Author: Luke, Mars Finance

Recently, the "50x leverage giant whale" on the Hyperliquid platform (address starting with 0xf3, nicknamed "Insider Brother" by the community) has shocked the crypto market with high-profile operations and astonishing profits. With high leverage, precise timing, and multi-platform strategies, he netted approximately $22 million within a few months, including $2 million plundered from the Hyperliquid treasury HLP (Hyperliquidity Provider) through "liquidation" operations, sparking heated discussions. This article will detail his trading trajectory along a timeline, deeply analyze his operational techniques, recalculate profits and losses based on clear profit-taking, present cumulative profits and losses in tabular form, and finally reveal the market and platform's reactions, outlining a unique crypto game.

Timeline and Operational Interpretation

March 2-3: BTC and ETH Long Positions Start with Huge Profits

The legend of Insider Brother began in early March. According to Lookonchain monitoring, he went long on BTC and ETH with 50x leverage on Hyperliquid, catching the price surge brought by Trump's crypto reserve announcement, and closed most of his long positions within a day, earning over $6.8 million. This precise operation laid the foundation for his massive profits, and the market began to pay attention to this mysterious trader.

March 10-12: ETH/BTC Long Positions and "Liquidation" Peak

From March 10 to 12, the whale's operations reached a climax, showcasing the most controversial scene. On March 10, he achieved a 100% win rate with two ultra-short-term ETH longs, netting $2.2 million. On March 12, he deposited $5.22 million into Hyperliquid and went long on ETH at $1,884.4 (liquidation price $1,838.2) and BTC at $82,003.9 (liquidation price $61,182) with 50x leverage. He then converted his BTC position into ETH longs, adding $10 million USDC as margin, increasing his holdings to 140,000 ETH (approximately $270 million), accounting for 24.65% of the platform's total ETH positions, with an unrealized profit of $3.1 million.

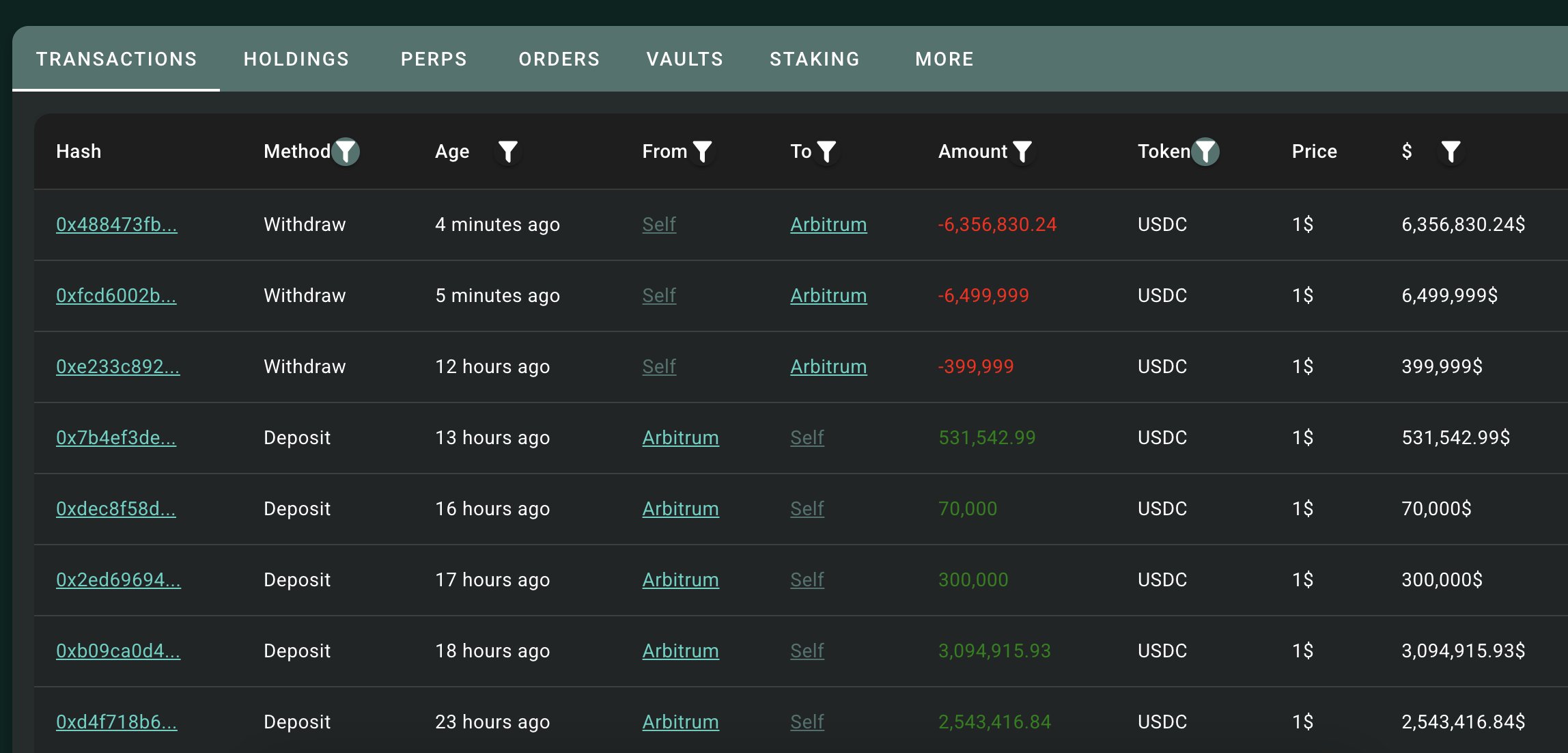

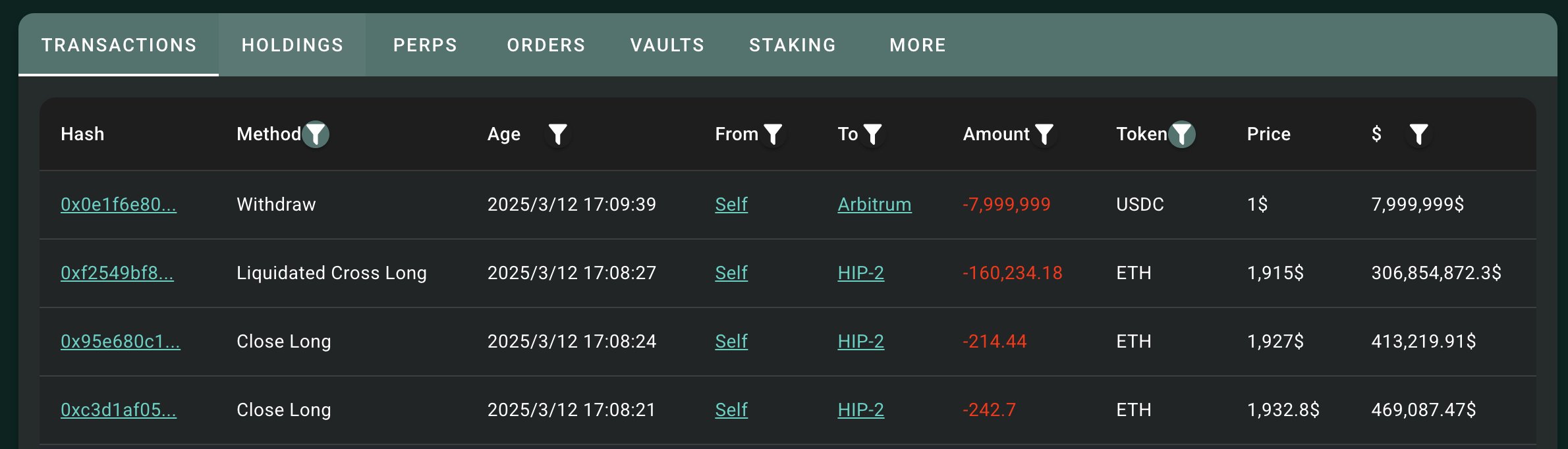

A dramatic turn occurred between 17:05 and 17:08. According to Hyperscan data, the whale attempted to withdraw continuously without closing his positions. First, he failed due to "exceeding the single transaction limit," then withdrew $17 million in two transactions ($8 million and $9 million USDC), exceeding his $15.23 million USDC margin. The remaining positions were quickly liquidated, and at 17:08, 140,000 ETH were taken over by HLP at $1,915. As the ETH price fell to $1,910 during liquidation, HLP incurred a loss of about $4 million, while the whale locked in a profit of $2 million upon exiting. This "liquidation" operation shocked the community, and Hyperliquid immediately announced a reduction in the maximum leverage for BTC and ETH to 40x and 25x, respectively, in an attempt to patch the loophole.

March 13-14: Cross-Platform Expansion and LINK Turmoil

On March 13, the whale extended his reach to GMX, opening a $45.17 million ETH short position while going long on the ETH/BTC exchange rate on Hyperliquid, precisely seizing the opportunity when the rate fell to 0.0228, earning $2.15 million. The next day, he shifted to LINK, investing $14.98 million to buy 506,000 LINK (cost $13.93), and opened long positions on Hyperliquid and GMX with leverage ranging from 10x to 23x, closing the operations with a profit of $1.27 million. However, a 20x LINK long position was liquidated at $13.6857, resulting in a loss of $1.07 million USDC. The market buzzed, and Hyperliquid quickly lowered the LINK leverage limit from 20x to 10x, showing vigilance towards the whale.

March 15-17: BTC Short Positions Dominate and Rules Tighten

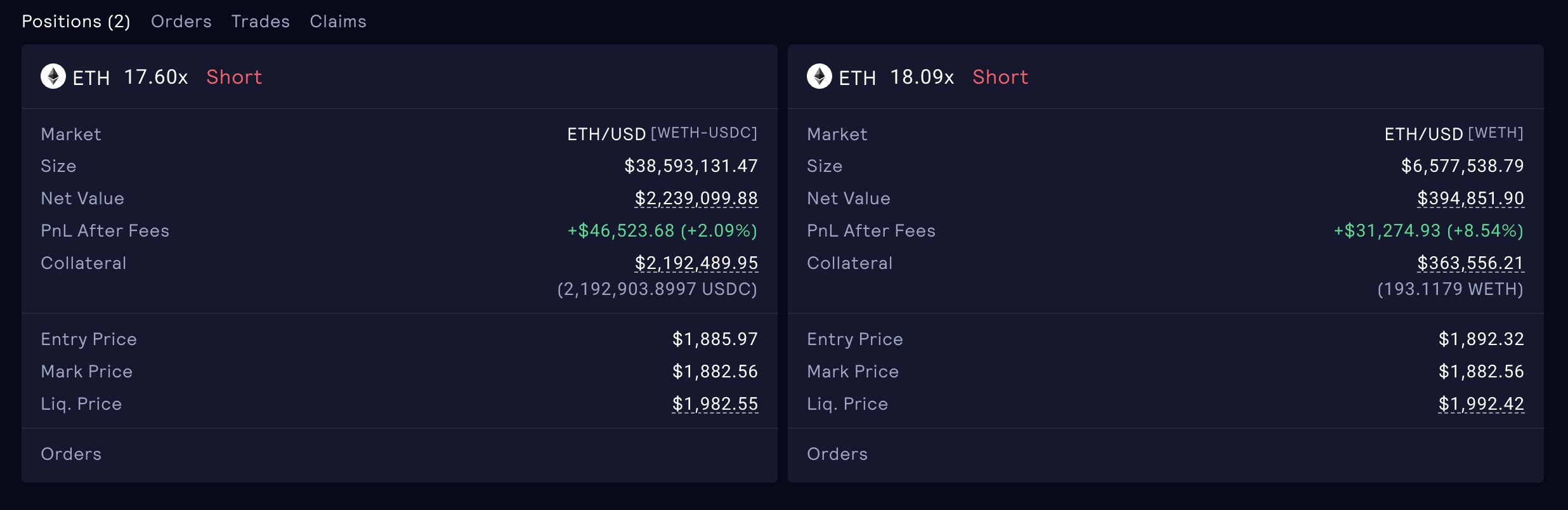

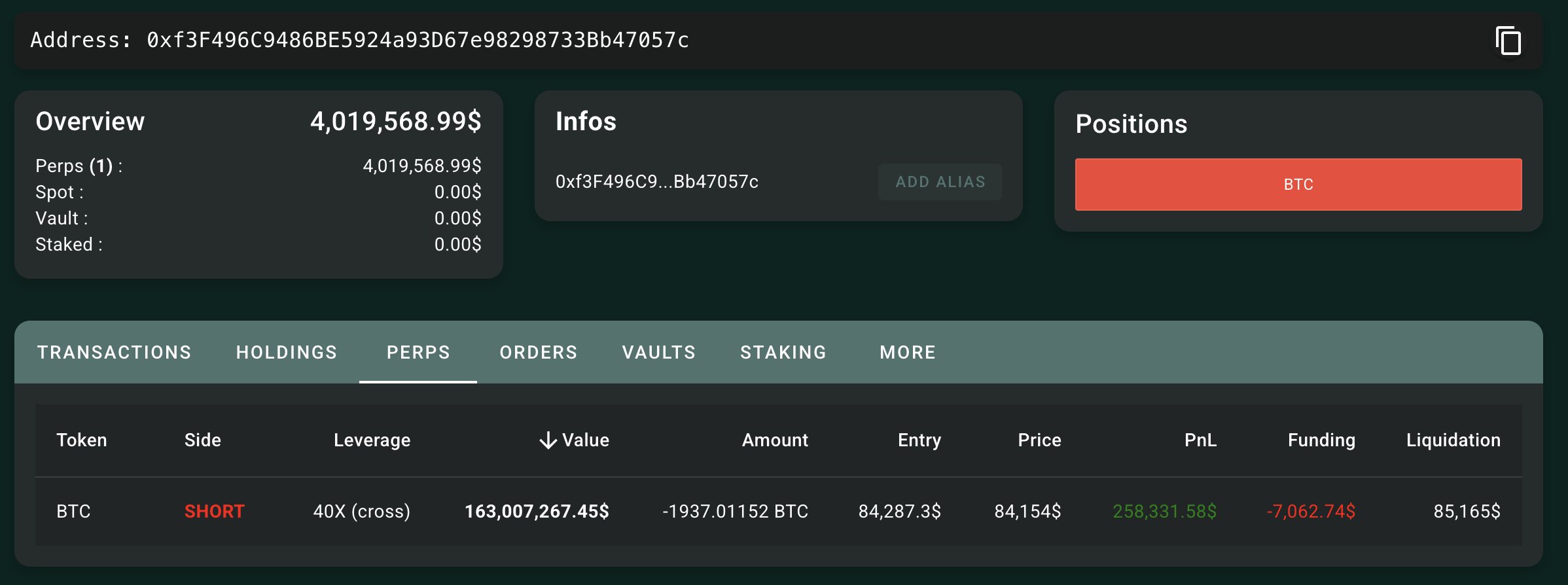

Starting March 15, the whale focused on BTC short positions, building a position on Hyperliquid with 40x leverage, increasing the scale to $330 million, with unrealized profits reaching $6.2 million at one point, later taking profits of $5.6 million through TWAP. He also opened a 44.97x BTC short position on GMX, with a total scale of $194 million, clearly taking profits of $3.05 million during this phase. Hyperliquid announced on March 15 that its trading volume had surpassed $1 trillion and raised the margin ratio from 5% to 20%, aiming to constrain high-leverage players. Market sentiment fluctuated, and investors began to worry about platform liquidity risks.

Operational Techniques Deconstructed

The whale's trading techniques are like a precise machine, both bold and delicate, blending high-risk strategies with clever exploitation of rule loopholes. Here is a detailed analysis of his core techniques:

High Leverage Drive and Event Capture

- Leverage Selection: The whale primarily used 50x leverage, the highest allowed by Hyperliquid, which can turn small fluctuations into massive profits. For example, the ETH/BTC long position at the end of February earned $6.83 million, demonstrating his adept control over high leverage. Even after the platform later reduced leverage, he flexibly adjusted to 40x (as in the March 15 BTC short), maintaining high profit potential.

- Event-Driven: He reacted extremely quickly to macro events, such as the ETH/BTC long position after Trump's comments at the end of February, earning $6.83 million within 24 hours. This ability may stem from early awareness of news or a deep understanding of market sentiment, even sparking speculation of "insider trading."

Cross-Platform Coordination and Capital Allocation

- Cross-Platform Layout: The whale did not rely solely on Hyperliquid. On March 13, he opened an ETH short position on GMX while going long on the ETH/BTC exchange rate on Hyperliquid, forming an arbitrage combination. On March 14, he borrowed 110,000 LINK ($1.54 million) from Aave for spot and contract operations, showcasing his ability to integrate resources across platforms.

- Capital Allocation: His capital management was efficient and flexible. Before the "liquidation" on March 12, he added $10 million USDC margin, pushing his ETH holdings to 140,000; on March 15, he added $3 million USDC for the BTC short, avoiding liquidation risks. This dynamic adjustment of margin ensured the stability of high-leverage positions.

Spot and Contract Dual-Drive

- Strategy Design: The whale often pushed prices up through spot trading and then amplified profits with contracts. On March 14, he invested $14.98 million to buy 506,000 LINK (cost $13.93), and the price later rose to $14.6, combined with long positions of 10x to 23x, closing the operations with a profit of $1.27 million. This combination of "spot lifting + contract leverage" fully utilized market depth and leverage effects.

- Execution Details: He bought LINK in batches on CowSwap (such as $5 million and $500,000 orders), avoiding a one-time market impact and ensuring controllable costs. This meticulous operation demonstrates his deep understanding of liquidity.

Quick Entry and Exit with "Liquidation" Arbitrage

- Short-Term Rhythm: The whale excelled at capturing short-term fluctuations for quick profits. On March 13, he went long on ETH with 50x leverage on Hyperliquid, earning $2.15 million in just 40 minutes; on March 16, he took profits of $3.05 million from the BTC short. This rapid entry and exit rhythm maximized profits and reduced risk exposure.

- "Liquidation" Technique: The operation on March 12 was his most unique technique. While having an unrealized profit of $3.1 million on the ETH long position, he withdrew $17 million USDC, exceeding his $15.23 million margin, leading to the liquidation of the remaining positions. When HLP took over the positions, a $4 million loss was incurred due to the drop in ETH price, while he locked in a profit of $2 million. This strategy exploited Hyperliquid's rule allowing the withdrawal of unrealized profits, transferring the liquidation risk to the platform, becoming his "killer move" to plunder liquidity.

Risk Management and Strategy Adjustment

- Profit Taking and Stop Loss: The whale was not blindly aggressive. After the LINK long position was liquidated on March 14, he quickly reduced leverage from 20x to 10x to avoid further losses. On March 17, he closed 108 BTC short positions using the TWAP (Time Weighted Average Price) strategy, reducing market impact and ensuring $5.6 million was secured.

- Adaptive Adjustment: In response to changes in platform rules (such as the margin ratio increase on March 15), he shifted from 50x leverage to 40x and supplemented a 44.97x position on GMX, demonstrating his flexible response to environmental changes.

Profit and Loss Details (Only Calculating Realized Profits)

Big Trees Attract Attention - Whale Hunting Team Assembles

The giant whale's massive profits and "liquidation" operations have stirred up tremendous waves in the market. The rumors of "insider trading" at the end of February cast a mysterious shadow over him, and after HLP incurred a $4 million loss on March 12, the community dubbed him a "liquidity predator," fearing that similar operations could undermine the market's foundation. Crypto KOL @Cbb0fe quickly posted to gather a "whale hunting team," aiming to encircle this giant whale. Just half an hour later, he shared a picture indicating that Tron founder Justin Sun had joined the action, reflecting the community's strong backlash against his influence.

Hyperliquid responded in succession, first lowering the leverage limits for BTC and ETH to 40x and 25x on March 12, then restricting LINK leverage to 10x on March 14, and on March 15, announcing an increase in the margin ratio from 5% to 20%, attempting to patch the loopholes in the rules. However, the platform's liquidity had already been severely impacted: on March 13, HLP incurred a loss of $3.23 million due to taking over 160,000 ETH long positions, causing the liquidity pool to plummet from $486 million to $351 million, a decrease of 27.7%; the $4 million loss on March 12 further exposed its mechanism flaws—allowing the withdrawal of unrealized profits and not restricting large leverage orders, turning HLP into the giant whale's "ATM."

Conclusion

From the low-key trial in February to the "liquidation" plunder in March, the Hyperliquid 50x leverage giant whale achieved a net profit of approximately $22.62 million, including $2 million plundered from HLP, writing a legend of high risk and high return. He conquered the market and "sheared the sheep" using high leverage, event-driven strategies, and rule loopholes, earning the title of a predator in crypto trading. However, this game also sounds the alarm: the LINK liquidation and HLP's massive losses reveal the double-edged nature of high leverage, and the community's "whale hunting" actions along with Hyperliquid's rule adjustments indicate that the encirclement of such players has begun. In the future, whether the giant whale can continue to ride the waves or falter in the hunt remains uncertain. For ordinary investors, this is both a breathtaking performance and a profound warning: in the game between the giant whale and the platform, retail investors may only be left to watch helplessly.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。