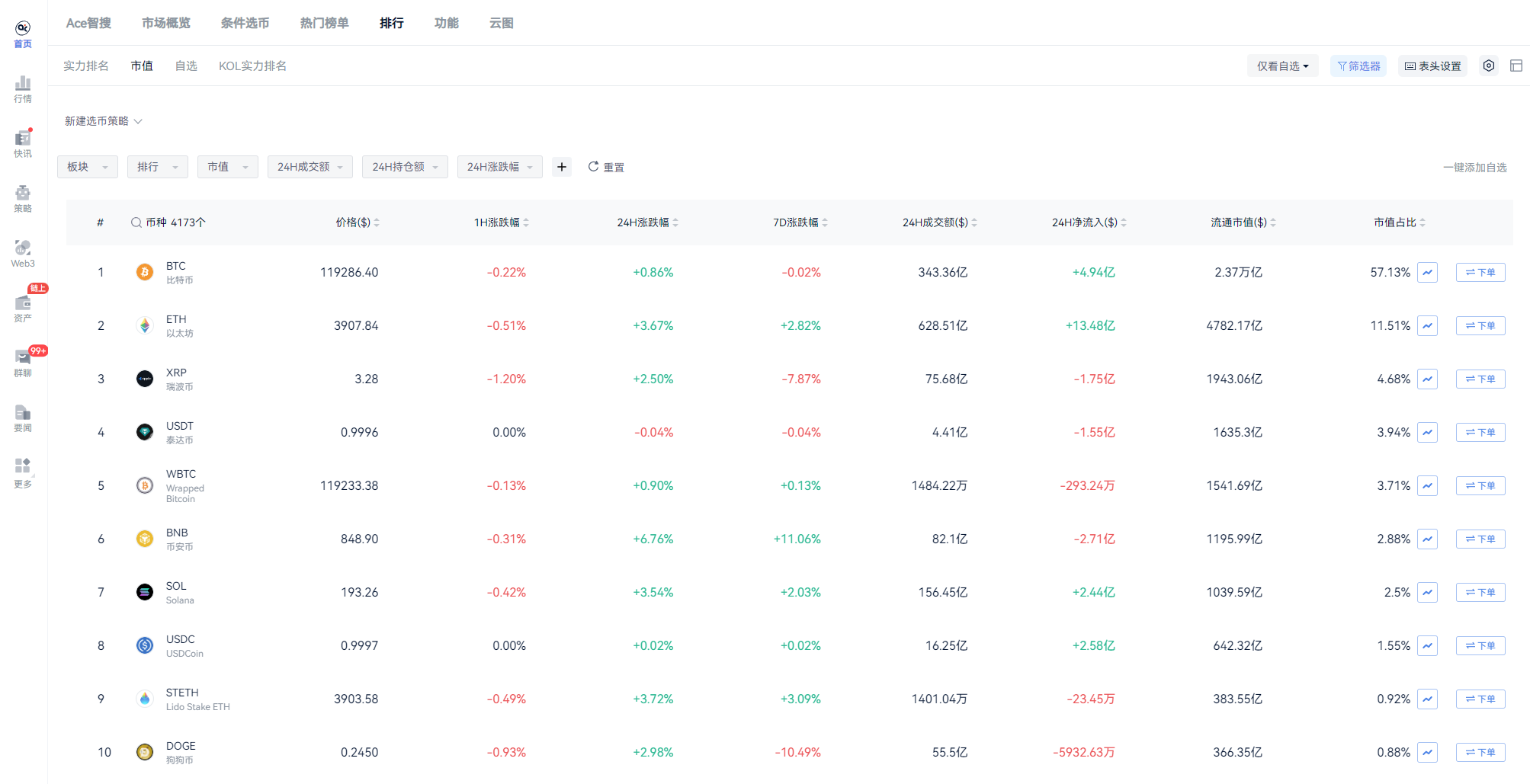

Binance Coin(BNB)短时突破855美元,续创历史新高,点燃了加密货币市场的投资热情。根据AiCoin实时数据,BNB在过去24小时上涨约6.76%,显示出强劲的市场动能。用户纷纷预测,BNB有望在2025年内突破1000美元,成为继比特币(BTC)之后又一冲刺关键心理关口的主流币。数据显示,BNB当前市值约1195亿美元,24小时交易额达82亿美元。这一涨势不仅彰显了BNB的强劲动能,也与全球Web3生态的快速发展密切相关。

BNB价格上涨的主要驱动因素是什么?

1. 机构资金流入与财库采用

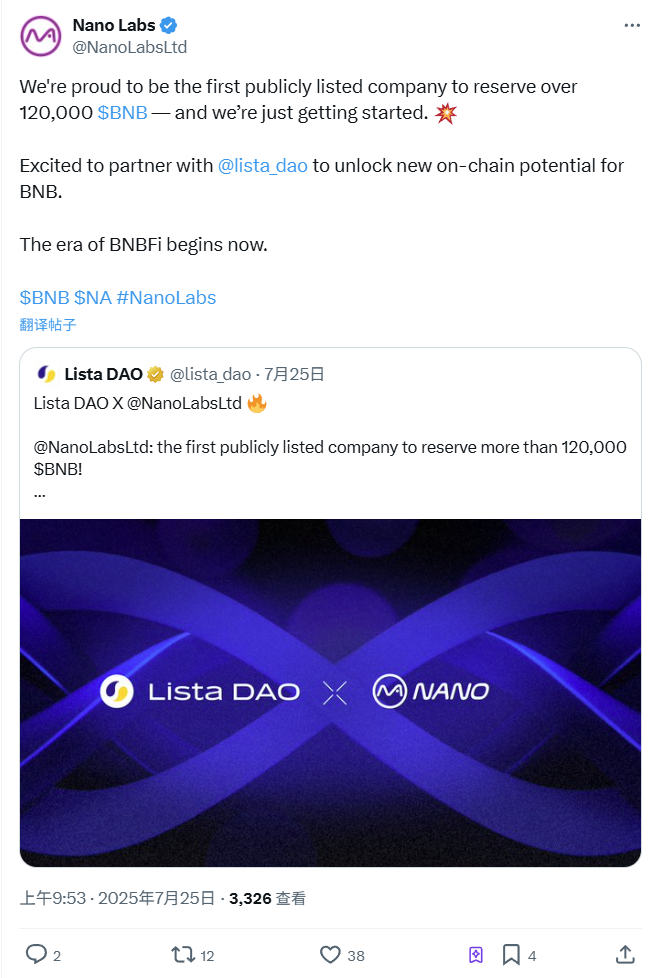

Windtree Capital和Nano Labs向BNB注入6.1亿美元,这一大胆举措显著提升了投资者对BNB的信心,同时也吸引更多机构关注加密资产的可能性。此外,越来越多企业探索以BNB作为其企业加密财库的一部分,从而进一步推动了需求增长。这种趋势标志着BNB逐渐转型为一种“机构级资产”,改变了以往仅局限于零售投资的定位。

2. 市场情绪与交易量增长

在推特和社交媒体上的看涨情绪浓厚,投资者普遍认为BNB具备挑战1000美元的潜力。这种情绪不仅反映在散户之间,也影响了市场整体动能。区块链数据表明,BNB的交易活跃度有所增加。

3. 系统扩张与功能多样性

BNB作为币安平台的原生代币,其应用场景覆盖交易费折扣、参与Launchpad项目、去中心化金融(DeFi)以及NFT领域,这些特性使得BNB成为币安生态中的核心资产。随着币安不断扩展其全球业务以及相关生态,比如近期支持YALA空投和Circle USDC跨链网关,这为BNB价格提供了良好的催化剂作用。

4. 宏观经济与市场环境

全球加密市场环境转好,包括比特币、以太坊等主流币种的表现促成了更广泛的资本进入山寨币市场,增强了BNB的表现。此外,美国证券交易委员会批准多个加密指数基金转换为ETF的消息,也带来了较为积极的加密市场前景,这间接促进了投资者关注BNB等资产。

【价格趋势分析】

K线形态:

- 日线级别显示近期价格持续上涨,形成多根阳线,尤其是7月27日的大阳线突破前期高点,表明市场情绪偏强。

- 小时线级别在850附近出现震荡整理,多次测试上方压力位未能有效突破,短期可能进入盘整阶段。

技术指标:

- MACD:小时线的DIF和DEA均为正值且保持向上发散,但柱状图开始缩短,动能减弱;日线级别MACD金叉后继续放量,趋势仍然偏多。

- RSI:小时线RSI处于75以上超买区间,短期有回调需求;日线RSI接近80,同样提示短期过热。

- EMA:小时线EMA7(845.09)对当前价格提供支撑,EMA30(824.08)与EMA120(792.34)呈现多头排列,整体趋势向上。日线EMA系统同样维持多头格局。

成交量:

- 日线成交量7月27日显著放大,伴随价格突破关键阻力,说明资金流入明显。

- 小时线成交量逐步萎缩,反映出短期内追涨意愿下降,需关注是否会引发调整。

市场仍需警惕以下风险:

监管不确定性:欧盟对Binance的监管审查和Tornado Cash相关争议可能引发波动。

市场过热:高杠杆交易导致爆仓风险加剧,BNB的快速上涨可能引发获利了结。

竞争压力:Sui、Solana等Layer 1区块链的崛起可能分流资金。

本文章仅供信息分享,不构成对任何人的任何投资建议。

加入我们的社区讨论该事件

官方电报(Telegram)社群:t.me/aicoincn

聊天室:致富群

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。