Naked K trading only looks at K lines, and K lines are the first-hand data of all trading processes; they are the most authentic representation of trading data!

Understanding K lines is an important technical analysis skill. By studying the trajectory of cryptocurrency prices, one can infer future directions based on historical K line patterns. Using naked K can help find clear trading logic and rules!

Classification of K Lines

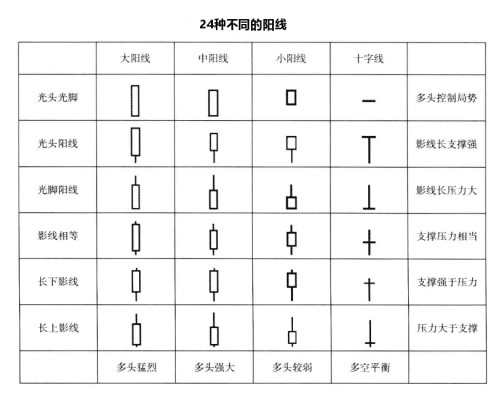

From the market perspective, various K line patterns may seem complex and chaotic, but in summary, there are only 24 different bullish lines and 24 different bearish lines. As shown in the figure below.

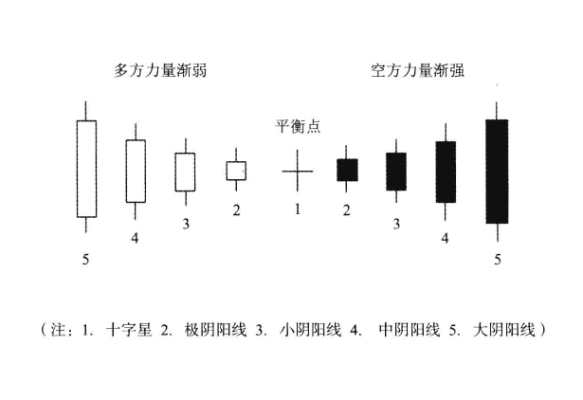

Based on the fluctuation range of opening and closing prices, K lines can be divided into eight types according to the size of the bullish and bearish line bodies: large bullish/bearish lines, medium bullish/bearish lines, small bullish/bearish lines, and small star lines (extreme bullish/bearish lines). As shown in the figure below.

Meaning of K Lines (1)

K lines contain a wealth of information, embodying rich Eastern philosophical thoughts. Before analyzing the meaning of K lines, one should understand the market implications contained in each K line.

Large Bullish Line

This type of K line has a closing price significantly higher than the opening price, with no upper or lower shadows or very short upper shadows. From the moment the market opens, buyers actively attack. There may be struggles between buyers and sellers in between, but buyers always maintain market dominance, causing prices to rise until the close.

A large bullish line indicates a strong upward trend, with the market experiencing a surge. Holders are reluctant to sell due to the strong momentum of buyers, leading to a situation of supply not meeting demand.

Large Bearish Line

This type of K line has a closing price significantly lower than the opening price, with no upper or lower shadows or very short shadows. After the market opens, sellers dominate, and the market enters a downturn. Holders sell off frantically regardless of price, creating a panic mentality. The market is one-sided until the close, with prices continuously falling, indicating a strong downward trend.

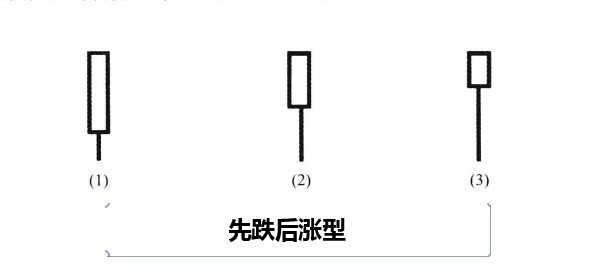

First Down Then Up Type

This is a K line with a bullish body and a lower shadow, where the highest price is the same or close to the closing price.

After the market opens, there is severe selling pressure, causing prices to drop, but strong support from buyers at low prices severely frustrates sellers. After breaking above the opening price, prices continue to rise until closing at the highest point or nearby.

Overall, the appearance of a first down then up type K line indicates strong buying power, but the length of the body compared to the lower shadow shows a difference in the strength of buyers and sellers. As shown in the figure below.

If the body is longer than the lower shadow, it indicates that the price did not drop much after opening and was supported by buyers, followed by continuous price increases, breaking above the opening price, and a significant surge, indicating strong buying power.

If the body is equal to or close to the lower shadow, it indicates fierce battles between buyers and sellers, but overall, buyers dominate at low levels, making the market situation favorable for buyers.

If the body is shorter than the lower shadow, it indicates fierce battles between buyers and sellers at low prices, with prices gradually pushed up by buyer support. However, as seen in the figure, the body is relatively small, indicating that the advantage of buyers is not significant. If sellers launch a full counterattack, the buyer's body can easily be broken.

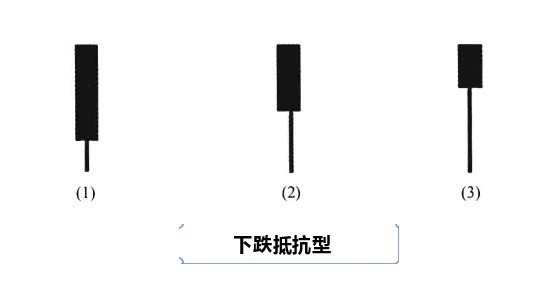

Downward Resistance Type

This is a K line with a bearish body and a lower shadow, where the opening price is equal to or close to the highest price.

At the opening, selling pressure is particularly strong, causing prices to continuously fall, but encountering buyer support at low prices leads to a rebound, indicating a possible future market reversal.

Similarly, based on the comparison of the lengths of the body and lower shadow, it can be divided into three situations. As shown in the figure below.

If the body is longer than the lower shadow, it indicates significant selling pressure, with a sharp drop at the opening, encountering buyer resistance at the low point, leading to fierce battles between buyers and sellers, resulting in a price rebound, but the upward momentum is weak, leading to a shorter lower shadow. This pattern indicates that buyers are not pushing prices up much, and overall, sellers remain dominant.

If the body is equal to or close to the lower shadow, it indicates that sellers have pushed prices down, but buyer resistance is increasing, although sellers still hold the advantage.

If the body is shorter than the lower shadow, it indicates that sellers have pushed prices down significantly, encountering strong buyer resistance at low prices. Buyers counterattack strongly, gradually pushing prices up. Although it closes as a bearish line, it shows that sellers only hold a slight advantage. If buyers launch a full attack in the future, they can easily overcome the small body of the bearish line.

Upward Resistance Type

This is a K line with a bullish body and an upper shadow, where the opening price is equal to or close to the lowest price.

At the opening, buyers strongly push prices up, but encounter selling pressure at high prices, causing prices to retreat. After battles between buyers and sellers, buyers have a slight edge. Similarly, the different lengths of the K line body and upper shadow reflect different market conditions, which can be divided into three types, as shown in the figure below.

If the bullish body is longer than the upper shadow, it indicates that buyers encounter resistance at high prices, with some bulls taking profits. However, buyers remain the dominant force in the market, and the outlook remains bullish.

If the bullish body is equal to or close to the upper shadow, it indicates that buyers have pushed prices up, but selling pressure is also increasing. After the battle, sellers have pushed prices down by half. This pattern indicates that while buyers dominate the market, they are clearly not as strong as in the first case.

If the bullish body is shorter than the upper shadow, it indicates that after a significant price increase, buyers encounter a full counterattack from sellers, leading to a significant price drop, putting buyer strength to a severe test.

Meaning of K Lines (2)

First Up Then Down Type

This is a K line with a bearish body and an upper shadow, where the closing price is equal to or close to the lowest price.

At the opening, buyers engage in battle with sellers, gaining the upper hand and pushing prices up, but encounter selling pressure at high prices. Subsequently, sellers organize a counterattack, and buyers retreat step by step, ultimately closing at the lowest price after breaking below the opening price, indicating that sellers dominate the market, putting buyers in a difficult position. The specific situations of the first up then down type are as follows, as shown in the figure below.

If the bearish body is longer than the upper shadow, it indicates that buyers did not push prices up much and encountered strong counterattacks from sellers, breaking below the opening price and pushing prices down significantly. This pattern indicates that sellers are particularly strong in the market and hold the advantage.

If the bearish body is equal to or close to the upper shadow, it indicates that while buyers pushed prices up, they encountered strong selling resistance, and although sellers are not as strong as in the first case, they still hold a dominant position in the market.

If the bearish body is shorter than the upper shadow, it indicates that after a significant price increase, buyers encounter strong counterattacks from sellers, leading to a price drop. Although sellers strive to push prices down, their advantage is not significant compared to buyers. Buyers may organize a counterattack, and the bearish body is likely to be broken.

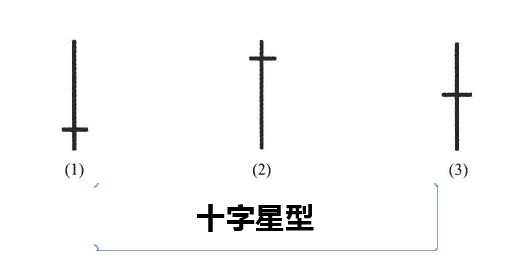

Cross Star Type

This is a K line with only upper and lower shadows, with no body or a very small body.

The opening price is equal to or close to the closing price, indicating that during trading, prices have exceeded the opening price but ultimately close at or near the opening price, showing that buyers and sellers in the market are almost evenly matched.

The longer the upper shadow, the heavier the selling pressure. The longer the lower shadow, the stronger the buying power. A cross star K line appearing at high or low prices indicates that the market may reverse.

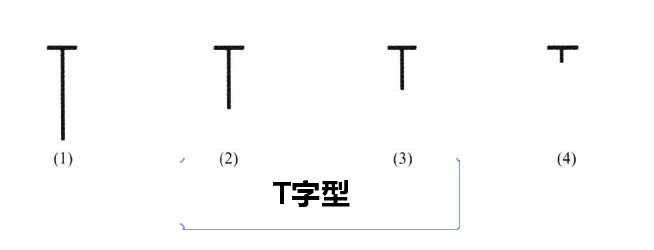

T Type

The opening price and closing price are the same, with transactions occurring below the opening price, but ultimately closing at the opening price as the highest price.

This pattern indicates that while selling pressure is strong, buying power is even stronger, making the situation favorable for buyers. If this pattern appears in a low price area, it indicates that the market will rebound.

The length of the lower shadow in this K line can also reflect the strength of buying power. Generally, the longer the lower shadow, the stronger the selling power; the shorter the lower shadow, the stronger the buying power. (This differs from the general shadow identification rules. In general K line patterns, a longer lower shadow indicates stronger buying power. As shown in the figure below, buying power increases sequentially while selling power decreases.)

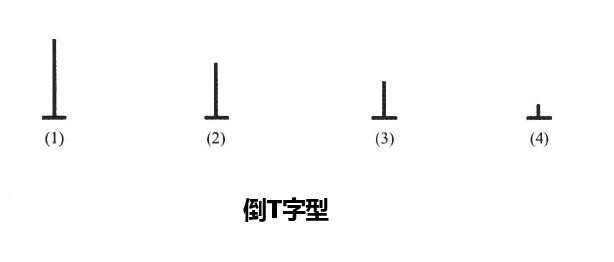

Inverted T Type

The inverted T type is the exact opposite of the T type. This pattern indicates that while buying power is strong, selling power is even stronger, and buyers are unable to push prices up further, indicating that sellers hold a slight advantage. If this pattern appears in a high price area, it suggests that the market may decline.

The length of the upper shadow in this K line can also reflect the strength of buying and selling power. Generally, the longer the upper shadow, the stronger the buying power; the shorter the upper shadow, the stronger the selling power. (This also differs from the general shadow identification rules. In general K line patterns, a longer upper shadow indicates stronger selling power. As shown in the figure below, buying power decreases sequentially while selling power increases.)

K Line Mechanics Theory

K lines adhere to mechanical principles, which can be explained from three aspects.

- The Yin and Yang Nature of K Lines.

Yin and Yang K lines represent trend directions; bullish lines indicate continued upward movement, while bearish lines indicate continued downward movement. Taking bullish lines as an example, after a period of struggle between buyers and sellers, if the closing price is higher than the opening price, it indicates that bulls have the upper hand. According to Newton's laws of motion, in the absence of external forces, prices will continue to move in the original direction and speed. Therefore, bullish lines predict that the next phase will continue to rise, at least ensuring initial upward inertia in the next phase. Going with the trend is also the core idea of K line technical analysis. Similarly, bearish lines continue to decline.

- The Size of K Line Bodies.

The size of K line bodies represents intrinsic momentum. The larger the body, the more obvious the upward or downward trend; conversely, the trend is less obvious. For bullish lines, the larger the body, the stronger the upward momentum. Just as an object with greater mass and speed has greater inertial force, the same applies to bearish lines—the larger the body, the stronger the downward momentum.

- The Length of K Line Shadows.

K line shadows represent reversal signals. The longer the shadow in one direction, the less favorable it is for prices to move in that direction; that is, the longer the upper shadow, the less favorable it is for upward movement; the longer the lower shadow, the less favorable it is for downward movement. Taking the upper shadow as an example, after a period of struggle between buyers and sellers, if bulls are defeated, regardless of whether the K line closes as a bearish or bullish line, the upper shadow forms the next phase's resistance, increasing the probability of price adjustment downward. Similarly, the lower shadow indicates a higher probability of upward price movement.

K Line Signal Theory

The main types of K line signals are two: one is confirmatory K line signals; the other is warning K line signals.

- Confirmatory K Line Signals

Confirmatory K Line signals, as the name suggests, often indicate the entry and exit of market makers, or the formation of tops and bottoms. More specifically, it suggests that prices will experience a rise or a drop. The credibility of confirmatory K lines is often very high and should be given sufficient attention. There are actually only two common types of confirmatory K lines: one is the large bullish line and the other is the large bearish line; the second is K lines with long upper shadows and K lines with long lower shadows.

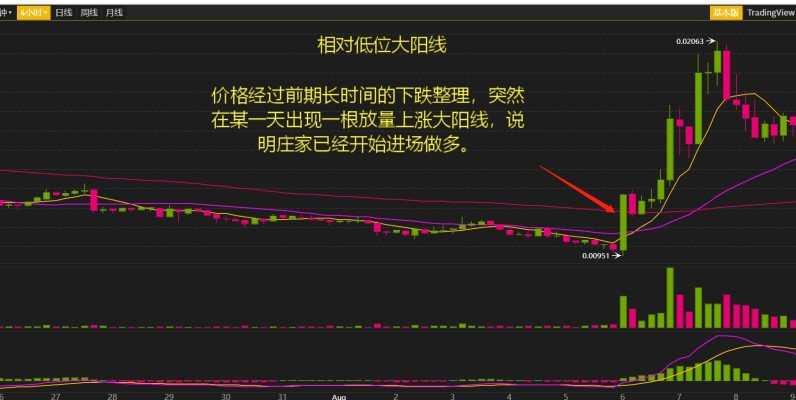

- Large Bullish Line.

Bullish lines represent strong buying power. A large bullish line at a relatively low position often indicates that market makers are starting to enter the market. This type of K line marks the arrival of a bottom, and the actions of market makers are clearly revealed by this K line. A large bullish line is a confirmatory signal, and one can gradually enter the market in batches during the large bullish line or during the subsequent pullback, closely following the market makers' steps, buying at relatively low positions, and then waiting for the market makers to push prices up for profit.

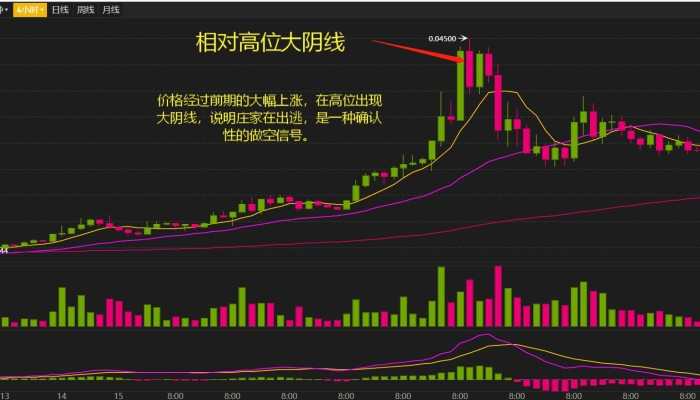

- Large Bearish Line.

A large bearish line represents strong selling power. A large bearish line at a relatively high position indicates that a large amount of capital is fleeing, and market makers are unloading their positions. Since market makers are starting to exit, what reason is there to continue fighting?

Of course, the entry and exit of market makers require time. Sometimes, after a large bullish line appears at a relatively low position, prices may still experience a certain degree of decline. After a large bearish line appears at a relatively high position, prices generally tend to rise again, but this trend is mostly caused by market makers inducing short positions to build up or inducing long positions to unload.

2. Warning K Line Signals

Warning K line signals are another important component of characteristic K lines. Their appearance often brings unexpected effects to practical analysis and operations. This type of K line pattern serves as a crucial early warning for investors. However, warning signals only serve as alerts, and the subsequent price movements can vary greatly, so they should not be used as confirmatory signals. Of course, if one can analyze them in conjunction with the theory of K line relative positions and the specific market environment, it is entirely possible to anticipate market bottoms and tops ahead of time. At the very least, warning signals often indicate that the market is about to change direction.

Generally speaking, warning signals can be divided into three groups:

The first group consists of warning signals for bottoms and tops, such as inverted hammers and hanging man lines.

The second group includes cross stars and consecutive cross stars.

The third group consists of engulfing lines and pregnant lines.

Follow the public account --- Bit Bear, to learn more about market trends and technical indicators, real-time strategy sharing, customized position management, trading logic training, and a unique experience from ten years in the cryptocurrency space.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。