Amir Ormu, an onchain analyst with crypto marketing firm Castle Labs revealed that insiders at crypto artificial intelligence (AI) startup Venice, founded by bitcoin entrepreneur Erik Voorhees, dumped $10.2 million worth of the platform’s Venice token (VVV) right after the cryptocurrency launched last week Monday.

The company touts itself as a privacy-focused, uncensored AI chatbot, powered by open-source large language models (LLMs) such as Llama and Deepseek. The hope is that Venice will provide infrastructure to power crypto AI agents which have become increasingly popular on networks such as Base, where Venice also debuted on the day of its token launch.

But in less than two weeks, VVV has tumbled by nearly 63% overall, peaking at $19.38 a few hours post-launch and crashing to a paltry $2.44 on Feb. 2, according to data from Coin Market Cap. Orma is now accusing the Venice team of dumping tokens on their own community.

“Venice team has sold over $10.2 million in $VVV tokens,” Orma posted on X. “They received tokens four days prior to the launch, and insta[ntly] dumped right after the launch.”

His data shows that sixteen wallets were funded by a Venice team multi-signature wallet that held 23% of the total token supply. Public tokenomics details provided by Venice show that 35% of the total supply of 100 million tokens was granted to the company, with 10% going to the team of which 25% was unlocked upfront, while the remainder will be distributed over two years.

“The announcement blog stated terms of the token clearly,” said Voorhees responding to Ormu’s accusations. “Approximately 2.5% of supply could be sold…A fraction of that 2.5% was actually sold. This was all conveyed upfront.”

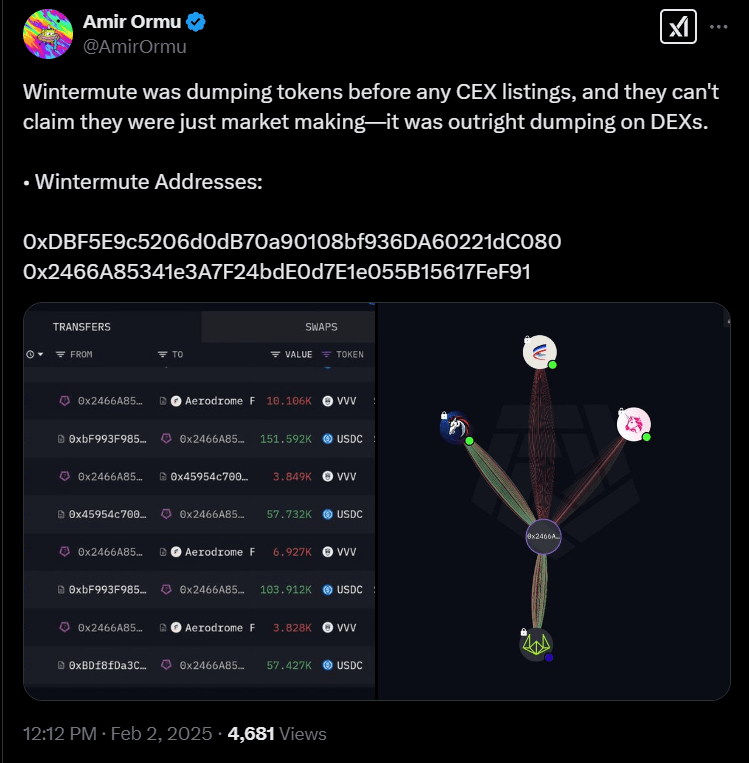

Ormu levied additional accusations about shadowy token deals that he says were not disclosed in the company’s official tokenomics post. He claims 5.5% of the VVV supply was sent to market makers Wintermute and Kbit. This doesn’t seem to contradict what Venice had already publicized, which is that they would allocate 10% to market makers. But Ormu says Wintermute quickly sold its portion before the token had even been listed. In other words, there was no market to make, it was just a cash grab.

“Wintermute was dumping tokens before any CEX listings, and they can’t claim they were just market making, it was outright dumping on DEXs,” Ormu said.

He went on to criticize Coinbase for how quickly it listed a token that, based on Ormu’s allegations, appears almost predatory in how it targets naïve investors who would be unaware of the insider shenanigans taking place behind closed doors. Coinbase CEO Brian Armstrong recently confessed that his company was being overwhelmed by a million token listing requests a week. Ormu may be implying that VVV is one of the bad apples that took advantage of the exchange’s inability to deal with the deluge, but Voorhees disagrees.

“The genesis addresses were all obvious, and everything is onchain and transparent,” Voorhees said.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。