3月16日,Bedrock 于 X 平台表示:BR 代币空投查询现已上线。BR 总供应量的 5.5%将在 TGE(第一季)空投;积分计划将继续用于未来的奖励;符合空投条件的地址数超 20 万;超 10 万个钱包将获得额外的忠诚度奖励;所有社区空投 BR 代币将完全解锁。

同日,Bedrock宣布其代币BR已支持Bitget、Bybit 和 Gate.io 三个交易所的预存功能。随后,上述三家交易所也陆续确认上线BR现货交易。

这两则与代币直接相关的重要消息迅速引起市场关注,社区反馈热烈:

Babylon官方在X平台举办线上Space,探讨Bedrock此次生态进展,表明其对Bedrock的高度关注;

Bedrock合作伙伴Penpie(@Penpiexyz_io)转发了Bedrock的官方空投公告;

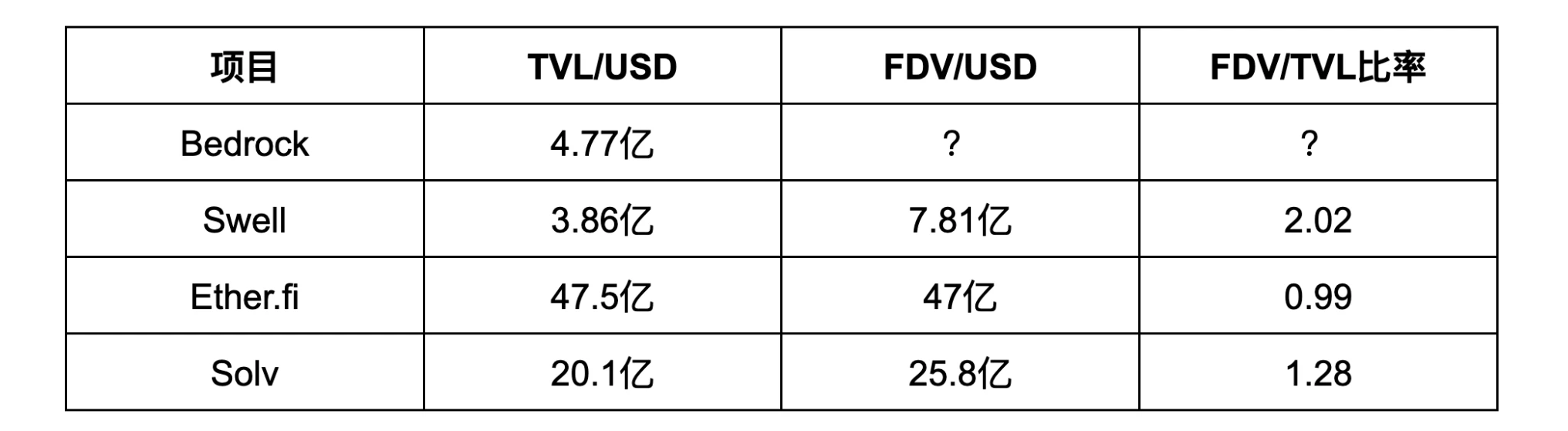

拥有5.6万关注者的社区成员BILI(@BiliSquare)表示,通过与同类项目的FDV与TVL比值对比分析,Bedrock具备较高的投资潜力;

社区成员cryptodoggy(@MultiDoggy)则通过发布相关视频积极推广。

……

是什么让Bedrock项目频繁获得社区积极肯定,并在而今低迷的市场行情中持续获得关注?结合各方信息,我们总结出以下四个核心原因:

(一)Bedrock空投规则良心和TGE(代币生成事件)节奏契合市场预期;

(二) 当前FDV估值相对较低(2至3亿美元),具备显著增长潜力;

(三)项目社区化程度高,散户占比大,社区自发驱动明显,未受大机构主导影响;

(四)基本面数据表现突出:总TVL达4.43亿美元,用户规模超27.8万,项目生态覆盖19条链,已整合超过60个DeFi协议。

在市场反响积极的背景下,即将上线的Bedrock代币的具体估值也成为投资者最关注的话题。

Bedrock代币(BR)估值分析与潜力预测

估值逻辑与FDV对比

首先, 根据目前BTC再质押市场规模(约35亿美元)及Bedrock占据的市场份额(约15%),其合理的初始FDV位于2~3亿美元之间。

再以TVL为基础,并参照同赛道竞争项目(Swell、Ether.fi、Solv)的估值数据(TVL数据来源Defillama;FDV数据来源Coinmarketcap)进行分析,结果显示Bedrock具有明显的FDV价格优势与较大的增长潜力:

如上表,已发币的同类产品FDV/TVL平均约1.43,以此系数计算,Bedrock的FDV未来具备增长至6.82亿美元(4.77亿*1.43)的潜力。

Diamonds积分与BR的连接

作为Babylon生态系统的重要组成协议,Bedrock通过独特的Diamonds积分机制激励用户积极参与资产质押与流动性提供,增强生态活跃度。这一机制自2024年1月28日主网上线以来获得广泛社区认可,Season 1积分奖励现已结束并完成快照,目前自动进入Season 2阶段,具体积分规则尚待公布。

Bedrock 核心贡献者 Zhuling(@czhuling) 在TGE community call里曾公开表示,Diamonds积分将在TGE时按特定机制兑换为原生BR代币,长期持有uniToken至TGE后的用户以及积极参与uniToken DeFi 用户将获得更高的空投奖励,进一步增强社区对项目长期发展的信心。

社区估值推算与投资价值分析

截至目前,Bedrock官方尚未正式披露BR代币的总供应量。

不过,据 KOL BITWU.ETH 分析,Bedrock 作为 BTCFi 2.0 领域的重要参与者,FDV 预估大概在 2-3 亿美元,远低于同类竞品。同时,新兴跨链质押或收益聚合协议的 FDV/TVL 则动辄达到 3~5 倍,即使按行业平均水平估算,Bedrock 的 FDV 仍有显著上调空间——哪怕只达到中值水准,Bedrock 的 FDV 相较当前也有翻倍的潜力。

另据Discord社区成员Jerry的推测,以2至3亿美元的FDV区间进行估算,Diamonds积分单价预计位于0.003至0.007美元范围内,尽管此估值较低,但考虑到增长潜力,BR代币价格可能达到0.2至0.3美元的乐观区间。

以社区乐观推测的0.2至0.3美元BR代币价格区间为基础进行空投APY计算:假设活跃用户在Pendle平台质押1.3个uniBTC(价值85,000美元)6个月,获得23,824个BR代币空投奖励:

若BR价格为0.2美元,则对应年化收益率(APY)约为9%;

若BR价格为0.3美元,则对应APY达到13%;

这一预测收益率区间(9%-13%)凸显Bedrock空投策略的吸引力,收益水平较为可观(需注意以上测算为社区用户案例推测,实际情况可能会随市场条件变化)。

理解了FDV估值和BR APY收益预测之后,让我们深入Bedrock独特的代币经济设计,了解PoSL与veBR模型的创新之处。

PoSL与veBR代币模型:构建比特币质押经济的增强范式

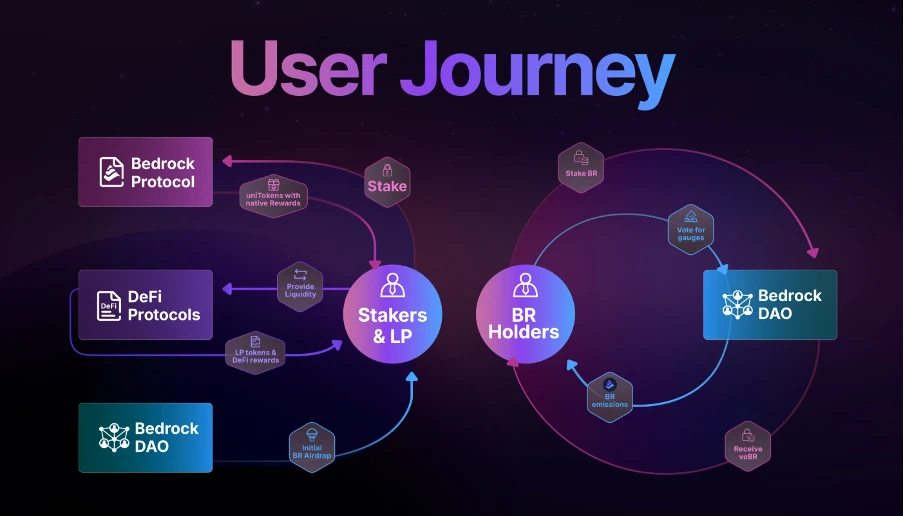

在传统质押协议普遍采用单一代币激励模式、治理权与资本效率割裂的背景下,Bedrock创新性地引入了ve(投票托管)代币模型,首次将PoSL(Proof of Staking Liquidity)框架应用于比特币再质押场景,构建了一个治理与收益深度结合的双代币体系。

veBR作为首个针对质押流动性设计的治理代币,通过BR代币锁仓铸造机制,将用户的时间偏好与协议的长期发展深度绑定。这种设计不仅解决了再质押场景中资本效率与治理权分离的难题,更通过非转让性治理凭证的设计,在比特币生态中首次实现了"流动性即治理权"的价值转化。

PoSL:质押与流动性的结合

PoSL与传统单一收益模式的质押协议不同,其核心优势在于通过激励用户质押多种资产(如uniBTC、uniETH)以赚取BR代币,实现收益与流动性的双重提升。用户质押操作简单,易于参与,但需注意的是,收益水平将受到市场活跃度和生态TVL变化的直接影响。

veBR:治理与增益的平衡

BR为可交易的治理代币,而veBR通过锁定BR获得,赋予持有者以下权益:

治理权:参与协议升级、BR排放分配等决策;

收益加成:提升质押回报,为长期持有者提供额外奖励;

Season投票权:参与Season运营,投票权将会在每个Season重置,确保公平和动态参与。

该机制通过锁定BR减少市场流通量,有助于稳定并提升BR代币的长期价值。然而,对于普通投资者而言,也意味着必须接受流动性受限的风险。Bedrock与Aragon的合作则进一步增强了治理过程的透明性,有助于提高投资者对长期持有和参与治理的信心。

当Diamonds在TGE后(自动兑换为BR),用户可选择直接出售,也可进一步锁定BR获得veBR,享受更高的收益加成。PoSL与veBR的机制设计使投资者收益与平台长期发展紧密相连,用户参与门槛较低,只需持有BTC或ETH即可加入。但需特别关注市场风险:生态TVL下降可能导致整体收益下滑;此前uniBTC发生的200万美元漏洞事件(现已赔付)也提醒用户需谨慎防范协议安全风险。

总而言之,Bedrock的Diamonds积分机制是一个更为明确有效的激励机制,有助于提高用户的积极性和生态参与度。同时,其创新的经济模型和技术布局,也为项目的可持续发展奠定了坚实基础,值得投资者进一步关注和研究。

未来,Bedrock的veBR代币模型是否真正形成飞轮效应,关键在于治理激励与长期锁仓机制是否持续促进生态价值循环增长,这个答案还要在项目本身的产品和技术中寻找。

产品布局与技术优势

Bedrock的产品布局与技术设计聚焦于为用户提供安全、可持续的投资收益。这一定位推动了Bedrock形成以多资产、多链布局为特色,并专注于BTCFi赛道的差异化发展策略。

Bedrock支持比特币(BTC)、以太坊(ETH)和IoTeX(IOTX)等多种资产。多资产布局使散户能够灵活选择投资标的,有效降低单一资产价格波动的风险。跨链部署则已覆盖以太坊和BNB Chain等19条链,并计划接入更多网络,进一步增加资产参与的灵活性。

BTCFi的优先布局与brBTC的推出

Bedrock将BTCFi视为核心方向,致力于充分挖掘比特币在DeFi领域的潜力。在BTCFi 1.0阶段,Bedrock推出了基于Babylon协议单一收益的uniBTC产品,累计质押超过4400 BTC,受到了用户的广泛认可。

为了进一步满足投资者多样化的策略需求,Bedrock于2024年12月20日正式推出brBTC,全面进入BTCFi 2.0阶段。brBTC支持多种比特币衍生品(如WBTC、FBTC、mBTC、cbBTC、BTCB、uniBTC),累计质押约500 BTC,brBTC不仅整合了Babylon收益渠道,还叠加了Babylon、Kernel、Pell等多重协议提供收益,具体呈现出以下特点:

多协议收益:连接Babylon、Kernel、Pell、SatLayer及Mellow等协议,散户可通过单一资产获得多源回报,减少对单一策略的依赖。

生态整合:统一多种比特币衍生品,简化参与流程,适合希望直接使用BTC的散户。

应用扩展:支持稳定币等功能,增加资产实用性,但实际收益取决于市场接受度。

brBTC已初步部署于以太坊和BNB Chain,散户只需通过主流钱包即可完成资产的存入与质押参与。未来随着更多区块链的接入,brBTC的使用门槛将进一步降低,覆盖用户范围也将更加广泛。但用户需注意不同链之间资产跨链的兼容性及风险。

安全性是散户参与的重要考量因素。为确保协议安全可靠,Bedrock与多家专业审计机构合作,对智能合约和相关协议进行严格审计与持续监测。此外,brBTC上线前已通过审计,并通过部署Layer-2技术进一步降低了资产安全风险。

Bedrock当前的产品布局与技术优势已经初见成效,并在其全程的市场数据表现中得到了明显的体现。

数据表现和市场活动

TVL及链上表现

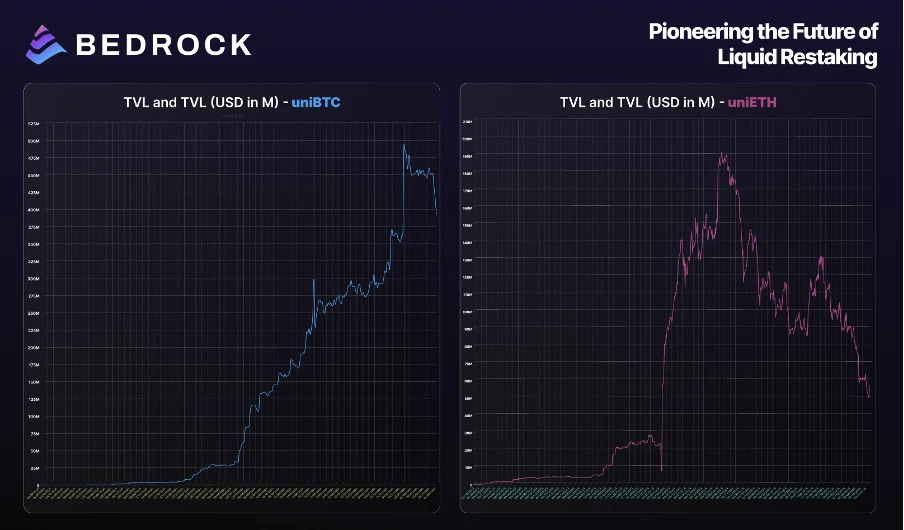

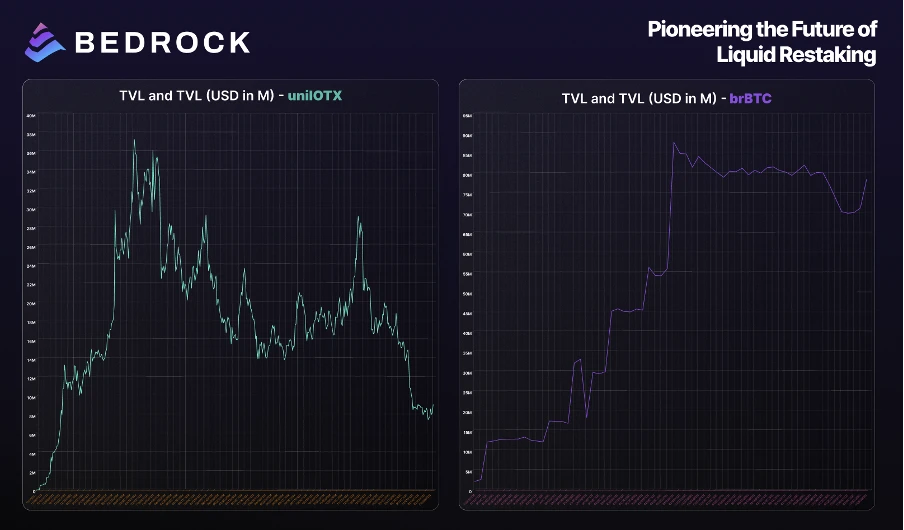

左:uniBTC TVL;右:uniETH TVL

左:uniIOTX TVL;右:brBTC TVL

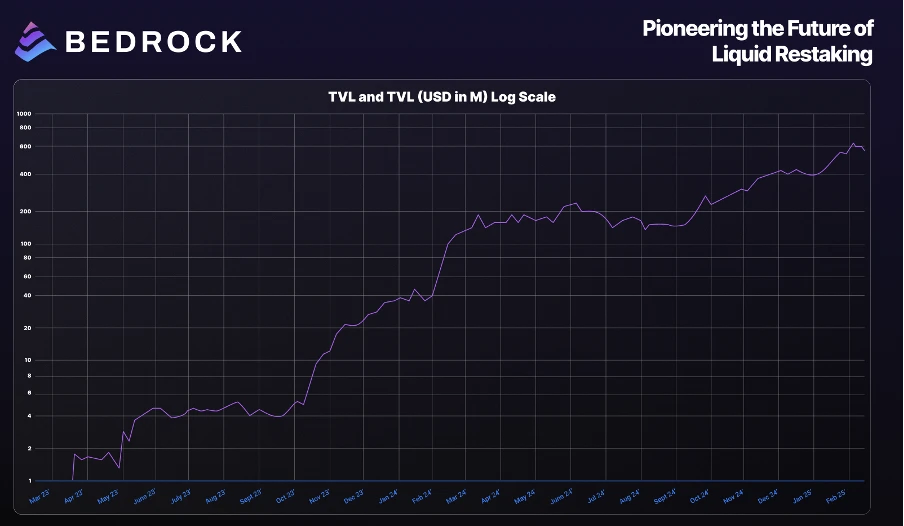

据Bedrock官方报告,截止目前,自24年4月至今项目总TVL在持续攀升中。

Bedrock TVL

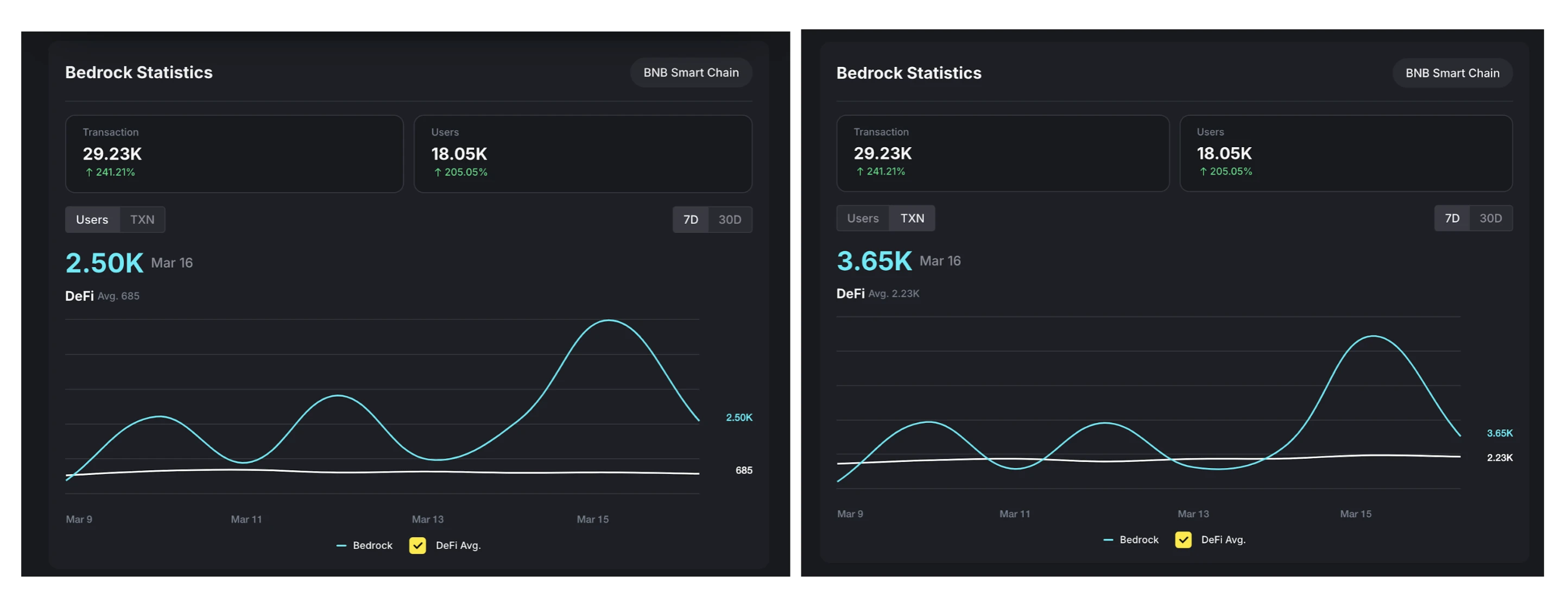

除了亮眼的 TVL 数据,Bedrock过去几周在BNB链上的数据也很亮眼。 连续两周在用户增长和交易活跃度排名第一,还在币安钱包上跟BNB链上了独家pre-tge活动。

用户增长与活跃度

根据BNB Chain平台最新排名(截至2025年3月18日),Bedrock已位列DeFi类第五名,反映了项目在该链上的强大竞争力与用户认可程度。

用户增长在7日内,总计1.8万,且在大部分时间段中,单日用户增长量也远超行业均值685;交易量在7日内,总计2.9万,且单日交易量在大部分的时间段内超越行业均值2300。

其用户数量和交易活跃度都呈现出显著的增长趋势,这进一步印证了市场对其产品的强烈需求和用户的积极参与。

社区影响力

值得特别指出的是,Bedrock 用户数已超过27.8万,与其他头部协议(如Lido、Renzo等)以机构为主导的情形不同,Bedrock散户占比较高,社区自发驱动明显。这种去中心化的社区生态,赋予了项目更加坚实的长期发展基础。

在数据持续攀升、市场表现优异的背景下,投资者最关心的莫过于TGE后的表现及未来的发展布局。

TGE预期与未来布局——如何把握Bedrock的爆发窗口

随着BR代币TGE进入倒计时,市场对Bedrock的预期正聚焦于两大核心逻辑:低FDV估值下的价值洼地与BTCFi赛道爆发的强叙事驱动。当前,项目已释放三大关键利好——空投检查器上线、三大交易所预存通道开放、Babylon生态联动的持续深化,而潜在的上币预期(如币安、OKX)或将成为TGE后的下一催化剂。

值得注意的是,BR代币活动已接连上线OKX Web3 Wallet和币安钱包。若团队在TGE前宣布新的头部CEX合作、brBTC生态集成进展(如与Solana或Layer2协议的兼容),其FDV有望突破3亿美元并冲击5亿估值区间。

从长期愿景看,Bedrock通过PoSL机制+veBR治理模型构建的"比特币流动性层",正在打通BTC质押收益与DeFi乐高的嵌套价值。随着brBTC在19条链的渗透和60+协议的深度集成,项目或将主导BTCFi 2.0的范式迭代——让比特币不仅成为生息资产,更成为跨链流动性网络的底层燃料。这一路径的可行性已获数据验证:超27万用户的参与和15%的BTC再质押市占率,使其具备生态扩张的强用户基础。

对于投资者而言,TGE后的参与策略可分为:

Season 2参与窗口:3月7日已自动进入Season 2,当前质押仍可捕获未公布的积分规则红利,建议在TGE前后1周内完成uniBTC头寸部署;

空投代币处置:基于三角平衡原则(收益性,安全性和流动性),建议30%通过质押BR获取veBR治理权(预计APY 15%-20%),40%择机在交易所套现锁定基础利润,30%用于参与brBTC流动性挖矿放大收益(如Pendle、Curve池);

忠诚度计划红利:根据社区近期信息披露,长期持有者预计在后续季度将获得额外奖励(此前参与第一季度的用户已获得空投激励,TGE后的额外奖励是针对持续参与第二季度及后续的用户),如BR代币空投加成、Diamonds积分折算提高比例,以及治理权益的特别加权,以进一步激励长期参与和生态贡献。

总体而言,Bedrock当前正处于关键发展的风口,市场对其充满乐观预期,投资者需要做好战略性布局,把握BTCFi热潮带来的发展红利。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。