Written by: Carlos & Luke Leasure

Translated and Compiled by: BitpushNews

Uniswap has become a typical representative of the widespread "equity-token" structural contradiction in the industry. For years, Uniswap Labs has accumulated all the revenue generated by the protocol, while UNI token holders have failed to benefit.

Yesterday, Uniswap founder Hayden Adams, on behalf of Uniswap Labs and the Uniswap Foundation, released a governance proposal aimed at unlocking Uniswap protocol fees and unifying ecosystem incentives, which is an unexpected victory for token holders.

The Uniswap protocol includes a fee switch that can only be activated through UNI governance voting. This proposal will activate the fee switch and introduce a programmatic token burn mechanism, while retroactively burning 100 million UNI tokens from the treasury to compensate for the value accumulation that token holders have missed over the past years.

At the same time, the proposal stipulates that after deducting the Layer 1 (L1) data costs and the 15% fee paid to Optimism, all Sequencer fees from Unichain will be transferred to this burn mechanism.

In terms of incentive alignment, the proposal will also merge most of the Foundation's functions into Labs and create a growth budget of 20 million UNI per year, aimed at allowing Labs to focus on protocol adoption while reducing its commission rates on front-end interfaces, wallets, and APIs to zero.

Since Uniswap will establish a clear value accumulation mechanism between the token and the protocol's success, what is the fair value of UNI?

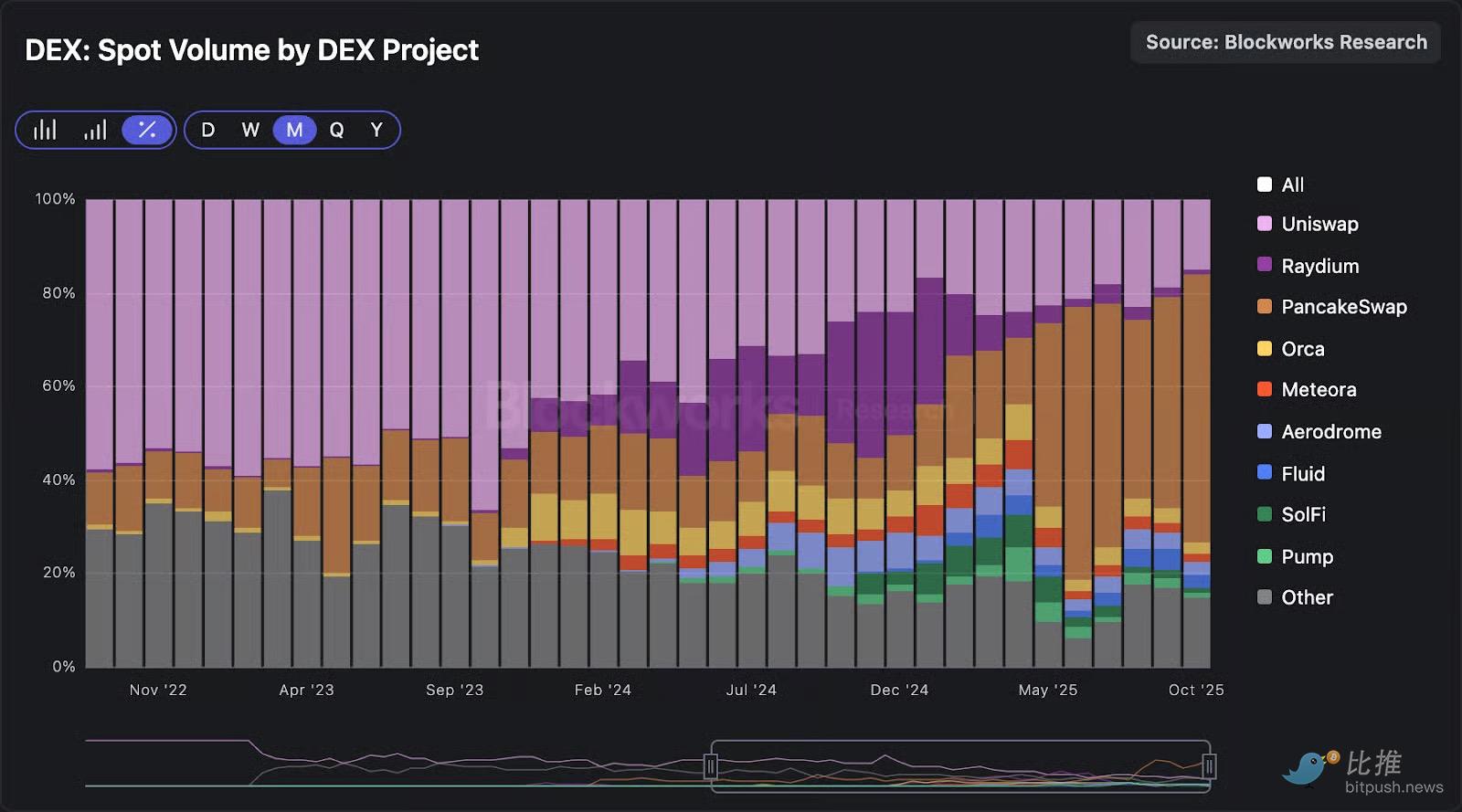

Over the past two years, Uniswap has lost its dominance in the DEX (decentralized exchange) space, with its trading volume market share dropping from over 60% in October 2023 to less than 15% last month.

This shift in DEX market share reflects the growing dominance of Solana in on-chain activity during the same period, as well as the rise of protocols like Aerodrome, which have successfully maintained a lead over Uniswap on the Base chain.

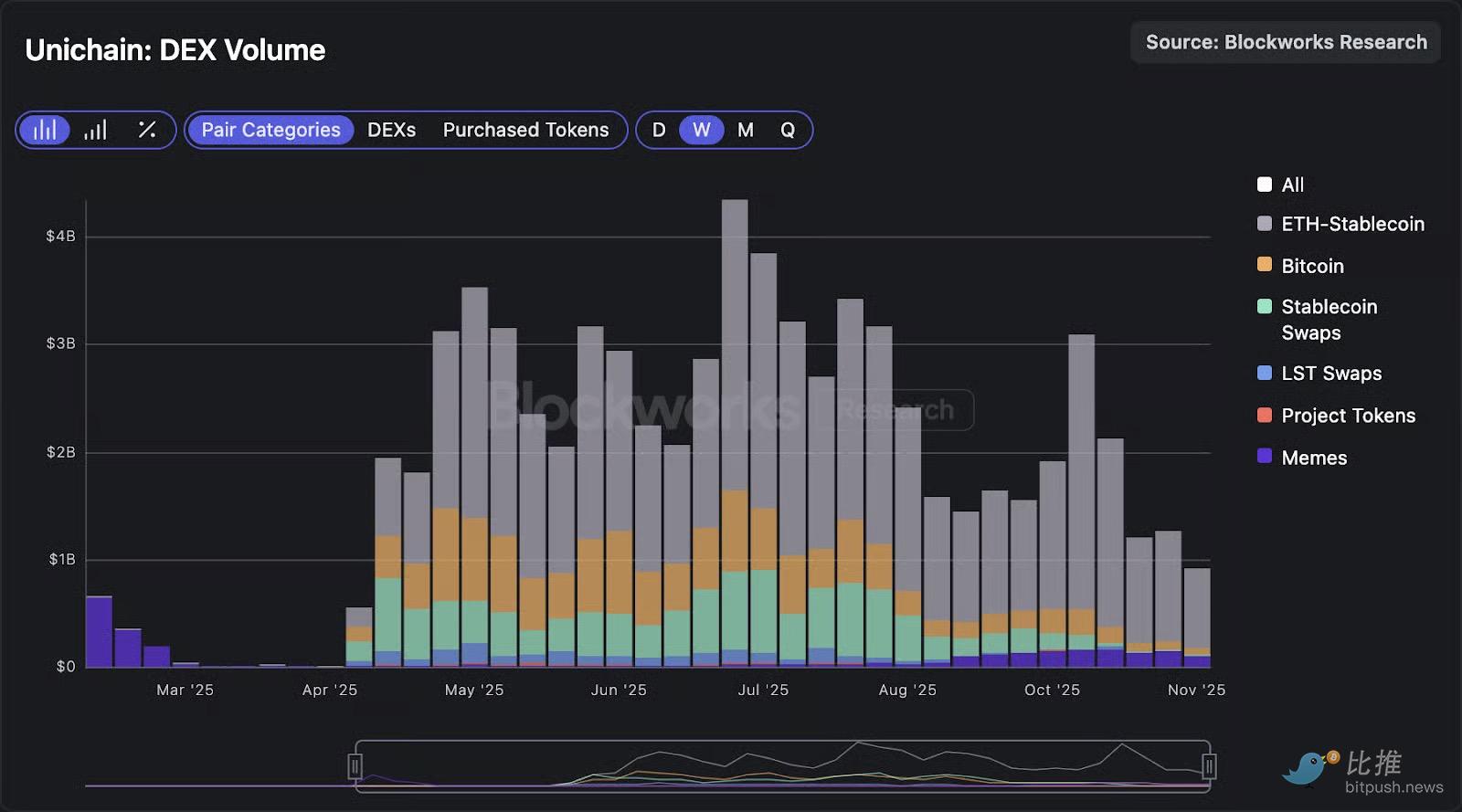

If we observe Unichain, its network activity remains relatively sluggish, with weekly DEX trading volume continuing to decline since July.

The recorded trading volume of $9.25 billion last week is the lowest since mid-April.

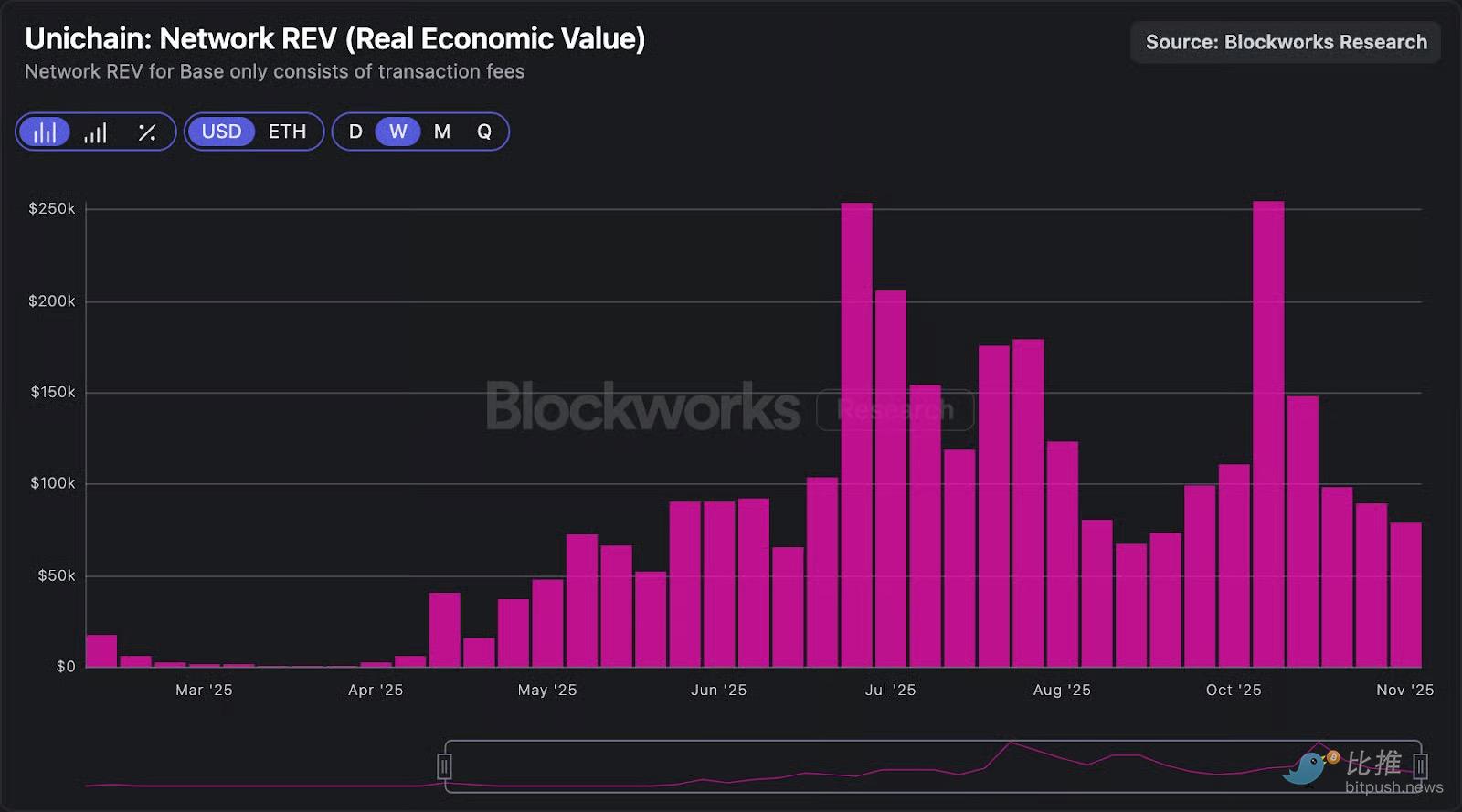

Unichain's network revenue presents a more optimistic picture, although we have also seen a decline in revenue in recent weeks.

In the past 30 days, Unichain's network revenue totaled $460,000, which translates to an annualized revenue of approximately $5.52 million.

With an 84% profit margin, this would bring $4.64 million in revenue to Uniswap Labs under the current structure; after the proposal is passed, this revenue will enter the burn mechanism.

That said, Unichain is only a small part of the protocol's total revenue, with most of the revenue still coming from the implementation of v2 and v3 versions.

Kunal, a researcher at Blockworks Research, has built an excellent dashboard based on this "UNIfication" proposal to showcase Uniswap's token burn estimates.

If this mechanism had been enabled earlier, the protocol should have burned nearly $26 million worth of UNI in the past 30 days;

and since the beginning of the year, it would have burned nearly $150 million.

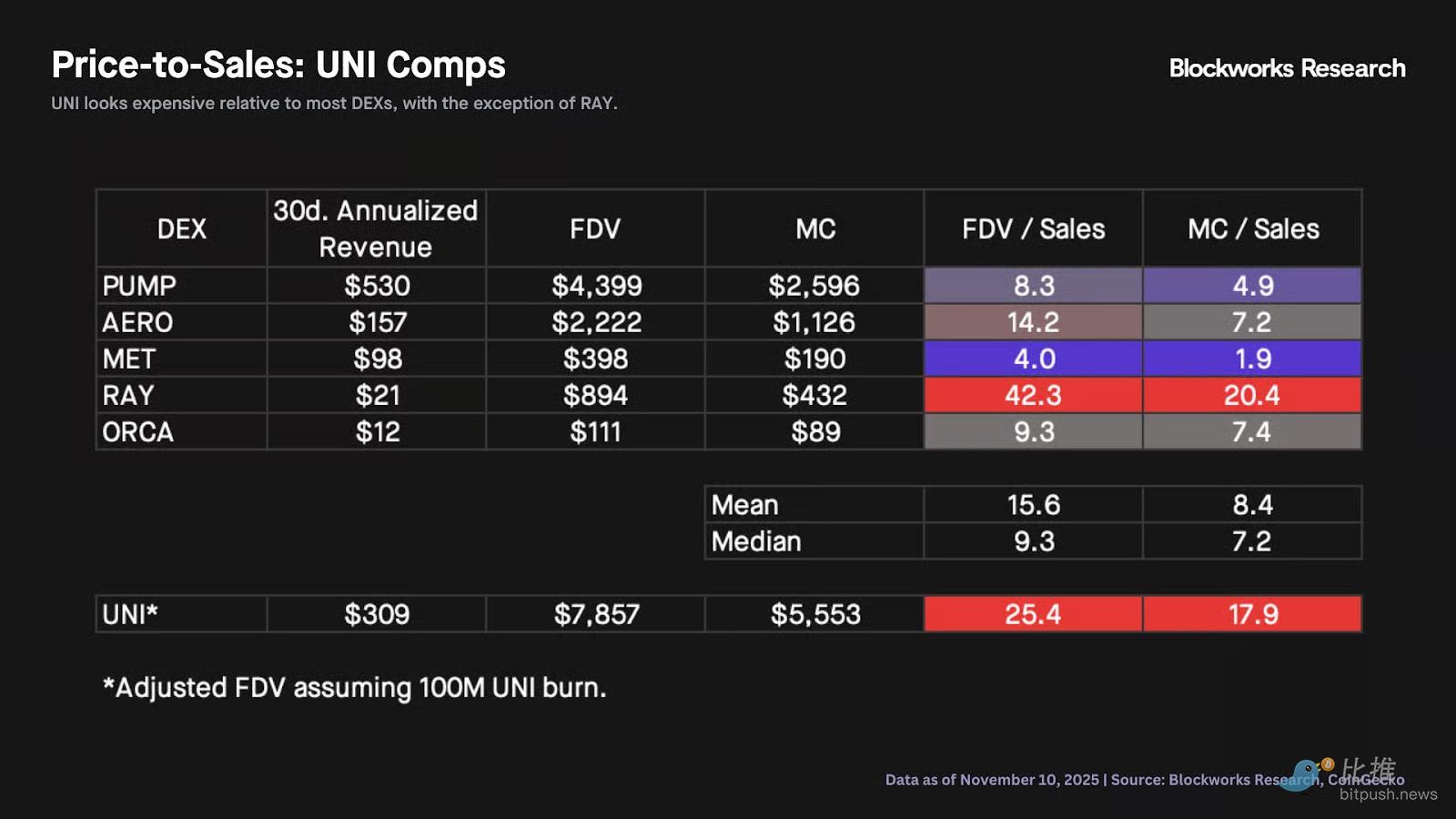

The table below compares UNI with other decentralized exchanges (note that we included Pump due to its AMM mechanism).

From this table, it can be seen that although the "UNIfication" proposal is heading in the right direction, even considering the retroactive burn of 100 million UNI, UNI's valuation remains high compared to the median and average price-to-sales ratios of its peers.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。