Author: Louis, Trendverse Lab

On October 28, 2025, Bitwise's Solana Staking ETF (BSOL) officially debuted on the New York Stock Exchange. In just a few days, the influx of funds surged rapidly—by early November, net inflows had exceeded $500 million, making Solana the next cryptocurrency asset to enter the mainstream financial system after Bitcoin and Ethereum.

Unlike traditional spot ETFs that only track prices, BSOL directly participates in on-chain staking with the SOL it holds, incorporating real network rewards into the fund's net asset value (NAV). This means that on-chain earnings are for the first time integrated into the asset pricing logic of the traditional financial system through the structural design of a compliant ETF.

At the intersection of crypto and traditional finance, this fund is not just "another ETF," but a turning point in market structure—capital logic is shifting from speculation to yield, from off-chain to on-chain.

However, this change has also brought three key questions to the forefront: Are institutions really betting on Solana's long-term position? How will this model change the on-chain staking ecosystem? Can it be replicated by other public chains?

Next, we will analyze this experiment of "on-chain earnings entering Wall Street" from four dimensions: "product mechanism—market response—ecological impact—future replicability."

1. BSOL's Structural Innovation: A Compliance Attempt for On-Chain Earnings

The Bitwise Solana Staking ETF (BSOL) is the world's first compliant product that directly incorporates public chain staking rewards into the calculation of the fund's net asset value (NAV). The fund is issued by Bitwise Asset Management and registered in the United States, officially listed on NYSE Arca on October 28, 2025.

In terms of mechanism design, BSOL's innovation lies in: Bitwise allows investors to obtain dual returns of "price exposure + on-chain earnings" within the same product by holding SOL and directly participating in Solana network staking.

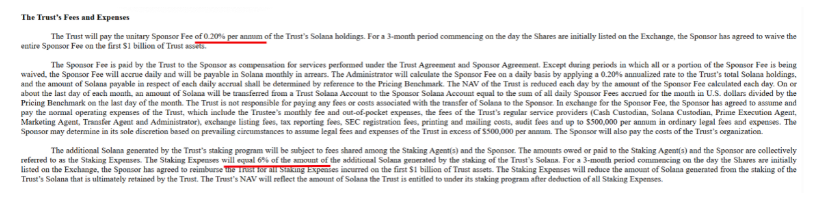

Source: BSOL FORM S-1

Specifically, when investors purchase BSOL shares, Bitwise will use the funds to buy an equivalent amount of SOL and hold it in Coinbase Custody. The assets will then be staked across more than 100 validator nodes. The rewards generated from staking, after deducting approximately 6% in node commissions and a 0.2% annual management fee, will be fully included in the fund's net asset value, rather than distributed as cash dividends.

As a result, BSOL's net asset value is driven daily by two key curves: one from the market price fluctuations of SOL, and the other from the continuously accumulated on-chain staking rewards. According to Bitwise's estimates, its initial staking annualized return rate is about 7%, significantly higher than most traditional fixed-income assets.

However, BSOL is not the first ETF linked to Solana in the U.S. market. Prior to it, the REX–Osprey SOL + Staking ETF (SSK) was launched first, with a current fund size of approximately $276 million.

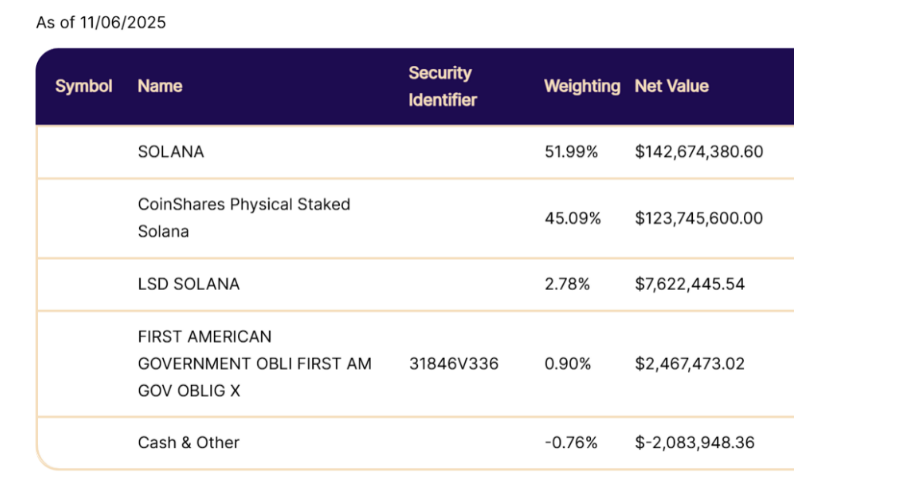

Source: Rexshares official website

SSK's model is more indirect: about half of the assets directly hold SOL, while the other half invests in the CoinShares Staked Solana ETP listed in Switzerland to obtain indirect staking rewards. For the portion it holds, SSK entrusts external validators for staking and regularly distributes dividends to investors in cash, with a distribution rate of about 5.1% as of the end of September.

In contrast, Bitwise has taken a more "native" approach. It does not rely on third-party nodes but collaborates with Solana infrastructure provider Helius to establish its own validator node, Bitwise Onchain Solutions, allowing all ETF assets to participate directly in staking. All staking rewards will automatically be included in the fund's net asset value, forming an internal revenue structure that grows with compounding over time.

This architecture makes BSOL not just an ETF, but a connecting mechanism between traditional finance and the on-chain economic system. It provides institutional funds with a new channel to directly access on-chain earnings within a compliant framework, thus becoming a focal point of market attention.

2. Market Response and Price Transmission: From Hype to Structural Capital Flow

Since its official listing on October 28, 2025, the market interest in the Bitwise Solana Staking ETF (BSOL) has continued to rise. According to Arkham Research data, the fund saw an inflow of approximately $69.5 million on its first day, followed by an additional $46.5 million the next day, and $36.5 million on the third day. In just three days, net inflows surpassed $100 million; by early November, cumulative inflows had exceeded $545 million, making it one of the fastest-growing crypto equity ETFs at that time.

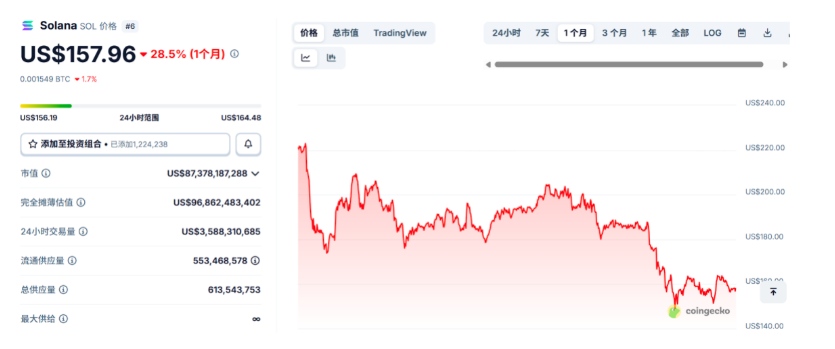

Source: Coingecko

However, in contrast to the rapid influx of funds, SOL's short-term price performance remained relatively stable and even saw a significant decline afterward. According to Trading News, despite ETF inflows exceeding $400 million, SOL's spot price still fell by about 29% over the following month. This contrast of "capital inflow coexisting with price decline" has sparked widespread discussion in the market. In fact, this trend is not unique to Solana but reflects a broader performance across the entire crypto market under macro pressures. Decrypt pointed out that during the same period, the total asset size of 11 Bitcoin spot ETFs shrank by over $2.1 billion, while 9 Ethereum ETFs also experienced a cumulative net outflow of $579 million. The rising risk of a U.S. government shutdown, soaring treasury yields, and tightening global liquidity have collectively suppressed the performance of risk assets. Thus, SOL's pullback appears more as a systemic reflection of macro risk aversion rather than a structural issue of a single asset. Meanwhile, the market response during this phase also reveals the essential differences in structural logic between the Solana ETF and BTC, ETH ETFs. Traditional Bitcoin and Ethereum spot ETFs typically correspond to immediate spot buying, where capital inflow directly drives price increases; whereas BSOL's mechanism is closer to "long-term locking," where funds are staked to participate in network operations, with earnings sourced from on-chain rewards rather than short-term price fluctuations. In other words, although capital inflow creates structural buying pressure, the transmission to secondary market prices is significantly slower.

As CoinPaper commented, the capital flow into BSOL reflects more of a "long-term capital allocation" rather than "short-term trading enthusiasm." Such capital entry is more likely to enhance ecological activity and the total value locked (TVL) in the network, rather than an immediate price reaction.

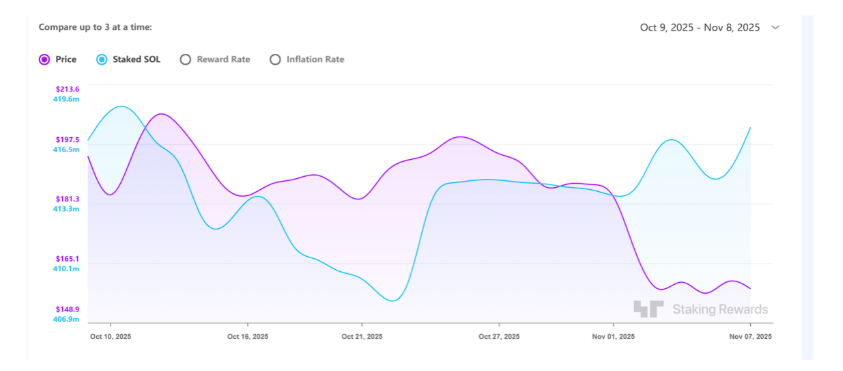

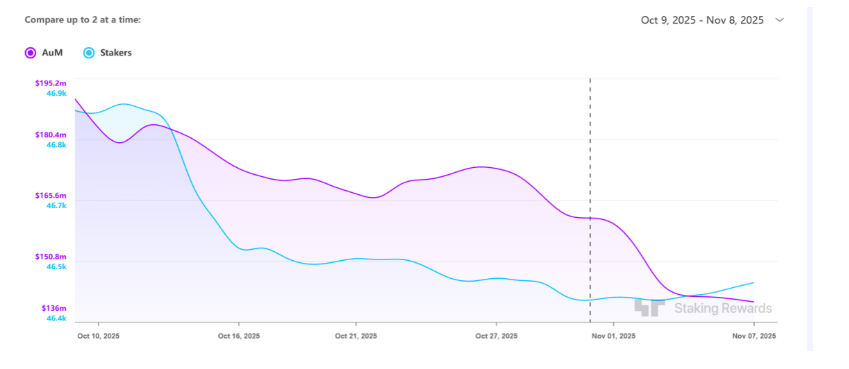

Source: Staking Rewards

This trend is also reflected in on-chain data: during the same period, the total amount of SOL staked on Solana rose to approximately 417 million SOL, estimated at a total staking value of about $35 billion based on an average price of around $180 at that time. In other words, despite the price decline, the network's staking scale and activity are still increasing, reflecting a robust expansion of the on-chain economic foundation. Overall, the launch of BSOL reveals a shift in the capital structure of the crypto market—capital is moving from chasing volatile speculative funds to seeking long-term allocation forces that pursue yield compounding. This type of "slow and deep" liquidity is becoming an important signal for Solana's entry into the mainstream financial system.

3. Institutional Participation and Ecological Rebalancing: Reconstruction of the Solana Staking System

The change in capital flow patterns essentially reflects a reconstruction of institutional participation logic. The significance of Bitwise launching BSOL goes beyond the birth of a new type of ETF. It serves more as a signal effect, indicating that some mainstream financial institutions are beginning to include Solana in the discussion of "configurable assets." This trend does not imply that regulators have formally recognized its status, but rather shows that the acceptance of the PoS network's earnings model is increasing within a risk-controlled framework by regulators and institutions. As one of the first crypto asset management companies in the U.S. to be registered with the SEC, Bitwise's entry is also widely seen as a signal of trust in the market. For institutional investors, BSOL is not just an investable product, but also an institutional-level channel innovation—it allows capital to directly participate in the on-chain earnings distribution of the Solana network within a compliant structure.

From a capital structure perspective, the investor profile of BSOL shows a clear stratification compared to traditional on-chain staking users:

The former mainly comes from compliant brokerages and institutional accounts, focusing on stable returns and asset liquidity;

The latter is primarily composed of DeFi native users, who are more inclined to stack returns through liquid staking tokens (LST).

As a result, a new question arises: Are BSOL and on-chain staking derivatives substitutes or symbiotic?

In the short term, some high-net-worth funds may indeed flow from on-chain products to BSOL—the latter provides a yield channel that requires "no self-custody and low operational thresholds." This migration may exert temporary pressure on the TVL growth of bSOL, mSOL, JitoSOL, and other LST tokens.

Source: StakingRewardsbSOL

However, from a mid-term perspective, the existence of BSOL may actually amplify the visibility and capital carrying capacity of the entire Solana ecosystem. The inflow of the ETF makes the concept of "staking rewards" more widely understood and accepted by mainstream investors, and is expected to guide some institutions to further explore on-chain native products. In other words, institutional entry may not necessarily lead to capital diversion, but could instead become a means of ecological attraction.

From the perspective of structural evolution, Solana's staking system is forming a "dual-layer complementary" pattern:

·TradFi Layer (Institutional Staking Pool): Represented by BSOL, it accommodates institutional and compliant capital, emphasizing safety and custody compliance.

·DeFi Layer (On-chain Staking Layer): Represented by bSOL, mSOL, JitoSOL, etc., pursuing liquidity and yield efficiency.

The relationship between the two is not a barrier but a bidirectional cyclical mechanism: the ETF brings off-chain capital into on-chain, while the DeFi ecosystem allows these funds to regain liquidity and efficiency.

In this cyclical system, Solana's staking network is evolving from a single yield tool into a value connection layer that bridges TradFi and DeFi—providing traditional institutions with a safe and transparent entry for earnings while injecting a more stable long-term capital source into the on-chain ecosystem.

4. Replicability and Model Evolution: The Expansion Prospects of Yield ETFs

The successful launch of Bitwise BSOL marks a transition in crypto financial products from the simple stage of "price exposure" to a new stage of "yield exposure."

This means that the focus of ETFs is shifting from "how to track prices" to "how to capture on-chain earnings." BSOL is not an isolated innovative case but the starting point for the structural and institutional evolution of crypto assets.

1. Replicability: Public Chains with "Yield Financialization" Potential

To replicate a similar "on-chain yield ETF" like BSOL, a public chain must meet conditions on three levels: technology, ecology, and compliance:

·Technical Level: Adopting a consensus mechanism similar to PoS or DPoS to ensure stable, transparent, and verifiable network staking returns;

·Ecological Level: Having a complete validator system and mature staking infrastructure (such as LST, restaking frameworks) to support institutional custody and liquidity management;

·Regulatory Level: Staking rewards must be defined as "network rewards" rather than "dividend income" to avoid triggering securities attributes.

As these prerequisites gradually mature, more public chains may enter the "yield financialization" track in the future.

For example, projects like Sui, TAO, and AVAX, with relatively complete PoS economic models, have the potential for structured expansion. If the U.S. regulatory environment becomes clearer, ETH ETFs based on staking rewards are expected to become the most representative replication case after BSOL.

2. Model Extension: From Single-Asset ETFs to Multi-Asset ETPs

BSOL may also serve as the starting point for more complex product forms.

In the future, there may be multi-asset staking yield baskets (Staking Basket ETPs) that include assets like SOL, ETH, AVAX, ATOM, etc., dynamically allocating weights based on their respective network yield rates.

In broader innovative directions, hybrid ETPs combining AI computing power and PoS yields may emerge, allowing investors to obtain composite returns from both computing output and on-chain earnings within the same asset package.

This trend is gradually giving PoS network staking yields "fixed income" attributes, transitioning crypto assets from a speculative logic reliant on price fluctuations to a valuation system centered on yield discounting.

In a sense, on-chain earnings are becoming a new generation of pricing anchors for crypto assets.

5. Opportunities and Structural Constraints of Yield Financialization

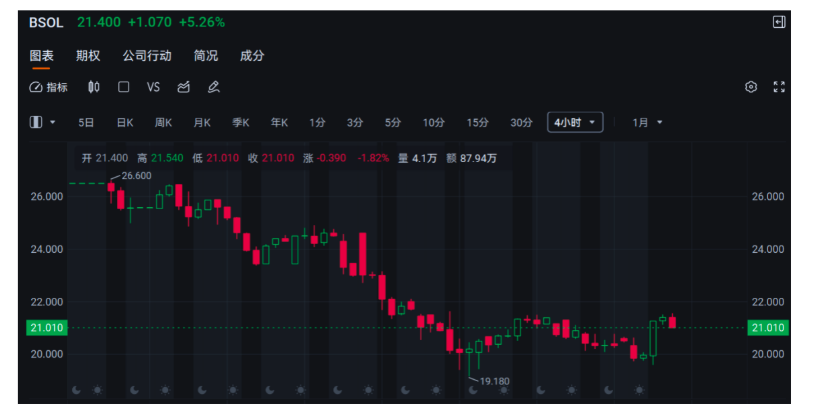

Overall, BSOL's staking yield model opens a new path for the financialization of crypto assets, but the stock price over the past week has not yielded positive feedback, and in the future expansion process, it still faces multiple structural risks:

·Yield Volatility Risk: Staking return rates are significantly affected by network activity, inflation rates, and the overall staking ratio; if ecological growth slows, ETF yields will decline accordingly;

·Node and Slashing Risk: If validators operate abnormally, staked assets may be penalized, directly eroding the fund's net value;

·Redemption and Liquidity Risk: Staked assets have an unlocking period (approximately 2 days for Solana); if the market experiences severe fluctuations, the ETF's net value may be temporarily discounted.

These factors imply that while BSOL represents the beginning of "yield financialization" for crypto assets, its long-term sustainability still depends on the dynamic balance between network health, operational robustness, and liquidity management capabilities.

Nevertheless, the emergence of BSOL is still of milestone significance. It proves for the first time that on-chain earnings can be recognized, priced, and structurally absorbed within traditional financial frameworks. This not only establishes a new value anchor for PoS networks but also reflects that crypto assets are gradually transitioning from "price games" to "yield pricing."

With the continued entry of institutional capital and the evolution of product forms, on-chain earnings are gradually becoming the core value of digital assets.

However, the market still needs time to verify whether this model can truly achieve long-term stable operation within a broader regulatory environment and liquidity cycle.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。