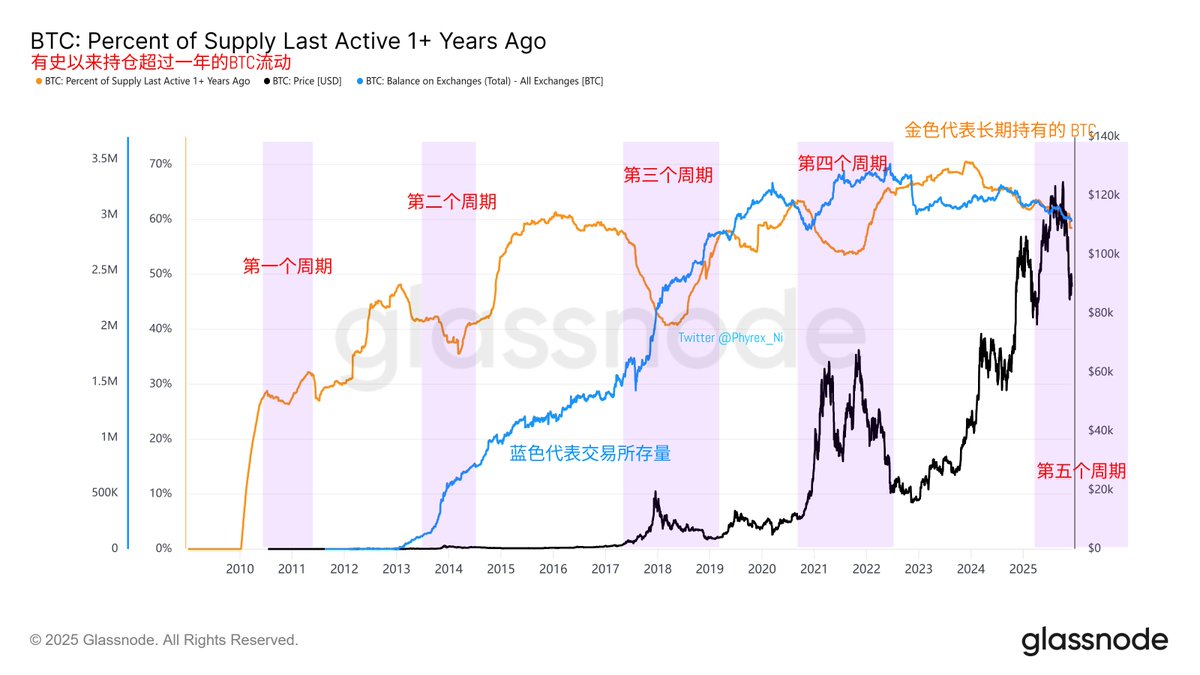

From all historical data, whenever long-term holders capitulate, it often corresponds to a higher range of $BTC prices. However, slightly differently, in the first four cycles, the capitulation of long-term holders corresponded to an increase in exchange inventory, which means that true long-term holders were selling out, and their selling is likely after a price increase.

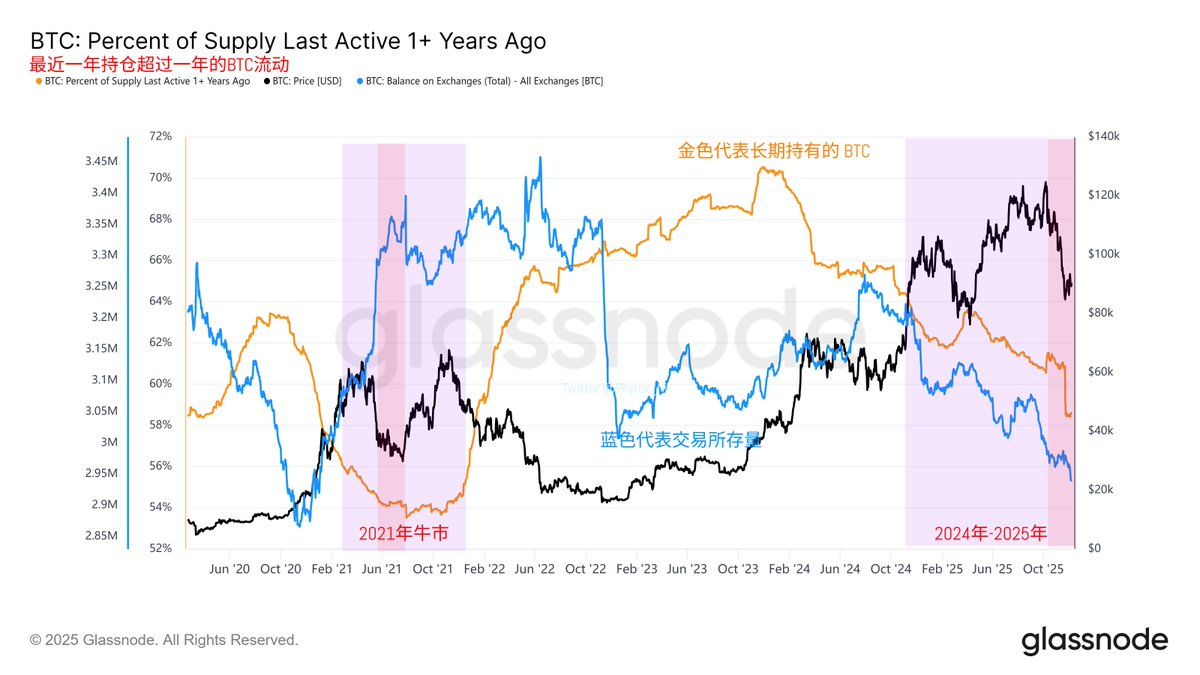

This data has never been wrong in the past; whenever long-term holders start to sell off in concentration, it often corresponds to historical highs for Bitcoin. But this cycle is completely different. Although long-term holders are also selling, the exchange inventory is decreasing, indicating that those truly selling may not be long-term holders, but rather the inventory at exchanges is being consumed.

So for the market now, it should be that long-term holders are continuing to hold, while the exchange inventory is forced to deplete due to reduced selling, which is one of the reasons for the decrease in long-term holders. Therefore, when this data appears in the past, it should indicate a rise in BTC prices, but currently, it is the opposite, which leaves only two possibilities:

This data is no longer following historical patterns.

This data is in the same red zone as in 2021.

A similar situation occurred in 2021, during the significant drop on March 12, and it wasn't until July that it began to gradually rebound. Currently, this situation cannot be ruled out as following the same pattern.

Bitget VIP, lower fees, better benefits

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。