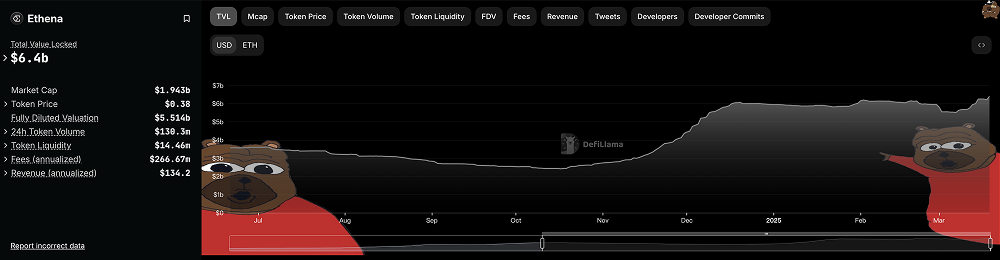

According to the latest data from the data platform DeFiLlama, the total locked value (TVL) of the Ethena protocol has increased by over 10% in the past week, reaching an astonishing $6.3 billion. This achievement not only marks Ethena as the current fourth-largest DeFi protocol but also places its TVL above any single public blockchain network other than Ethereum and Solana. This phenomenon has sparked widespread attention in the industry, with Ethena's rise seen as a symbol of a new round of competition in the DeFi space, while also reflecting the increasingly complex interweaving relationship between stablecoin protocols and public chain ecosystems.

Ethena's Rapid Growth and TVL Milestone

Ethena is a synthetic dollar protocol based on Ethereum, with its core product USDe being a stablecoin that does not rely on traditional banking infrastructure, quickly emerging since its launch in 2024. According to the latest data from DeFiLlama, Ethena's TVL surpassed $6.3 billion this week, outpacing many well-known DeFi protocols including PancakeSwap and Jupiter, only behind stablecoin giants like Tether (USDT) and Circle (USDC), as well as leading protocols like Aave. The speed of this growth is remarkable, especially considering that Ethena has secured its place in the competitive DeFi market in less than a year since its launch.

Notably, Ethena's TVL has exceeded that of all public chain networks except for Ethereum and Solana. Ethereum, as the birthplace of DeFi, still holds the top spot with a TVL of over $50 billion; while Solana, with its high performance and low-cost advantages, has a TVL close to $7.5 billion. However, other mainstream public chains like Tron and BNB Chain have significantly lower TVLs compared to Ethena. This data indicates that Ethena is not only standing out among DeFi protocols but is also challenging the traditional status of public chain ecosystems to some extent.

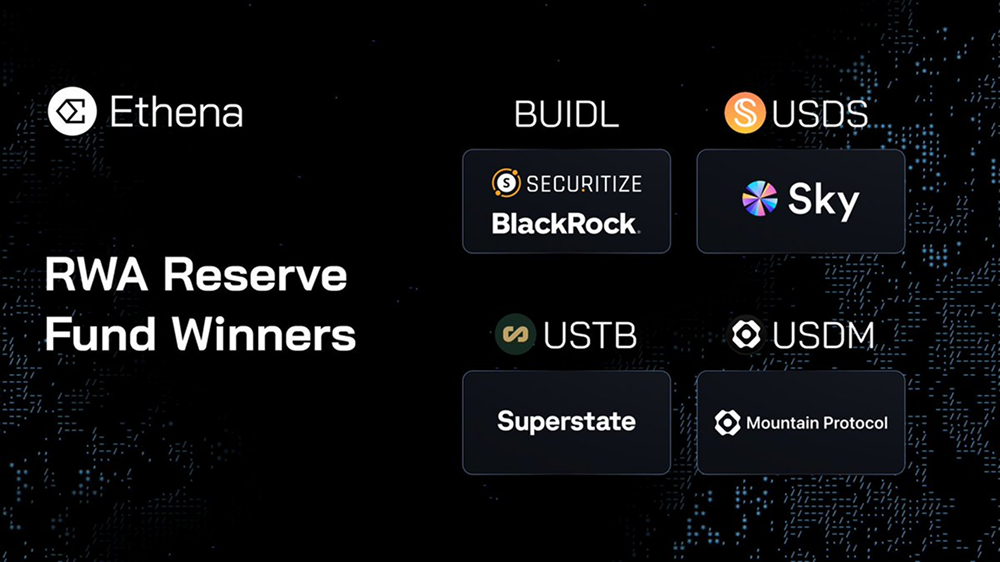

The surge in Ethena's TVL is not coincidental. Recently, the protocol's layout in the real-world asset (RWA) sector has become a significant driving force for its growth. It is reported that Ethena has partnered with asset tokenization company Securitize to launch the Converge blockchain and has invested part of its funds into BlackRock's tokenized U.S. Treasury fund BUIDL, which alone has brought Ethena hundreds of millions in TVL increments. Additionally, its newly launched stablecoins USDtb and iUSDe have attracted considerable attention from both institutional and retail investors, further solidifying its market position.

Ethena's Unique Advantages and Strategic Layout

Ethena's core competitiveness lies in its innovative stablecoin model and profound insights into the integration of traditional finance (TradFi) and DeFi. USDe, as a synthetic dollar, generates returns by leveraging the price differences between spot and futures markets (i.e., basis trading strategy), allowing it to maintain stability and profitability without traditional bank support. Meanwhile, Ethena collaborates with traditional financial giants like BlackRock to introduce tokenized assets into the DeFi ecosystem, providing institutional investors with a secure and compliant entry channel.

On March 17, 2025, Ethena Labs and Securitize jointly announced the launch of the Converge blockchain, a Layer-1 network compatible with the Ethereum Virtual Machine (EVM), focusing on retail and institutional-level DeFi and RWA applications. Converge not only supports the staking of Ethena's native governance token ENA (in the form of sENA) but also uses USDe and USDtb as the network's fuel tokens (gas tokens). This design not only enhances the internal circulation of the Ethena ecosystem but also provides a bridge for traditional financial institutions to interact with DeFi.

Furthermore, Ethena's recent successes in fundraising and partnerships have injected strong momentum into its growth. In just the past month, Ethena secured a $36 million investment from MEXC Ventures (including $16 million in direct investment and $20 million in USDe purchases) and $10 million in financing to launch the institutional-focused iUSDe stablecoin. The influx of these funds and resources has enabled Ethena to rapidly expand its product line and attract more users.

New Competitive Landscape Between DeFi and Public Chains

Ethena's rise not only reshapes the internal rankings of DeFi protocols but also prompts a rethinking of the relationship between DeFi and public chains. Traditionally, public chain networks like Ethereum, Solana, and Tron accumulate TVL by hosting various DeFi protocols, with the prosperity of their ecosystems directly determining the level of TVL. However, Ethena's case indicates that an independent DeFi protocol can potentially surpass the TVL scale of most public chains through innovative product design and strategic partnerships. Public chains like Tron, once known for high TVLs, now face the awkward situation of being surpassed by Ethena. This phenomenon may suggest that future blockchain competition will no longer be limited to battles between public chains but will extend to the interplay between DeFi protocols and public chains.

Industry experts point out that Ethena's success is closely related to its focus on stablecoins and RWAs. Stablecoins, as the cornerstone of DeFi, have always been at the core of user and capital flow, while the introduction of RWAs opens the door to traditional finance for DeFi. In contrast, many public chains overly rely on decentralized exchanges (DEXs) or the short-term hype of meme coins in their ecosystem expansion, lacking long-term sustainable growth momentum. Ethena has found a unique differentiated path by combining the stability of stablecoins with the compliance of RWAs.

Market Response and Future Outlook

The news of Ethena's TVL surpassing $6.3 billion has sparked enthusiastic discussions within the crypto community. On the X platform, @DefiLlama posted, "Ethena has now become the fourth-largest DeFi protocol, with its TVL exceeding that of any public chain other than Ethereum and Solana." This statement quickly garnered thousands of shares and likes. @0xCoumarin commented, "Ethena's RWA business is its safety net for maintaining its leading position in the stablecoin protocol space, while other DeFi leaders like Aave and Pendle are also striving to attract RWAs and traditional capital."

However, Ethena's rapid rise has also been accompanied by some controversy. Due to its yield generation relying on basis trading strategies, its long-term sustainability is subject to market conditions, and some analysts warn that if market volatility increases, Ethena's model may face challenges. Additionally, its early associations with centralized exchanges like Bybit (although it has since reduced related exposure to zero) have raised community concerns about its risk management.

Despite this, most industry insiders hold an optimistic view of Ethena's future. Analysis firm Messari noted in its latest report that Ethena's TVL growth reflects strong market demand for synthetic dollars and tokenized assets, and the launch of the Converge blockchain may further solidify its position in the institutional market. Predictions suggest that by the end of 2025, Ethena's TVL could exceed $10 billion, potentially challenging Solana's position as the second-largest ecosystem.

Conclusion

With a TVL of $6.3 billion, Ethena ranks as the fourth-largest DeFi protocol, surpassing all public chain networks except for Ethereum and Solana. This achievement not only highlights its strong momentum in the DeFi space but also brings new reflections for the entire blockchain industry. As competition between DeFi and public chains intensifies, Ethena's innovative model and strategic vision undoubtedly set a new benchmark for the market. As its ecosystem continues to expand and deepen its integration with traditional finance, Ethena's next moves are worth close attention from global investors.

This article represents the author's personal views and does not reflect the stance or views of this platform. This article is for informational sharing only and does not constitute any investment advice to anyone.

AiCoin official website: www.aicoin.com

Telegram: t.me/aicoincn

Twitter: x.com/AiCoinzh

Email: support@aicoin.com

Group chat: Customer Service Yingying、Customer Service KK

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。