特朗普政府对于通过谈判换取降低关税保持“开放”态度,并且透露已有包括日本、韩国等在内的近70个国家就关税问题与白宫接触,暗示美股可能很快会与部分国家达成友好协商。

美国时间4月9号起,将对所有来自中的进口商品额外征收84%关税,加上先前已有的关税,几乎所有中国输美商品的总关税率将飙升至惊人的104%。这项消息对市场如同一颗震撼弹,此前因谈判预期而出现的反弹瞬间化为乌有,恐慌情绪蔓延,导致股市尾盘大幅跳水。市场普遍认为,如此高额的关税几乎等同贸易堡垒,中美贸易站已升至前所未有的激烈程度。

面对美方的极限施压,中国今日也展现出强硬的立场。中国外交部发言人林剑在例行记者会上强调“中国人不怕事,也不惹事,施压、威胁和讹诈不是同中方打交道的正确方式,中方必将采取必要措施。坚决维护自身正当合法权益。如果美方置两国和国际社会的利益于不顾,执意打关税战、贸易战,中方必将奉陪到底。”

贸易战的升级除了导致传统金融市场剧烈波动以外。全美12档比特币现货ETF中,有7档基金遭遇撤资,合计流出3.26亿美元,这已是比特币现货ETF连续第四个交易日出现净流出。同时,这也是自3月11日以来规模最大的单日净流出,反映出市场对总体经济风险的高度敏感。截止撰稿时间,比特币报价为77750美元,近24小时下跌约0.87%。

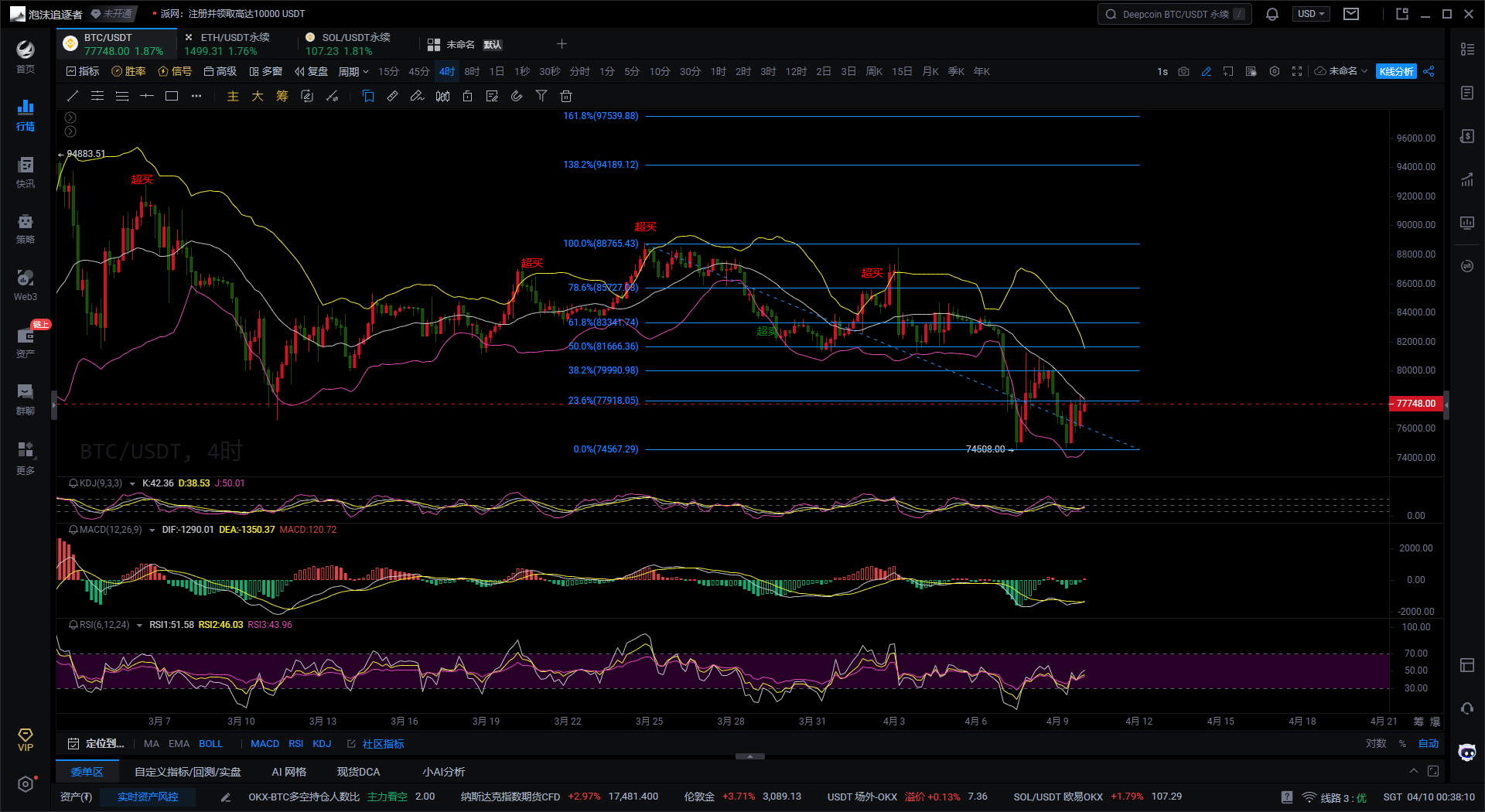

比特币四小时图

当前价格处于布林带中下轨之间,中轨约为80000,上轨在87000附近,下轨则在75000附近。布林带呈现收口趋势,说明市场可能即将选择方向,可能会突破或进一步震荡。DIF线已经上穿DEA线形成金叉形态,同时MACD柱状图由绿转红,说明空头动能正在减弱。但是,DIF线和DEA线仍在0轴下方运行,说明当前只是弱反弹阶段,尚未进入强势多头行情。

KDJ三线值向上运行,形成金叉形态后进入中性偏强区间,但尚未过热。当前反弹正处于斐波那契23.6%的回撤位,如果突破,目标将是79900-81600区域。但是,若再次跌破77000并伴随MACD柱状图放量,可能会重新测试前低74500,甚至可能走出新一轮下跌。

比特币一小时图

当前价格运行在布林带上轨附近,大约在78,000至78,500区间,布林带略有张口。中轨大约在76,700至77,000区间提供有效支撑,而上轨则可能成为阻力。DIF线和DEA线形成金叉形态并持续上扬,MACD红色柱状图正在逐渐增长,说明中短期反弹信号正在增强,但仍处于空头格局。

KDJ三线值维持多头排列,进入高位区间,短期处于强势反弹阶段,但已有超买迹象。KDJ显示短线反弹接近高位,需警惕高位钝化或回调修复,特别是J线值拐头将触发短期调整。当前反弹恰好触及斐波那契23.6%回撤位附近,这是一个关键的阻力点。

综合分析,当前比特币4H级别上正处于底部震荡修复期,MACD与KDJ呈现反弹信号,BOLL带下轨支撑有效,斐波那契23.6%回撤位正面临关键突破点。若突破,将有机会冲击80000-81600区间;若失败,需警惕回踩75000甚至更低。比特币目前在1H级别上呈现温和反弹态势,MACD金叉持续、KDJ处于高位,布林中轨支撑有效,正在挑战斐波那契23.6%关键阻力。如果能够放量突破78000,则有望进一步走强;反之,仍然需要提防短期冲高回落。

综上所述大仙给出以下建议供参考

📈多头策略:突破并企稳77900-78000区域,可轻仓做多,目标看向79900-81600,止损位建议放在77000附近。

📉空头策略:比特币反弹至81600附近,无法突破斐波那契50%回撤位,并伴随着KDJ死叉、MACD放量减弱,可尝试轻仓空单,目标看向78000-77600,止损位建议放在82300附近。

给你一个百分百准的建议,不如给你一个正确的思路与趋势,毕竟授人与鱼不如授人与渔,建议赚一时,思路学会赚一生!注重的是思路,对于趋势的把握,对于行情的布局和仓位规划,我所能做的就是用我的实战经验,给大家帮助,让您的投资决策和经营管理走在一条正确的方向上。

撰稿时间:(2025-04-10,00:40)

(文-大仙说币)特此申明:网络发布具有延迟,以上建议仅供参考。笔者致力于比特币、以太坊、山寨币、外汇、股票等投资领域研究分析,涉足金融市场多年,拥有丰富的实盘操作经验,投资有风险,入市需谨慎,更多实时行情分析请关注伀重號大仙说币一起探讨交流。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。