Qubic founder Sergey Ivancheglo (known as CFB) has hinted at a planned 51% attack on social media this week. The operation aims to dominate Monero’s network until Aug. 31, potentially enabling double-spending, transaction censorship, or orphan blocks. CFB claims this demonstrates Qubic’s Useful Proof of Work (uPoW) technology rather than attempting to destroy Monero.

Qubic is a layer one (L1) blockchain project founded by CFB.

Qubic’s uPoW system allows its “AI miners” to simultaneously secure its network and mine Monero during idle cycles. Rewards from mining XMR are converted to USDT, used to buy Qubic’s QUBIC tokens, and burned – creating a profitable deflationary model. This integration, active since May 2025, has drawn significant Monero mining power. Qubic’s share of Monero’s global hashrate fluctuated between 20-40% in July, nearing levels triggering community alarm.

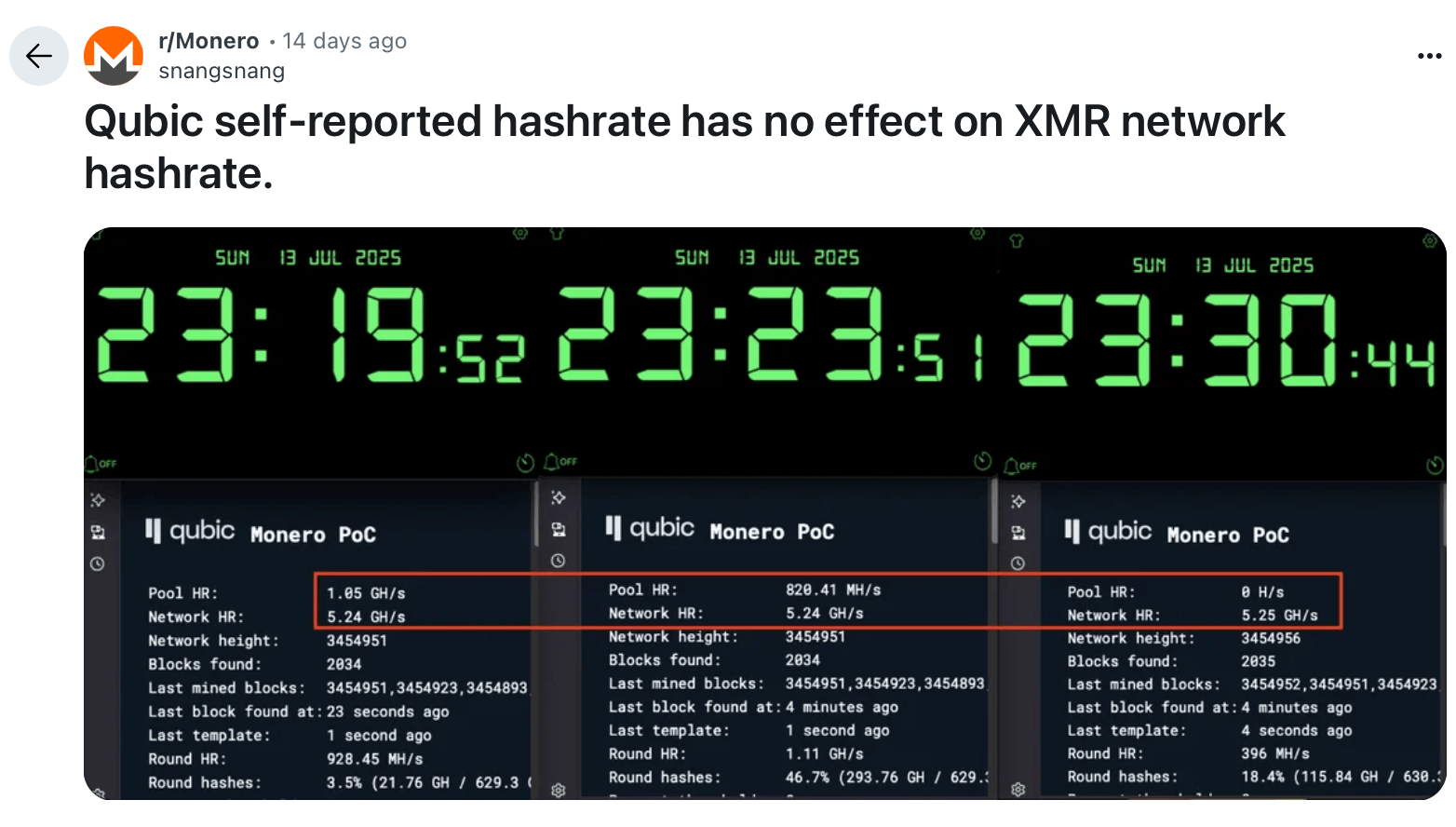

As of Sunday, July 27, 2025, Qubic is flexing its muscle, commanding 26.96% of Monero’s 6.12 gigahash per second (GH/s) hashrate. Monero advocates allege Qubic artificially inflates its “self-reported” hashrate (“spoofing”) and parasitizes their network. They warn that a successful 51% attack could devastate trust in Monero, widely used for private transactions.

“Let’s take this seriously and not wait till it’s too late to try and act on it,” a Redditor posting on the r/monero subreddit said.

Some XMR proponents believe Qubic’s hashrate is being spoofed.

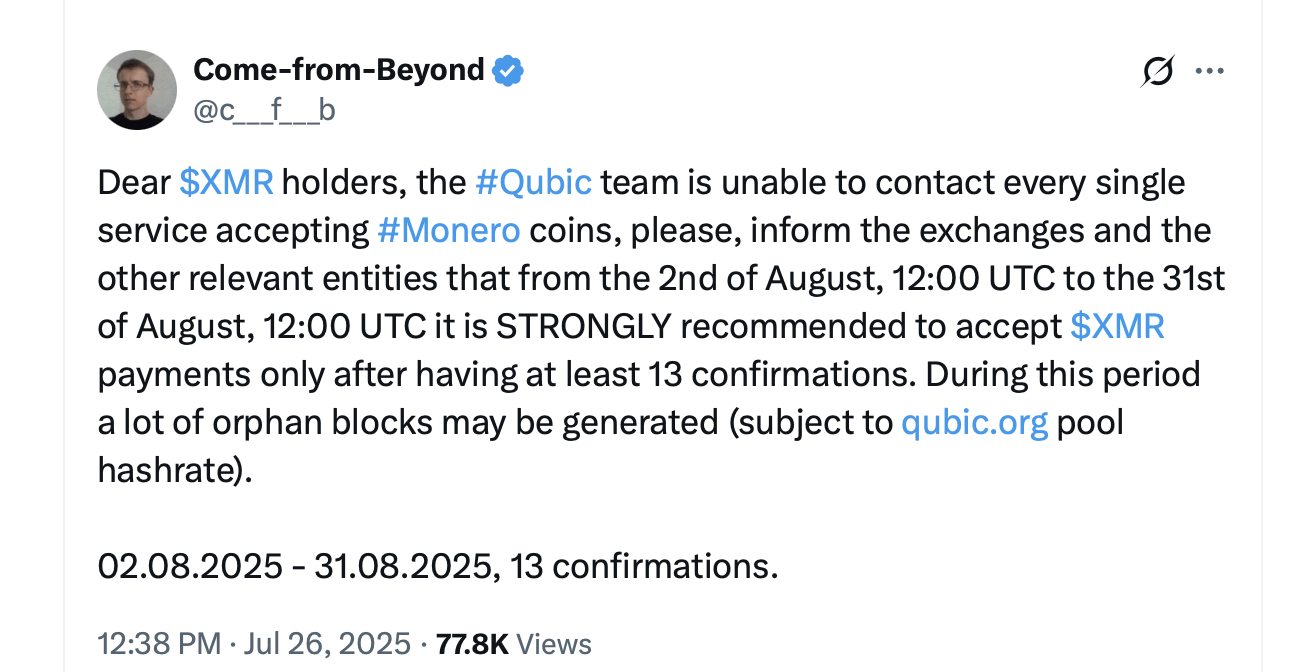

Past threats (like MineXMR in 2022) were mitigated by decentralization and calls for pool migration. CFB advised exchanges via X to require 13 XMR transaction confirmations instead of 10 during the test. The project insists Qubic provides “economic incentive,” not harm, and that Monero’s privacy uniqueness will shield its price. Qubic supporters echo this view, framing it as uPoW validation. The Monero community is divided on responses: Some urge switching to decentralized pools like P2Pool; others suggest protocol changes.

XMR advocates fear users may migrate to alternative networks like Zcash or Zano if Monero confidence erodes. Others argue that chasing ASIC resistance has always been a futile effort. Neutral observers call this a stress test for both projects and proof-of-work vulnerabilities. If Qubic succeeds without damage, it could validate uPoW; if chaos ensues, it may reinforce Monero’s resilience despite short-term price risks.

As of July 27, Qubic hasn’t sustained 51% control, but its hashrate has fluctuated near critical thresholds.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。