Key Points

· The total market capitalization of global cryptocurrencies is $4.16 trillion, up from $3.97 trillion last week, representing a 4.7% increase this week. As of the time of writing, the cumulative net inflow of the U.S. Bitcoin spot ETF is approximately $54.82 billion, with a net inflow of $72.06 million this week; the cumulative net inflow of the U.S. Ethereum spot ETF is approximately $9.33 billion, with a net inflow of $1.85 billion this week.

· The total market capitalization of stablecoins is $260.9 billion, with USDT's market cap at $163.3 billion, accounting for 62.59% of the total stablecoin market cap; followed by USDC with a market cap of $64.3 billion, accounting for 24.65% of the total stablecoin market cap; and DAI with a market cap of $5.37 billion, accounting for 2.06% of the total stablecoin market cap.

· According to DeFiLlama, the total TVL of DeFi this week is $143.2 billion, up from $141.5 billion last week, an increase of about 1.18%. By public chain, the top three chains by TVL are Ethereum at 59.95%; Solana at 7.11%; and BNB Chain at 4.99%.

· On-chain data shows a significant divergence in performance among major public chains this week: Ton's daily transaction volume plummeted by 713%, while Solana (-4.36%) and BNB Chain (-12.98%) saw slight declines; Ethereum and Sui increased by 39.37% and 43.88%, respectively, while Aptos remained relatively stable. In terms of transaction fees, Ethereum (-150%) and TON (-18.71%) decreased, while TON increased by 80%; Solana and Sui saw slight growth, and BNB remained flat. In terms of daily active addresses, Sui (+23.81%), Aptos (+7.99%), and Ethereum (+3.26%) saw growth, while other chains declined, with Solana experiencing a drop of 44%. Overall, TVL increased, with only Aptos seeing a slight decline (-3.19%), while TON and BNB Chain had the highest increases at 6.25% and 5.43%, respectively.

· New project focus: Quack AI is an AI protocol aimed at general on-chain governance, dedicated to revolutionizing DAO governance processes. Poseidon is a full-stack decentralized data layer project built on a Story protocol centered around intellectual property, incubated by the Story team, aimed at solving the core challenge of acquiring high-quality, usable, and legally authorized training data in the AI field. WaveX is a decentralized exchange (DEX) built on the Soneium network, offering high-leverage trading, zero price impact, and deep liquidity.

Table of Contents

Key Points………………………………………………………………………………………. 1

Table of Contents……………………………………………………………………………… 2

1. Market Overview…………………………………………………………………………… 2

1. Total Cryptocurrency Market Cap/Bitcoin Market Cap Proportion……….. 2

2. Fear Index…………………………………………………………………………………. 2

3. ETF Inflow and Outflow Data………………………………………………………. 2

4. ETH/BTC and ETH/USD Exchange Rates………………………………………….. 2

5. Decentralized Finance (DeFi)………………………………………………………… 2

6. On-chain Data……………………………………………………………………………. 2

7. Stablecoin Market Cap and Issuance Status……………………………………. 2

2. This Week's Hot Money Trends………………………………………………………. 2

1. Top Five VC Coins and Meme Coins by Growth This Week……………….. 2

2. New Project Insights…………………………………………………………………… 2

3. Industry News Updates……………………………………………………………….. 2

1. Major Industry Events This Week…………………………………………………. 2

2. Major Upcoming Events Next Week………………………………………………. 2

3. Important Financing Events from Last Week………………………………….. 2

4. Reference Links………………………………………………………………………….. 2

1. Market Overview

1. Total Cryptocurrency Market Cap/Bitcoin Market Cap Proportion

The total market capitalization of global cryptocurrencies is $4.16 trillion, up from $3.97 trillion last week, representing a 4.7% increase this week.

Data source: cryptorank

Data as of July 27, 2025

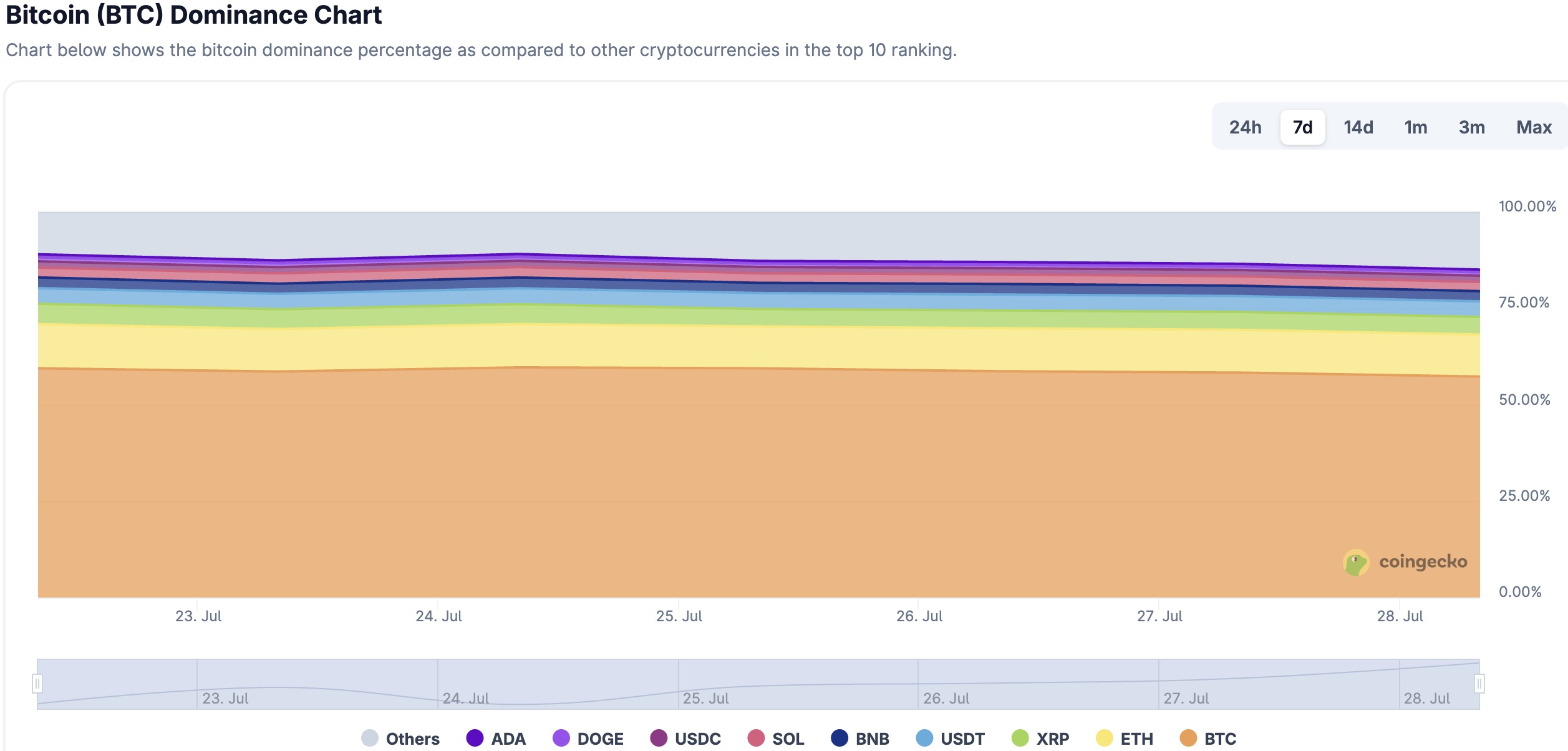

As of the time of writing, the market cap of Bitcoin is $2.37 trillion, accounting for 56.9% of the total cryptocurrency market cap. Meanwhile, the market cap of stablecoins is $260.9 billion, accounting for 6.27% of the total cryptocurrency market cap.

Data source: coingeck

Data as of July 27, 2025

2. Fear Index

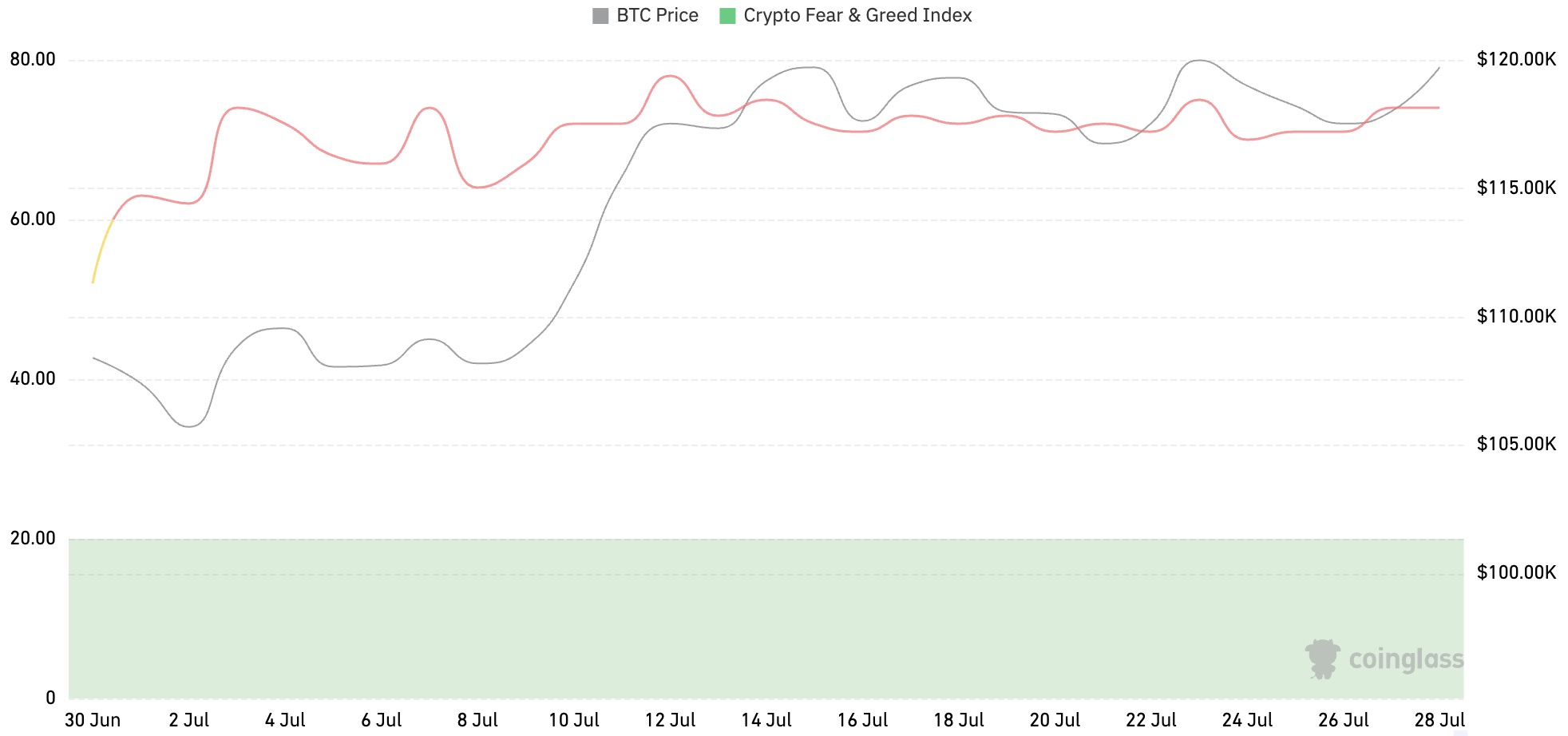

The cryptocurrency fear index is at 74, indicating greed.

Data source: coinglass

Data as of July 27, 2025

3. ETF Inflow and Outflow Data

As of the time of writing, the cumulative net inflow of the U.S. Bitcoin spot ETF is approximately $54.82 billion, with a net inflow of $7.206 million this week; the cumulative net inflow of the U.S. Ethereum spot ETF is approximately $9.33 billion, with a net inflow of $1.85 billion this week.

Data source: sosovalue

Data as of July 27, 2025

4. ETH/BTC and ETH/USD Exchange Rates

ETHUSD: Current price $3,844.53, all-time high $4,878.26, approximately 21.11% down from the all-time high.

ETHBTC: Currently at 0.032289, all-time high 0.1238.

Data source: ratiogang

Data as of July 27, 2025

5. Decentralized Finance (DeFi)

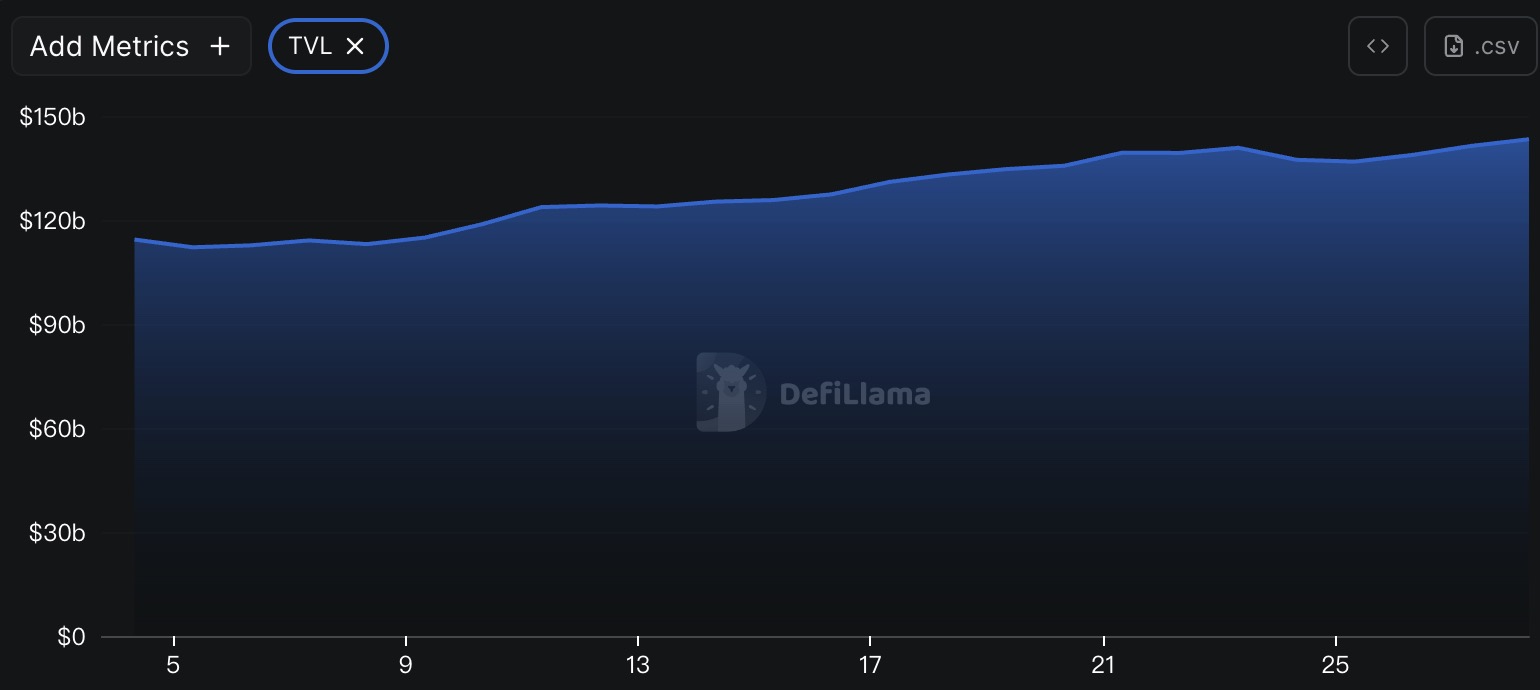

According to DeFiLlama, the total TVL of DeFi this week is $143.2 billion, up from $141.5 billion last week, an increase of about 1.18%.

Data source: defillama

Data as of July 27, 2025

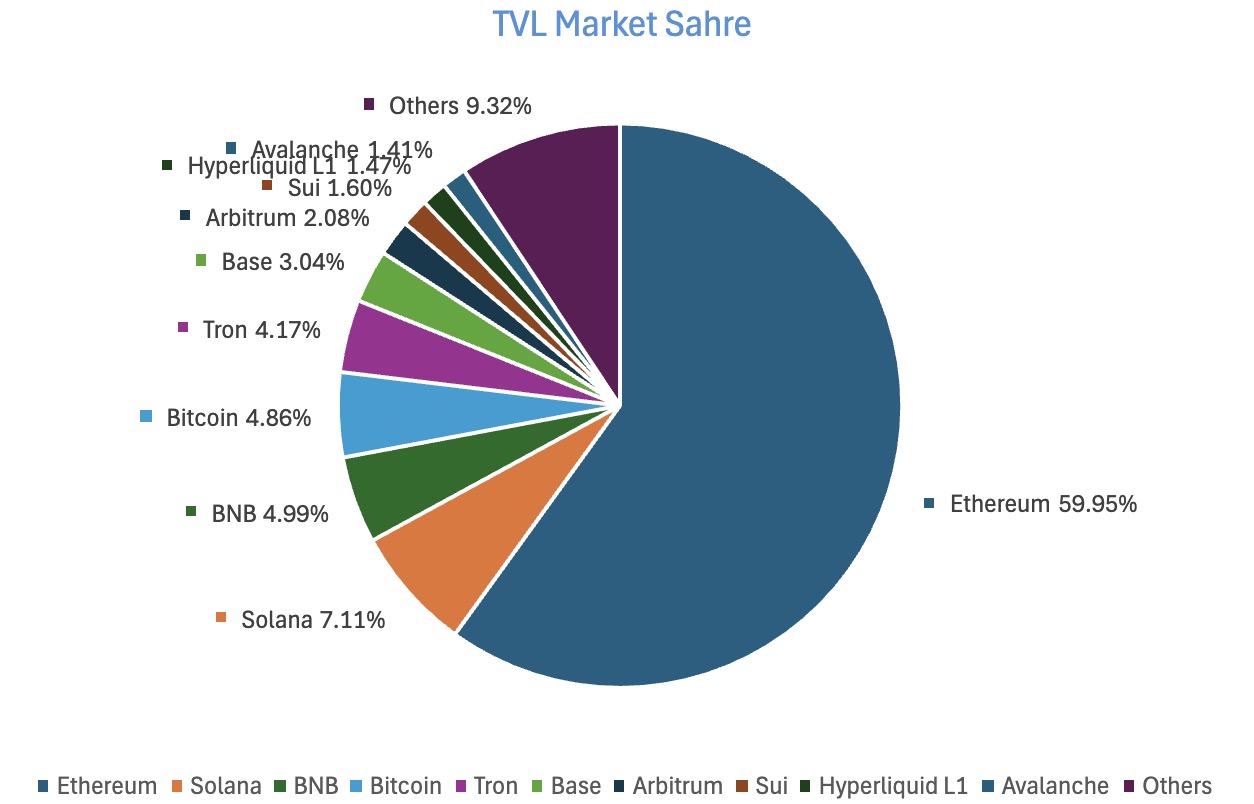

By public chain, the top three chains by TVL are Ethereum at 59.95%; Solana at 7.11%; and BNB Chain at 4.99%.

Data source: CoinW Research Institute, defillama

Data as of July 27, 2025

6. On-chain Data

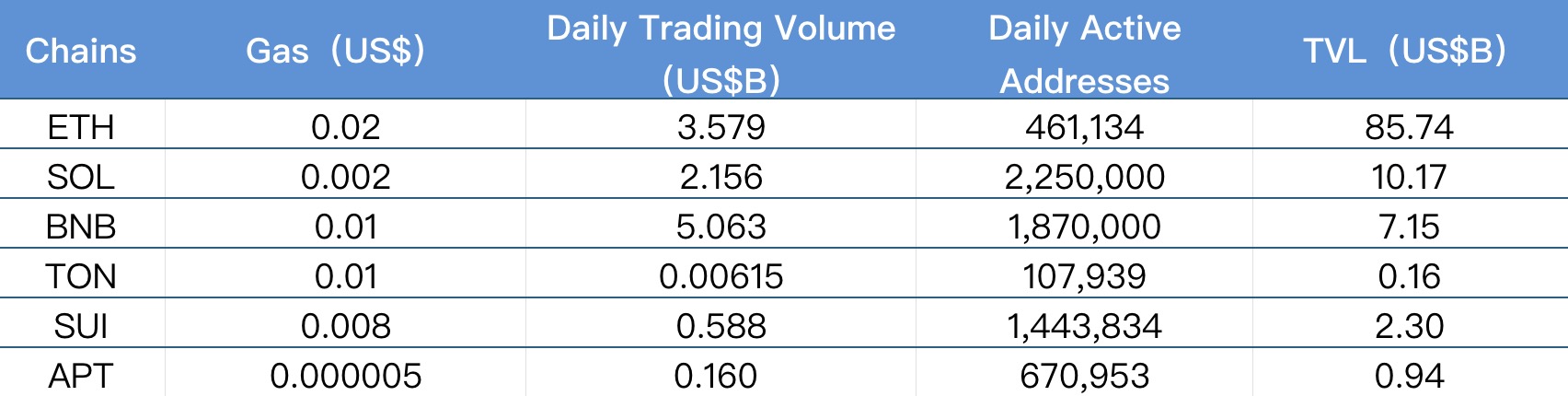

Layer 1 Related Data

Mainly analyzing the current data of major Layer 1 chains including ETH, SOL, BNB, TON, SUI, and APT based on daily transaction volume, daily active addresses, and transaction fees.

Data source: CoinW Research Institute, defillama, Nansen

Data as of July 27, 2025

· Daily transaction volume and transaction fees: Daily transaction volume and transaction fees are core indicators of public chain activity and user experience. In terms of daily transaction volume, Ton saw a significant drop this week, down 713%; Solana (-4.36%) and BNB Chain (-12.98%) experienced slight declines. Ethereum and Sui increased by 39.37% and 43.88%, respectively; Aptos remained nearly flat compared to last week. In terms of transaction fees, only Ethereum and TON chains decreased this week, with declines of 150% and 18.71%, respectively; BNB remained flat compared to last week; Sui (+4.24%) and Solana (+16.99%) saw slight increases; TON had a significant increase of 80%.

· Daily active addresses and TVL: Daily active addresses reflect the ecological participation and user stickiness of public chains, while TVL reflects user trust in the platform. This week, daily active addresses for Ethereum, Sui, and Aptos increased by 3.26%, 23.81%, and 7.99%, respectively; other chains saw declines, with Solana (-44%), BNB Chain (-26.2%), and TON (-19.43%). In terms of TVL, only Aptos saw a slight decline (-3.19%), while other public chains achieved increases. Among them, TON and BNB Chain grew by 6.25% and 5.43%, respectively; Ethereum, Solana, and Sui had smaller increases of 2.82%, 2.44%, and 2.78%.

Layer 2 Related Data

According to L2Beat, the total TVL of Ethereum Layer 2 is $41.67 billion, with an overall increase of 1.37% compared to last week ($41.1 billion).

Data source: L2Beat

Data as of July 27, 2025

Base and Arbitrum occupy the top positions with market shares of 37.37% and 34.27%, respectively, while Base and Optimism saw slight declines in market share over the past week.

Data source: footprint

Data as of July 27, 2025

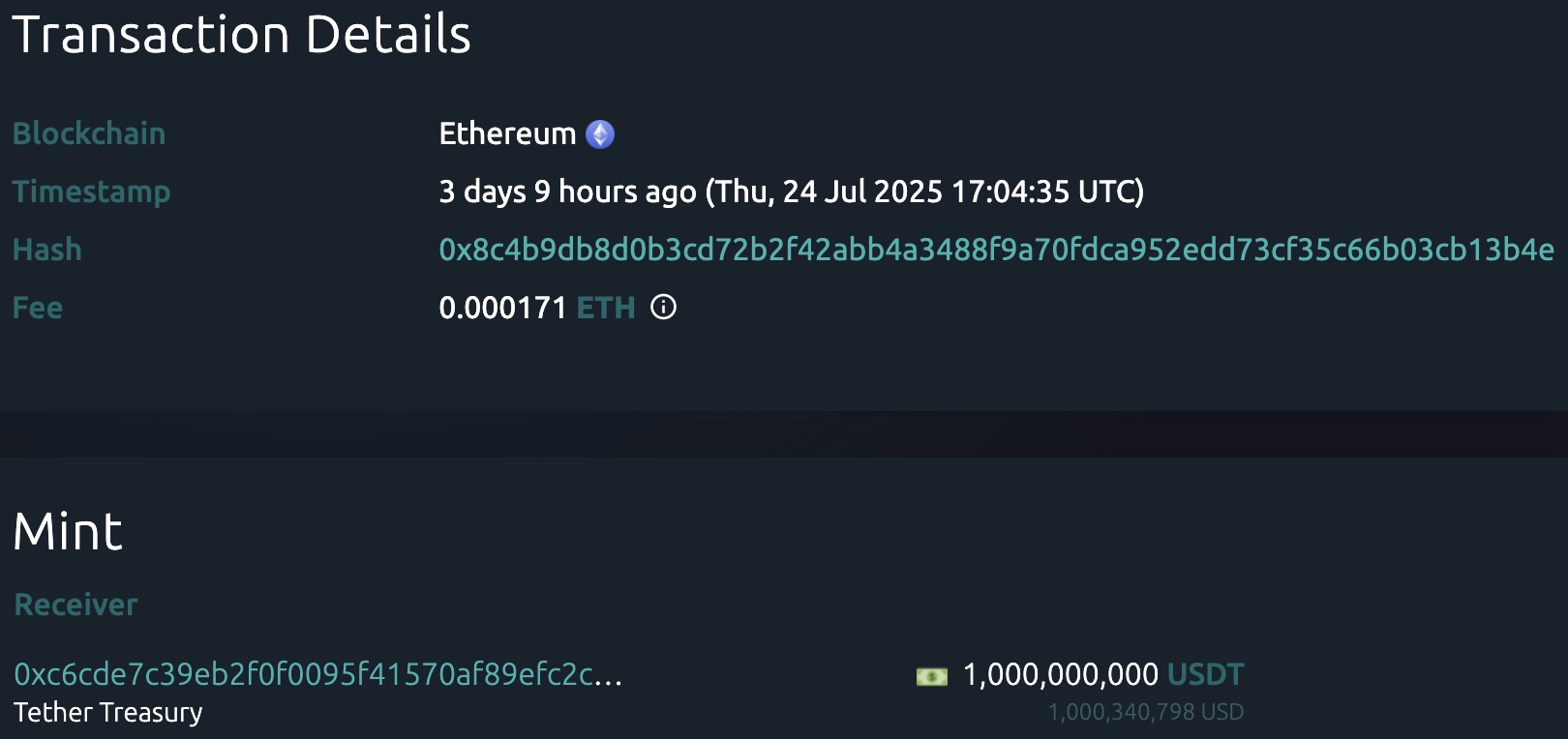

7. Stablecoin Market Cap and Issuance Status

According to Coinglass, the total market capitalization of stablecoins is $260.9 billion, with USDT's market cap at $163.3 billion, accounting for 62.59% of the total stablecoin market cap; followed by USDC with a market cap of $64.3 billion, accounting for 24.65% of the total stablecoin market cap; and DAI with a market cap of $5.37 billion, accounting for 2.06% of the total stablecoin market cap.

Data source: CoinW Research Institute, Coinglass

Data as of July 27, 2025

According to Whale Alert, this week the USDC Treasury issued a total of 1.412 billion USDC, and the Tether Treasury issued a total of 2 billion USDT this week. The total issuance of stablecoins this week was 3.412 billion, down 33.35% from last week's total issuance of 4.55 billion.

Data source: Whale Alert

Data as of July 27, 2025

II. This Week's Hot Money Trends

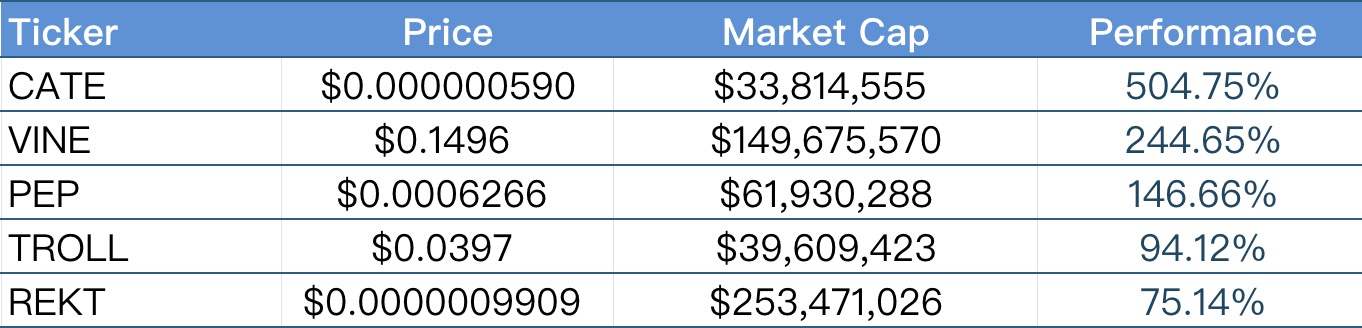

1. Top Five VC Coins and Meme Coins by Growth This Week

The top five VC coins by growth over the past week.

Data source: CoinW Research Institute, coinmarketcap

Data as of July 27, 2025

The top five Meme coins by growth over the past week.

Data source: CoinW Research Institute, coinmarketcap

Data as of July 27, 2025

2. New Project Insights

· Quack AI is an AI protocol aimed at general on-chain governance, dedicated to revolutionizing DAO governance processes. Through automated decision-making, real-time execution, and AI-driven risk analysis, Quack AI achieves seamless management from AI-generated proposals to multi-chain on-chain execution, enhancing governance efficiency and transparency.

· Poseidon is a full-stack decentralized data layer project built on a Story protocol centered around intellectual property, incubated by the Story team, aimed at solving the core challenge of acquiring high-quality, usable, and legally authorized training data in the AI field. The project completed a $15 million funding round led by a16z in July 2025. a16z founder Chris Dixon stated that Poseidon provides compliant and secure data access for AI developers through the programmable intellectual property layer and immutable registry of the Story protocol, helping to build a new internet data economy ecosystem.

· WaveX is a decentralized exchange (DEX) built on the Soneium network, offering high-leverage trading, zero price impact, and deep liquidity. Users can not only trade efficiently but also become liquidity providers by depositing assets to earn potential returns.

III. Industry News Updates

1. Major Industry Events This Week

· DePHY Network officially launched the token generation event (TGE) and community airdrop for its native token PHY on July 26, 2025. As an important component of decentralized IoT infrastructure, the PHY token will play a core role in driving network incentives, node operations, and governance mechanisms. This airdrop is aimed at long-term supporters of DePHY, and eligible users will have the opportunity to claim airdrop rewards through designated channels on the platform.

· Aspecta officially launched its native token ASP's Token Generation Event (TGE) on July 24, 2025, at 18:00 (UTC+8). The total issuance of ASP is 1 billion, with 45% allocated to the community and ecosystem, 20% to investors, 15% to early contributors, 3% for liquidity support, and 17% managed by the foundation. The official airdrop eligibility query opened at 15:00 (UTC+8) on July 24, and the airdrop claim opened simultaneously with the TGE at 18:00.

· Elympics announced the official launch of its native token ELP's Token Generation Event (TGE) on July 24, 2025, along with the launch of an airdrop eligibility query tool. The airdrop is open to three categories of community users: the top 1,600 users with the highest Respect scores, the top 500 users from Cookie DAO snapshot #1, and users participating in Elympics' multiple airdrop incentive activities who staked COOKIE.

· Bitlayer launched the Ooster Program (Acceleration Incentive Program) and Pre-TGE activities on July 24, 2025, at 09:00 UTC. The former airdropped 3% of the total BTR supply (30 million tokens) to early community supporters who completed tasks, while the latter opened subscriptions for 2% of BTR (20 million tokens) at a price of $0.02 per token, with a subscription limit of 3 BNB. The tokens must be locked and can only circulate after the project team announces the unlocking.

· Delphinus Lab launched the first generation event (TGE) for the ZKWASM token on July 22, 2025, marking a new phase for the project ecosystem. This TGE is open to core community members and aims to further promote the construction and development of decentralized zero-knowledge application infrastructure through token distribution. ZKWASM is the native token launched by Delphinus Lab, which will be used to incentivize the developer ecosystem, node participation, and protocol governance, helping to build an efficient, secure, and scalable ZK application execution environment.

2. Major Events Coming Next Week

· Ulalo (ULA) will conduct its TGE on July 30 at 15:00 (UTC), releasing 30% of the tokens initially, with the remaining portion to be released linearly over three months after a one-month lock-up period. Previously, the project completed airdrop distributions with partner platforms, and eligible users can claim airdrop qualifications. Several IDO and Launchpool activities have also been scheduled to prepare for subsequent token circulation and ecosystem development.

· Refacta (REFACTA) will conduct its TGE through an IDO on July 28, 2025, issuing approximately 2% of the total supply of tokens, with a fundraising target of $250,000. Refacta is a platform that combines artificial intelligence and blockchain technology, dedicated to providing automated generation and optimization services for smart contracts, helping developers enhance the efficiency and security of smart contracts.

· The TGE and first phase Booster activity for Treehouse (TREE) will end on July 28, when the initial token distribution and participation rewards allocation will be largely completed. Users can participate by staking to earn token rewards, with the total allocation accounting for approximately 0.25% of the total supply. Prior to this, the project conducted a snapshot for GoNuts Season 1 participants on May 29 at 00:00 (UTC), and eligible users can claim the basic token allocation and possible additional rewards during the TGE. Additionally, TSC NFT holders can claim 500 TREE incentives corresponding to each NFT within three months after the TGE.

· STEPN will soon launch a new round of GMT airdrops. The official snapshot for the airdrop was completed on July 17 at 07:00 UTC, and this round of airdrops will distribute GMT rewards to STEPN and STEPNGO community users. Eligible users for the airdrop must meet one of the following conditions: hold eligible STEPN badges in their spending accounts; own at least one Genesis sneaker or shoebox (holding time counts); rank in the top 5000 on the historical leaderboard; or have used at least 10 energy points within 30 days prior to the snapshot. Specific airdrop claim times and processes will be announced later.

3. Important Financing Events Last Week

· Bitzero, a crypto mining company supported by Kevin O'Leary, completed a $25 million financing round, with the investors undisclosed. Bitzero focuses on building data centers for cryptocurrency and sustainability and plans to use part of the funds to purchase 2,900 Bitmain S21 Pro mining machines to expand its computing power scale. (July 24, 2025)

· UK-listed company Satsuma Technology (formerly Tao Alpha) announced it has completed over £100 million in financing. The company focuses on building infrastructure and AI agents on the Bittensor network and is actively increasing its Bitcoin holdings. The funds will be used to expand decentralized infrastructure and accelerate Bitcoin holdings. Previously, Satsuma had established a position of 28.56 BTC on July 14. (July 24, 2025)

· South Korean blockchain infrastructure service provider DSRV completed approximately 16 billion KRW (about $11.6 million) in its Series B first round of financing, with investors including Intervest and NH-SK Securities. DSRV provides node and infrastructure services for over 70 blockchain networks globally, managing assets exceeding 40 trillion KRW. The company plans to expand into new businesses such as stablecoins and custody, and accelerate its layout in the U.S., Japan, and Africa. (July 23, 2025)

· Decentralized AI inference platform Gaia announced the completion of $20 million in seed and Series A financing, with investors including ByteTrade, SIG, Mirana, Mantle, and follow-on investments from Outlier Ventures, NGC, Taisu Ventures, and Consensys Mesh. The funds will be used to expand decentralized AI infrastructure and launch the world's first AI-native smartphone—the Gaia AI phone, built on Galaxy S25 Edge hardware, supporting local AI inference without data uploads, ensuring user privacy. (July 23, 2025)

· MEI Pharma (NASDAQ: MEIP) announced the completion of a $100 million private placement, intending to use the funds to purchase Litecoin (LTC) as a financial reserve asset, becoming the first company listed on a national exchange to hold Litecoin. Litecoin founder Charlie Lee joined the board, and GSR served as financial advisor. This round of financing issued approximately 29.24 million shares at $3.42 per share, with investors including the Litecoin Foundation and several institutions. (July 22, 2025)

4. Reference Links

Quack AI: https://quackai.ai/

Poseidon: https://psdn.ai/

WaveX: https://wavex.fi/

Bitzero: https://bitzero.com/

Satsuma Technology: https://www.satsuma.digital/

Gaia: https://www.gaianet.ai/

MEI Pharma: https://meipharma.com/

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。