Original | Odaily Planet Daily (@OdailyChina)

Author | Ethan (@ethanzhangweb3)_

Recently, a class action lawsuit accepted by the Southern District Court of New York has pulled the prediction platform Kalshi into another regulatory dispute.

Seven users accuse the platform of selling sports-related contracts without obtaining any state gambling licenses and question its market-making structure, which "effectively pits users against the house." Just days earlier, a Nevada court had lifted Kalshi's protective injunction, exposing it to potential criminal enforcement at any time in the state.

The regulatory stance has become increasingly severe. The Nevada Gaming Control Board has determined that Kalshi's sports "event contracts" are essentially unlicensed gambling products and should not enjoy the regulatory protection of the CFTC (Commodity Futures Trading Commission). Federal Judge Andrew Gordon bluntly stated at the hearing: "Before Kalshi, no one would have thought that sports bets were financial products."

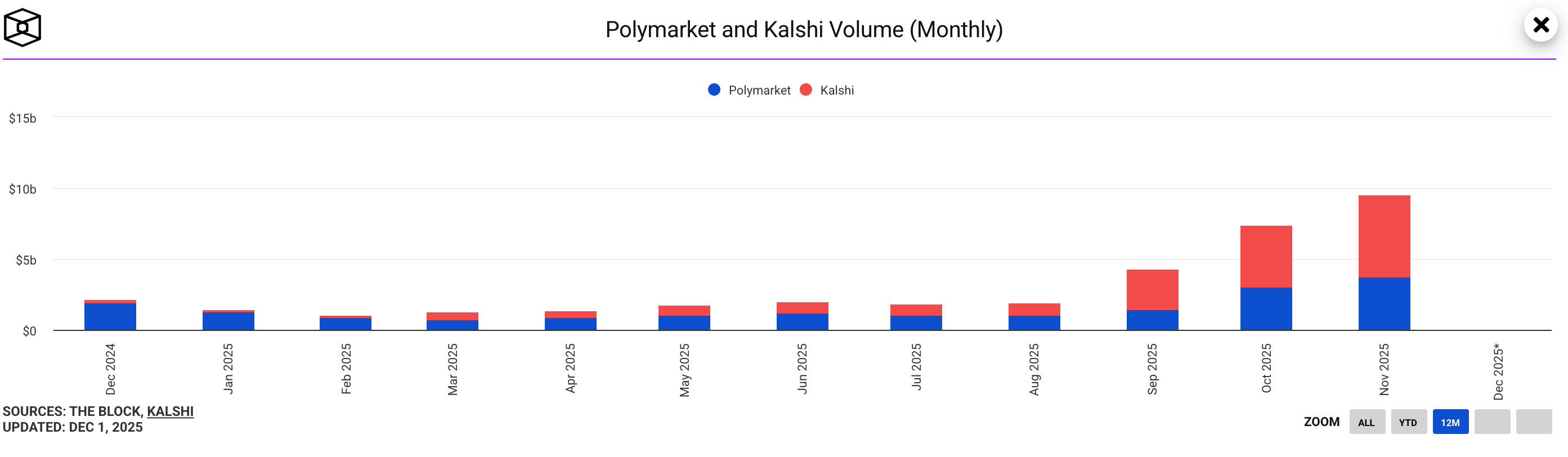

However, what most did not anticipate was that during the weeks of tightening regulatory crackdowns and legal pressures, Kalshi's various business metrics exhibited a nearly provocative counter-trend growth—trading volumes reached new highs, and the latest round of financing valued the company at $11 billion, making it an undisputed superstar in the prediction market sector.

The fervor of capital and the coldness of regulation have formed a striking contrast at this moment: Why does a company deemed "illegal" by multiple parties exhibit unprecedented vitality in the market? This article attempts to penetrate the judgment documents and trading data to dissect the regulatory logical conflicts, trust crises, and capital's reverse betting that Kalshi faces, restoring the true logic of this hundred-billion market at the center of the storm.

The Break in Legal Identity: How Kalshi Went from "Compliant" to "Illegal"

Returning to the starting point of the event, one of the most overlooked issues by the outside world is: Kalshi was not "illegal" in the past; it simply was suddenly no longer allowed to continue legally. This shift from "compliant" to "illegal" did not stem from changes in the business itself but rather from a shift in regulatory recognition—especially regarding the core question of whether prediction markets belong to "financial derivatives" or "unlicensed gambling."

Kalshi's self-narrative has always been clear: it is a "Designated Contract Market" (DCM) registered with the CFTC, and the event contracts it offers are a form of binary options derivative with "real economic purposes," thus should be exclusively regulated by federal authorities. Over the past few years, this narrative has indeed gained traction within the U.S. regulatory framework, allowing Kalshi to launch binary prediction contracts in hundreds of areas such as election cycles, macroeconomics, and technological events, gradually growing into an industry leader.

However, the Nevada regulatory authorities clearly do not accept this logic, especially when Kalshi began to touch on the sports sector, causing the conflict to escalate instantly. Sports betting is one of the most strictly regulated and localized areas in the U.S., with each state having completely different systems for licensing, taxation, and risk control. In other words, sports betting is a typical "state rights red line." When Kalshi began to launch contracts involving touchdown times, game progress, and other sports events, the Nevada regulatory authorities believed these products essentially belonged to prop bets, a typical category of sports betting, rather than financial derivatives.

This is also why Judge Gordon's attitude shifted significantly during the hearing. He pointed out that according to Kalshi's definition, as long as it involves future events and is related to money, almost anything could be packaged as a derivative, which would lead to a failure of the regulatory system. The court subsequently ruled that sports events do not fall under the "excluded commodity" framework of the Commodity Exchange Act and thus are not under the exclusive regulation of the CFTC.

As a result, the Nevada court not only officially lifted Kalshi's protective injunction at the end of November but also clearly stated: These sports event contracts essentially belong to gambling contracts, not derivatives.

This determination not only exposes Kalshi's operations in Nevada to dual risks of criminal and civil enforcement but also provides important legal references for other states across the U.S. Currently, at least six states have initiated lawsuits in different courts regarding the 'regulatory boundaries of prediction markets,' and the rulings are showing increasingly evident jurisdictional discrepancies:

- Federal faction: Some states insist on the principle of federal priority, advocating for unified regulation by the CFTC;

- Gambling faction: More states are following Nevada's lead, mandating that it be included in the local gambling licensing system;

- Legislative faction: Some states are attempting to redefine the legal boundaries of "prediction markets" through legislation.

In this environment of regulatory division, Kalshi's legality suddenly lacks a unified interpretation and has become a victim of the "battle for regulatory interpretation rights." More realistically, after losing the injunction, if Kalshi continues to operate in Nevada, it will face the possibility of immediate criminal enforcement, which is also why the company urgently applied for a court stay.

From derivatives to gambling, from federal regulation to state regulation, and to the fierce competition among courts, users, and industry parties, several unavoidable questions emerge: What exactly is a prediction market? Is its legal identity stable? Can it find its place within the existing regulatory framework in the U.S.?

And while this identity oscillation remains unresolved, Kalshi faces an even trickier second blow—questions from its users themselves.

Why are users suing? Market-making disputes, betting accusations, and the shadow of the "house"

If the regulatory conflict merely exposed systemic gaps, then the class action lawsuit from users directly strikes at the foundation of trust in the trading platform.

On November 28, a class action lawsuit was initiated by seven Kalshi users through the well-known plaintiff law firm Lieff Cabraser Heimann & Bernstein. Although the core accusations are only two, they are lethal, attempting to fundamentally reshape the external perception of Kalshi:

First, illegal operation accusation: The prosecution believes that Kalshi falsely advertised and provided substantial "sports betting" services without holding any state-level gambling licenses.

Second, being both the referee and the player: The prosecution accuses Kalshi's affiliated market makers of not merely being liquidity providers but actually acting as the platform's "house," allowing users to unknowingly bet against a professional trading platform with information or capital advantages.

In other words, users are questioning not the prediction contracts themselves but the transparency and fairness of the trading mechanism. A particularly provocative statement in the lawsuit documents quickly gained traction in the industry: "When consumers bet on Kalshi, they are not facing a market, but the house."

The reason this statement is so damaging is that it precisely penetrates the "identity defense line" of prediction markets. Platforms like Kalshi have always vigorously argued that they are neutral facilitators, markets for price discovery, rather than gambling companies betting against users. However, once the accusation that "the platform participates in pricing and profits from it" is established, this boundary will instantly collapse on both legal and moral levels.

In response to the accusations, Kalshi co-founder Luana Lopes Lara quickly countered, stating that the lawsuit is "based on a fundamental misunderstanding of the derivative market mechanism." Her defense logic aligns with standard financial market common sense:

- Like other financial exchanges, Kalshi allows multiple market makers to competitively provide liquidity;

- Affiliated market makers do not receive any internal advantages;

- Having affiliated institutions provide liquidity in the early stages is "an industry norm."

In traditional finance or mature crypto asset markets (like Binance or Coinbase), this coexistence of "market makers" and "proprietary trading" may be an industry unwritten rule. But in the gray, emerging field of prediction markets, the user structure and understanding are entirely different. When ordinary retail investors encounter high-win-rate opponents, bottomless order walls, or rapidly adjusted odds, they find it hard to interpret this as "efficient market pricing" and are more inclined to see it as "the house manipulating the market."

The most dangerous aspect of this lawsuit is that it creates a fatal narrative resonance with the regulatory actions in Nevada. The regulators say you are unlicensed gambling, and the users say you are a house casino. With both narratives overlapping, Kalshi faces not just compliance risks but also a more difficult-to-reverse narrative risk.

In the financial world, "market making" is fundamentally a neutral infrastructure; however, in the context of prediction markets, it is rapidly being stigmatized as "manipulation" and "harvesting." When "Kalshi is not the open market it claims to be" becomes a consensus, its legitimacy and business ethics will simultaneously collapse.

But ironically, the dual crisis of law and trust has not interrupted Kalshi's growth curve. After the lawsuit was exposed, its trading volumes in the sports and political sectors increased rather than decreased. This abnormal phenomenon reveals the most profound contradiction currently facing prediction markets: in the face of extreme speculative demand, users seem indifferent to whether this is an "exchange" or a "casino," as long as the odds are moving, the funds will flow in.

Why does Kalshi become more sought after by the market as it sinks deeper into the "compliance quagmire"?

Despite facing crackdowns from multiple state regulatory agencies, negative judicial rulings, and a class action lawsuit from users, Kalshi has delivered a jaw-dropping performance amid the crisis: the platform's trading volume has surged exponentially, driven by sports and political contracts, while completing a $1 billion financing round led by Sequoia Capital, pushing its latest valuation to $11 billion. This coexistence of a "regulatory winter" and a "market summer" seems counterintuitive but profoundly reveals the structural characteristics of this emerging prediction market sector. Kalshi's counter-trend explosion is not coincidental but the result of a quadruple resonance of market logic.

1. Psychological Game: The "Regulatory Countdown" Triggers a Rush Effect

The uncertainty of regulation has not deterred users; rather, it has sparked a certain "apocalyptic carnival" style of participation enthusiasm. With Nevada lifting its injunction, the public has realized that the boundaries between prediction markets and traditional gambling are becoming blurred. This expectation of "upcoming regulatory tightening" has transformed into a sense of scarcity anxiety among users: traders are eager to enter before the window closes. For speculative capital, the less clear the rules, the greater the potential arbitrage opportunities. Kalshi has effectively enjoyed a flow bonus brought by a "regulatory risk premium."

2. Capital Voting: Betting on the Endgame of "Institutional Dividends"

From the perspective of top institutions like Sequoia, the current legal disputes are merely growing pains in the early stages of industry development, not the endgame. The logic of capital is very clear: prediction markets are not only alternatives to gambling but also part of future financial infrastructure. According to a report by Certuity, the market size is expected to exceed $95.5 billion by 2035, with a compound annual growth rate of nearly 47%. In the eyes of institutional investors, the resistance Kalshi currently faces only proves that it is a leading player. Capital is making a reverse bet: prediction markets will ultimately be incorporated into a regulatory framework, and the surviving leading platforms will enjoy substantial institutional dividends. The current high valuation reflects the pricing of the time window where "regulation has yet to take shape, but demand is irreversible."

3. Competitive Landscape: Liquidity Siphoning from Supply-Side Clearance

Kalshi's trading volume surge is largely due to the forced exit of competitors. As Crypto.com and Robinhood suspended related operations during the appeals process, a significant vacuum emerged on the supply side of compliant prediction markets in the U.S. With the demand side (especially during election seasons and sports events) continuing to expand, market liquidity was forced to seek new outlets. As one of the few remaining open platforms in this field, Kalshi absorbed a massive flow of users spilling over from competing platforms. This "survivor takes all" effect has made it the deepest and broadest liquidity pool in the U.S. market in a short period, further reinforcing its Matthew effect.

4. Nature of Demand: A Paradigm Shift from "Speculation" to "Risk Expression"

Finally, and most fundamentally, the core driving force behind user participation in prediction markets is no longer merely speculation. In an era of heightened macro volatility, the demand for risk pricing related to interest rate decisions, election trends, and geopolitical events has surged. Traditional financial derivatives struggle to cover these non-standardized events, while prediction markets precisely fill this gap. For professional traders, this is a risk hedging tool; for ordinary users, it is a high-frequency channel for participating in public events. This trading demand based on "the events themselves" is highly rigid and will not disappear due to a single state's regulatory ban. On the contrary, the high exposure brought by regulatory disputes has pushed prediction markets from a niche financial circle to the center of public discourse.

In summary, Kalshi's counter-trend growth is not because "the more illegal, the more attractive," but rather a product of the combination of rigid demand explosion on the demand side, long-term bets on the capital side, and supply vacuum on the competitive side.

Kalshi is currently at a historically tense moment: it faces an unprecedented dark hour legally while experiencing its brightest growth commercially. This may be the "coming of age" that all disruptive financial innovations must undergo—before the regulatory system completes its logical coherence, the market has already cast its vote with real money.

Conclusion: The Future of Prediction Markets is Being Unfolded Ahead of Time at Kalshi

Kalshi is currently at the eye of the storm, which is not merely a compliance crisis for a startup but a prematurely ignited institutional conflict. It forces the U.S. financial system to confront the long-ignored core question: How should this new financial infrastructure of prediction markets be defined, regulated, and even allowed to exist?

It hovers on the edge of securities and gambling—possessing the price discovery function of financial markets while also having the entertainment attributes of mass consumption; it carries the serious demand for hedging real-world risks while being filled with the fervent speculation of gamblers. It is precisely this "identity hybridity" that has led the CFTC, state law enforcers, the judicial system, and market users to fall into a four-dimensional tug-of-war with divergent goals and conflicting means.

In this sense, Kalshi's experience is not an accidental "incident" but an inevitable "origin point" for the entire industry.

From Nevada to Massachusetts, the regulatory boundaries of prediction markets are being rewritten state by state; from the CFTC's policy oscillation to local courts' repeated rulings, the federal system is revealing its hesitation in the face of new species; and from user-initiated class actions to intense public debates, the public is beginning to scrutinize the industry's underlying nature with a critical eye—whether it is an information-transparent "oracle" or a "digital casino" cloaked in financial garb.

This intense uncertainty may seem dangerous, but it is precisely a testament to the industry's explosive potential. Looking back over the past twenty years, from electronic payments to crypto assets, from internet securities to DeFi, every institutional conflict occurring at the financial margins has ultimately driven the reconstruction of underlying logic and birthed new regulatory paradigms. Prediction markets are now entering a similar cycle, but their evolution is far exceeding expectations.

Standing at the future crossroads, we can at least establish three irreversible trends:

First, the legitimacy game will fall into a "protracted war." Since at least six states have emerged with distinctly different legal interpretations, this means that the struggle for jurisdiction is likely to escalate to the Supreme Court level. A single ruling cannot determine the outcome; regulatory fragmentation will be the norm.

Second, prediction markets are transitioning from "niche toys" to "infrastructure." Whether hedging political risks with money as votes or quantifying societal expectations for macro events, prediction markets are becoming an indispensable "risk pricing anchor" in the real world.

Third, the industry's endgame will be dynamically reshaped by multiple forces. Ultimately, the form of prediction markets will not be determined by the unilateral will of a single regulator but by a dynamic balance constructed by market demand, capital will, political games, and judicial precedents.

Therefore, Kalshi's victory or defeat may no longer be the sole focus; it is more like the first curtain being torn open. In the short term, the two key legal documents on December 8 and 12 will determine whether Kalshi can survive this regulatory storm; but in the long historical view, these two days of confrontation are destined to become the first watershed moment in the hundred-billion prediction market sector.

The future of prediction markets will not be written by a single ruling, but its direction will certainly change at a critical juncture. And this juncture is being brought forward by Kalshi.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。