In just over a month, eight altcoins previously regarded as "speculative toys" by mainstream finance, including SOL, XRP, and DOGE, have received approval for spot ETFs, attracting over $700 million in funds. However, the prices of these related cryptocurrencies have generally dropped by more than 20%.

Bitwise's XRP ETF even directly uses "XRP" as its trading code, a bold marketing strategy that has sparked controversy in the industry. By the end of November, the total assets under management of six Solana funds had reached $843 million, accounting for approximately 1.09% of SOL's total market capitalization.

I. Market Sketch Under Regulatory Changes

● In December 2025, Wall Street is experiencing an unprecedented wave of acceptance for crypto assets. In less than a month, a series of altcoin spot ETFs, including Solana, XRP, Dogecoin, Litecoin, and Hedera, have successively landed on the New York Stock Exchange and Nasdaq.

● In stark contrast to the nearly ten-year struggle for the approval of Bitcoin spot ETFs, this batch of altcoins completed the entire process from application to listing in just six months.

● This sudden wave of listings stems from a "strategic abandonment" by regulators. On September 17, 2025, the SEC approved the revision proposal for "universal listing standards" put forward by three major exchanges, opening a fast track for eligible crypto assets.

● The core admission criteria are twofold: either the asset has at least six months of trading history in CFTC-regulated futures markets; or there are precedents of ETFs holding at least 40% exposure to the asset in the market.

II. Divergence Between ETF Fund Inflows and Cryptocurrency Price Declines

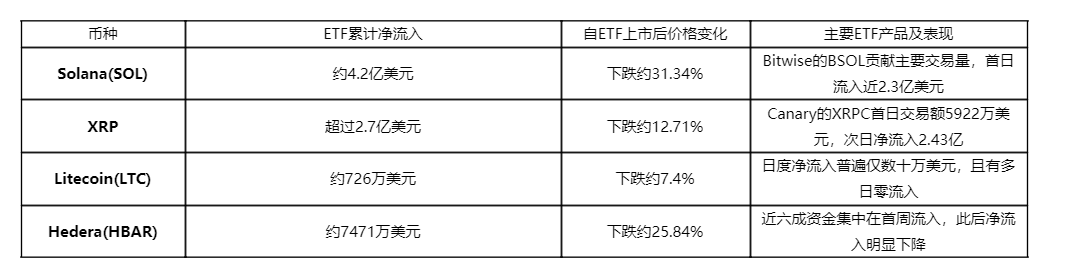

Although these emerging crypto project ETFs have been approved one after another, a puzzling phenomenon has emerged: funds continue to flow into ETFs while the prices of the underlying assets generally decline. According to Coinglass data, as of mid-November, the cumulative net inflow into major altcoin ETFs was approximately $700 million, yet the prices of various cryptocurrencies showed significant declines.

By the end of November, the Solana ETF has recorded net inflows for 20 consecutive days since its launch, totaling $568 million. Notably, while Bitcoin and Ethereum ETFs faced large-scale net outflows in November, the Solana ETF demonstrated strong counter-trend capital attraction.

III. Dual Pressure of "Selling the Fact" and Market Environment

The decoupling of fund inflows and price declines is primarily caused by market behavior patterns and the overall environment.

● The typical "buy the expectation, sell the fact" behavior is particularly evident in the cryptocurrency market. Speculative funds position themselves in advance when expectations for ETF approvals form, and when the good news materializes, they quickly take profits, creating short-term selling pressure.

● Taking XRP as an example, within days of the Bitwise XRP ETF's launch, the price fell by about 7.6%, with a peak decline exceeding 18%.

● Macroeconomic factors also exert pressure on the crypto market. Strong employment data has led to a weakened expectation for interest rate cuts, suppressing the performance of overall risk assets. Since the beginning of this year, the relative profits of altcoins have largely fallen into deep surrender territory, with a significant divergence between Bitcoin and altcoins that is rarely seen in previous cycles.

IV. Structural Challenges Facing Altcoin ETFs

● Beyond short-term market sentiment, altcoin ETFs face deeper structural challenges. Insufficient liquidity and market depth are core issues. According to Kaiko data, the recent 1% market depth for Bitcoin is approximately $535 million, while the market depth for most altcoins is only a fraction of that.

● This means that an equivalent scale of fund inflow should have a greater impact on altcoin prices than on Bitcoin, but the current "selling the fact" phenomenon obscures this effect.

● Market manipulation and transparency risks cannot be ignored. Many altcoins have insufficient liquidity, making them susceptible to price manipulation. The net asset value of ETFs relies on the prices of underlying assets; if altcoin prices are manipulated, it will directly affect the value of the ETF, potentially leading to legal risks or regulatory investigations.

V. Long-term Benefits: Compliance and Market Structure Reshaping

● Despite the unsatisfactory short-term performance, the approval of altcoin ETFs still represents a long-term structural benefit. The launch of these ETFs has de facto confirmed the "non-security" nature of these assets on a legal level, providing a compliant fiat entry point for them.

● From the perspective of institutional allocation, the ETF structure introduces continuous passive buying for these altcoins. Data shows that the cumulative net inflow into the XRP ETF has exceeded $587 million since its launch.

Speculators are retreating, but allocation-focused institutional funds are entering the market, building a higher long-term bottom for assets like XRP.

● More importantly, the launch of ETFs is intensifying the liquidity stratification in the crypto market. The first tier includes ETF assets like BTC, ETH, SOL, XRP, and DOGE, which have compliant fiat entry points, allowing registered investment advisors (RIAs) and pension funds to allocate without barriers and enjoy "compliance premiums."

● The second tier consists of non-ETF assets, including other Layer 1 and DeFi tokens, which will continue to rely on retail funds and on-chain liquidity due to the lack of ETF channels.

VI. Innovative Attempts and Future Outlook

● In this wave of altcoin ETFs, some innovative attempts are particularly noteworthy. Bitwise's Solana ETF not only provides exposure to SOL prices but also attempts to allocate on-chain yields to investors through a staking mechanism.

● This is a bold attempt, as the SEC has long viewed staking services as securities issuance, but Bitwise clearly labels it as a "Staking ETF" in its S-1 filing, attempting to design a compliant structure to distribute staking rewards. If successful, the Solana ETF will not only capture price increases but also provide cash flows similar to "dividends," making it far more attractive than non-yielding Bitcoin ETFs.

● As Bitcoin has fallen from a high of $126,000 in early 2025 to around $80,000 by the end of November, the entire crypto market is shrouded in a downward shadow. However, this has not hindered the pace of altcoin ETF listings; in the next 6-12 months, the market may see more assets (such as Avalanche and Chainlink) attempting to replicate this path.

● The BNB ETF is widely seen as the ultimate test of the SEC's new leadership's regulatory standards. Given the close ties between BNB and the Binance exchange, as well as Binance's previous complex entanglements with U.S. regulators, its path to an ETF will be fraught with challenges.

In the Litecoin ETF, daily net inflows are generally only in the tens of thousands of dollars, with several days showing zero inflows. Meanwhile, nearly 60% of funds in the HBAR ETF were concentrated in the first week, with net inflows significantly declining thereafter.

This market, once driven by speculation and narratives, is irreversibly evolving towards a new order anchored in compliance channels and institutional allocations. The concentrated listing of altcoin ETFs is merely the beginning of this transformation.

Join our community to discuss and grow stronger together!

Official Telegram community: https://t.me/aicoincn

AiCoin Chinese Twitter: https://x.com/AiCoinzh

OKX benefits group: https://aicoin.com/link/chat?cid=l61eM4owQ

Binance benefits group: https://aicoin.com/link/chat?cid=ynr7d1P6Z

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。