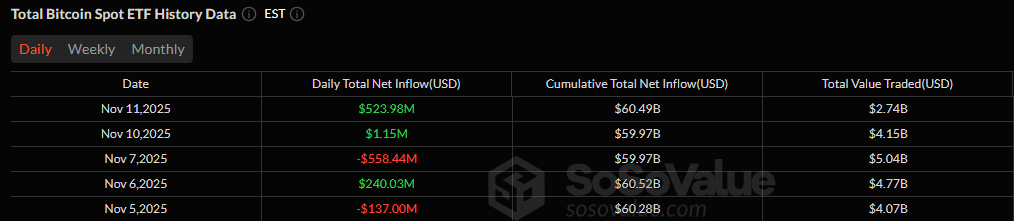

After a sluggish Monday, crypto exchange-traded funds (ETFs) burst into motion on Tuesday, Nov. 11, marking a day of stark contrasts across the digital assets market. Bitcoin ETFs came roaring back with more than $524 million in inflows, while ether funds bled over $100 million in redemptions. Solana, once again, held its green streak, quietly posting fresh gains.

Bitcoin ETFs were the day’s clear winners. A combined $523.98 million in inflows surged across five major funds, reigniting investor enthusiasm after weeks of mixed sentiment. Blackrock’s IBIT dominated, pulling in $224.22 million, followed by Fidelity’s FBTC with $165.86 million and Ark & 21Shares’ ARKB with $102.53 million.

Smaller inflows came from Grayscale’s Bitcoin Mini Trust with $24.10 million and Bitwise’s BITB with $7.27 million. Daily trading volume reached $2.74 billion, while net assets rose to $137.83 billion, signaling renewed confidence among institutional players.

Bitcoin ETFs see back-to-back inflow days for the first time since 28 October.

The picture was less rosy for ether ETFs, which recorded a sharp $107.18 million in net outflows across five funds. Grayscale’s Ether Mini Trust led the exodus with $75.75 million in redemptions, followed by Blackrock’s ETHA at $19.78 million. Smaller losses came from Bitwise’s ETHW ($4.44 million), Vaneck’s ETHV ($3.78 million), and Fidelity’s FETH ($3.43 million). Despite the red day, trading activity remained steady at $1.13 billion, with net assets holding at $22.48 billion.

Solana ETFs, meanwhile, maintained their upward momentum. Bitwise’s BSOL added $2.05 million, while Grayscale’s GSOL brought in $5.93 million, totaling $7.98 million in new capital. The segment’s total trading volume stood at $23.52 million, with net assets steady at $568.35 million.

Tuesday’s action painted a vivid picture of shifting sentiment: bitcoin roared back to dominance, ether struggled to find its footing, and solana quietly continued to build strength. This was an important reminder that in the fast-changing ETF market, every day can tell a different story.

FAQ🚀

- What drove the big move in bitcoin ETFs?

Bitcoin ETFs surged with $524 million in inflows, led by Blackrock’s IBIT and Fidelity’s FBTC. - Why did ether ETFs struggle?

Ether funds saw $107 million in redemptions, with Grayscale’s Ether Mini Trust leading the outflows. - How did solana ETFs perform amid the volatility?

Solana ETFs added $7.98 million in new capital, extending their consistent streak of inflows. - What does this divergence signal for crypto markets?

Investors are rotating back into bitcoin while staying cautious on ether, keeping solana quietly in play.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。