This study believes that the evolution of future markets is not a simple replacement of models, but rather a fusion and transformation.

Authors: Lacie Zhang (X:@Laaaaacieee), Owen Chen (X:@xizhe_chan)

Abstract

Equity in private companies is a trillion-dollar segment in global asset allocation, but it has long been constrained by the "high participation threshold" and "narrow exit channels," ultimately leading to severe liquidity challenges for institutions such as private equity (PE) and venture capital (VC). Equity tokenization, as a key application of the real-world asset (RWA) wave, provides a new path to address this structural issue. This report aims to explore the current market status, core models, key bottlenecks, and future trends of equity tokenization in private companies, assessing its potential to empower PE/VC exits.

Research findings:

(1) The market status presents a stark contrast between "trillion-dollar potential" and "tens of millions in reality." Although the total valuation of unicorn companies has exceeded $5 trillion, the current market value of tradable equity tokens is only in the tens of millions, indicating that the market is still in its very early stages, with targets highly concentrated in leading companies.

(2) The market has differentiated into three mainstream models: native collaborative (compliant but few implementations, such as Securitize), synthetic mirror (pure derivatives, such as Ventuals), and SPV indirect holding (such as PreStocks, Jarsy).

(3) The SPV model, as a pioneering force that has validated market demand, demonstrates high flexibility; although the current market faces challenges in regulatory compliance, liquidity depth, and IPO endpoint connections, this also drives it towards more mature models.

This study believes that the evolution of future markets is not a simple replacement of models, but rather a fusion and transformation. The core driving force of the market will be the change in attitude of private companies (issuers) themselves—namely, as Web3 becomes increasingly mainstream, physical enterprises begin to actively view tokenization (STO) as a new and efficient financing and market value management tool, shifting the market from one-way exploration to two-way collaboration. At the same time, the true blue ocean of tokenization is not the super unicorns, but rather the broader long-tail mature private enterprises seeking exit paths, whose scaled explosion will depend on the maturity of native RWA liquidity infrastructure.

Keywords: private company equity, real-world assets, tokenization, PE/VC exit, SPV

01 Introduction

Equity in private companies, especially in rapidly growing unicorn companies, is an important asset segment in the global economy. However, investment opportunities and significant gains in these high-value assets have long been primarily enjoyed by professional institutions such as private equity (PE) and venture capital (VC), limited to a few institutions and high-net-worth individuals, making it difficult for ordinary investors to participate. In recent years, the rise of blockchain technology has made the tokenization of private company equity possible, allowing for the issuance of digital tokens on the blockchain to represent these equity shares, which is expected to change the game rules of the traditional private market. Tokenization is seen as a bridge connecting traditional finance (TradFi) and decentralized finance (DeFi), and is an important part of the wave of real-world assets (RWA) on-chain.

This trend is driven by enormous market potential. According to Boston Consulting Group (BCG), the on-chain RWA market could reach $16 trillion by 2030. Citigroup also pointed out that the tokenization of private markets is expected to surge 80 times in this decade, approaching $4 trillion. The massive market forecasts reflect high expectations in the industry for the prospects of tokenization. On one hand, private companies (such as unicorns valued at hundreds of billions of dollars) contain immense value; on the other hand, blockchain tokenization technology is expected to break the barriers of the current private market, achieving higher efficiency and broader participation.

This article will delve into the background and current status of private company equity tokenization, analyze traditional market pain points, tokenization solutions and advantages, and outline major global platform cases, technical support, regulatory policies, and challenges faced, ultimately forecasting future development trends to help readers understand the financial innovation wave being led by this popular field.

02 Private Company Equity Market: A New Blue Ocean for Tokenization

Private company equity—especially equity in unlisted unicorn companies—is one of the largest but most liquidity-constrained islands in global asset allocation. It is this stark contrast between scale and efficiency that makes it the most imaginative new blue ocean in the wave of asset tokenization (RWA).

2.1 Trillion-Dollar Fortress: The Value Landscape of Private Company Equity

1. Asset Boundaries: What Entities Does Private Company Equity Cover?

Private company equity broadly refers to all company shares that are not traded on public securities exchanges. This is an extremely large and heterogeneous asset class, encompassing equity from early-stage startups to mature large private groups. Its holders include not only professional private equity (PE) and venture capital (VC) funds but also large founder teams, employees holding employee stock ownership plans (ESOP) or restricted stock units (RSU), and early angel investors.

As shown in the table above, among the holders of private equity, aside from strategic investors and founding teams, the vast majority of participants have a strong desire to liquidate their equity and obtain certain returns. Among them, the exit demand from private equity funds (PE) and early investors (such as angel investors, VC) is particularly urgent. Additionally, employees holding equity incentives also have a practical motivation to realize options and "cash out" when considering leaving the company. However, under traditional pathways, aside from a few channels like company buybacks, the secondary market for private equity is not smooth, leading to a widespread structural dilemma of difficulty in exiting and poor liquidity.

2. Quantitative Estimation: The Asset Volume of the Trillion-Dollar "Fortress"

First, it is important to clarify that there is currently no unified official data on the total volume of global private company equity. This is mainly due to the inherent subjectivity and non-public nature of primary market company valuations. Nevertheless, we can still estimate the scale of this market using key public data.

According to the data in the table above, we can estimate the enormous volume of this "fortress" from two dimensions:

First, from the perspective of assets under management (AUM), the total capital managed by global private equity (PE) and venture capital (VC) funds—being the main allocators of private equity—has reached $8.9 trillion (i.e., $5.8T + $3.1T). Although this includes some dry powder from certain funds, this figure itself reflects the substantial capital that the institutional market has reserved for allocating such assets.

Second, from the perspective of asset valuation, the total market value of global "unicorn" companies (private companies valued over $1 billion) has already reached the trillion-dollar level. As shown in Table 2, data from Hurun Research Institute indicates $5.6 trillion. Although results from different data sources vary slightly, for example, CB Insights statistics show that as of July 2025, the cumulative valuation of 1,289 unicorn companies globally exceeds $4.8 trillion, all confirm this enormous scale.

Figure 1 lists the top ten unicorns globally ranked by valuation according to CB Insights, with OpenAI (valued over $500 billion), SpaceX (valued at $400 billion), and ByteDance (valued at $300 billion) at the top.

It is important to emphasize that whether it is $4.8 trillion or $5.6 trillion, this only represents the thousands of leading companies at the top of the pyramid; the vast value of tens of thousands of mature private enterprises and growth companies worldwide that have not reached unicorn status has yet to be accounted for.

In summary, the actual total value of the global private equity market is a massive fortress far exceeding several trillion dollars. This astonishing scale of assets, which is high in value but low in liquidity, undoubtedly provides an imaginative application prospect for tokenization.

2.2 The "Fortress" Dilemma: The "Participation" and "Exit" Challenges of High-Value Assets

The private company equity market contains a vast value of tens of trillions of dollars, but this potential has not been released under traditional models. Due to the lack of effective value transfer channels, this market has instead become a "fortress": its enormous value is firmly bound by the structural dilemmas of "difficult exits" and "difficult participation." It is this significant friction between high value and low efficiency that constitutes the fundamental market driving force for private company equity tokenization.

"Difficult participation" lies in the towering entry barriers. Unlike the public market, investment opportunities in private company equity are strictly limited to a "small circle" of "accredited investors" or institutional investors in almost all jurisdictions. Minimum investment thresholds often reach hundreds of thousands or even millions of dollars, along with stringent requirements for personal net worth, creating a high wall that excludes the vast majority of ordinary investors from this high-growth dividend. This not only solidifies inequality of opportunity but fundamentally restricts the capital supply and breadth of the market.

"Difficult exits," on the other hand, stem from the extremely scarce liquidity outlets. For holders within the "fortress"—whether early angel investors, VC/PE funds, or employee teams holding equity incentives—their exit paths are highly narrow and lengthy. Traditionally, exits heavily rely on two endpoint events: initial public offerings (IPOs) or mergers and acquisitions (M&A). However, the trend of unicorn companies delaying their public listings has made it common for investors to face lock-up periods of up to ten years, with substantial wealth remaining in a paper value state. Meanwhile, private secondary market transfers outside of IPOs represent an inefficient, high-friction narrow door: they heavily depend on offline intermediaries for matchmaking, have opaque processes, and are accompanied by cumbersome legal due diligence, high transaction costs, and lengthy settlement periods.

It is this dual dilemma of "unable to enter" and "unable to exit" that jointly constructs the fortress shape of the private company equity market, leading to the deep locking of tens of trillions of dollars in value. This sharp contradiction between high value and low efficiency provides the most urgent and imaginative application scenarios for tokenization technology.

2.3 Mechanism Restructuring: The Core Advantages of Tokenization Empowering Private Company Equity

In the face of the fortress dilemma analyzed above, tokenization technology offers not just a simple patch but a systematic solution that fundamentally reshapes the value chain of private company equity. Its core function goes far beyond passively resolving the frictions of "participation" and "exit"; it actively introduces new market mechanisms and valuation paradigms.

First, the primary advantage of tokenization lies in the construction of continuous secondary liquidity, thereby breaking the stalemate of the fortress. This is reflected in two aspects:

• For external investors: Tokenization significantly lowers the investment threshold by finely splitting high-value equity shares, breaking the previous "difficulty of participation" dilemma and opening up participation channels for a broader range of compliant investors. This is fundamentally different from the tokenization of listed stocks (such as U.S. stocks): the tokenization of stocks primarily optimizes trading convenience (such as 24/7 trading), while the tokenization of private company equity fundamentally achieves the "breaking of boundaries" for asset classes under compliance—allowing compliant ordinary investors to access high-growth investment targets for the first time—enabling ordinary people to easily purchase equity in OpenAI.

• For internal stakeholders: It is expected to open up a brand new exit path. Beyond traditional IPOs, company buybacks, mergers and acquisitions, or inefficient secondary equity transfers, stakeholders (such as employees and early investors) can transfer their equity through compliant tokenization platforms and "put it on-chain," obtaining liquidity in a 24/7 on-chain market—this adds a new exit channel for traditional private equity and venture capital investors beyond IPOs and mergers, and this exit method can reach a broader base of ordinary investors.

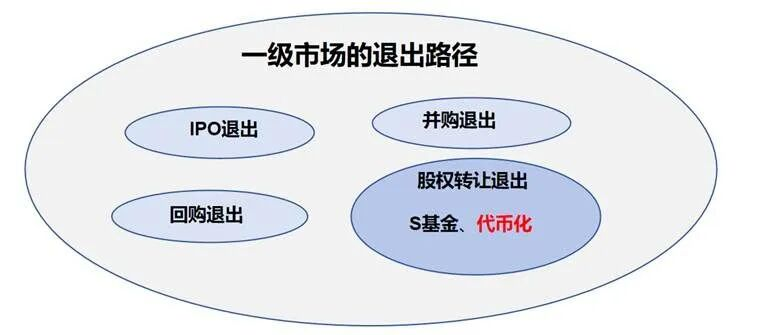

Figure 4: Summary of Primary Market Exit Paths

Source: Pharos Research

Secondly, tokenization brings a continuous price discovery mechanism, empowering proactive market value management. The valuation of traditional private company equity relies on private financing rounds that occur every few months or even years, resulting in prices that are discrete, lagging, and opaque. The continuous secondary market trading brought by tokenization provides private company equity with high-frequency price signals close to those of public markets for the first time. This continuous price discovery mechanism allows for a more equitable pricing of subsequent financing by companies and primary market investors, enabling more reasonable and proactive "market value management," significantly reducing the valuation gap between primary and secondary markets.

Finally, tokenization also opens up new financing channels, reconstructing the capital strategy for enterprises. Tokenization is not only a tool for the circulation of existing assets but can also become a new financing channel for incremental capital. High-growth companies (such as unicorns) can collaborate with professional Web3 project parties or tokenization platforms to bypass the lengthy cycles and high underwriting costs of traditional IPOs, directly issuing security tokens (STOs) to qualified digital investors globally. This model of digital listing fundamentally revolutionizes the fundraising channels for enterprises, allowing them to access a larger and more diverse global capital pool. Currently, emerging platforms like Opening Bell are actively attempting to collaborate with private companies to explore this cutting-edge fundraising path.

03 Market Status of Private Company Equity Tokenization

3.1 Market Size and Overview of Target Assets

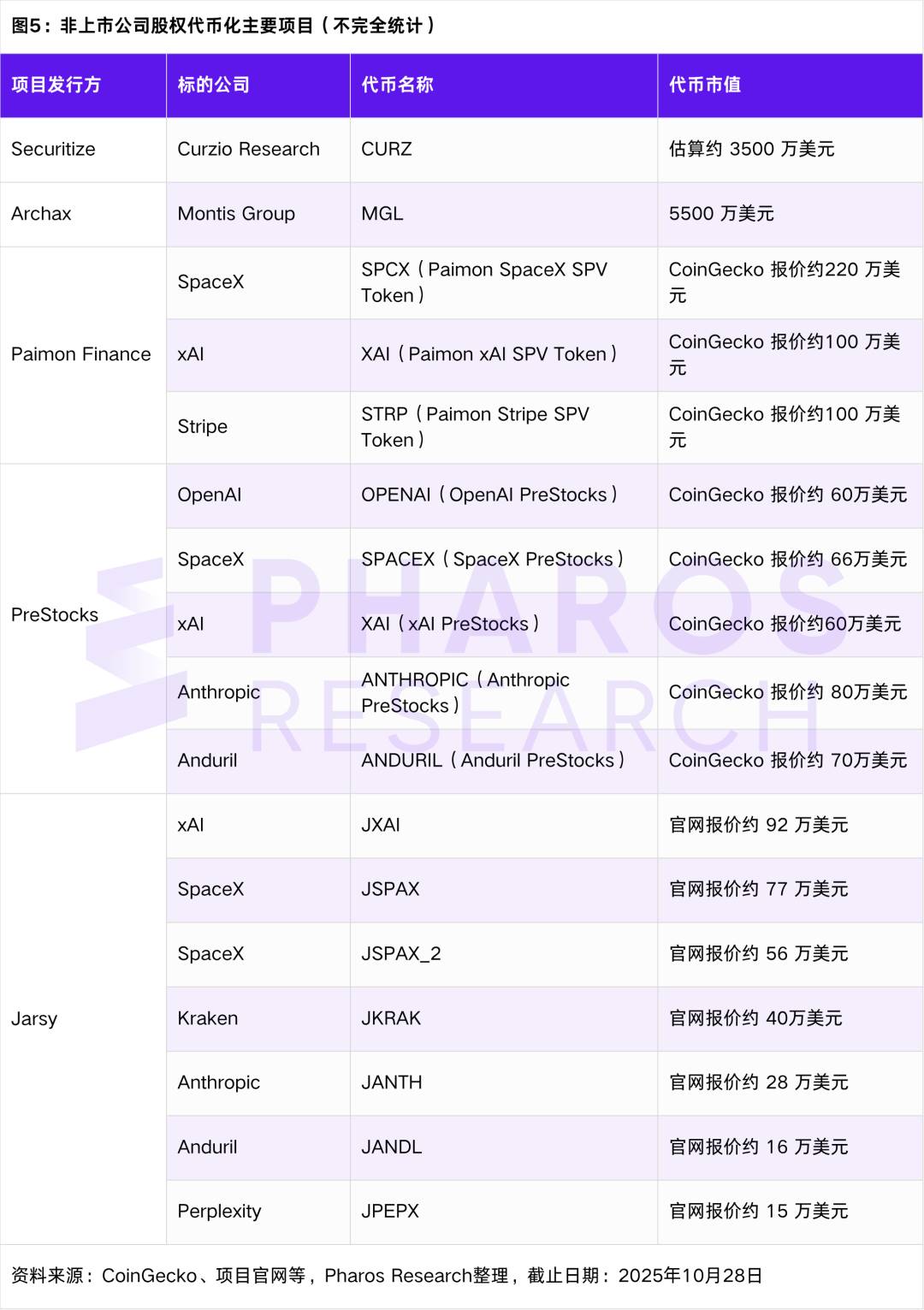

Currently, there is some difficulty in accurately measuring the overall market size for private company equity tokenization. On one hand, some platforms (such as Robinhood) have not disclosed the complete market value data of their tokenized equity; on the other hand, synthetic contract products like Ventuals only have "open interest" and do not have a so-called "equity token market value." Therefore, this section primarily conducts a macro estimation of the current market size by sorting through publicly available market data (such as CoinGecko) for some key product market values.

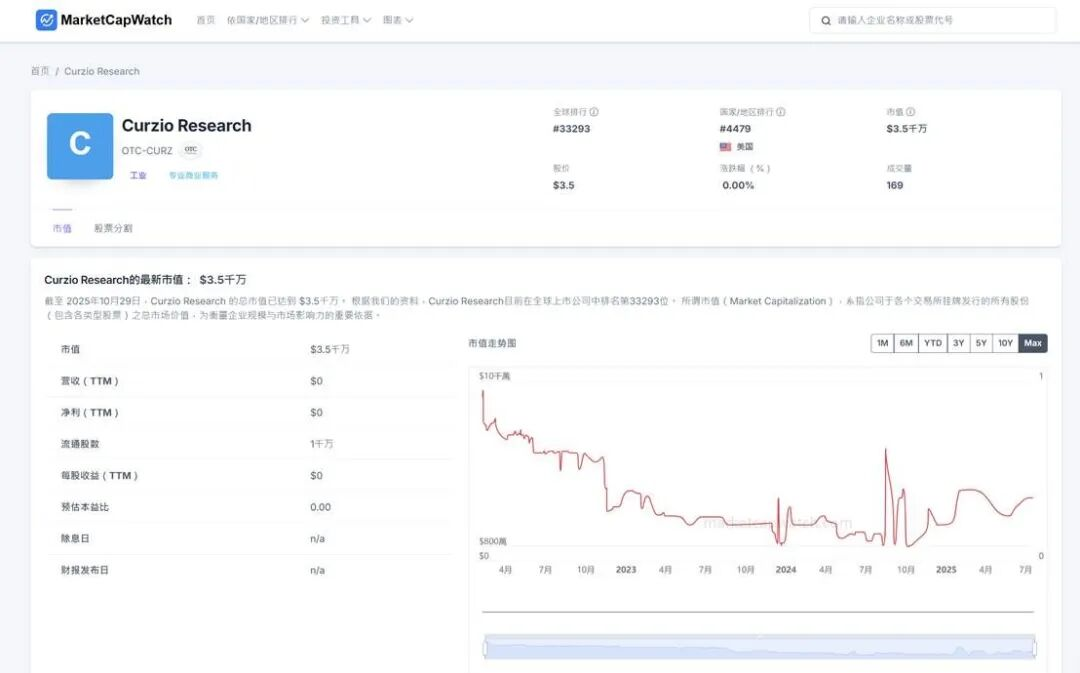

① The CURZ token trades on tZERO (an ATS platform), which has not publicly disclosed its total market value; the data in the table is estimated by "latest available price × total shares," and this product is not a product that can flow freely in the traditional sense in DEX or CEX, but circulates within an Alternative Trading System (ATS).

② The MGL token issued by Archax is part of the UK Financial Conduct Authority (FCA) digital securities sandbox project launched in July 2023. This asset is issued by Montis Group on the Hedera chain, with Archax providing custody; it is a tokenized equity but has not yet entered public circulation.

③ Some tokens issued by Jarsy include already listed stocks (such as NVIDIA and Tesla), but their total value locked (TVL) is generally low. Additionally, some tokens with market values below $100,000 are not included in the statistics.

Based on the incomplete statistics in the table above, the private company equity tokenization market is still in its very early stages, with an estimated total market value of approximately $100 million to $200 million. Excluding Securitize and Archax, the total market size is expected to be in the tens of millions of dollars, representing a particularly niche market. The reason for excluding Securitize's CURZ and Archax's MGL is that the former trades in the alternative trading system (ATS) tZERO, while the latter belongs to a UK regulatory sandbox product, and neither currently possesses liquidity in the traditional crypto-native sense.

From a market structure perspective, shares are highly concentrated in compliant issued leading projects. The combined total of CURZ issued by Securitize and MGL issued by Archax (regulatory sandbox project) already accounts for over 60% of the total market.

From the perspective of underlying assets (excluding the special projects of Securitize and Archax), the current market's tokenized targets show a high degree of homogeneity, concentrated in top U.S. high-tech unicorn companies, especially in the AI sector. Companies like OpenAI, SpaceX, and xAI have become the most sought-after assets. This primarily reflects that project parties, in the early stages of market cultivation, tend to prioritize selecting the most well-known companies that can attract investor interest. In contrast, although some project parties have indicated they are in talks with equity holders of Chinese-backed unicorns (such as ByteDance and Xiaohongshu), no actual landing projects have emerged yet.

3.2 Three Mainstream Models of Private Company Equity Tokenization

Currently, the market has evolved three distinctly different implementation models in exploring the path of private company equity tokenization, which have essential differences in compliance basis, asset attributes, and investor rights. The third model—SPV Indirect Holding—has become the mainstream model.

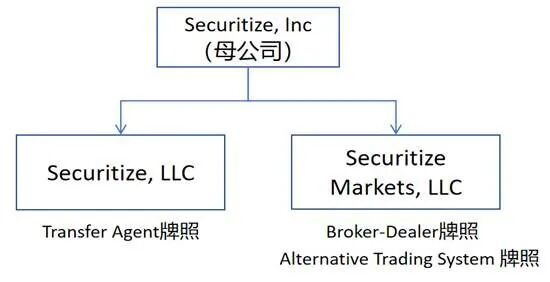

① A Transfer Agent license refers to the registration completed with the SEC for transfer agency, which has the authority to maintain, manage, and change the shareholder register. This is the compliant starting point for tokenizing equity in the U.S. The full set of compliance for securities issuance and operation by the SEC also requires a Broker-Dealer license and an Alternative Trading System license.

② SPV (Special Purpose Vehicle) is a common financial term that refers to a "ring-fenced" company established for a specific transaction (or asset holding) to isolate risk; in simple terms, it is a "shell company."

③ Although Opening Bell adopts a method of collaborating with target companies to tokenize company equity, its current landing cases are all for listed companies, and its cooperation with private companies remains at the promotional level without actual implementation.

1. Native Collaborative Model

This model is directly authorized and deeply involved by the target company (i.e., the private company entity), registering and issuing "legally effective equity" directly on the blockchain. In this model, the on-chain token is the equity itself, and its legal effect is completely equivalent to that of the offline shareholder register (specific rights are executed according to the company's articles of association and the laws of the relevant jurisdiction).

Therefore, token holders are registered as "registered shareholders" of the target company and typically enjoy full voting rights, dividend rights, and information access rights. The issuing platform must hold key financial licenses, such as obtaining SEC approval for a "Transfer Agent" license, to legally manage and change the shareholder register. Representatives of this path include Opening Bell (which advocates for the "on-chaining" of statutory company stocks) and Securitize (whose model is more applied to the compliant tokenization of fund shares and possesses a full set of licenses including Transfer Agent, Broker-Dealer, and Alternative Trading System).

However, there are currently limited landing cases for this model. Securitize has only a handful of landing cases, while Opening Bell's current landing cases are all for listed companies, and its cooperation with private companies is still at the promotional level.

2. Synthetic Mirror Model

This model is typically issued unilaterally by third-party project parties without the permission of the target company. What is issued is not equity but synthetic derivatives that simulate the economic benefits of the target equity, such as "Contingent Value Notes" or on-chain perpetual contracts.

The tokens purchased by investors do not correspond to real shares, and holders will not be registered as shareholders, thus naturally lacking voting rights and dividend rights. The gains or losses for investors depend entirely on the contractual settlement with the issuer. Therefore, this model carries significant counterparty risk, price tracking errors, and severe regulatory uncertainty. Representatives of this path include Republic (with its mirror note-type tokens) and Ventuals (based on Hyperliquid's company valuation perpetual contracts).

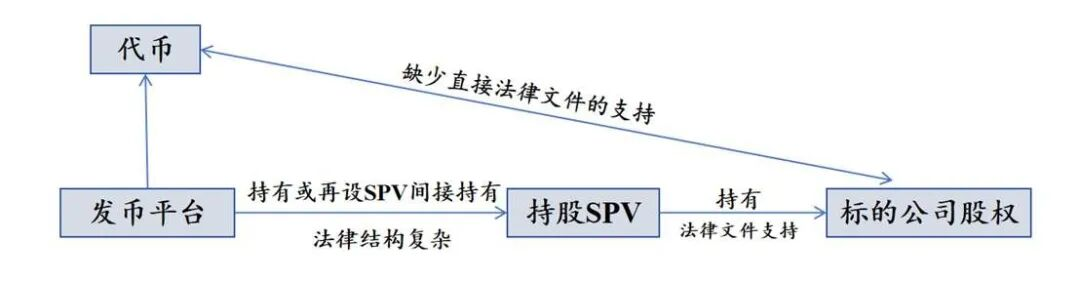

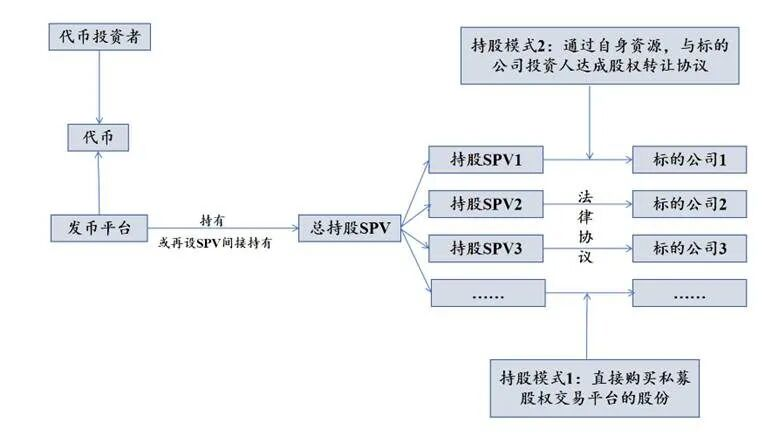

3. SPV Indirect Holding Model

This model is the mainstream method of private company equity tokenization today and is a common workaround structure. The tokenization platform first establishes a "Special Purpose Vehicle" (SPV), which acquires and holds the real equity of the target company through the traditional private secondary market. Subsequently, the platform tokenizes and sells the "equity shares" or "beneficial certificates" of the SPV (rather than the equity of the target company itself).

Figure 7: SPV Indirect Holding Issuer Structure Diagram

Source: Pharos Research

Under this structure, investors hold contractual economic rights to the SPV rather than the registered shareholder rights of the target company, and therefore typically do not enjoy voting rights over the operating company. This model essentially issues tokens based on SPV holdings, with legal documentation supporting the relationship between the SPV and the target company's equity, but the tokenization of SPV shares attempts to bypass direct permission from the target company.

This model carries risks of operational opacity and compliance warnings from the target company. Issuing platforms (project parties) often seek "regulatory arbitrage" by establishing complex offshore SPV structures. Their transparency is often one-sided: investors can usually only see proof of the SPV's "asset side," meaning that the SPV indeed holds the target company's equity (through asset proof and custody documents); however, there is often a lack of transparency regarding the SPV's "liability side," which includes the operational status, financial health, and specific details of the token issuance by the project party, resembling a "black box." At the same time (as will be discussed in detail later), such operations have already received legal warnings from some target companies (such as OpenAI). Representatives of this path include PreStocks, Jarsy, Paimon Finance, and Robinhood.

3.3 Landing and Compliance Paths for Private Company Equity Tokenization

The three models analyzed above (Native Collaborative, Synthetic Mirror, SPV Indirect Holding) differ in legal frameworks, investor rights, and risk exposure. This section will delve into their specific landing methods and compliance paths.

1. Synthetic Mirror Model: Simulating Equity with Derivatives

The essence of synthetic mirror tokens is financial derivatives. Their value is not anchored to real equity but tracks the valuation performance of the target company through mechanisms similar to "Contracts for Difference" (CFDs). The implementation path typically involves "indexing" the valuation and dividing it into tradable contract units, which are then matched through on-chain protocols.

For example, Republic's Mirror Token is legally classified as a Contingent Payment Note, and its nature is that of a debt instrument—specifically, a debt note issued by the platform that is anchored to the valuation of unicorns. Ventuals, on the other hand, is more direct, being a perpetual contract (Perps) launched based on Hyperliquid, which is purely a contract derivative.

In terms of compliance, such tokens do not grant holders shareholder rights, leading to differentiated paths. Projects like Ventuals have adopted a purely Web3 "regulatory evasion" path, relying on the Hyperliquid protocol, which explicitly does not target U.S. investors. Republic, however, demonstrates a different compliance approach: its platform has a broad main business, a high level of compliance, and holds a Broker-Dealer license, with its Mirror Token (debt note) being issued as a security under U.S. securities law, clearly indicating whether specific products are open to U.S. investors.

2. Native Collaborative Model: Achieving True Equity on-Chain through Compliance

In the native collaborative space, market explorers are primarily concentrated in Securitize and Opening Bell. Opening Bell is a sub-project launched by Superstate, advocating for "issuer-coordinated true equity on-chain." Currently, its landing cases (such as Galaxy Digital and Exodus) involve target companies actively tokenizing their equity using the Opening Bell platform.

However, it must be noted that all of Opening Bell's current landing cases involve listed companies, not the private companies that are the core focus of this article. Its cooperation with private companies is currently limited to promotional levels, with no actual projects having landed. Therefore, under the native collaborative model, Securitize's path is currently the more valuable reference case for analyzing private company equity tokenization.

• Securitize, established in 2017, is an infrastructure service provider focused on RWA tokenization. The core of its business model is to transform traditional financial assets such as company equity and fund shares into compliant digital securities that can be issued, managed, and traded on the blockchain, providing a full-service process from primary market issuance to secondary market trading.

• To achieve this business closed loop, Securitize holds three key licenses—Transfer Agent (TA), Broker-Dealer (B-D), and Alternative Trading System (ATS)—under the regulatory framework of the U.S. SEC and FINRA, forming a complete compliance qualification.

Figure 8: Securitize's Compliance License Structure Diagram

Source: Securitize Official Website

Securitize's practice provides two directions for private companies: one is the tokenized IPO path represented by Exodus; the other is the long-term circulation path in the private market represented by Curzio Research.

Path One: From ATS to NYSE—Exodus's Tokenized IPO Method: The collaboration between U.S. crypto wallet company Exodus and Securitize serves as a benchmark case demonstrating the complete lifecycle of private equity tokenization. As of November 1, 2025, the project's token market value reached $230 million, accounting for over 30% of the entire stock token market share. At the same time, its successful journey to a public exchange clearly illustrates the evolution of liquidity paths for tokenized equity at different development stages.

(1) Project Journey: The collaboration between U.S. crypto wallet company Exodus and Securitize serves as a benchmark case demonstrating the complete lifecycle of private company equity tokenization. As of October 2025, the project's token market value reached $230 million, making it an important part of the tokenized stock market. Its successful journey to a public exchange clearly illustrates the evolution of liquidity paths for tokenized equity at different development stages.

• Exodus's tokenization began in 2021 when the company, as a private entity, collaborated with Securitize to mint its Class A common stock as "equity tokens" on the Algorand chain using its DS protocol. Throughout this process, Securitize served as its core Transfer Agent (TA), responsible for the creation, maintenance, and destruction of all tokens.

• Subsequently, the project underwent a series of key developmental milestones: from initially supporting peer-to-peer transfers only between whitelisted wallets to launching on Securitize Markets and tZERO (both ATS platforms) for compliant trading; ultimately, in December 2024, Exodus successfully listed on the New York Stock Exchange (NYSE American) under the ticker symbol "EXOD," officially making its tokenized equity a publicly traded security. After the listing, to expand asset reach, Exodus announced in 2025 a partnership with Superstate's Opening Bell platform to further extend stock tokens to the Solana and Ethereum networks, while Securitize's core position as Transfer Agent remained unchanged.

(2) Liquidity Realization Mechanisms for Exodus Products at Different Stages: Depending on the different stages of the asset, the liquidity realization mechanisms for Exodus stock tokens can be primarily divided into the following three:

• Pre-Listing (2021-2024): Circulation through ATS Platforms: Before going public, the main liquidity channel for the token was licensed Alternative Trading Systems (ATS). The standard process was as follows: investors first needed to deposit their tokens with the Transfer Agent (Securitize) to update the shareholder register, after which the agent would transfer the corresponding holding records to the ATS broker (such as tZERO Markets or Securitize Markets). Finally, investors would submit trade instructions through the corresponding ATS platform, with the system completing the matching and settlement.

• Post-Listing (December 2024 - Present): Conversion to Public Market Stocks: After successfully listing on the NYSE American, the token gained access to the public market. The standard process was as follows: investors would hand over their tokens to the Transfer Agent Securitize, which would assist in converting the tokens into traditional registered shares (i.e., street name holdings) in their personal brokerage accounts. Once the conversion was complete, investors could trade stocks on the public market under the ticker symbol "EXOD" through their brokers.

Figure 9: Token Trading Process Before and After Exodus Listing

Source: Paramita Venture

• Basic Path: Compliant Over-the-Counter (OTC) Transfers: As a consistently existing underlying trading method, the tokenized EXOD stock also supports compliant over-the-counter (OTC) or peer-to-peer (P2P) transfers. The core premise of this path is that both parties' wallet addresses must be verified through the whitelist of the Transfer Agent Securitize. The transaction price and consideration payment are negotiated offline by both parties and then executed on-chain for token transfer. It is worth noting that during the transition period from the project delisting from ATS to officially landing on the NYSE, this compliant OTC path was the only liquidity realization method at that time.

Path Two: Long-Term Circulation in the Private Market—Curzio Research's ATS Norm: Although Exodus's listing path outlines the most ideal blueprint, for the vast majority of private companies, conducting private circulation within ATS platforms may not be a transitional phase toward an IPO but rather its long-term existence. The case of U.S. investment research firm Curzio Research profoundly reflects this common reality.

• The company tokenized its equity into CURZ tokens through Securitize and continues to trade on the tZERO ATS platform for qualified investors. The core value of this model lies in providing a compliant, continuous, yet limited liquidity secondary market for a large number of private enterprises that cannot or do not intend to go public, addressing the critical exit challenges for early shareholders.

• Its market value trend (as shown in Figure 6) also confirms the characteristics of private circulation on the ATS platform: after its issuance in 2022, the CURZ token's market value experienced a long-term decline, bottoming out in early 2024. Subsequently, its market value entered a high volatility range, exhibiting typical characteristics of a "Thin Market," marked by a lack of liquidity and low price discovery efficiency, which stands in stark contrast to the high liquidity of public markets like the NYSE.

Figure 10: Curzio Research Token Market Value Trend (Trading on ATS Platform)

Data Source: MarketCapWatch

3. SPV Indirect Holding: The Mainstream "Regulatory Arbitrage" Path

The SPV indirect holding model is currently the most mainstream practice in the field of private company equity tokenization. Its core structure involves the issuing platform establishing a (usually offshore) Special Purpose Vehicle (SPV), which holds the target company's equity through the private secondary market, and the platform then tokenizes the SPV's beneficial certificates.

In terms of asset acquisition, the SPV primarily obtains the target equity through two paths:

• One is to leverage the issuer's core resources in the traditional PE/VC field to directly acquire shares from private equity or venture capital funds that hold the target company's equity. In this structure, the holding SPV typically acts as a new LP (limited partner) in the fund, holding indirectly.

• The second is to purchase through private equity secondary market platforms (such as EquityZen, Forge Global, Hiive). While this path is more standardized, it may also incur additional legal structure costs and compliance risks.

Figure 11: SPV Indirect Holding Token Issuance Structure Diagram

Data Source: Pharos Research

The key to this model lies in circumventing the transfer restrictions in the target company's shareholder agreement. Since the shares acquired by the SPV are usually small, and the transaction (as in the first path) may be viewed as an internal LP share transfer within the investor's fund, it often does not require reporting to the target company. This provides the platform with temporary legal maneuvering space to bypass the target company's permission.

However, the operation of this model often lacks transparency. The issuing platform utilizes complex offshore SPVs, providing only one-sided transparency: investors can only verify the SPV's asset holdings (the target equity), while the project party's financial health and operational details remain in a "black box." This lack of transparency is also reflected in its issuance model, which can be categorized into two common operational types:

• "Buy First, Issue Later" Model: This refers to the project party (and its subordinate SPV) using its own funds to first purchase the target company's equity, and then tokenizing the equity shares held by the SPV to sell to the public to recoup funds. This model is relatively robust, as the assets have been secured in advance.

• "Issue First, Buy Later" Model: This refers to the project party first issuing tokens to raise funds, then committing to use the raised funds to purchase the target company's equity. This model carries higher risks, as the project party may face insufficient fundraising, price volatility of the target asset, or even the inability to acquire the asset, creating significant uncertainty for investors.

Of course, this operational lack of transparency is relative. Compared to "synthetic mirror" derivatives that have no asset backing, the SPV model at least provides tangible equity asset support, thus offering relatively higher asset stability.

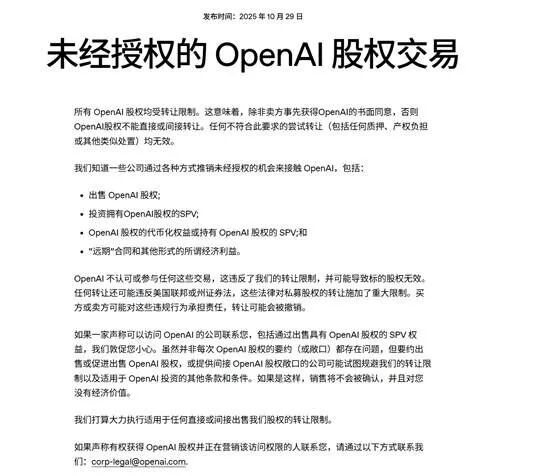

However, what truly raises concerns about this model is not its internal operational risks, but the external legal and compliance challenges faced by its "regulatory arbitrage" structure. Due to the project party's unauthorized tokenization actions, which have been publicly opposed by some target companies (such as OpenAI), SPV holdings under this "regulatory arbitrage" model often face dual restrictions from compliance regulation (from the government) and corporate legal affairs (from the target company). This will be discussed in detail below.

04 Reflection and Outlook

4.1 Proceed with Caution: Core Bottlenecks in Private Company Equity Tokenization

Although private company equity tokenization shows the potential to reshape a trillion-dollar market, its current development is still in the very early stages and faces four major core bottlenecks that need to be addressed.

1. Compliance Challenges: The Dual Pressure of Government Regulation and Corporate Legal Affairs

Compliance issues are the primary and most complex bottleneck currently facing private company equity tokenization. Unlike the tokenization of publicly listed stocks, the tokenization of private company equity must not only contend with securities law regulation from agencies like the SEC (U.S. Securities and Exchange Commission) but also faces legal risks from the target company itself.

Especially in the SPV indirect holding model, its essence is an attempt to circumvent the transfer restriction clauses in the target company's shareholder agreement for regulatory arbitrage. Recently, companies like OpenAI and Stripe have issued public warnings (as shown in Figures 8 and 9), clearly stating that the equity held by the SPV behind such tokens violates transfer agreements, and that token holders will not be recognized as company shareholders, with the SPV potentially facing sanctions from the company.

Figure 12: OpenAI's Warning on Tokenized Equity Announcement

Data Source: OpenAI Official Website

Figure 13: Stripe's Warning on Tokenized Equity Announcement

Data Source: Stripe Official Website

This risk has quickly become a reality. For example, after Robinhood (which established an entity in Lithuania) launched the OpenAI token in June 2025, it immediately received a public warning from OpenAI in July (as shown in Figure 10) and was subsequently investigated by Lithuanian regulatory authorities within the following week. This dual pressure from government regulation and corporate legal affairs constitutes the largest compliance uncertainty currently.

Figure 14: The X Post that Led to Robinhood's Investigation

Data Source: OpenAI's Official X Account

However, despite this, it should be noted that there are certain mitigating mechanisms for this dual pressure risk.

• On one hand, the complex legal structure of the SPV constructed by the project party objectively utilizes the legal gray area of "equity transfer restrictions." Although the target company publicly opposes it, there remains uncertainty as to whether it can successfully prevent such indirect transfers at the legal level—especially since the time and economic costs of such legal actions are extremely high, making it uncertain whether the target company has a strong motivation to enter legal proceedings.

• On the other hand, the number of target companies currently publicly expressing strong opposition is still limited (such as OpenAI and Stripe), while more leading companies in the market (such as Elon Musk's SpaceX) maintain a "no comment" strategy, which is interpreted by the market as tacit approval to some extent.

• More importantly, as crypto assets are increasingly accepted by mainstream finance, companies' attitudes toward tokenization are also dynamically evolving (for example, some companies have begun adopting DAT treasury strategies). Therefore, whether companies currently opposing will seek cooperation in the future—this dramatic turn of events is indeed possible. We assess that the core evolution direction in this field will depend on whether it can promote the integration of the "SPV indirect holding" model with the "native collaborative" model, with the key distinction being the penetration of crypto assets into traditional finance and technology companies.

2. Unclear Price Discovery Mechanism: Lack of Fair Value Anchoring

The pricing mechanism for tokenized equity also has significant flaws. Private company equity itself lacks continuous quotes in the public market, and its valuation anchoring (such as the most recent financing valuation) is infrequent, lagging, and opaque. When such non-standard assets are tokenized and placed in a 24/7 market, the effectiveness of its price discovery mechanism is put to the test.

For investors, it is difficult to discern the reasonableness of the token price—whether it is anchored to a lagging financing valuation or a speculative premium driven by market sentiment? This leads to token prices in the secondary market being more susceptible to fluctuations influenced by market sentiment, potentially resulting in significant deviations from the true valuation in the primary market. When the target company (or its industry) faces extreme market volatility, this pricing mechanism, lacking a solid value anchor, may risk failure, and its potential risk transmission mechanisms remain unclear.

3. Liquidity Dilemma: Constraints of Market Depth and Scale

Although one of the core goals of tokenization is to release liquidity, the current market performance indicates that this goal is far from being achieved. As previously mentioned (Table 3), the current market value of freely circulating equity tokens (excluding Securitize and Archax) is extremely low, mostly in the million-dollar range, and trading is primarily dispersed across DEXs (decentralized exchanges).

This situation of small market capitalization combined with dispersed trading has led to a severe lack of liquidity depth. The market exhibits typical characteristics of a thin market: significant widening of bid-ask spreads, and any relatively large order is likely to trigger severe price slippage. This fragile market structure makes token prices highly susceptible to shocks, resulting in significant volatility, which not only fails to effectively accommodate the large exit demands of traditional shareholders but also greatly increases the trading costs and risks for ordinary investors.

4. Poor Listing Transition: The Endgame Risks of the SPV Model

When a tokenized private company (such as OpenAI) ultimately seeks an IPO, the existing SPV model will face significant transition challenges. As warned by companies like OpenAI, indirect holdings through SPVs may violate transfer restriction clauses, leading to legal obstacles for the registration and conversion of shares held by the SPV controlled by the token issuer during the IPO (to public stock). If the SPV's shareholder status is not recognized, the tokens held will not be convertible into publicly tradable stocks, thus preventing value exit in the public market and potentially excluding them from future shareholder rights (such as dividends and stock distributions).

Currently, the only successful case of transitioning from a private company token to a public company stock is the Exodus case in collaboration with Securitize. However, even this compliant path is not without friction. During the nearly one-year transition period as Exodus delisted from the ATS platform and prepared for listing on the NYSE American, trading of its tokenized equity almost completely halted (with only compliant OTC paths remaining), and market liquidity once stagnated.

Moreover, once the asset nature shifts from Pre-IPO equity to public market stock, the complexity of compliance regulation, clearing and settlement, and transfer agency will significantly increase. Currently, the project parties dominating SPV issuance (mostly Web3 teams) generally lack the professional licenses (such as Broker-Dealer, Transfer Agent, etc.) and operational experience required to handle compliance for post-IPO securities. This lack of operational capability adds new uncertainty to whether the assets can smoothly transition to the public market, making the value realization path of the SPV model in this critical exit phase still unclear.

Of course, in the face of this "endgame" dilemma, some project parties of the SPV model are actively building compliant qualifications for tokenizing public company stocks (such as considering acquiring licensed securities brokers). Additionally, project parties have proposed another exit path: after the target company’s IPO, the SPV (as the original shareholder) will immediately liquidate all its shares after the lock-up period expires, and then distribute the fiat gains to all token holders in the form of "dividends." This path theoretically circumvents the compliance challenges of "token to stock," but its execution effectiveness, liquidation timing, and the project party's credit risk have yet to be validated by the market and time.

4.2 Outlook: Three Major Trends in Private Company Equity Tokenization

Despite facing the aforementioned bottlenecks, private company equity tokenization is one of the most imaginative areas in the RWA track, and its potential to reshape traditional financial structures cannot be ignored. We assess that after experiencing the current phase of "barbaric growth," the market will evolve towards the following three key trends:

1. Evolution of Driving Forces: From "One-Way Arbitrage" to "Two-Way Integration"

The legal friction arising between the SPV model and the target companies (such as OpenAI) clearly reveals the friction and limitations faced when circumventing the issuer. Such operations directly touch upon the core clauses regarding transfer restrictions in the target company's shareholder agreement, leading not only to legal risks but also to public resistance from target companies (such as Stripe and OpenAI).

However, the true breakthrough point driving the market forward does not solely come from external regulatory pressure but rather from a shift in the attitude of the target companies (private companies) themselves—from being passive defenders to active participants. As Web3 and crypto assets gradually enter the sights of Wall Street and traditional finance, technology companies' understanding of tokenization is rapidly maturing. They are beginning to reassess tokenization (such as STO) as an efficient, global capital strategy tool that may offer advantages over traditional IPOs, including:

(1) Lower issuance costs;

(2) Access to a broader global compliant capital pool;

(3) Continuous price discovery and market capitalization management capabilities before the IPO.

Therefore, the future mainstream path of the market may not simply be a replacement of "native collaborative" with "SPV arbitrage," but rather a form of integration and transformation. The divergence in attitudes of target companies (OpenAI's resistance versus SpaceX's silence) and dynamic evolution (such as some companies beginning to adopt DAT treasury strategies) suggest that some currently opposing companies may dramatically seek proactive cooperation—much like the varied attitudes of numerous business stars and political figures towards BTC.

We assess that the core evolution direction in this field will depend on whether it can promote the integration of the "SPV indirect holding" model with the "native collaborative" model—specifically, whether the SPV model can gradually gain recognition from issuers through its flexibility and market sensitivity, ultimately transforming "regulatory arbitrage" into "issuer-led" compliance collaboration.

2. Evolution of Infrastructure: From DEX Speculation to Deepening Native RWA Liquidity

The liquidity dilemma in the thin market on current DEXs does not have a solution by retreating to traditional non-native trading systems like ATS. As crypto trading assets, their future lies in building and deepening true "on-chain native liquidity."

It is foreseeable that the next phase will focus on infrastructure development, which specifically includes:

(1) Extensive deployment of multi-chain and L2, bringing assets to new frontiers like Solana and Base, which have vast users and capital;

(2) The emergence of dedicated RWA protocols, building DEXs that provide order books, market-making, and clearing services specifically for security tokens (rather than memecoins);

(3) Project parties building their own exchanges or dedicated liquidity layers to manage their token's secondary market in a more centralized and efficient manner (under compliance conditions), ensuring stable depth.

3. Evolution of Targets: From Super Unicorns to Long-Tail Private Enterprises

Currently, the market is highly concentrated on star unicorn companies like OpenAI and SpaceX, which is often driven by project parties for marketing purposes to attract market attention. However, these leading companies typically have ample funding and stringent legal mechanisms, and their shareholder agreements pose the most severe legal challenges and resistance to the tokenization path of the SPV model. In contrast, a large number of mid-to-late stage, non-leading unicorns—even some mature private enterprises—are more motivated for proactive cooperation.

Based on this, another vast blue ocean for tokenization may lie in providing services to the tens of thousands of mature private enterprises seeking exit paths beyond IPOs. As demonstrated by the Curzio Research case, these long-tail value companies may not have immediate plans for public listing, but their employees and early investors have urgent liquidity needs. When these companies actively seek to collaborate with native liquidity platforms, the private company equity tokenization market will truly shift from marketing-driven to pragmatic, ushering in a phase of scaled explosion and releasing its true market potential.

05 Conclusion

Private company equity tokenization aims to provide solutions for the "walled city" of the world's largest but most liquidity-constrained assets worth trillions of dollars. This report analyzes its market size, core pain points, mechanism advantages, mainstream models, and future challenges, leading to the following conclusions:

First, the market presents a huge contrast between "trillion-dollar potential" and "tens of millions of reality," still in a very early stage. On one hand, private company equity, represented by unicorn companies, is a vast "walled city" worth trillions of dollars—long plagued by the pain points of "difficult participation" (high barriers preventing investors from entering) and "difficult exit" (long lock-up periods preventing PE/VC holders from exiting). On the other hand, in stark contrast to its enormous potential, the current market value of freely circulating tokens (excluding sandbox and ATS projects) is only in the tens of millions. This indicates that the market is still in the very early stages of germination, with core functions such as price discovery and liquidity release far from realization.

Second, the current model shows a path differentiation of diverse exploration. The market has differentiated into three models: the native collaborative model (such as Securitize) represents the ideal compliance path but has a long implementation cycle and few cases; the synthetic mirror model (such as Ventuals) is purely a Web3 derivative; while the SPV indirect holding model (such as PreStocks and Jarsy) is currently the most prominent practical path, having explored the market through a flexible structure but also facing urgent issues in communication with target companies and the final connection to IPOs.

Third, the core of future market evolution is "integration and transformation," rather than simple "replacement." The SPV model, having validated market demand through its flexibility, is currently facing challenges in regulatory compliance, final IPO connections, and insufficient liquidity, which are driving it towards a more mature model. The future core driving force will be the shift in attitude of private companies (issuers)—as Web3 becomes increasingly mainstream, physical enterprises will begin to view tokenization (STO) as a new, efficient financing and market capitalization management tool. This maturation in understanding will drive the SPV model from one-way market exploration to compliance collaboration involving the target companies.

Fourth, the blue ocean of long-tail private enterprises and the landing of native infrastructure are key to scaled explosion. The true blue ocean for tokenization is not limited to super unicorns but rather encompasses a broader range of long-tail mature private enterprises seeking exit paths (as shown in the Curzio Research case). When these pragmatically driven issuers combine with "native RWA liquidity infrastructure" tailored for them (such as dedicated RWA protocols and L2 deployments), the private company equity tokenization market will truly transition from the prologue of "marketing-driven" to the scaled explosion phase of "pragmatic-driven."

In summary, private company equity tokenization is at a critical period of moving from spontaneous market exploration towards "ecological compliance collaboration." This track is undoubtedly one of the most worthy directions for long-term attention and exploration in the RWA and even the entire crypto finance field. How its final form will manifest remains to be seen, but once this door is opened, it may herald the beginning of a new financial model.

References

[1] Kumar, S., Suresh, R., Kronfellner, B., Kaul, A., & Liu, D. (2022, September 12). Relevance of on-chain asset tokenization in “crypto winter”. Boston Consulting Group & ADDX.

[2] Citi Global Perspectives & Solutions. (2023, March 30). Money, Tokens, and Games: Blockchain’s Next Billion Users and Trillions in Value. Citigroup.

[3] Hurun Research Institute. (July 2025). "2025 Global Unicorn Index" Press Release

[4] CB Insights. (July 2025). The Complete List of Unicorn Companies. CB Insights Official Database

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。