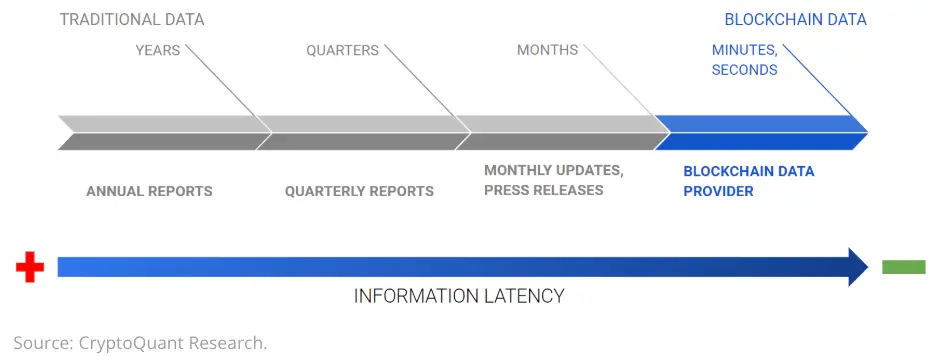

A recent cryptoquant.com analysis reveals exceptional precision in monitoring output and reserves, presenting an agile instrument for evaluating fiscal stability during market turbulence. Cryptoquant notes that conventional financial documentation for mining enterprises—including quarterly submissions and yearly summaries—frequently grapples with notable data delays.

Blockchain intelligence, however, collapses these lags from protracted intervals to mere moments, empowering stakeholders to scrutinize metrics like daily bitcoin (BTC) yield and earnings instantaneously. The firm’s bespoke tagging framework pinpoints blockchain addresses tied to entities like MARA, Riot, and Hive with “near 100% accuracy,” per their findings.

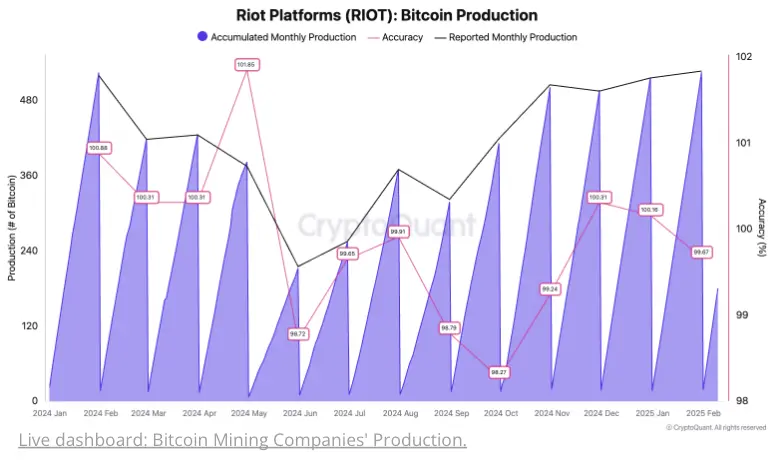

Such meticulous oversight permits independent verification of output assertions, curtailing overreliance on corporate pronouncements. Eight leading publicly traded miners now feature on Cryptoquant’s dashboards, which showcase live metrics alongside archival patterns. One illustrative example from Cryptoquant’s research demonstrates blockchain data’s exactitude.

Between Jan. 2024 and Jan. 2025, their real-time tracking of Riot’s daily bitcoin yield synchronized with corporate month-end disclosures at a 99.85% match rate. Marginal deviations—often tied to rounded figures in official statements—bolster blockchain’s credibility for instantaneous equity evaluation.

Terawulf (WULF) exemplifies blockchain analytics’ diagnostic prowess. Cryptoquant spotted a near-total output halt from Jan. 21–23, 2025, later explained by the firm as maintenance-related. Preceding this, daily yields averaged 5.08 Bitcoin from Dec. 1, 2024, to Jan. 20, 2025, rebounding by early February—a narrative traditional reports disclosed weeks post-fact.

Aggregate precision across monitored miners sits at 99.7% over 12 months, per the study, with firm-level metrics spanning 95% to 104%. Slight divergences, typically from rounding conventions, affirm blockchain’s reliability for live fiscal scrutiny. Analysts stress this erodes “asymmetric information” hazards for market participants.

Cryptoquant’s conclusions posit blockchain analytics as a potential tectonic shift in equity research for crypto mining businesses. By delivering minute-by-minute updates on output and inventories, this approach neutralizes delays plaguing traditional disclosures. The firm contends such immediacy is indispensable as Bitcoin mining matures, advocating for real-time tools to decode the sector’s volatility and intricate operational dynamics.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。