一个不小心写大哥的故事太投入了,写完看时间美股都停盘了,作业还没交,每次都想早点交,结果每次都很晚。今天的市场还是不错的,虽然盘前股指期货走的并不好,但是进入欧洲时间以后股指期货几乎完成了从下跌到上涨的逆转,尤其是公布了零售数据后,纳指和标普到收盘走势是都是不错的。就连 Bitcoin 都几乎突破到了 85,000 美元。

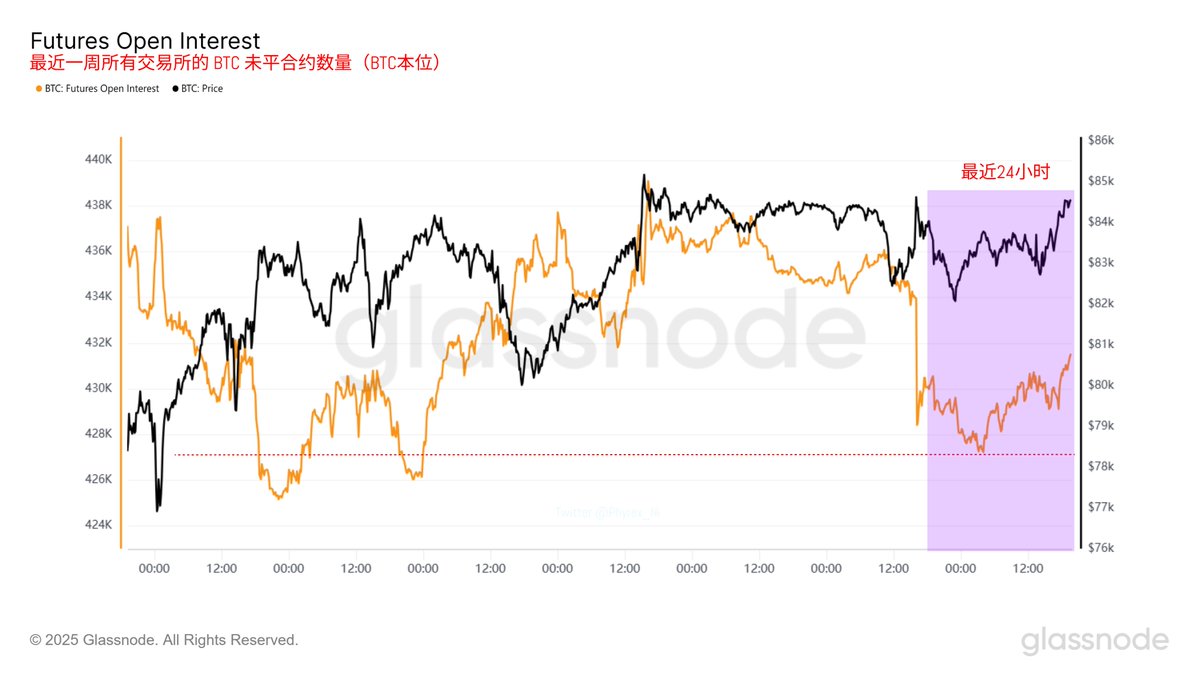

随着价格的上涨,投资者的情绪也开始调动起来,从 Bitcoin 的未平合约可以发现,最近24小时未平合约已经有了上涨的趋势,投资者又开始了对多空的博弈,不过现在应该都是小打小闹,真的能决定短期价格走势的还是20日的议息会议。

议息会议的重要性已经说了好几天了,点阵图,衰退和缩表就是这次的主要叙事,可能全世界的投资者都在关注这次美联储的议息会议,这次调整利率是几乎不可能的,应该也没有人会保有期望,重点还是要看鲍威尔的讲话。

是反转还是反弹,可能20日给不了最终的结果,但是对于短期来说必然是一个机会,至于怎么选就要看小伙伴们自己的了。

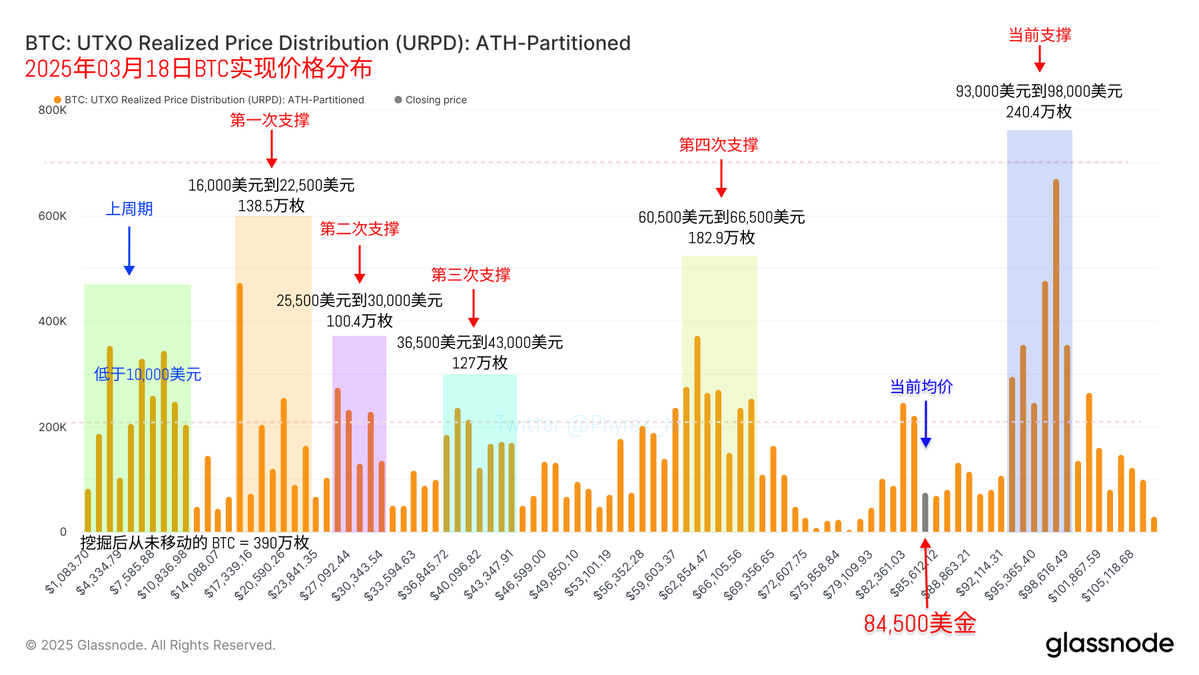

回到 #Bitcoin 的数据来看,虽然已经是工作日了,但换手仍然并不多,可能是连续上涨的结果,很多投资者都降低了换手的频率,即便是短期投资者都没有着急参与换手,也有可能是因为市场对于20日的预期不错,如果真的能如市场预期一般,现在这个价格买入盈利还是有机会的。

换手率低,就像周末一样,自然对于支撑就没有破坏,93,000美元到98,000美元的密集筹码区仍然非常的完好,并没有看到恐慌的迹象,不过 83,000美元左右的筑底虽然还很稚嫩,但已经开始显示出来了,如果在多震荡几个月,估计筑底就会下移了。

当然市场未必会给这么久的时间,先过了20日再说吧,市场的情绪也都集中在这个时间了。

数据已更新,地址:https://docs.google.com/spreadsheets/d/1E9awSVwrVOxKOiaMdYT5YZvfveeFd9ENU-iO6dVcGj0/edit?usp=sharing

本推文由 @ApeXProtocolCN 赞助|Dex With ApeX

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。