On the hourly chart, a tentative rebound emerges: XRP climbed from $2.31 to $2.52 before confronting resistance. Yet, the pattern of diminishing peaks reveals persistent pessimism, amplified by rising liquidation volumes. Failure to breach $2.50 may invite a retreat toward $2.35–$2.30, while conquering this barrier could pave the way for revisiting $2.55–$2.60, though faltering energy lingers.

XRP/USDT via Binance 1H chart on Feb. 12, 2025.

XRP’s four-hour view depicts a stalemate, with prices meandering between $2.30 and $2.50—a testament to market ambivalence. Though selling fervor has cooled, timid accumulation curtails bullish potential. A decisive leap past $2.50 with conviction might challenge $2.60, whereas slipping below $2.30 risks probing $2.15–$2.10. Until then, erratic oscillations dominate.

XRP/USDT via Binance 4H chart on Feb. 12, 2025.

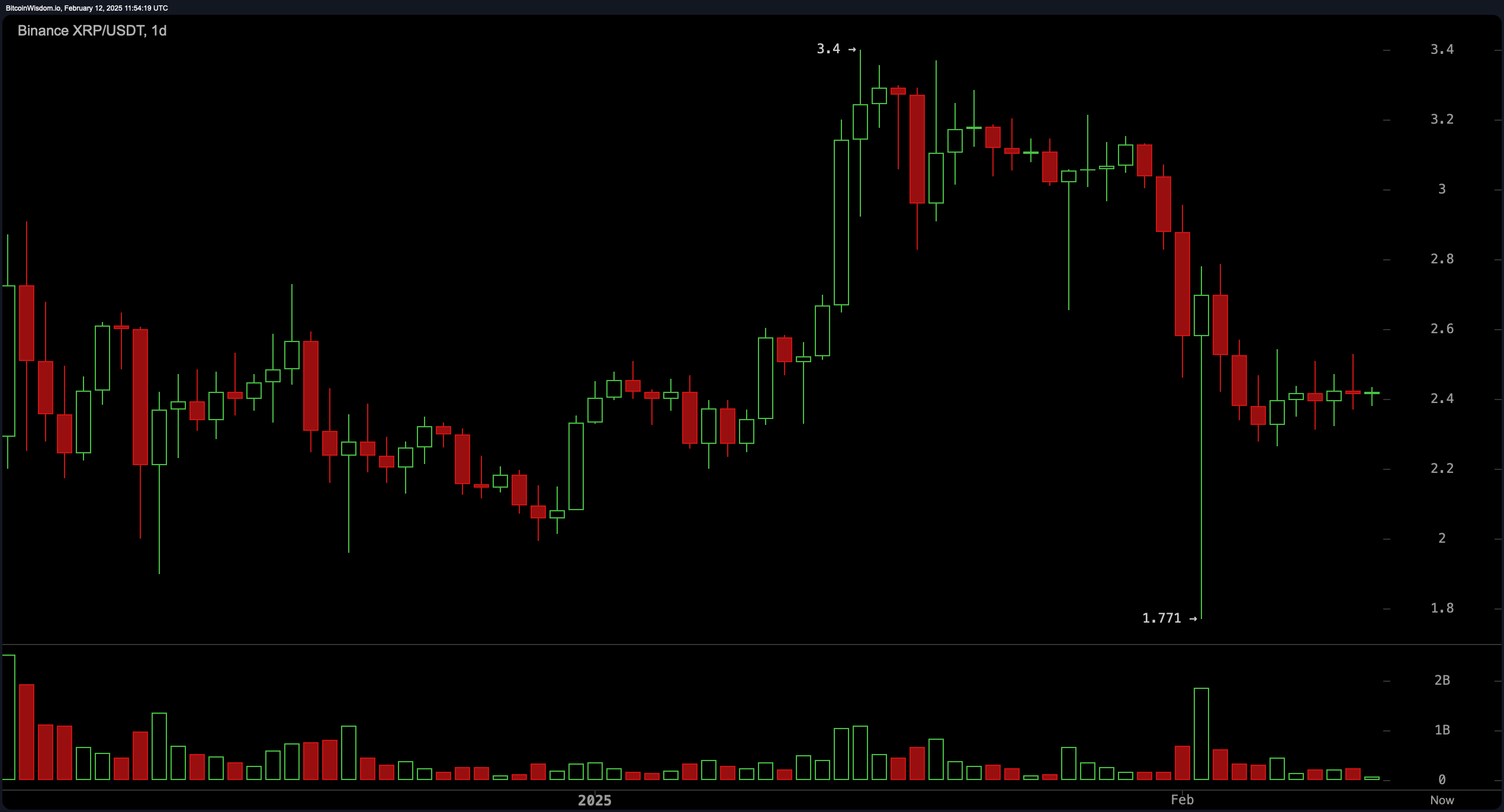

Zooming out, the daily chart unveils an extended corrective cycle after XRP’s ascent to $3.40, now finding equilibrium near $2.40 following a dip to $1.77. Critical support coalesces at $2.15–$2.39, while resistance looms at $2.58–$2.78. Fibonacci ratios imply maintaining $2.39 could present a tactical entry, but losing this foothold might catalyze a slide toward $2.15 or $1.77 in prolonged bearishness.

XRP/USDT via Binance 1D chart on Feb. 12, 2025.

Oscillators broadcast divergent cues: the RSI (39.08), Stochastic (46.27), CCI (-68.83), and ADX (35.96) collectively signal market equipoise. A bearish indication flashes via the awesome oscillator (-0.3765), while momentum (-0.1587) teases ephemeral recovery. The MACD (-0.1126) buttresses a cautious outlook, reflecting tepid upward conviction.

Moving averages lean bearish, with EMAs and SMAs (10–50 periods) uniformly issuing sell signals. However, the 100-period EMA (2.1978) and 200-period EMA (1.6744) whisper of underlying resilience. Sustained pressure may prolong lateral movement, demanding an upside breach of pivotal resistance thresholds to rekindle bullish ardor.

Bull Verdict:

Despite current consolidation, XRP holds key support levels and could see a breakout if it reclaims $2.50 with strong volume. Oscillators remain neutral, suggesting potential for a reversal, while long-term moving averages indicate underlying support. A successful push above $2.60 could shift momentum toward $2.78 and beyond, making the short-term outlook cautiously bullish.

Bear Verdict:

XRP remains under selling pressure, with lower highs forming and key moving averages signaling continued downside risk. The failure to break above $2.50 increases the likelihood of a decline toward $2.30 or lower, with strong support near $2.15. Until a bullish breakout occurs, the market remains vulnerable to further corrections, favoring a bearish outlook.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。