Overall, this quarter may become the low point for cryptocurrency prices in 2025.

Author: David Duong, CFA - Global Head of Research

Compiled by: Tim, PANews

The market conditions in recent weeks have shaken our confidence in a more optimistic outlook for the first quarter of 2025 (a view previously expressed in December 2024), as tightening liquidity and macroeconomic uncertainty have eroded investor confidence. The current market consensus seems generally pessimistic, reflected in the total cryptocurrency market capitalization falling below pre-U.S. election levels, as well as a significant drop in perpetual contract funding rates. We do believe that the speed and magnitude of this market correction have left many investors feeling bewildered.

The current pessimistic market sentiment is primarily driven by concerns over the unstable trajectory of economic activity, especially after many investors have overly focused on the "American Exceptionalism 2.0" narrative in recent months. In terms of the crypto market, the momentum of special positive factors seems to have slowed, causing anxiety among many market players. However, we believe that the current pessimistic sentiment is an important signal that the market may bottom out in the coming weeks, laying the groundwork for new highs later in the year.

Note: American Exceptionalism is one of the core ideologies throughout American history, asserting that the United States has a uniqueness or even superiority in political systems, values, and development paths compared to other countries. This concept has shaped America's national identity and profoundly influenced its domestic and foreign policies.

Global liquidity is beginning to recover, and the decline in real and nominal interest rates should ultimately help lower borrowing costs. We also believe that long-term trends are likely to continue supporting global growth in the future. That said, we think the crypto market is unlikely to achieve an effective rebound before traditional risk assets recover, so we are closely monitoring whether the U.S. stock market shows signs of capitulation selling. Compared to survey data, the earnings season (April) may provide a more accurate measure of the true state of American consumers. We will continue to maintain an optimistic outlook for the second quarter of 2025, but we advise investors to adopt a neutral stance on risk assets for now.

When will it bottom out?

Despite the recent emergence of many positive factors in the cryptocurrency space, such as the repeal of SAB 121 and the formal establishment of Bitcoin strategic reserves, the crypto market has remained weak since the beginning of the year. Additionally, the SEC has recently withdrawn multiple lawsuits against several crypto entities, including Coinbase, and the "Stablecoin Innovation and User Safety Act" may be submitted to the U.S. House of Representatives and Senate for review in the summer of 2025.

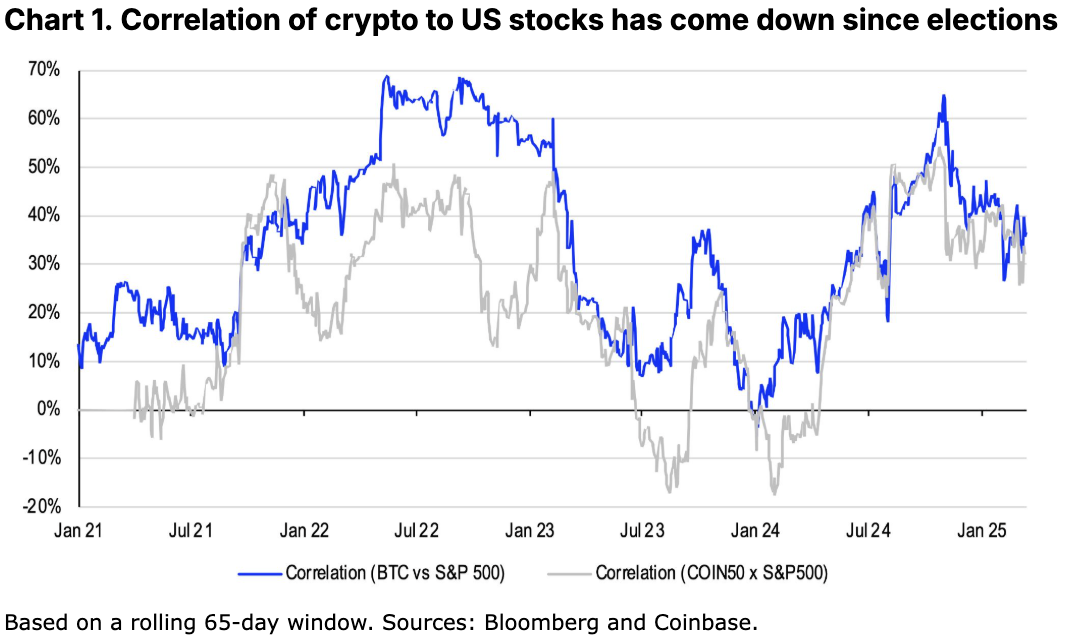

Although regulatory news has been positive, many market players are concerned that the unique catalytic effects in the crypto space are diminishing. This has led macro factors to become the dominant force, with the correlation between the crypto market and U.S. stocks rising. Indeed, the recent correlation between traditional risk assets and the crypto market clearly indicates that our previous optimistic outlook for the first quarter of 2025 was evidently a misjudgment.

Concerns over a sharp slowdown or even recession in the U.S. economy have led to a rapid decline in market sentiment, answering the question we raised in our monthly outlook: whether market participants would view the impact of tariffs as inflationary or deflationary. Currently, expectations for the federal funds rate have shifted from pricing in just one rate cut in 2025 to three.

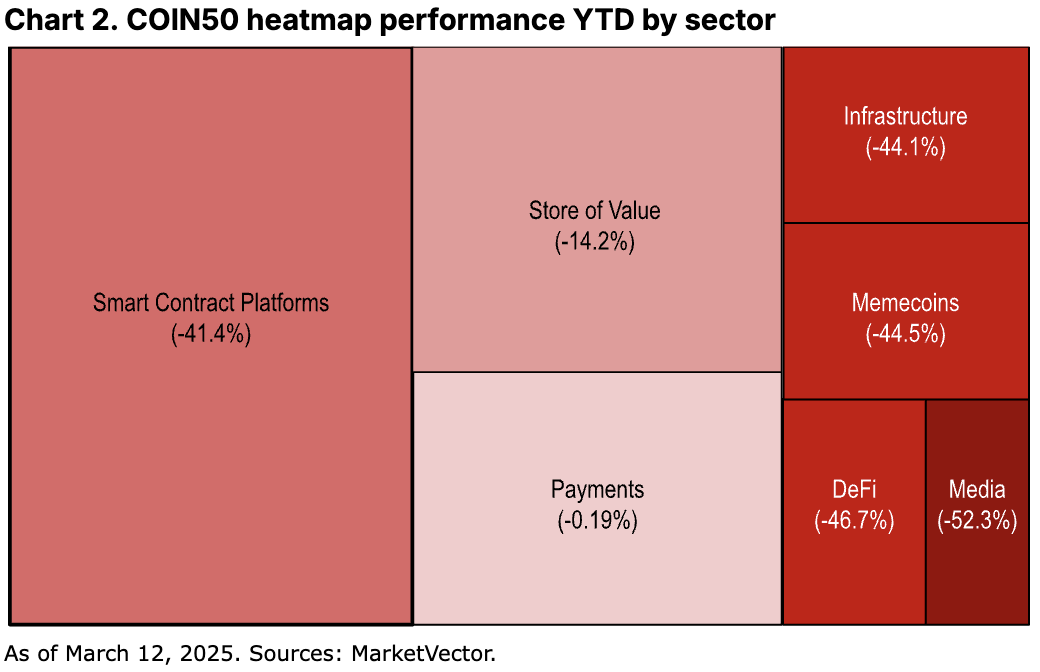

This round of sell-off has caused our Coinbase 50 (COIN50) index to drop 25.5% year-to-date, with a total evaporation of $532 billion in the cryptocurrency market capitalization. Interestingly, except for the media and entertainment sector, the impact of market volatility on various sub-sectors within the index has not been significantly different. DeFi, Memecoin, and infrastructure sectors have all experienced similar degrees of severe corrections. This phenomenon highlights the widespread risk-averse sentiment across the entire market, with no selective consideration of the fundamentals and revenue capabilities of different projects.

Overall, we believe this quarter may become the low point for cryptocurrency prices in 2025, as structural positive news such as tax cuts, regulatory easing, and other stimulative fiscal policies may materialize later this year. The current stablecoin balance has risen to $229 billion (data source: DeFiLlama), indicating that a large number of investors are seeking refuge by shifting to stablecoins, pushing the market capitalization of stablecoins to account for 8.5% of the total cryptocurrency market capitalization (up from 6.3% at the beginning of the year). Furthermore, we believe that long-term trends such as artificial intelligence are likely to soon fulfill their promise of enhancing economic productivity.

Cognitive Bias

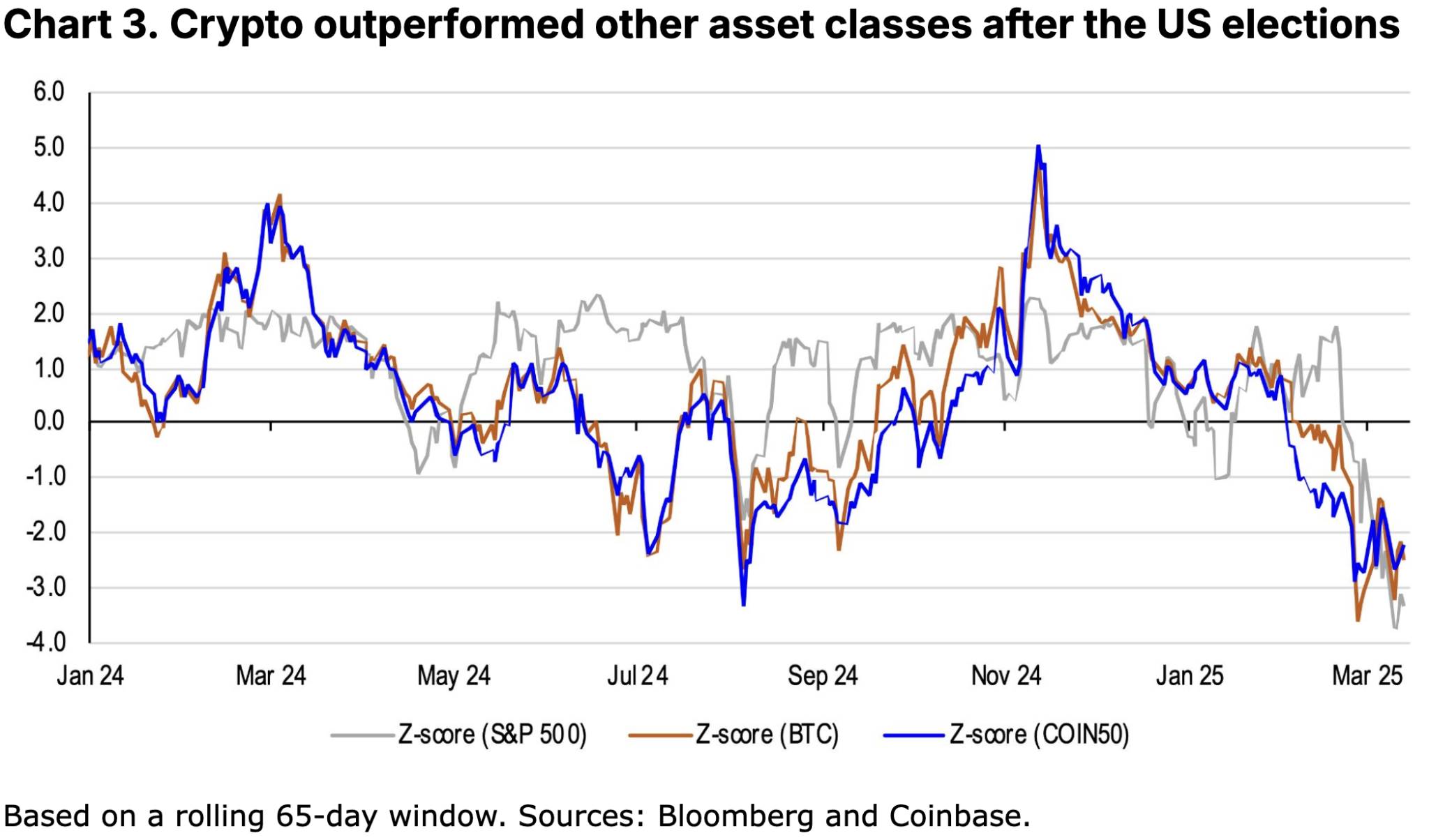

Additionally, we do not believe that the weak performance of cryptocurrencies in recent weeks is an abnormal divergence from today's macro tightening conditions. On the contrary, the real divergence is reflected in the performance differences between crypto assets and traditional risk assets during the period from November 2024 (U.S. election) to January 20, 2025 (presidential inauguration). Although the liquidity environment has gradually tightened since the second half of 2024, the market prices represented by the COIN50 index have cumulatively risen over 67% during this period (see Chart 3).

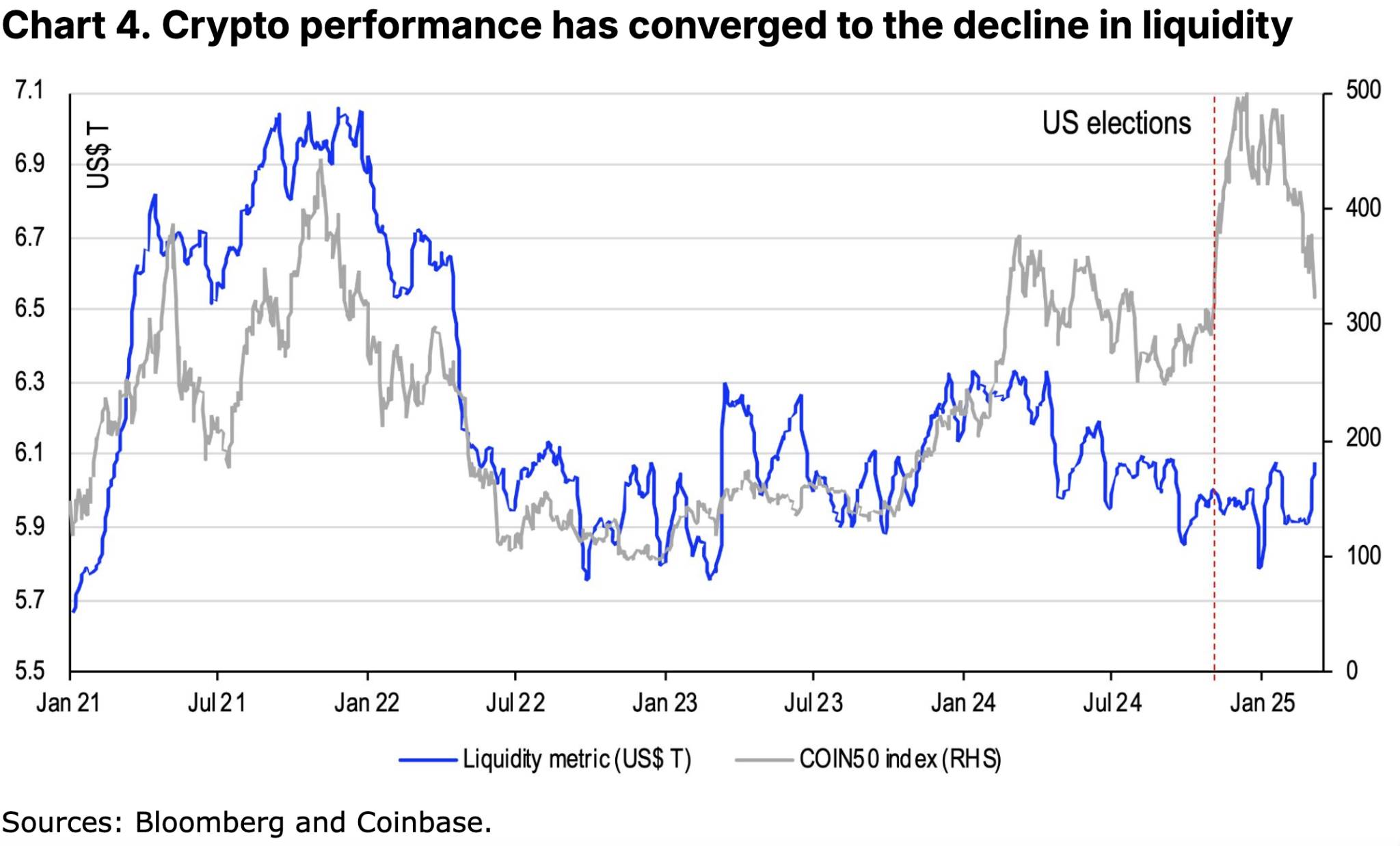

If we focus on the total assets of the Federal Reserve's balance sheet, excluding reverse repos and the Treasury General Account (TGA) balance, this serves as a market liquidity indicator. This indicator has fallen from $6.2 trillion in early June 2024 to nearly $5.7 trillion at the beginning of 2025, a decline of over $500 billion (see Chart 4). Generally, the expansion of the Federal Reserve's balance sheet injects liquidity into the market, while reverse repo operations help absorb excess liquidity in the banking system, and an increase in TGA balance reduces the available cash levels in the financial system.

Liquidity is the lifeblood of any market, as it guides savings funds to borrowers by promoting increased investor participation, leveraging effects, and improving price discovery mechanisms. Conversely, liquidity contraction often suppresses trading activity and can lead to sharp price fluctuations. However, despite the continued decline in liquidity in the second half of 2024, the core factor triggering significant fluctuations in cryptocurrency prices is the market's expectation of a major shift in the U.S. regulatory environment— the U.S. election represents a key event with relatively binary outcomes for investors. We believe that the recent sell-off in the crypto market largely reflects a return to a low liquidity trend in prices.

In our view, this may be a potential positive signal. Over the past two months, the balance of the Treasury General Account (TGA) has decreased from $745 billion at the end of 2024 to $500 billion on March 12, which has allowed liquidity levels to rise above $6 trillion. Additionally, the current bank reserve levels are close to 10-11% of GDP, which is generally considered sufficient to maintain financial stability, suggesting that the Federal Reserve may decide to pause or terminate its quantitative tightening policy as early as the Federal Open Market Committee (FOMC) meeting on March 18-19.

All these signs suggest that market liquidity may be returning. The yield on the U.S. 10-year Treasury bond is expected to decline further, as U.S. Treasury Secretary Yellen has made it clear that this administration is committed to lowering long-term interest rates. We believe it is best not to question her policy determination. From the perspective of the Federal Reserve model, a decline in yields will enhance the present value of future cash flows from risk assets such as stocks, which may also drive up cryptocurrency prices.

Conclusion

The cryptocurrency market is currently facing significant challenges due to increased volatility and macroeconomic uncertainty. Nevertheless, we still believe that accelerated regulation and increased institutional participation bring a more optimistic outlook for the coming months. Furthermore, in the context of liquidity shifting from tightening to easing after nearly six months, the speed at which cryptocurrency prices may bottom out could be faster than most market participants expect. Therefore, we adopt a constructive stance on the crypto market for the second quarter of 2025. However, short-term positive catalysts remain limited, and it is best to maintain a cautious attitude at this stage.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。