Cryptocurrency News

November 11 Highlights:

1. Uniswap proposal initiates protocol fees and UNI burn mechanism, the foundation's functions will be merged into Labs.

2. Analyst Peter Cardillo from Spartan Capital Securities: A U.S. government shutdown may make further interest rate cuts by the Federal Reserve in December possible.

3. U.S. Treasury Secretary: The Treasury and IRS have released new guidelines regarding cryptocurrency exchange-traded products.

4. Gemini's financial report falls short of expectations, with a third-quarter loss per share exceeding market estimates.

5. The U.S. Commodity Futures Trading Commission (CFTC) pushes for compliant exchanges to launch leveraged crypto spot products as early as next month.

Trading Insights

The underlying logic of making money in cryptocurrency trading: A correct mindset leads to profits. Many people lose not due to technical skills but because of "impatience" and "confusion"—chasing prices, holding at peaks, and cutting losses at bottoms are all symptoms of an imbalanced mindset. In fact, adhering to these three mindset principles is more effective than blindly staring at the market for 10 hours, helping you avoid pitfalls and secure profits:

Set a "loss limit" before discussing "profit targets." Before entering a trade, ask yourself: If I lose this money, will it affect my life? Mortgage payments, living expenses, and borrowed money must not be touched; such funds will lead to panic during market fluctuations. Only use "disposable" funds that you won't regret losing; this amount gives you the confidence to remain calm and withstand volatility.

Don’t compete with the market; compete with yourself. Price movements on the K-line have no "shoulds"; both rises and falls are random. No matter how impatient you are, you cannot change the facts. The real challenge is to control your greed and fear: when prices reach your target, take profits as planned without being greedy; when prices hit your stop-loss, exit decisively without hoping for a reversal. If you can do these two things, you’ve already outperformed 80% of retail investors.

Accept "imperfection" to win in the long term. No one can buy at the lowest point or sell at the highest point, and no one can make a profit every time. Constantly trying to make up for missed gains or recover lost capital will only lead to more mistakes. Trading is a long-term battle, not a one-time win or loss. Accept occasional losses and let go of opportunities that aren't meant for you, allowing you to patiently wait for quality market conditions and turn small profits into large ones. Ultimately, not losing in trading is the starting point for winning, and maintaining stability is the greatest skill. When your mindset is chaotic, even the best strategies will fail; when your mindset is stable, even a slow pace can lead to success.

LIFE IS LIKE

A JOURNEY ▲

Below are the real trading signals from the Big White Community this week. Congratulations to those who followed along; if your trades aren't going well, you can come and test the waters.

The data is real, and each trade has a screenshot from when it was issued.

**Search for the public account: *Big White Talks About Coins*

BTC

Analysis

Starting today, all compliant BTC, ETH, SOL, and other cryptocurrency spot ETFs can be staked by fund managers, and the earnings can be legally distributed to investors. This is a good thing, and it is expected that institutions will soon announce staking starting with ETH and SOL. However, is this a positive development for existing staking DeFi projects? Personally, I believe it is not a positive development but rather a negative one, because staking must be executed by institutions that are "licensed, regulated, and have custody capabilities," and ETF institutions cannot randomly select nodes. All staking must occur within the framework of traditional financial regulation.

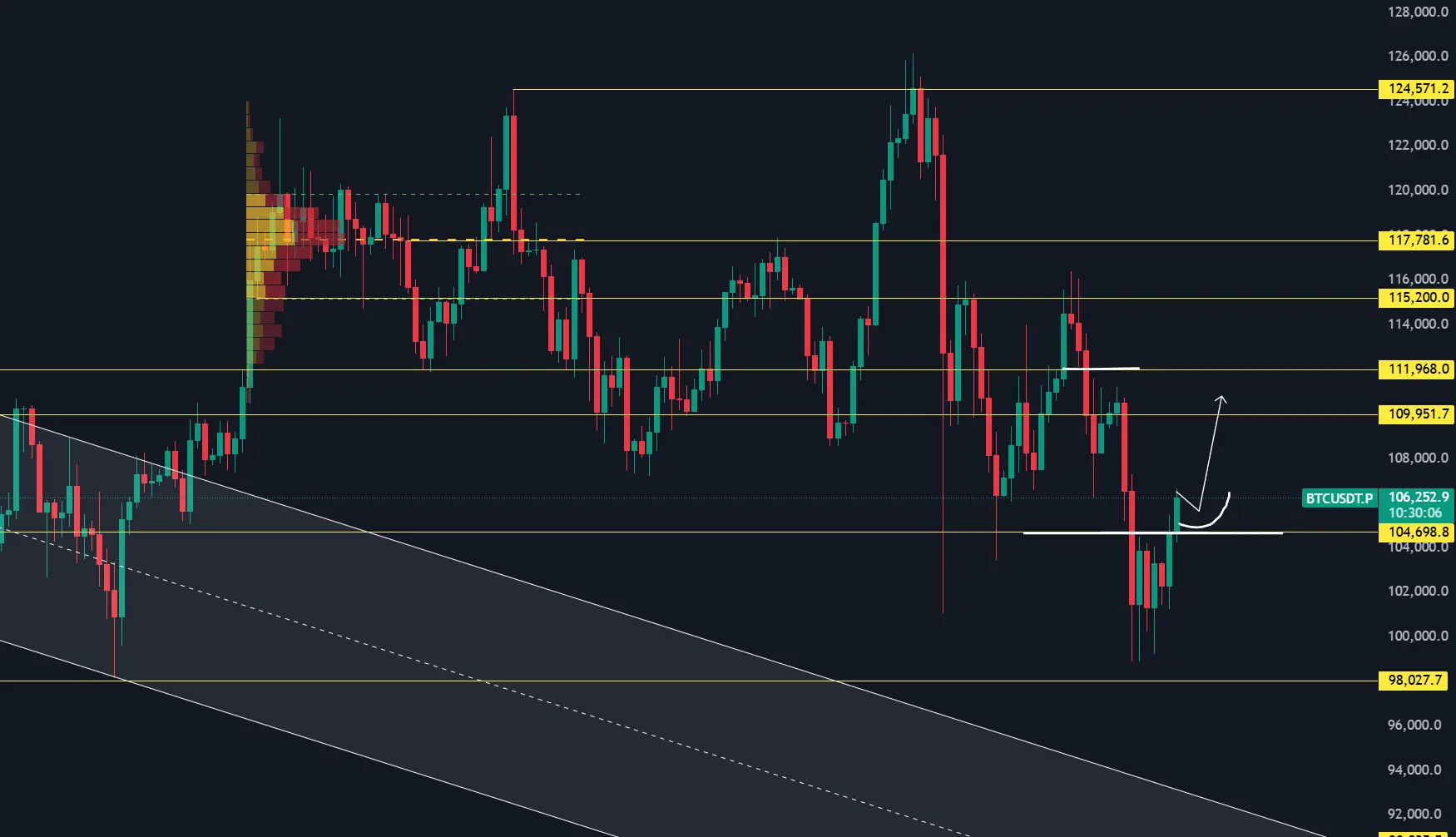

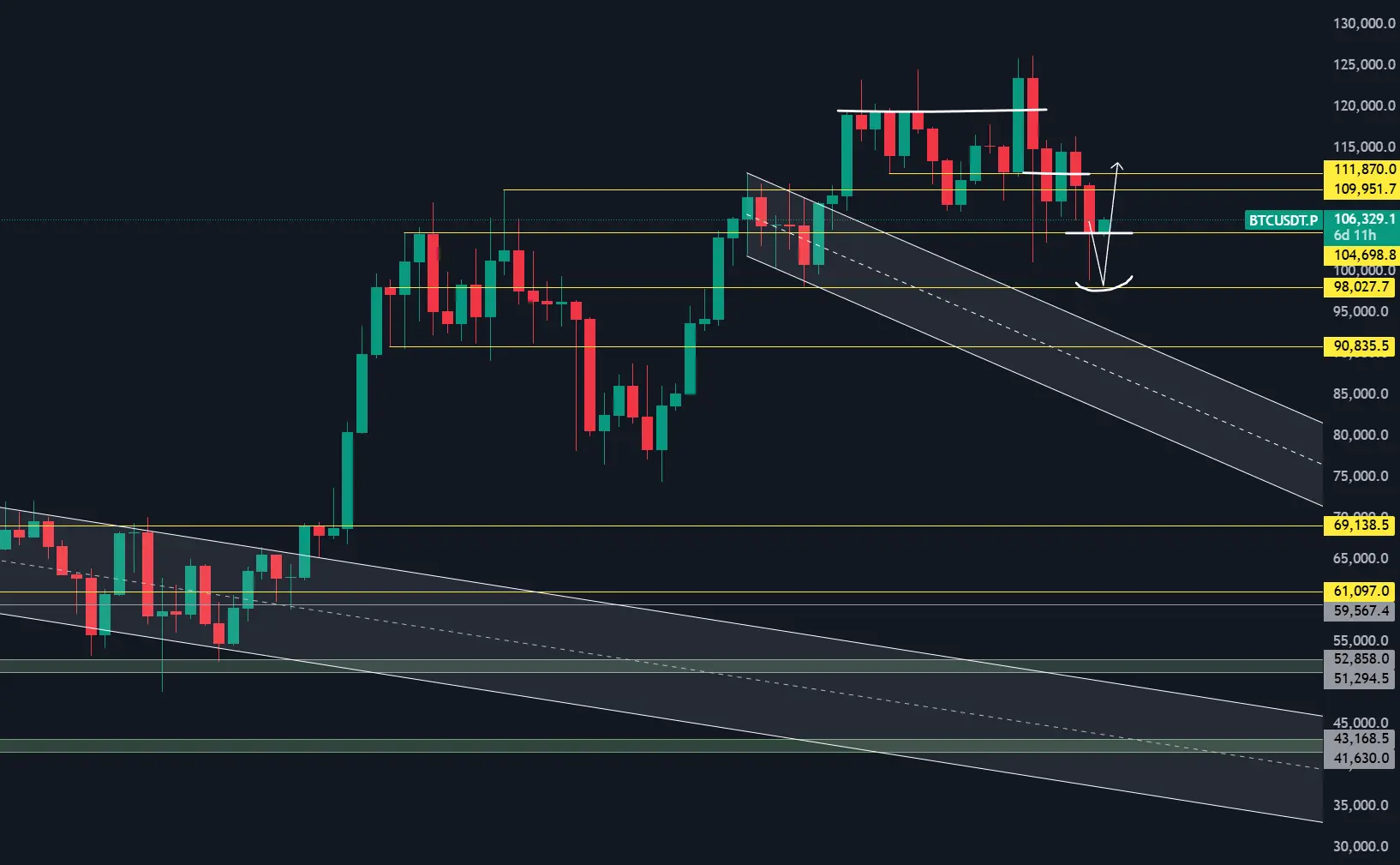

The weekly chart is still in a downtrend channel, and bearish indicators (MACD, RSI) have not been resolved. The key is whether it can stabilize above the M top neckline. The daily chart shows that the key resistance for the rebound is around 109,700, forming a triple resonance (M top neckline resistance - descending trend line pressure - Fibonacci 0.618 pressure). If it cannot stabilize above 109,700, the structure remains a rebound; daily indicators MACD and RSI golden cross support the possibility of a continued rebound. For short-term levels, pay attention to the 4-hour chart, where short-term opportunities may arise.

- In terms of short-term analysis, on the 4-hour level, yesterday it retraced to the W bottom neckline (also the midline of the channel) and stabilized to continue the rebound, continuing to operate within the ascending channel. The key is whether it can break through the upper track of the rebound channel near 108,500; if it breaks through, the next resistance level is around 111,200 (initial drop resistance). If the resistance near 108,500 is blocked, it may retrace to the midline support around 104,900, and if it breaks below the lower track near 102,500, it may follow a downward flag pattern. In terms of indicators, both MACD and RSI show upward recovery, which is a good rebound signal; RSI is about to become oversold.

Operational Strategy: The larger trend is bearish, and the short-selling strategy can continue, with pressure levels to short in batches, stopping losses if it breaks through.

ETH

Analysis

Compared to BTC's data, ETH's data is much better. Although there is still a net outflow, the amount of outflow is more than ten times less. While ETH has had few independent narratives recently, it seems that there aren't many traditional investors willing to sell ETH, possibly related to the current losses of ETH spot ETFs. However, looking at the weekly data, it is concerning; in week 67, ETH spot ETF investors in the U.S. saw an outflow of over 155,000 ETH, while in week 66, there was a net inflow of 6,700 ETH. This shows that while selling ETH is less common during an upward trend, when panic occurs among investors, the selling of ETH far exceeds that of BTC.

Currently, it has indeed quickly rebounded following BTC at the key level of 3,370, and there was also a slight resistance near 3,674. As long as it can maintain above the lower edge of the channel, around 3,500, there is a chance to continue pushing towards 3,900, also depending on how BTC performs. In recent days, large whales have been continuously buying.

Disclaimer: The above content is personal opinion and for reference only! It does not constitute specific operational advice and does not bear legal responsibility. Market conditions change rapidly, and the article may have some lag; if you have any questions, feel free to consult.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。