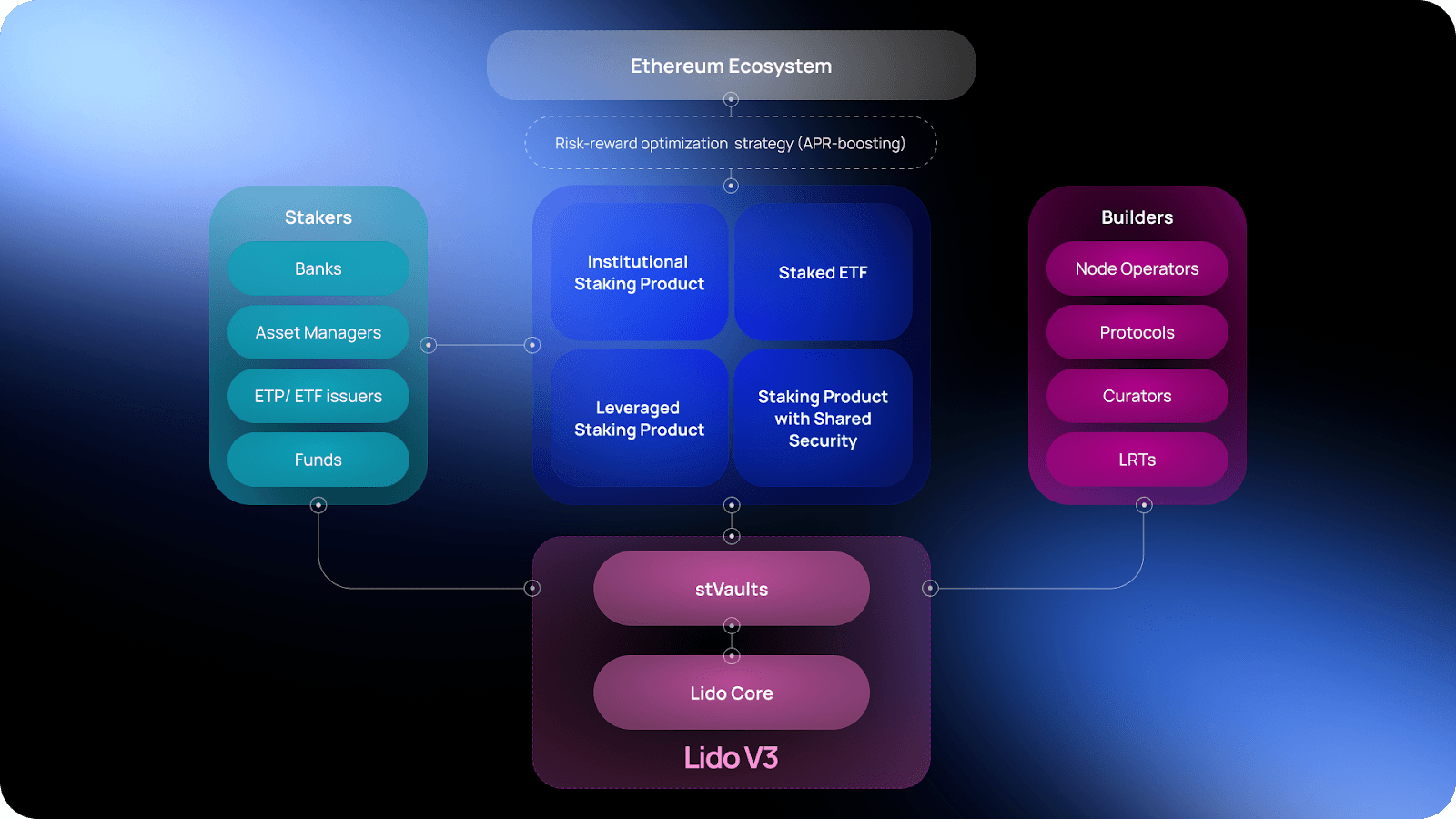

Lido‘s update responds to evolving demands in Ethereum’s staking landscape, where institutional participants seek compliance-tailored setups and advanced users require flexible reward mechanisms. Lido’s previous “one-size-fits-all” model no longer aligns with market diversity, prompting V3’s emphasis on personalization.

stVaults operate non-custodially, letting users stake ETH through chosen node operators while minting STETH. A Reserve Ratio (RR) mechanism requires vaults to maintain over-collateralization, mitigating slashing risks by ensuring STETH remains backed by sufficient ETH. This design integrates with Lido’s existing core protocol, leveraging its liquidity and security.

Institutions can create dedicated vaults with verified node operators for compliance, while asset managers use stVaults to develop structured DeFi products. Node operators gain direct access to high-volume stakers, diversifying revenue streams. The system also supports leveraged strategies via primary or secondary ETH markets.

Lido V3’s rollout occurs in three stages: early adopter testing, a testnet phase, and a mainnet launch enabling institutional setups and shared security configurations. The protocol aims to bolster Ethereum’s decentralization by fostering competition among node operators and spreading stake distribution.

By allowing customizable vaults and voluntary protocol upgrades, Lido V3 seeks to balance liquidity, security, and user sovereignty. The update positions STETH as adaptable collateral within Ethereum’s ecosystem, aiming to sustain Lido’s dominance in liquid staking amid growing competition.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。