Written by: Luke, Mars Finance

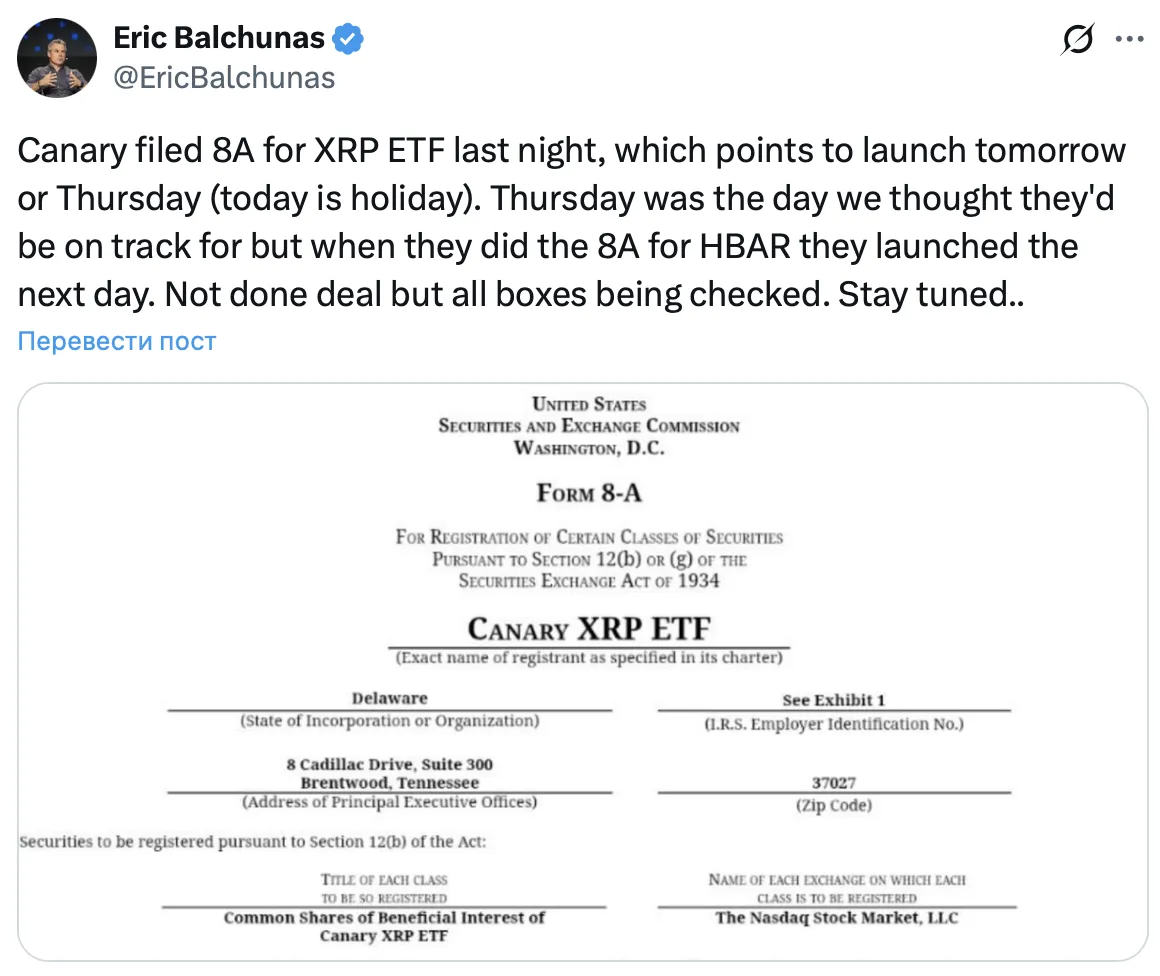

On November 12, a document made all the alpha traders in the crypto market hold their breath: Canary submitted the 8-A Form for its XRP spot ETF.

To outsiders, this is just another regulatory document. But for professional ETF analysts, this is the ultimate signal before the listing.

The timing of this signal is nothing short of perfect.

Just 18 hours later (5 AM Beijing time on November 13), the U.S. House of Representatives will hold a final vote on "ending the government shutdown." Once passed, there will be a clear timeline for the trillion dollars frozen in the Treasury General Account (TGA) to be released.

The trillion-dollar liquidity (new water) released from the TGA is about to meet the first confirmed compliant channel (XRP ETF).

This "coincidence" is set to become a fuse that will not only ignite XRP but also reignite the expectations for the "batch approval" of altcoin ETFs (such as LINK, DOT, SUI) that have been dormant on the DTCC list for months.

Signal One: The Ultimate Alpha of the 8-A Form

We must first understand why the 8-A Form is such a significant signal.

To approve an ETF, there are three steps:

- 19b-4 Filing: Submitted by the exchange (like Nasdaq) to request a "rule change." This is the SEC's first gate.

- S-1 Filing: Submitted by the issuer (like Canary), which is the "prospectus." This is the SEC's second gate.

- 8-A Filing: This is key. This document is submitted by the issuer to the SEC to register the security on the exchange so it can be traded legally.

Historical precedents (like the BTC ETF in January 2024) indicate that issuers only dare to submit this administrative document on the eve of listing after receiving a "green light" from the SEC for both the 19b-4 and S-1.

Translated, this means: Canary has received a "call" from the SEC, informing them "you are approved."

The judgment that the XRP ETF may officially list on Thursday (tomorrow) is entirely reasonable. This is the first quasi-confirmation signal we have seen for a mainstream altcoin ETF approved since January 2024, aside from BTC/ETH.

Signal Two: A Trillion in "New Water" About to Overflow

The XRP ETF is just a pipe, and the water is ready on the same day.

The House's vote at 5 AM tomorrow (Speaker Mike Johnson has expressed support) will "open the door." This means the TGA (Treasury General Account) will transform from a trillion-dollar black hole back into a super faucet.

During the 40 days of the shutdown, the TGA has withdrawn $700 billion from the market due to a lack of inflows. This is the real culprit behind the market crash in early November (BTC fell below $99,000) and the "dollar shortage" in the banking system (the $50 billion "emergency pawn shop" usage on October 31).

Now, the flood is about to begin.

But why is this flood so important?

The answer lies in the RRP (Reverse Repurchase Agreement)—the "sponge" that was once used to absorb the Federal Reserve's flood—has now been depleted.

When the TGA was rebuilt in 2023, the RRP had $2.2 trillion, perfectly absorbing the liquidity released from the TGA. Now, the RRP balance is less than $80 billion.

This means a trillion-dollar flood is about to come, and the $2.2 trillion sponge in the market is now just $80 billion of residue.

This trillion-dollar flood will have no buffer, overflowing directly into bank reserves and frantically seeking any high-risk assets that can accommodate it.

"New Water" Ignites "Old Fire": The Detonation of the DTCC List

Now, let's put the pieces together.

The trillion-dollar liquidity released from the TGA, combined with the first confirmed XRP ETF channel, will reignite the market's fervent expectations for "batch approvals."

This brings us to that "old" list. Back in August and September 2025, Bitwise's LINK ETF, 21Shares' DOT ETF, and others had already "appeared" on the DTCC website.

At that time, this triggered a wave of preemptive trading. We remember how the listing of IBIT on the DTCC in October 2023 pushed BTC up 7.2% within 24 hours.

But in August and September, the market only had "expectations" (DTCC list) but no "confirmation" (like the 8-A Form), and no "new water" (TGA flood). Therefore, that narrative fizzled out.

And today, the situation has fundamentally changed.

The 8-A Form for the XRP ETF is the SEC's first "explicit" indication: the SEC is ready to approve altcoin ETFs.

It's like lighting the first match next to a pile of dormant kindling (LINK, DOT, SUI on the DTCC), while a "gasoline truck" (the trillion-dollar TGA flood) is on its way.

The Conspiracy of "Batch Approval": Why the SEC Has No Choice?

XRP will certainly not be the only one. Institutions like Sygnum (Swiss crypto bank) are completely correct in their analysis of "batch approvals."

The SEC must "batch approve," stemming from the "ghost" of the Grayscale case.

On January 10, 2024, the SEC "batch approved" 11 Bitcoin ETFs because the court ruled that its rejection of Grayscale was "arbitrary and capricious." The lesson for the SEC from this precedent is: you must apply a uniform standard to similar products.

Now, a pile of applications (XRP, LINK, DOT…) is before the SEC.

On the eve of XRP (which has clarified its non-security status in the Ripple case) about to be approved, the SEC has no reason to reject LINK (which even has CME futures, similar to ETH). If the SEC dares to pick winners, issuers like Bitwise will immediately sue it, citing "arbitrary and capricious."

The SEC does not want to lose again.

Therefore, the 8-A Form for XRP is not just a victory for XRP, but a starting gun for the collective victory of altcoins.

Goodbye to Meme Speculation: The "Institutional Bull" of Altcoin Season

The approval of these ETFs will mean far more than the "altcoin season" of 2021.

In 2021, it was a retail frenzy. The surge of DOGE was driven by Musk's tweets, and the rise of SHIB was pure meme speculation. It was a liquidity-driven, sentiment-led carnival, where the capital was not "sticky," coming quickly and leaving just as fast.

However, the "institutional bull" of 2025 has a completely different underlying logic.

Let's review what happened after the BTC spot ETF was approved in January 2024:

- Capital Flow: As of November 2025 (now), the BTC spot ETF has attracted nearly $60 billion in net inflows. The ETH ETF has also attracted about $13.8 billion.

- Narrative Shift: Surveys show that 88% of financial advisors reported that the SEC's approval made them "more optimistic."

- Market Structure: The biggest change is that it unlocked pensions. Morgan Stanley has allowed its financial advisors to recommend crypto funds to clients (including retirement accounts 401k) since October 15, 2025.

BTC and ETH ETFs are just appetizers; they educated the market and paved the way for compliant channels. The real demand from institutions is always diversification. Research from Sygnum shows that over 80% of institutional investors have shown strong interest in crypto ETFs "beyond BTC and ETH."

This is the true significance of the DTCC list (XRP, LINK, DOT, SUI). They are no longer meme coins; they are institutionally allocatable assets.

When a manager of a 401(k) pension fund decides to allocate 1% to "digital assets," he will not go (and cannot) buy SUI on OKX. But he will not hesitate to buy a crypto diversified basket ETF issued by BlackRock or Franklin that includes (BTC, ETH, XRP, LINK, DOT).

The Starting Gun Has Fired

We are witnessing a profound transformation in market structure.

Canary's 8-A Form and the trillion-dollar flood from the TGA are not signals of "good news fully priced in"; they are the starting gun for a paradigm shift.

The ignition of XRP will inevitably detonate the market's expectations for the "batch approval" of all altcoins on the DTCC list.

This marks a transition for the altcoin market from a "disorderly casino" driven by retail sentiment and memes to a "compliant market" driven by institutional allocations and 401(k) funds.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。