Fears around soaring AI valuations, uncertainty about the direction of interest rates, and drama in the aftermath of a 43-day government shutdown have all converged to create what can only be described as a perfect storm for stock and crypto markets alike.

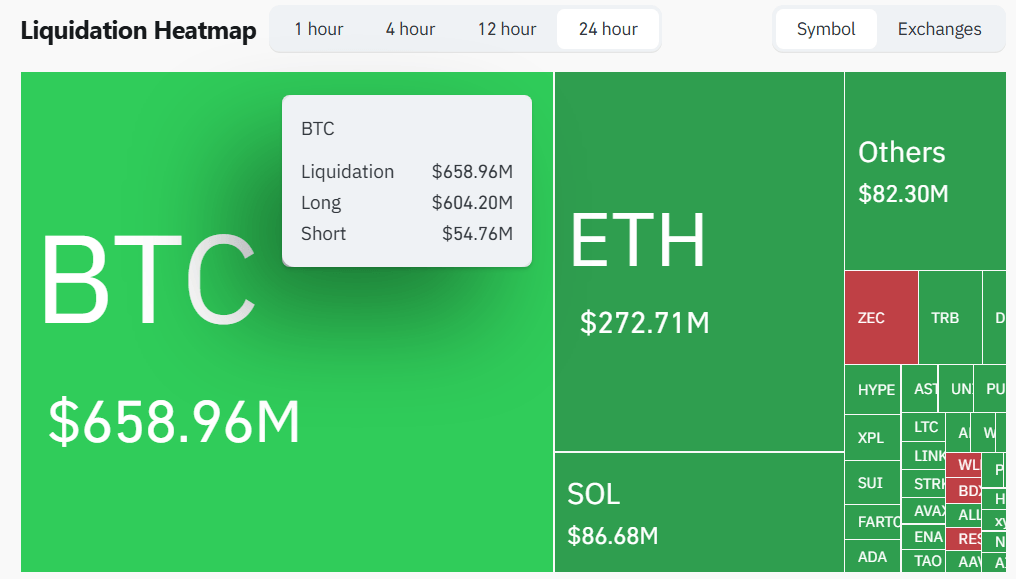

( Bitcoin liquidations tripled on Friday, reaching nearly $660 million at the time of reporting / Coinglass)

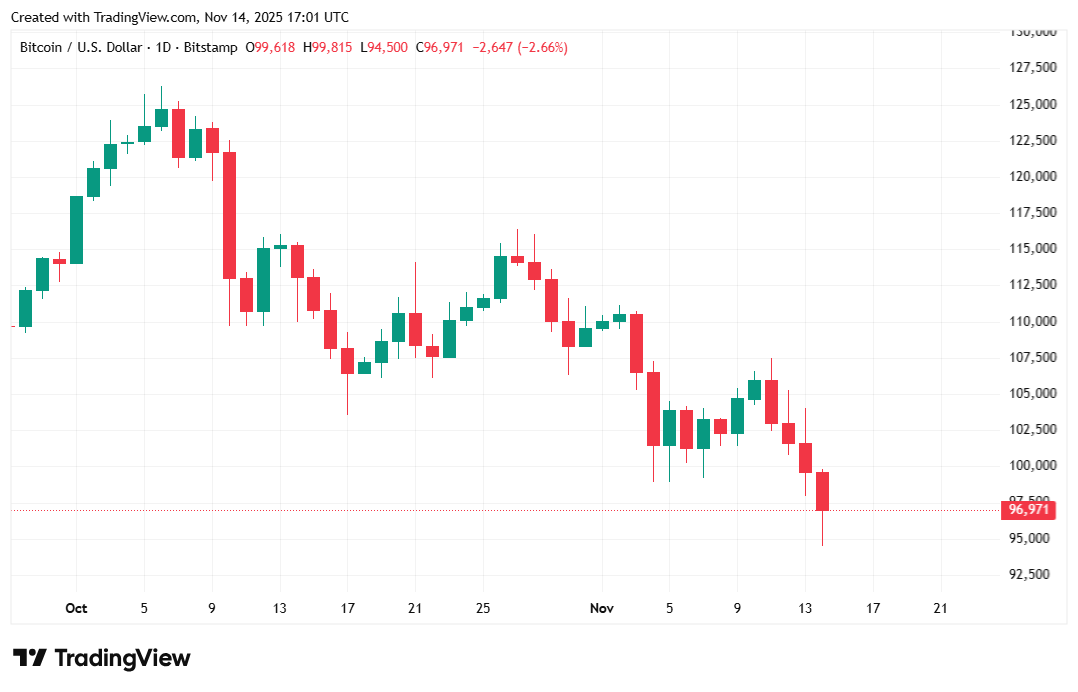

Bitcoin sank to $94K on Friday, and stocks took a beating, with all major indices dipping into the red. Some blamed overzealous tech giants who have plowed billions into AI investments, raising fears of a bubble rivaling the dot-com boom of the late 1990s. Others pointed the finger at the Fed, which many expected to go on an interest rate reduction spree, until Fed Chair Jerome Powell declared that a December cut “is not a foregone conclusion.” Even worse, the White House confirmed on Wednesday that key economic data not collected during the record 43-day government shutdown will likely never be released, further muddying up the interest rate landscape.

“The Democrats may have permanently damaged the Federal Statistical system with October CPI and jobs reports likely never being released,” White House Press Secretary Karoline Leavitt told reporters. “All of that economic data released will be permanently impaired, leaving our policymakers at the Fed, flying blind at a critical period.”

Then, while the country applauded a funding bill that finally brought the government shutdown to an end, mainstream media dropped a bombshell about two Kentucky senators dueling over the fate of America’s $28 billion hemp industry. More than 300,000 jobs are in limbo, thanks to Kentucky Senator Mitch McConnell, who snuck a provision into Wednesday’s appropriations bill that effectively bans retail hemp products.

Read more: Did a New Ban on Weed Cause Bitcoin to Fall Below $100K?

“This is the most thoughtless, ignorant proposal to an industry that I’ve seen in a long, long time,” said McConnell’s junior colleague Senator Rand Paul, also of Kentucky.

All of these events appear to have conspired to create an ideal recipe for disaster. At $94K, Coinglass data shows that leveraged bitcoin traders have lost nearly $660 million in liquidated margin over the past 24 hours. But while this week’s carnage is still ongoing, the long-term outlook for the cryptocurrency remains mostly positive.

“I think there’s a pretty good chance that we’ve been in a bear market for almost 6 months now and are almost through it,” said Hunter Horsley, CEO of crypto investment firm Bitwise. “The setup for crypto right now has never been stronger.”

Bitcoin was trading at $96,983.32 at the time of reporting, down 3.53% over 24 hours and 4.1% since last week, according to data from Coinmarketcap. The digital asset fell to $94,525.06 early Friday morning after trading as high as $100,770.97.

( Bitcoin price / Trading View)

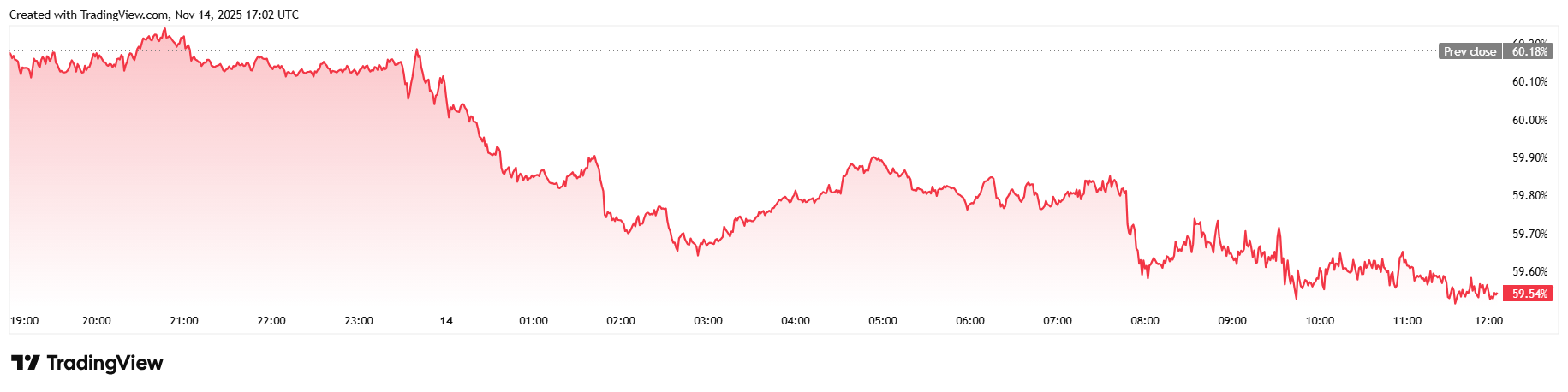

Daily trading volume climbed to $128.86 billion, a 62.04% jump, indicating a much more intense sell-off than yesterday. Market capitalization fell to $1.93 trillion, and bitcoin dominance retreated 1.14% to 59.55%.

( BTC dominance / Trading View)

Total value of open bitcoin futures contracts rose 1.46% to $67.46 billion over 24 hours, according to Coinglass. Liquidations were front and center on Friday, skyrocketing from yesterday’s total of $235.80 million to $658.96 million. Long BTC traders lost $604.20 million in liquidated margin, a nearly threefold increase from Thursday. Short sellers lost a much smaller $54.76 million, which is still roughly $20 million more than the day before.

- Why did bitcoin plunge to $94K?

A mix of AI-bubble fears, stalled rate-cut expectations, and fallout from the 43-day U.S. government shutdown sparked a broad market sell-off. - Did missing economic data make things worse?

Yes. The White House confirmed that key CPI and jobs data may not be released, leaving markets and the Fed “flying blind.” - What role did the new hemp ban play?

A provision in Wednesday’s funding bill targeting retail hemp products threatens 300,000 jobs and has shaken investor sentiment further. - Is the long-term outlook still positive?

Many analysts, including Bitwise CEO Hunter Horsley, still see strong fundamentals and believe the crypto downturn may be nearly over.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。