The rise of OCCAs and risk managers is an inevitable result of DeFi entering the structured product phase.

Written by: Chaos Labs

Translated by: AididiaoJP, Foresight News

The Rise of Risk Managers and Onchain Capital Allocators (OCCA)

DeFi has entered a new structured phase, where institutional trading strategies are being abstracted into composable and tokenizable assets.

This all began with the emergence of liquid staking tokens, and the tokenized basis trading launched by Ethena Labs became a key turning point for DeFi structured products. The protocol packages a delta-neutral hedging strategy that requires 24-hour margin management into a synthetic dollar token, allowing users to participate with just one click, thereby redefining their expectations of DeFi.

Yield products that were once exclusive to trading departments and institutions have now entered the mainstream. USDe has become the fastest stablecoin to reach a total locked value of $10 billion.

Ethena's success confirms the strong market demand for "institutional strategy tokenization." This shift is reshaping market structures and giving rise to a group of "risk managers" or "onchain capital allocators" who package complex yield and risk strategies into simpler products for users.

What are Risk Managers and Onchain Capital Allocators (OCCA)?

Currently, there is no unified definition for "risk managers" or "OCCA" in the industry. This label encompasses various designs, but the commonality lies in their repackaging of yield strategies.

Translator's Note: OCCA stands for Onchain Capital Allocator, which can be understood as professional fund managers or asset administrators in DeFi. They attract user funds by packaging complex strategies into simple products.

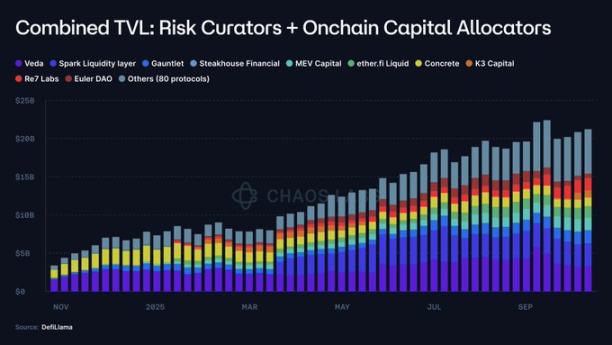

OCCAs typically launch branded strategy products, while risk managers more often utilize modular money markets (such as Morpho and Euler) to provide yield through parameterized vaults. The total locked value of these two types of products surged from less than $2 million in 2023 to $20 billion, an increase of about ten thousand times.

This also raises a series of fundamental questions:

Where are the deposits being directed?

What protocols or counterparties are the funds exposed to?

Can risk parameters be flexibly adjusted even in the face of severe volatility? What assumptions are they based on?

How liquid are the underlying assets?

What is the exit path in the event of large-scale redemptions or runs?

Where exactly does the risk lie?

On October 10, the cryptocurrency market experienced the largest altcoin crash in history, affecting centralized exchanges and perpetual contract DEXs, triggering cross-market liquidations and automatic deleveraging.

However, delta-neutral tokenized products seemed largely unaffected.

Most of these products operate like black boxes, providing almost no information beyond highlighted APYs and marketing slogans. Very few OCCAs indirectly disclose protocol exposures and strategy details, but key information such as position-level data, hedging venues, margin buffers, real-time reserves, and stress testing strategies are rarely made public; even when they are, it is often selective or delayed disclosure.

The lack of verifiable markers or trading venue footprints makes it difficult for users to determine whether a product's resilience comes from robust design, luck, or even financial delays in confirmation. Most of the time, they cannot even ascertain whether losses have occurred.

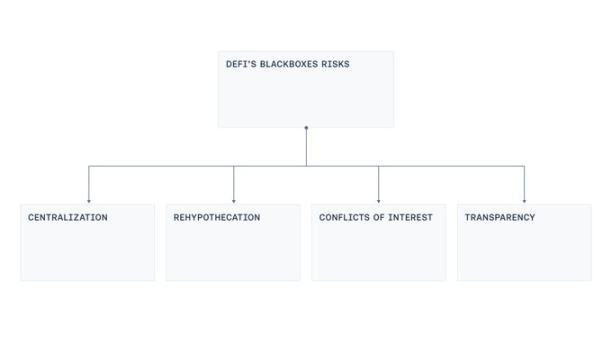

We observe four recurring weak points in the design: centralized control, re-hypothecation, conflicts of interest, and insufficient transparency.

Centralization

Most yield-generating "black boxes" are managed by multi-signature wallets controlled by external accounts or operators, responsible for custody, transfer, and deployment of user funds. This concentration of control means that once an operational error occurs (such as private key leakage or coercion of signers), it can easily lead to catastrophic losses. This also replicates the common patterns of bridge attacks from the previous cycle: even without malicious intent, a single workstation being compromised, phishing links, or internal personnel abusing emergency permissions can cause significant damage.

Re-hypothecation

In some yield products, collateral is reused across multiple vaults. One vault deposits or lends to another, which then recycles into a third. Investigations have found a circular lending pattern: deposits are "washed" through multiple vaults, artificially inflating TVL, forming recursive chains of "minting - lending" or "borrowing - supplying," continuously accumulating systemic risk.

Conflicts of Interest

Even if all parties are well-intentioned, setting optimal supply/borrowing limits, interest rate curves, or selecting appropriate oracles for the product is not easy. These decisions involve trade-offs. Overly large or unlimited markets may exhaust exit liquidity, leading to liquidation failures and potential manipulation. Conversely, limits that are too low can restrict normal activity. Ignoring the liquidity depth of interest rate curves may trap lender funds. When curators' performance is assessed based on growth, the problem becomes more pronounced, as their interests may diverge from those of depositors.

Transparency

The market washout in October exposed a simple fact: users lack effective data to assess risk positions, risk marking methods, and whether supporting assets are consistently sufficient. While it may be unrealistic to publicly disclose all positions in real-time due to risks such as front-running and short squeezes, a certain degree of transparency is still compatible with business models. For example, visibility at the portfolio level, disclosure of reserve asset composition, and hedging coverage rates aggregated by asset can all be verified through third-party audits. The system could also introduce dashboards and proofs to reconcile custodial balances, custodial or locked positions with outstanding liabilities, providing proof of reserves and governance permissions without exposing transaction details.

A Viable Path Forward

The current wave of packaged yield products is pushing DeFi away from its original principles of "non-custodial, verifiable, transparent" towards operational models closer to traditional institutions.

This shift itself is not inherently sinful. The maturity of DeFi has created space for structured strategies, which indeed require a certain degree of operational flexibility and centralized operations.

However, accepting complexity does not equate to accepting opacity.

Our goal is to allow operators to run complex strategies while retaining transparency for users, finding a feasible middle ground that accommodates both sides.

To this end, the industry should advance in the following directions:

Proof of Reserves: It should not only promote APYs but also disclose underlying strategies, complemented by regular third-party audits and PoR systems, enabling users to verify asset backing at any time.

Modern Risk Management: Existing solutions can price and manage risks for structured yield products, such as mainstream protocols like Aave that have adopted risk oracles to optimize parameters through decentralized frameworks, maintaining the health and safety of money markets.

Reducing Centralization: This is not a new issue. Bridge attacks have forced the industry to confront problems such as upgrade permissions, collusion among signers, and opaque emergency permissions. We should learn from these lessons and adopt threshold signatures, key duty separation, role separation (proposal/approval/execution), instant funding with minimal hot wallet balances, whitelisting for custodial withdrawal paths, time-lock upgrades for public queues, and strictly revocable emergency permissions.

Limiting Systemic Risk: Re-hypothecation is an inherent characteristic of insurance or re-staking products, but it should be limited and clearly disclosed to avoid forming circular minting-lending loops between related products.

Mechanism Transparency: Incentives should be as public as possible. Users need to know where the risk manager's interests lie, whether there are related party relationships, and how changes are approved, so that the black box can be transformed into an assessable contract.

Standardization: Onchain packaged yield assets have already become a $20 billion industry, and the DeFi space should establish minimum standards for general classification, disclosure requirements, and event tracking mechanisms.

Through these efforts, the onchain packaged yield market can retain the advantages of professional structuring while leveraging transparency and verifiable data to protect users.

Conclusion

The rise of OCCAs and risk managers is an inevitable result of DeFi entering the structured product phase. Since Ethena demonstrated that institutional-level strategies could be tokenized and distributed, the formation of a professional allocation layer around money markets has become a foregone conclusion. This layer itself is not the problem; the issue lies in the operational flexibility it relies on, which should not replace verifiability.

The solutions are not complex: publish proof of reserves corresponding to liabilities, disclose incentives and related parties, limit re-hypothecation, reduce single-point control through modern key management and change control, and incorporate risk signals into parameter management.

Ultimately, success depends on the ability to answer three key questions at any time:

Are my deposits backed by real assets?

What protocols, venues, or counterparties are the asset exposures exposed to?

Who is controlling the assets?

DeFi does not need to choose between complexity and fundamental principles. Both can coexist, and transparency should expand in tandem with complexity.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。