Author: Zen, PANews

As Trump has repeatedly hinted in public that he has decided on the next Federal Reserve Chair, Kevin Hassett, the Director of the White House National Economic Council (NEC), is seen by major media and prediction markets as one of the most likely candidates to succeed Powell.

Three intertwined narratives surround him: a typical Republican conservative economist, an official with substantial interests and policy intersections with crypto assets, and a candidate labeled by some media as the "shadow chair" of the Federal Reserve amid the controversy over "Fed independence."

How did Hassett come to the forefront of the "next chair"?

Born in 1962 in Greenfield, Massachusetts, Hassett is a standard Republican economist with a background in mainstream macroeconomics. He earned his bachelor's degree in economics from Swarthmore College and subsequently obtained his master's and doctoral degrees in economics from the University of Pennsylvania.

In the early stages of his academic career, he taught at Columbia Business School and served as a senior economist on the Board of Governors of the Federal Reserve, focusing on macro and fiscal policy. In the think tank arena, he worked for a long time at the conservative American Enterprise Institute (AEI), where he was the head of economic policy research and had significant influence on tax reform, corporate taxes, and capital markets.

His most well-known early work in the public sphere is the book "Dow 36,000," co-authored with conservative columnist James K. Glassman, which claimed in 1999 at the peak of the internet bubble that stock market valuations were still "severely undervalued." This judgment was later contradicted by market trends, but it made him a prominent figure in conservative economic circles.

Before entering the White House, Hassett had provided economic policy advice for Republican presidential candidates multiple times, including McCain in 2000 and 2008, George W. Bush in 2004, and Romney's campaign team in 2012. In 2017, Trump appointed him as the Chair of the Council of Economic Advisers (CEA), during which he frequently defended Trump's tax cuts and industrial policies in public, emphasizing that tax cuts would boost corporate capital spending and wage growth. In mid-2019, he stepped down from the CEA chair position and subsequently became a visiting scholar at the Hoover Institution, continuing to voice his opinions on tax systems and macroeconomic policy.

During the pandemic in 2020, Hassett was called back to the White House by Trump to serve as a senior economic advisor, participating in calculations regarding the economic impact of the pandemic and reopening strategies. Although Hassett had no prior experience in epidemiology, some of the pandemic models he led were viewed as important guidelines within Trump's team. However, Hassett's models were widely criticized by scholars and commentators for contradicting assessments from public health experts.

By the end of 2024, after winning the election, Trump announced that Hassett would serve as the Director of the National Economic Council (NEC) during his second term, responsible for coordinating economic policy within the White House. He officially took on this role on January 20, 2025, becoming the primary economic "hub" for communication between the White House, the Treasury, and the Federal Reserve.

In the early days of the second term, the Trump administration frequently signaled that it "did not intend to renew Powell's term" and began to have Treasury Secretary Scott Bessent lead the search for the next chair candidate. By the fall of 2025, several candidates, including former Fed Governor Kevin Warsh, current Governors Christopher Waller, Michelle Bowman, and BlackRock executive Rick Rieder, were included on the list.

As the fourth quarter approached, the situation of this candidate race gradually became clear—Hassett would stand out in this "final round." The core reason Hassett has gained Trump's favor is that he meets Trump's two major criteria for personnel: loyalty and market recognition.

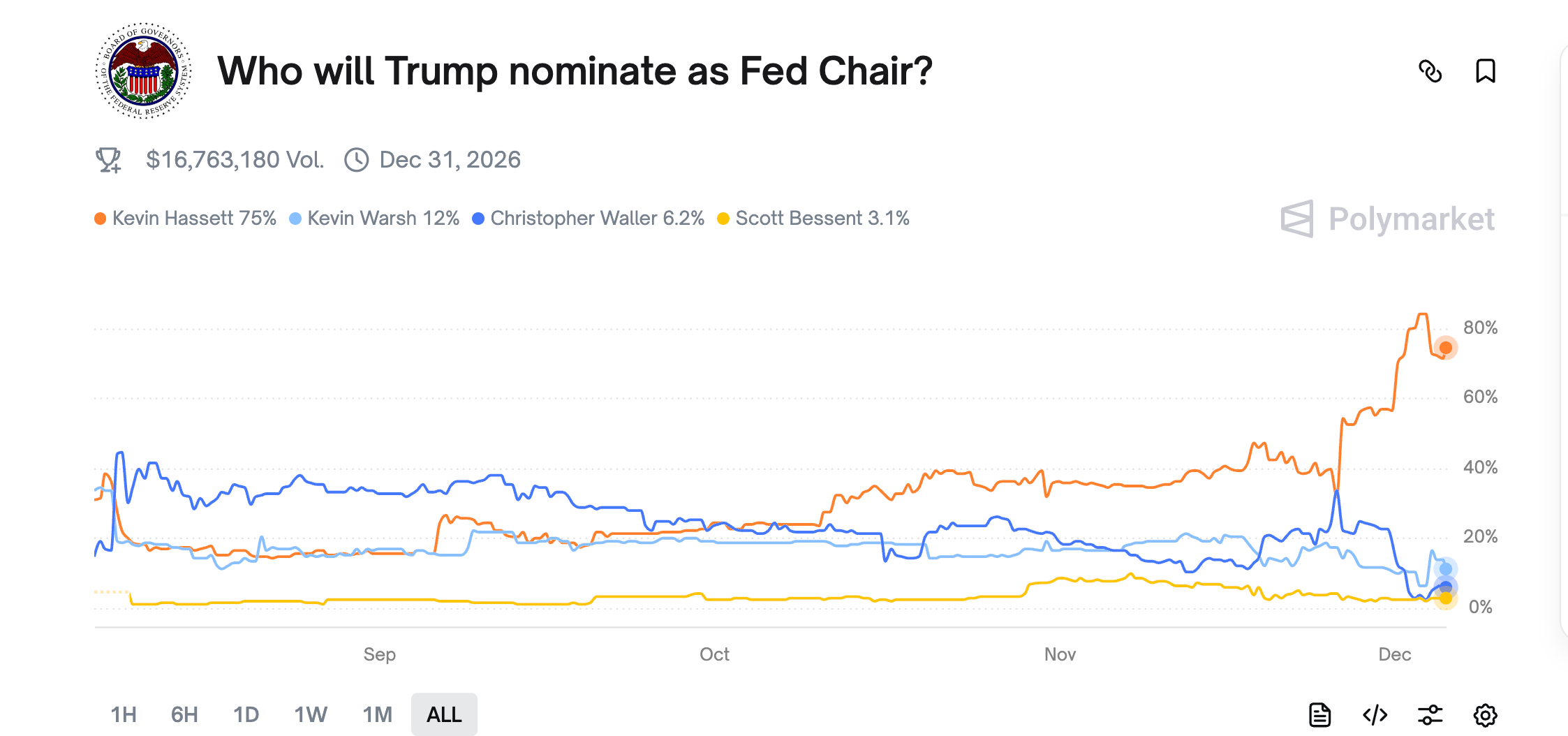

As of December 5, on prediction market platforms like Polymarket, Hassett's probability of being elected was about 75%; mainstream media like Bloomberg had previously cited sources saying that Hassett had become the "top favorite" to succeed Powell. Trump himself has publicly stated that he has made a decision and will officially announce the candidate in early 2026, repeatedly praising Hassett in interviews.

Even before the official nomination is announced, the outside world has begun to describe Hassett as the "shadow Fed Chair for the next five months." This is because the market believes he is likely to take over, and every public statement he makes in the next six months may be seen as a preview of the Fed's stance.

Coinbase advisor, holdings, friendly to the cryptocurrency industry

For the cryptocurrency industry, compared to previous Federal Reserve Chairs and other candidates, Hassett's "substantial connection" with the crypto industry is the most concerning point for the community, as he has both policy intersections in his official capacity and relevant investments on a personal asset level.

In 2021, the digital asset hedge fund One River Digital Asset Management announced the establishment of an "Academic and Regulatory Advisory Committee," of which Hassett was a key member. Although this role does not directly involve specific transactions, it signifies that Hassett has had a formal connection with digital asset fund management since 2021 in an advisory capacity. In this process, he is also seen as an important bridge between traditional macroeconomics and emerging crypto assets.

In 2023, Coinbase acquired part of One River's asset management business and reorganized it into the Coinbase Asset Management Academic and Regulatory Advisory Committee, continuing the original academic and regulatory advisory structure, thus making Hassett a Coinbase advisor. Hassett is also an "investor" in Coinbase; in June 2025, as a senior White House official, he reported in a financial disclosure submitted to the government ethics office that he held Coinbase Global (COIN) stock valued between $1 million and $5 million.

After Trump took office, he immediately signed a large number of executive orders. Among them, Executive Order 14178, "Strengthening America's Leadership in Digital Financial Technology," not only revoked related digital asset executive orders from the Biden era but also explicitly prohibited the U.S. from launching a CBDC, while establishing a presidential "Digital Asset Market Working Group" responsible for proposing policy recommendations on crypto assets, stablecoins, market structure, consumer protection, and "national digital asset reserves" within 180 days. This working group is led by David Sacks, the White House Special Advisor on AI and Crypto Affairs, but is administratively under the NEC system, coordinated and organized by Hassett.

The first report released by the working group in the summer proposed a comprehensive set of recommendations for the U.S. digital asset regulatory framework—covering how banks should hold and manage exposure to crypto assets, enhancing reserve transparency and compliance requirements in stablecoin regulation, clarifying crypto tax and anti-money laundering rules, and outlining feasible paths for national digital asset reserves. In this process, Hassett is seen as a "key driver of the White House's digital asset agenda," believed to lean towards promoting a "relatively friendly but compliance-focused crypto policy route" when coordinating with the Treasury, SEC, CFTC, and DOJ.

Compared to technical details, Hassett tends to express himself from a macro and political economy perspective in public statements. He is categorized as "crypto-friendly" by outsiders, who believe he views digital assets as part of U.S. financial innovation and geopolitical competition, hoping that the U.S. maintains a dominant position in this field.

Dovish "shadow chair," or Trump's puppet?

The biggest controversy surrounding Hassett is not only his "pro-crypto" stance but also whether he will act as an extension of Trump's will in monetary policy, thereby undermining the independence of the Federal Reserve.

From recent speeches and market interpretations, Hassett is generally viewed as a dovish candidate by mainstream institutions. Several bond investors and Wall Street firms have expressed concerns to the U.S. Treasury, believing that if Hassett were to become chair, he might "more actively push for interest rate cuts," even if inflation remains above the 2% target, citing his strong alignment with Trump on the demand for "faster and larger interest rate cuts."

Hassett has publicly stated, "I don't see a strong reason to stop cutting rates now," downplaying inflationary pressures caused by tariffs, and suggesting that they can be offset through longer-term growth and structural measures. From the traditional "hawkish/dovish" classification, Hassett is clearly closer to the dovish end, being "willing to cut rates faster and deeper even in a high-inflation environment," which is one of the key reasons bond market participants hold a cautious or even worried attitude towards him.

Many foreign media reports suggest that regardless of who the candidate is, Trump values whether the person is loyal to him in order to achieve his goal of having the Federal Reserve cut rates. Interestingly, amid doubts about whether he would become Trump's puppet, Hassett himself has repeatedly emphasized the importance of Fed independence in public interviews.

In September 2025, he was directly asked in a CBS program: in a poll, most Republican voters wanted the Fed to "act according to Trump's wishes," while a minority advocated for complete independence; which side did he belong to? Hassett responded that he would choose 100% for monetary policy to be completely independent of political influence, including from President Trump. He also warned that historically, countries that allowed political leaders to control central banks often ended up facing soaring inflation and consumers paying the price.

However, in the same interview, Hassett also stated that he agreed with Treasury Secretary Bessent's view that there should be a "comprehensive review of the Federal Reserve, including its scope of responsibilities and research paradigms," and indicated that if he were to become chair in the future, he would be "prepared to implement this vision." This means that while he emphasizes formal independence, he also agrees with a series of proposals initiated by the Trump administration to "reshape the role of the Federal Reserve"—leaving room for interpretation by outsiders.

Regarding the question of whether he would "become Trump's tool," some analyses point out that Hassett had previously supported carbon taxes, immigration expansion, and free trade—typical mainstream conservative economic positions—but after long-term collaboration with Trump, he gradually shifted to support tariffs, tough immigration policies, and more politically charged economic issues; if such a "highly politicized economic advisor" takes over the Federal Reserve, it would pose a substantial test to the central bank's independence.

The future is difficult to predict, but it is certain that whether Hassett will cater to Trump's demand for "more aggressive rate cuts" in specific decisions will still depend on several constraints: the actual trends in inflation and employment, the voting behavior of other governors and regional Fed presidents, and the financial market's tolerance for potential inflation and fiscal sustainability.

For the crypto market, even if the chair is personally friendly to crypto, the direct influence he can exert is still mainly concentrated in two areas: the overall monetary environment, such as interest rates and liquidity, and his attitude towards financial stability risks related to crypto, such as banks holding crypto exposure and the connection between stablecoins and payment systems.

According to Trump's statement at a cabinet meeting in the White House earlier this month, the nomination for the next Federal Reserve Chair will be announced in early 2026. Although the official result has not yet been disclosed, Kevin Hassett has already stepped into the spotlight, and the market has begun to scrutinize his every word with the standards of "the next chair," preparing for a potentially more "dovish" and more familiar new chair regarding crypto assets.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。