government shutdown but also serves as a catalyst for a financial market frenzy. On the evening of November 10, Eastern Time, the U.S. Senate passed a crucial procedural vote with 60 votes in favor and 40 against, taking a substantial step towards ending the federal government shutdown that has lasted for 40 days.

This longest government shutdown in history has caused approximately $15 billion in economic losses each week, leading to the cancellation of over 2,700 flights, 10,000 flight delays, and causing the U.S. consumer confidence index to drop to its lowest point in three years in November.

1. Shutdown Crisis: Political Compromise and Social Costs

The Long Road of Shutdown

● The current U.S. government shutdown began on October 1 and has lasted for 40 days, becoming the longest government shutdown in U.S. history. The shutdown has had a comprehensive impact on American society and the economy, with nearly 3 million federal employees forced to take unpaid leave, and active-duty military personnel relying on private loans to cover their salaries.

● Supplemental Nutrition Assistance Program (food stamps) distribution has been interrupted, affecting the livelihoods of over 40 million people.

Difficult Bipartisan Compromise

● In the Senate procedural vote on November 10, eight Democratic senators joined the Republican camp to cast votes in favor, finally gathering the 60 votes needed to break the filibuster. This breakthrough was described by Senate Minority Whip Dick Durbin as “an important step to mitigate the losses caused by the government shutdown.”

● However, this compromise did not include the Democrats' long-sought extension of subsidies for the Affordable Care Act, leading to strong dissatisfaction within the Democratic Party.

2. The Fed's Rate Cut Dilemma

Intensifying Internal Divisions

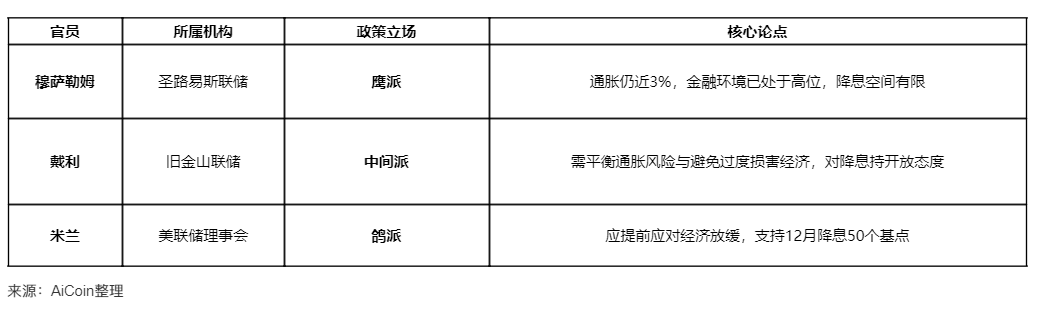

As the government shutdown nears its end, debates within the Federal Reserve regarding whether to cut rates in December have intensified. Federal Reserve officials have shown clear divisions on the direction of monetary policy, which can be categorized into three main camps:

● St. Louis Fed President James Bullard has expressed clear skepticism about further monetary easing. He believes that “the current inflation rate is closer to 3%, rather than the Fed's 2% target,” and emphasizes that “the room for further easing is very limited without making policy excessively loose.”

● Fed Governor Michelle Bowman continues to advocate for a more significant rate cut. She has reiterated her call for a 50 basis point rate reduction at the December Federal Open Market Committee meeting. Bowman argues, “If you base policy on current data, you are essentially looking in the rearview mirror, as policy transmission takes 12 to 18 months to truly impact the economy.”

● San Francisco Fed President Mary Daly has taken a middle ground between her two colleagues. She stated that it is necessary to ensure inflation does not rebound while also avoiding the mistake of keeping policy rates too high for too long.

Data Fog

The government shutdown has led to interruptions in the release of key economic data, putting the Fed's decision-making in a “data fog.”

● Important inflation data such as the Consumer Price Index (CPI) and Producer Price Index (PPI) have not been released as scheduled, and the official employment report is also missing.

● A forecast report released by the Chicago Fed indicates that the U.S. unemployment rate may slightly rise to a four-year high of 4.4% in October.

The table below clearly shows the significant differences in the current monetary policy positions of the three main Fed officials:

3. Market Reversal Frenzy

Gold Shines Bright

Under the dual stimulus of the potential end of the government shutdown and expectations of rate cuts, the gold market has seen a strong surge.

● Spot gold prices broke through $4,100 per ounce, rising over 2.6% in a single day; New York futures gold closed at $4,119.2 per ounce, up 2.73%, marking a near two-week high.

● Funds continue to flow into the gold market: In the first three quarters of 2025, domestic gold ETF holdings increased by 79.015 tons, a year-on-year growth of 164.03%, with total holdings reaching 193.749 tons by the end of September.

● The global central bank gold purchasing trend has not stopped: In the first three quarters of 2025, China increased its gold holdings by 23.95 tons, raising official reserves to 2,303.52 tons, continuously driving strategic demand for gold.

U.S. Stock Market Risk Appetite Rises

● All three major U.S. stock indices closed higher, with the Nasdaq Composite Index soaring 2.27%, the S&P 500 Index rising 1.54%, and the Dow Jones Index increasing 0.81%.

● Tech stocks led the rally, with Nvidia rising 5.8% in a single day, Google up 3.9%, and Tesla up 3.6%, pushing the Nasdaq Golden Dragon Index up 2.25%.

● However, structural issues in the market remain prominent: statistics show that the “Big Seven” tech stocks account for a total weight of 34.98% in the S&P 500 Index, yet contribute about 55% of the index's gains; if Broadcom is included, the weight of the top eight tech stocks rises to 37.7%, with a contribution rate of 64.72%, reflecting insufficient market breadth and structural risks reliant on a few giants.

Sparta Capital Securities analyst Peter Cardillo pointed out: “Once the government reopens, a backlog of macro data will be released, which may show that inflation remains stubborn while the labor market is weaker than expected. Both could prompt the Fed to choose to cut rates in December.”

4. Rate Cut Probability and Market Outlook

Fluctuating Rate Cut Probability

● According to the latest data from the CME FedWatch Tool, the probability of a 25 basis point rate cut by the Fed in December is 64.1%, while the probability of keeping rates unchanged is 35.9%. This probability has decreased from 72% over the weekend, indicating that the market is reassessing the Fed's policy direction.

Economic Concerns Persist

● Despite the potential end of the government shutdown, the U.S. economy still faces multiple challenges: the total U.S. government debt has grown to $38.17 trillion, increasing by over $10 billion almost every day. Each taxpayer bears an average debt of $328,200, putting increasing pressure on the U.S. government.

● Bullard noted: “More and more families are turning to food banks for help due to rising living costs or applying for utility assistance, reflecting that consumers' actual purchasing power is being eroded by high inflation.”

5. Investment Landscape and Future Direction

Structural Risks in U.S. Stocks

● This year's S&P 500 Index rally continues to be driven by the “Big Seven” tech stocks, whose valuations have reached nearly exaggerated levels. These seven stocks account for 34.98% of the S&P 500 Index components, contributing a total of 7.96% to the index's gains, which accounts for 55.28% of the total increase.

● Currently, the price-to-earnings ratio of S&P 500 Index components is 30.36, with an annual return of 3.3%, which is lower than short-term interest rates and mid-to-long-term bond yields.

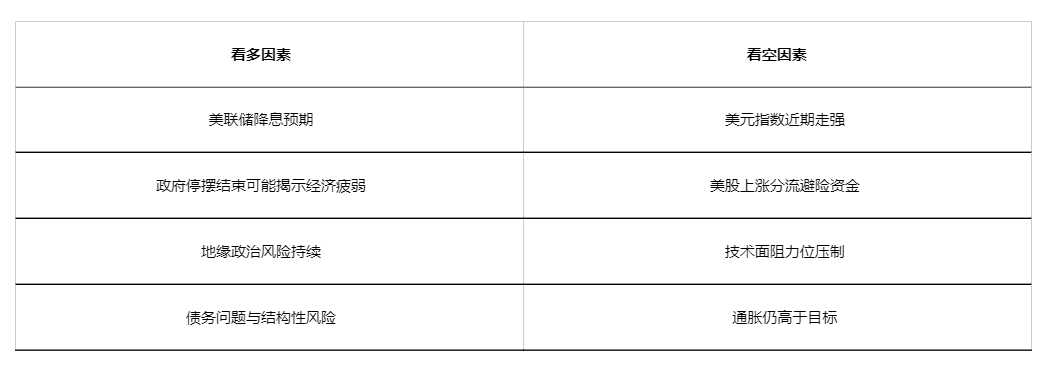

Gold Price Outlook Analysis

The main factors influencing gold prices present a complex interplay, and the table below lists the main arguments from both bulls and bears:

6. Data-Driven Decision Making

As the government shutdown nears its end, the financial market will welcome a wave of delayed economic data releases. This data will become a key basis for the Fed's December rate decision and may trigger a new round of market volatility.

● St. Louis Fed President Bullard expects that the U.S. economy will see a significant rebound in the first quarter of next year, driven mainly by the normalization effect after the government shutdown ends, ongoing fiscal support, the lagging effects of the previous two rate cuts, and a relaxed regulatory environment.

● However, he also emphasized that the current level of the federal funds rate is close to the range of “no longer exerting downward pressure on inflation,” leaving limited room for further rate cuts.

● Fed Governor Bowman insists that at least a 25 basis point rate cut should occur in December, and a 50 basis point cut is appropriate.

After the government shutdown ends, a series of delayed economic data will flood the market: potentially weak employment data, persistently stubborn inflation indicators, and a significant decline in consumer confidence.

This data will serve as the sole basis for the Fed's December rate cut decision, also giving gold bulls new hope. After breaking through $4,100, gold prices are poised to surge, waiting for the moment the Fed signals the rate cut.

Join our community to discuss and grow stronger together!

Official Telegram community: https://t.me/aicoincn

AiCoin Chinese Twitter: https://x.com/AiCoinzh

OKX benefits group: https://aicoin.com/link/chat?cid=l61eM4owQ

Binance benefits group: https://aicoin.com/link/chat?cid=ynr7d1P6Z

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。