Author: Nancy, PANews

As signs of a bear market become increasingly evident in the crypto market, more projects like Monad, MegaETH, and Meteora are rushing to issue tokens in an attempt to seize the last liquidity window. Recently, the once-star project Aztec Network announced its token issuance as the privacy sector heats up, making a return to the market after seven years, but it has sparked controversy due to its token sale.

Absence of TGE Airdrop, Over 70% Valuation Discount Public Sale Faces Discontent

After years of waiting, Aztec finally announced its token issuance after experiencing multiple cycles of change.

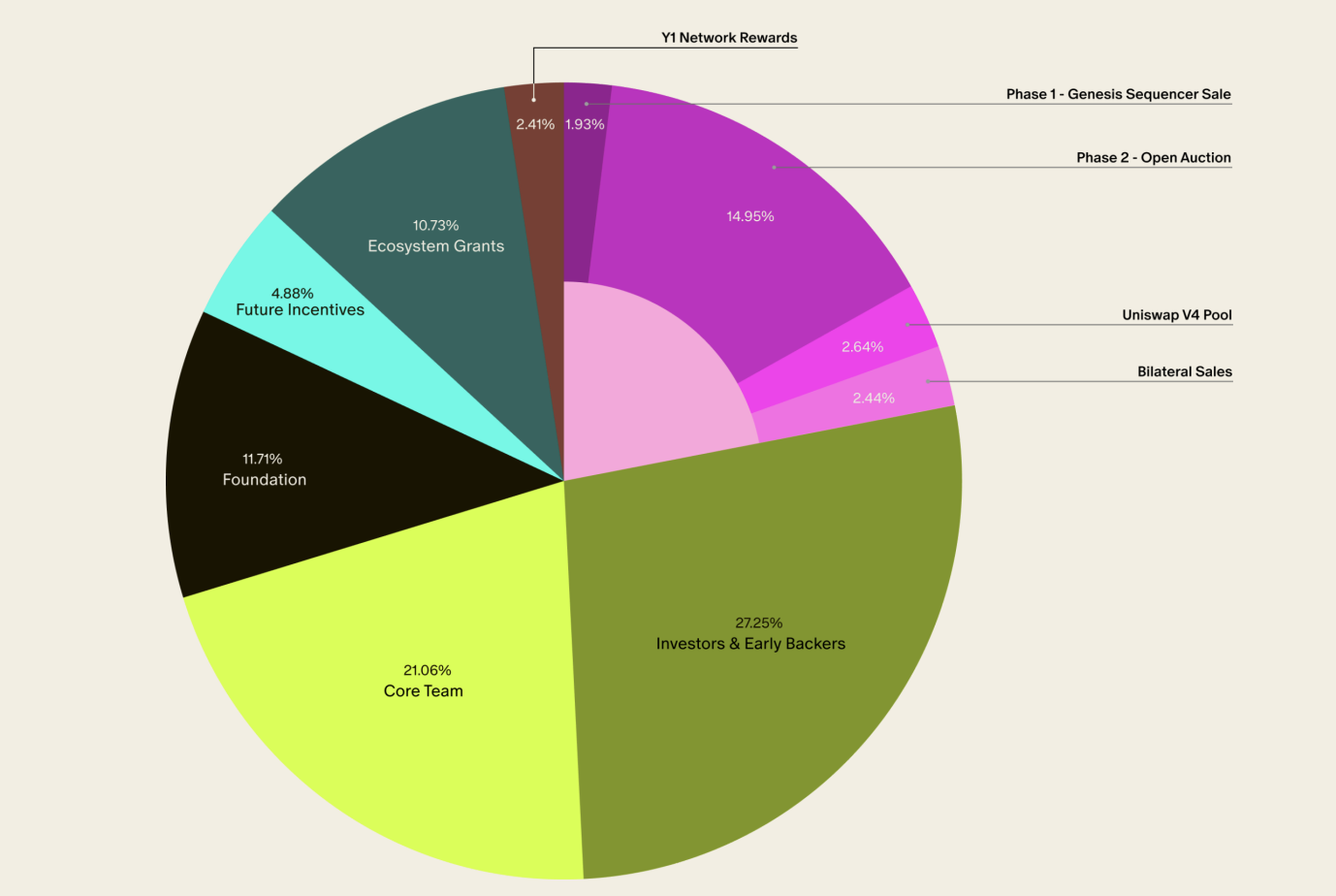

On November 13, Aztec disclosed its token economic model, with a total initial supply of 10.35 billion AZTEC tokens. Of this, 27.26% is allocated to investors and early supporters, 21.06% to the core team, 11.71% to the foundation, 10.73% to ecosystem grants, 4.89% to future incentives, 2.41% to Y1 Network Rewards, and the remaining 21.96% (approximately 2.273 billion tokens) for token sales, including Phase 2 public auction (14.95%), Uniswap V4 liquidity pool (2.64%), Phase 1 genesis sorter sale (1.93%), and Bilateral reserves (2.44%). The tokens will primarily be used for sorter staking, network governance, and payment of network fees, with a future annual inflation cap of no more than 20%, determined by governance.

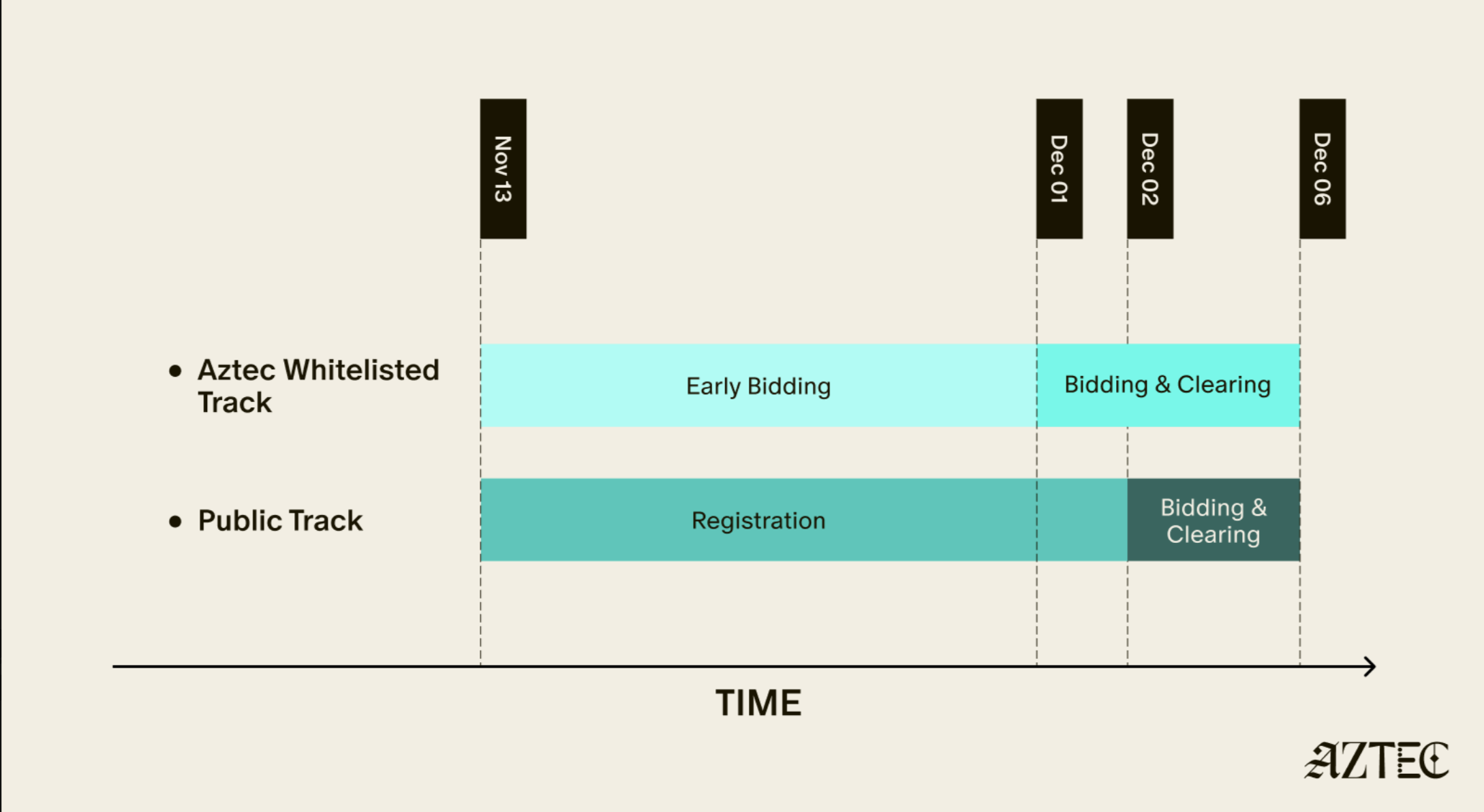

As Aztec announced, it will initiate the TGE through the AZTEC token sale. The genesis sorter round sale will start from November 13 at 22:00 to December 1 at 22:00, with the public auction taking place from December 1 at 22:00 to December 6 at 22:00.

This token sale will be based on Uniswap's newly launched Continuous Clearing Auction (CCA). This scheme aims to guide liquidity for newly issued or low liquidity tokens on Uniswap v4 and facilitate public price discovery, operating entirely on-chain, setting a single clearing price per block, prioritizing higher bids, and proportionally distributing at the same price, with successful bidders paying the same price. After the auction, proceeds will automatically be pooled in v4. Aztec is the first project to adopt this mechanism and can choose to use the ZK Passport module for private, verifiable participation authentication.

However, Aztec's token sale plan has faced criticism from the community. As a privacy project with considerable financing scale and high attention, Aztec was a primary target for "yield farmers" in its early days, but the official stance of not conducting any airdrops has left long-term participants feeling their time and financial investments have gone to waste. Instead, Aztec emphasizes community priority, opening early bidding qualifications to network contributors, including testnet node operators, Aztec Connect users, zk.money users, and active community members, with over 300,000 addresses currently on the whitelist.

More attention is drawn to the valuation and lock-up conditions. The starting FDV for Aztec tokens is $350 million, with a public sale ratio of 14.5%. Although the official statement claims this price reflects a roughly 75% discount from the implied valuation of the latest equity financing round, many community members still believe the valuation does not match the project's current output. Meanwhile, Aztec's new token issuance is criticized for having a long lock-up period, with both the genesis sale (minimum staking requirement of 200,000 AZTEC) and proceeds from the public auction needing to be locked for 12 months, and tokens from the public auction requiring governance voting after 90 days to decide whether to unlock immediately. Given the current market sentiment is low, and most projects perform poorly post-TGE, such lock-up conditions amplify the financial risks for participants. Notably, the white paper indicates that 0.12% of the tokens (approximately 12.42 million) will be allocated to "non-internal early contributors, community members, and related interested individuals," most of which will be distributed before the token sale begins.

Additionally, due to compliance requirements, Aztec mandates that participants complete KYC and mint NFTs to enter the auction process. However, this requirement contrasts with its privacy narrative, becoming another focal point of community discussion.

Over $100 Million in Financing, Business Transformation, Issuing Tokens Amid Privacy Sector Recovery

Once a hot project, Aztec has been dedicated to creating privacy solutions on Ethereum since its launch in 2018. Public records show that Aztec completed four rounds of financing between 2018 and 2022, raising over $119 million, with investors including industry heavyweights like Vitalik Buterin, ConsenSys, Paradigm, a16z, Ethereal Ventures, and Coinbase Ventures.

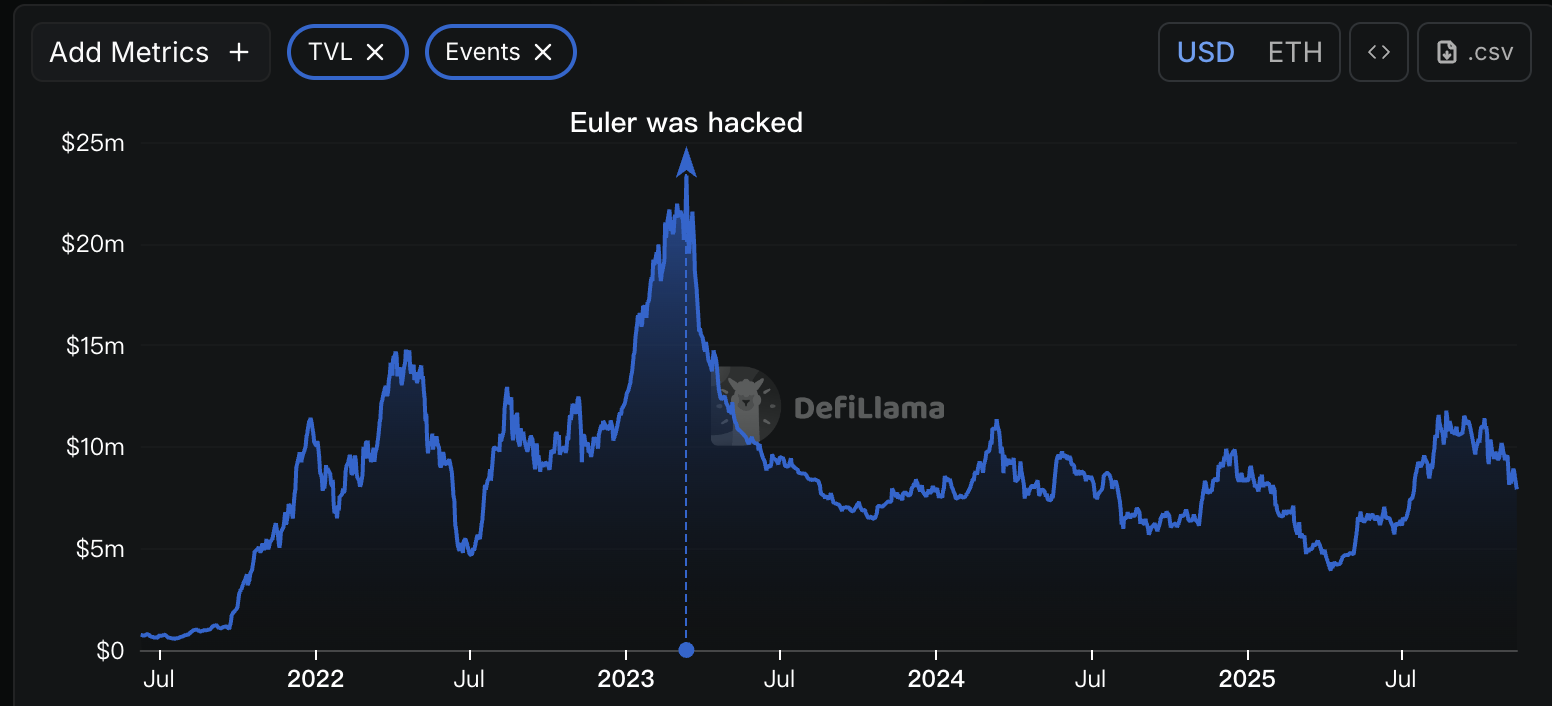

However, despite the large financing scale and high market attention, Aztec's ecosystem development has not progressed well. Especially after Tornado Cash was sanctioned by the U.S. OFAC in 2022, the regulatory risks for the entire privacy project sector significantly increased. In March 2023, Aztec announced a business transformation, gradually shutting down its DeFi privacy bridge project Aztec Connect and halting the deposit function of zk.money. The official statement indicated that they had not been contacted by regulatory agencies, and this move was made for commercial considerations, shifting focus to the zero-knowledge general language Noir and the development of the next-generation encrypted blockchain. This decision impacted the Aztec ecosystem, as Aztec Connect and zk.money had already accumulated tens of millions of dollars in transaction volume and hundreds of thousands of users at that time.

After a period of weakness in the privacy narrative, although Aztec has continued to push product updates, market enthusiasm has noticeably declined. According to DeFi Llama data, Aztec's total locked value (TVL) dropped from a peak of $21 million to a low of about $4 million.

However, signs of recovery began to appear in the privacy sector at the end of last year. In November 2024, a U.S. court ruled that the "OFAC sanctions against Tornado Cash" were illegal and removed it from the sanctions list in March this year, bringing positive signals to crypto privacy projects.

Seizing this opportunity, Aztec announced the establishment of a foundation in February this year, leading to market speculation about its token issuance plans. Subsequently, Aztec launched a public testnet, attracting user interaction and driving TVL recovery. In just four weeks, the platform added over 30 application developments, with node connections exceeding 17,000. Following this, Aztec also completed network upgrades, developer ecosystem expansion, and cross-chain and performance optimization.

Recently, as the prices of privacy coins like Zcash have surged, market attention on the privacy sector has increased again, providing a relatively favorable window for Aztec's token issuance. However, given the current sluggish crypto market environment and rapid narrative shifts, whether Zcash can sustain its ecological development and attract long-term participation from developers and users after gaining short-term attention and liquidity through token issuance remains to be seen.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。