Original Title: "Robinhood's Rare Bet, Lighter and Its Genius Founder"

Original Author: Eric, Foresight News

Perp DEX has undoubtedly been one of the hottest topics in recent months. After HyperLiquid broke through, leading projects have showcased their strengths. HyperLiquid shone brightly without any funding due to the team's operational capabilities, while Aster clung to Binance's influence to quickly capture the market. Lighter, on the other hand, chose to embrace capital.

Fortune magazine reported on November 11 that Lighter has completed its latest round of financing, raising $68 million, with a strong lineup of investors that includes Founders Fund, Ribbit Capital, and Haun Ventures, even the usually non-investing celebrity brokerage Robinhood couldn't resist voting with their feet.

In addition to the financing, the report also revealed the lesser-known story behind Lighter.

From Trading to AI and Back to Trading

Lighter's founder, Vladimir Novakovski, has shown us a profound truth: even geniuses need to focus on areas they are familiar with. Unlike many entrepreneurs who have transitioned from the Web3 industry to AI, Vlad chose to go against the tide.

Vlad immigrated from Russia to the United States at a young age and was selected for the U.S. national team to participate in international informatics and physics Olympiads while many were still solving quadratic equations. At 16, Vlad entered Harvard University and graduated early three years later, being personally invited by Ken Griffin, CEO of Citadel, one of the world's largest hedge funds and market makers, to join at the age of 18.

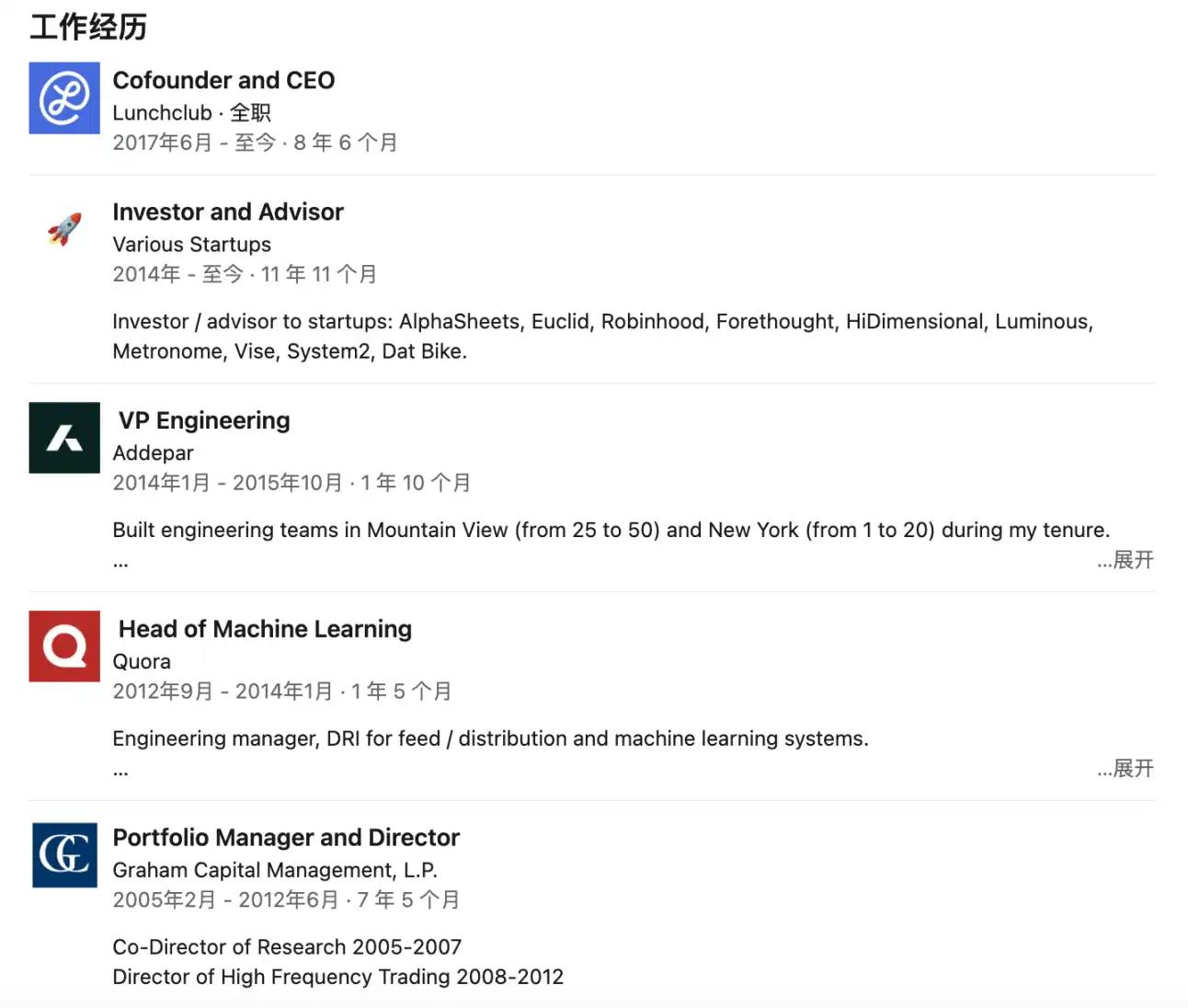

After nearly 15 years of experience as an engineer and trader, in 2017, Vlad co-founded the AI social networking platform Lunchclub with Scott Wu, whom he worked with at the investment firm Addepar.

Lunchclub raised about $30 million in funding, and at the beginning of the pandemic, its product attracted a large number of users eager to meet new friends. However, by 2022, growth began to stagnate. "At that time, we had three paths: one was to try to make it profitable but on a smaller scale; the second was to find a way to evolve it into a platform similar to TikTok or Snapchat, but that didn't seem feasible," Vlad said. "The third path was to pivot to do what we were truly interested in."

That year, the two founders parted ways, with Wu leaving Lunchclub to establish the AI coding company Cognition, which is now valued at over $10 billion. Vlad, who remained at Lunchclub, decided to lead the company in a transformation, and the direction of that transformation was trading, which he excelled at. After the pivot, Lunchclub became Lighter, with Vlad retaining 80% of the original team, and in 2024, they completed a $21 million financing round led by Haun Ventures and Craft Ventures, with participation from Dragonfly and Robot Ventures, although this financing was not publicly disclosed at the time.

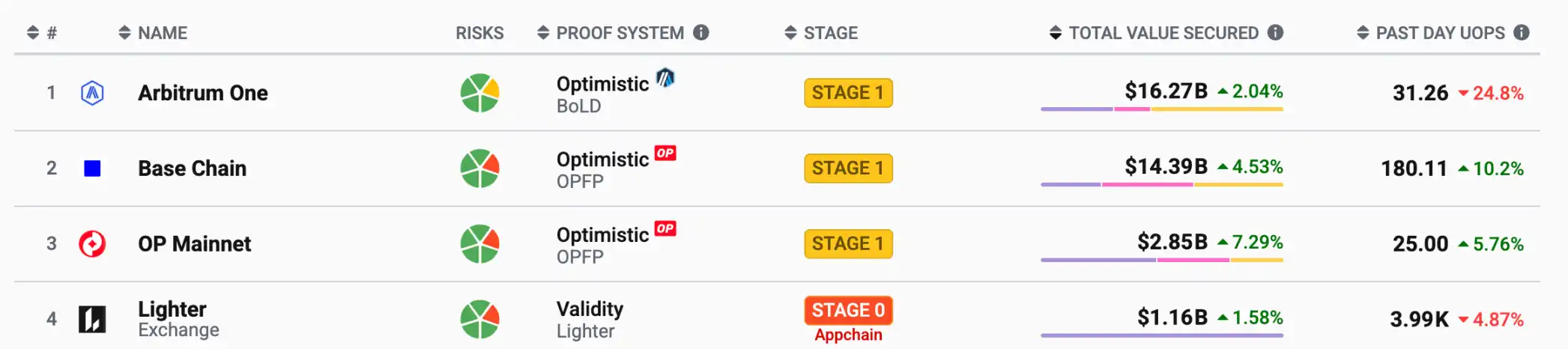

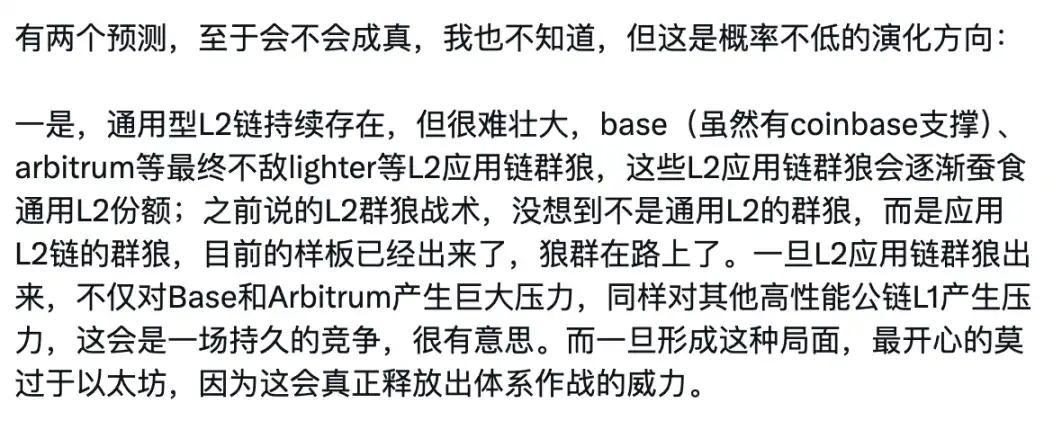

In fact, Lighter did not initially aim for the perp DEX direction. Launched at the end of 2022, Lighter started as a spot DEX on Arbitrum and only began its transition to a perp DEX in 2023, developing its own ZK Rollup, with the mainnet officially launched in October of this year. However, in just over a month since its launch, Lighter has already become the fourth largest L2 by TVL, following Arbitrum One, Base, and OP Mainnet. Even OG Blue Fox expressed surprise that a customized L2 would emerge before a general-purpose L2.

What Kind of ZK L2 is Lighter?

As OP Rollup gained an advantage, many insightful industry insiders pointed out that "ZK is the End Game." To this day, from Brevis to ZKsync Airbender, we finally understand the meaning of this statement, and clearly, Vlad had already seen through it all.

As a founder with both engineering and trading experience, Vlad's L2 is almost tailor-made for DEX.

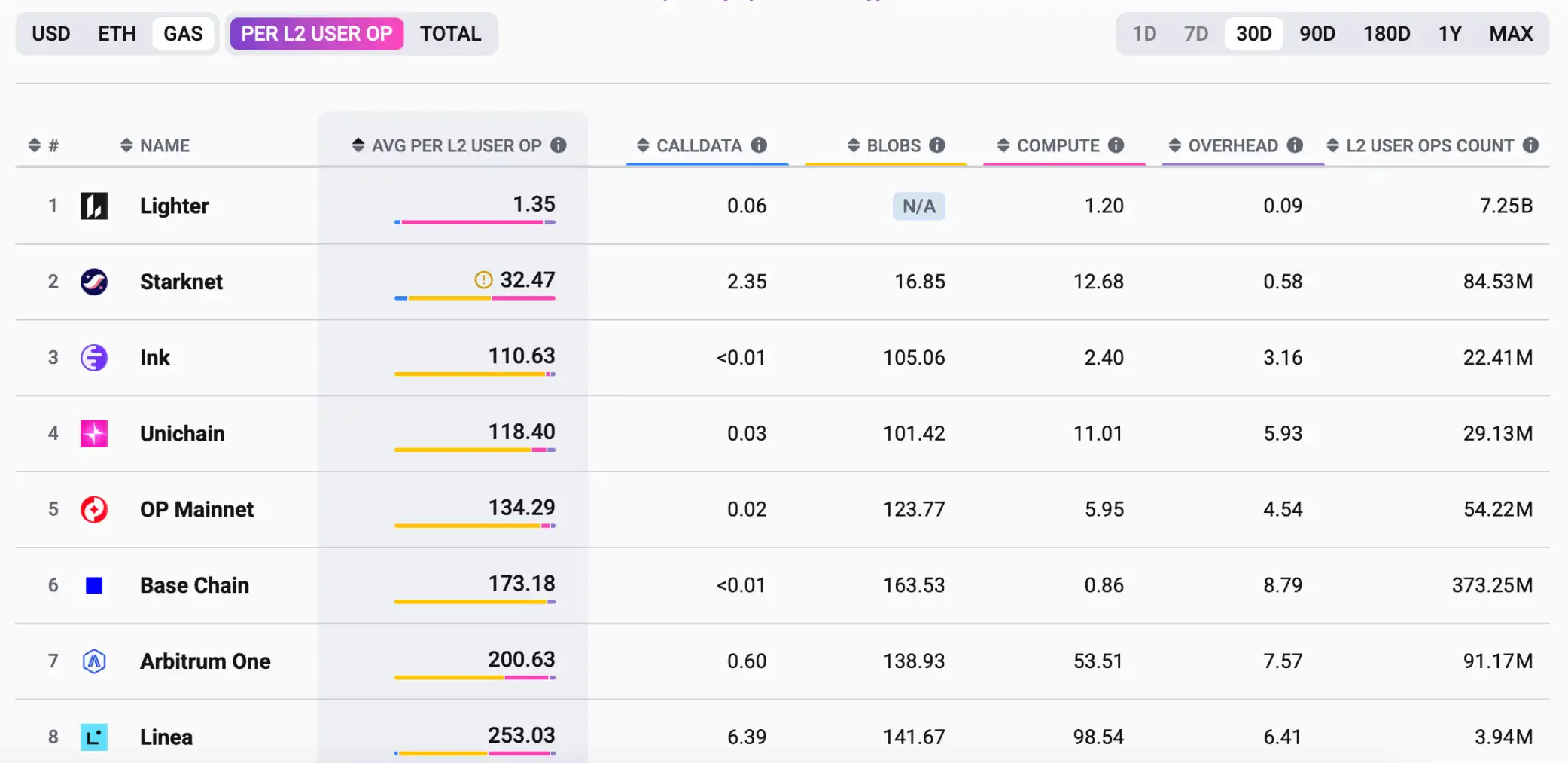

In simple terms, Lighter has integrated all core logic such as matching, clearing, and risk control into a customized SNARK circuit, anchoring the final state in batches to Ethereum L1. This means that the design of Lighter's L2 incorporates "exchange logic" into the ZKP circuit, with all designs centered around how to execute and verify transactions faster. Even Lighter's sorter only has "sorting rights," with the matching logic solidified in the circuit, preventing the sorter from cherry-picking or inserting orders.

Lighter has named this architecture "Lighter Core," stating in its documentation, "The scalability of Lighter Core benefits from its newly developed proof engine, which is built from the ground up for exchange-specific workloads. It utilizes new algorithms and optimized data structures to efficiently generate proofs for exchange operations. All exchange operations are deterministically executed through user-signed transactions. A batch of such transactions will generate a new post-execution state and a concise cryptographic proof."

In my article "Vitalik Praises ZKsync, It Might Really Be Underestimated," I explained the advantages of ZK in verification. Theoretically, once a transaction is verified by ZKP, it achieves finality, and submitting it to Ethereum L1 becomes a "process" issue. Lighter has increased the complexity of the proof process to generate simple proofs but optimized transaction speed.

Additionally, Lighter's zero-fee trading for retail investors is another point of interest in the market. Lighter has not specifically explained why it does not charge fees, but from its mechanism design and Robinhood's investment, we can roughly guess the reasoning.

According to Lighter's documentation, the protocol does not charge retail traders fees, but the delays for taking and placing orders are 300 milliseconds and 200 milliseconds, respectively. In contrast, advanced accounts for market makers and high-frequency traders are charged 0.002% and 0.02% for placing and taking orders, respectively, but their delays are 0 and 150 milliseconds. I speculate that the design of offering free but high-latency trading for price-sensitive retail traders may mimic Robinhood's payment for order flow (PFOF) mechanism, while the fees charged to advanced accounts are akin to the commissions Robinhood extracts from market makers.

In this way, retail trading enthusiasm is high, and high-frequency trading for advanced accounts is profitable. Lighter only needs to charge fees to advanced accounts to provide a better user experience while also collecting substantial fees from market makers. This mutual benefit significantly reduces gas fees while the trading volume continues to expand.

As a side note, the second season of Lighter's points program is currently underway, with corresponding point distribution policies for both retail traders and market makers. For retail traders, there is a total of 200,000 points distributed weekly, based on a comprehensive calculation of users' trading volume, open contracts, earnings, etc., with distributions occurring every Friday. Given that the report from Fortune mentioned that the financing also involved token warrants, Lighter's points are likely to be an important consideration for future airdrops.

Even Geniuses Can't Do It All

Entering Harvard at 16, completing all courses in three years, and being personally recruited by the CEO of Citadel—this kind of story that even a fiction writer wouldn't dare to fabricate has truly happened to Lighter's founder, Vladimir Novakovski. However, even someone as strong as Vlad faced setbacks in his AI social entrepreneurship.

With his talents in engineering and trading, Vlad entered Web3 through Lighter, attracting a queue of profit-seeking capital. Joey Krug, a partner at Founders Fund, stated that Vlad and his team accounted for 85% to 90% of the investment decisions.

According to DefiLlama data, Lighter's recent trading volume has surged to the top, although we cannot rule out the influence of airdrop hunters due to the zero-fee structure. Interestingly, what was thought to be the end of the perp DEX saga written by HyperLiquid may just be the beginning.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。