The paper published in the Stanford Blockchain Review outlines a paradigm shift in decentralized finance (DeFi) with “Type III Stablecoins,” a model leveraging self-enforcing smart contracts to autonomously manage yield generation and user protections. Authored by Benjamin and Jae from Cap Labs, the research positions Type III as a solution to scalability and safety limitations plaguing existing yield-bearing stablecoins.

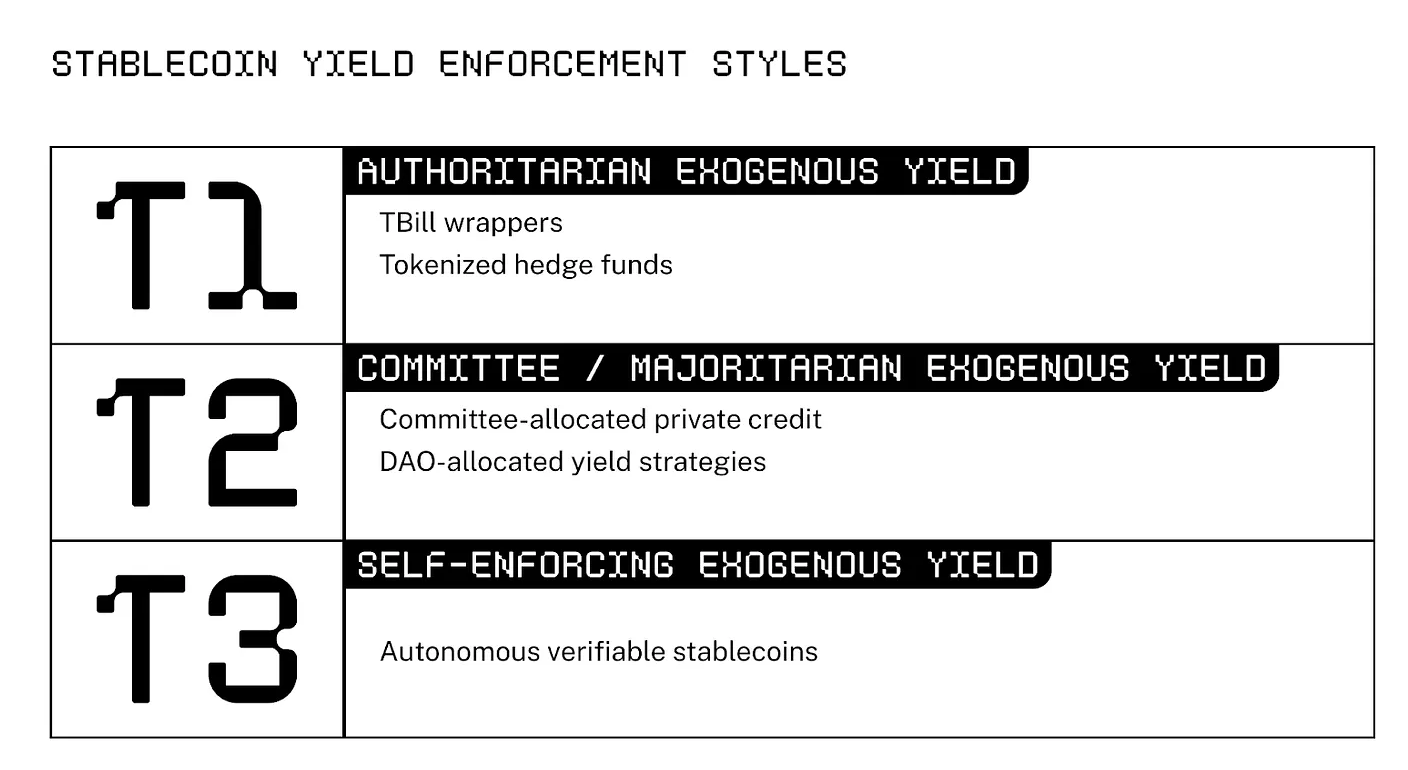

Type III stablecoins eliminate human governance by encoding rules for capital allocation, operator oversight, and recourse into immutable smart contracts. Unlike Type I (centralized) or Type II (DAO-managed) models, Type III delegates decision-making to “restakers” who collateralize assets to back third-party operators. These operators generate yield through strategies like lending, with restakers incentivized to prioritize safety due to direct exposure to slashing risks if strategies fail.

The framework, presented by Benjamin at ETH Denver’s Stable Summit, addresses key challenges in current yield models. Type I stablecoins rely on centralized teams prone to obsolescence, while Type II faces corruption risks in decentralized committees. Cap Labs’ solution automates strategy shifts via market-driven interest rates and redistributes slashed funds to users during failures, ensuring verifiable recourse without legal intermediaries.

However, the paper acknowledges trade-offs. Complex smart contract dependencies introduce technical risks, and initial adoption will be restricted to accredited institutions for security. Despite this, proponents argue the model’s latency reduction and permissionless long-term vision could unlock mass adoption of yield-bearing stablecoins, which currently represent just 10% of the $200B stablecoin market.

Cap Labs’ innovation arrives as TradFi institutions increasingly explore DeFi integrations. Stablecoins remain tethered to the frailties of human misjudgment and discretionary control. The paper contends that yield-bearing variants will falter in achieving scalable growth unless manual oversight is excised from capital distribution. Type III’s architecture—anchored in algorithmic precision—seeks to harmonize motives among operators, restakers, and end-users through code-driven governance.

As the first architect of Type III, Cap Labs envisions a phased deployment, initially courting institutional collaborators to fortify foundational trust before democratizing access. This blueprint signifies a pivotal leap in reimagining stablecoins beyond mere transactional utilities, transforming them into agile, yield-optimized instruments shielded by cryptographic accountability.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。