According to market reports, digital asset investment products recorded a net inflow of $1.9 billion in the past week, pushing the cumulative inflow for this month to a record $11.2 billion, far exceeding the $7.6 billion inflow recorded after the U.S. presidential election in December 2024. This data not only highlights the market's continued enthusiasm for crypto assets but also marks the 15th consecutive week of net inflows into digital asset investment products, reflecting that investor confidence in the crypto market is at a high point in recent years.

Ethereum Leads Strongly, Fund Inflows Reach Historic Second High

In the past week’s fund flows, Ethereum was undoubtedly the biggest winner, attracting $1.59 billion in inflows, setting a record for its second-highest weekly inflow, second only to the peak during the 2021 crypto market boom. Year-to-date, Ethereum's total inflow has reached $7.79 billion, surpassing the total for the entire year of 2024. This phenomenon reflects Ethereum's continued appeal among institutional and retail investors, with its widespread applications in decentralized finance (DeFi), smart contracts, and real asset tokenization (RWA) further solidifying its market position.

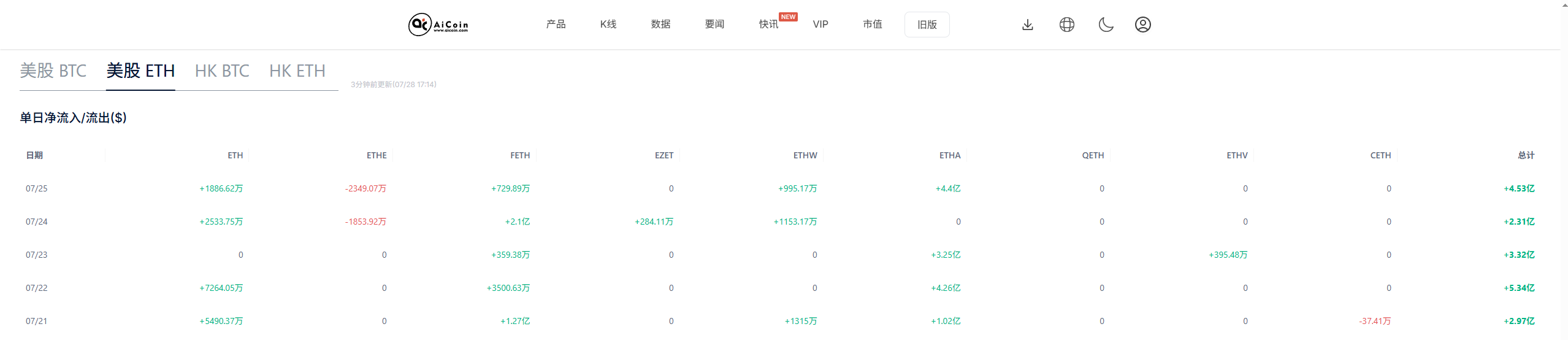

Ethereum's strong performance is closely related to several favorable factors. The U.S. Securities and Exchange Commission (SEC) approved Ethereum spot ETFs in 2024, providing a compliant channel for institutional funds to enter. AiCoin data shows that from July 21 to 25, the net inflow into U.S. Ethereum spot ETFs was $1.847 billion, far exceeding the $73 million inflow for Bitcoin ETFs during the same period. This gap indicates that institutional investors are shifting funds from Bitcoin to Ethereum, possibly due to Ethereum's network upgrades (such as the Dencun upgrade) enhancing its trading efficiency and scalability, while its core position in the DeFi and NFT ecosystems further boosts investor confidence.

Additionally, Ethereum's staking mechanism provides investors with a stable source of income. As of July 2025, the staking rate on the Ethereum network has approached 28%, with over 32 million ETH locked in staking contracts. This high level of participation not only reduces circulating supply but also offers investors a passive income with an annual percentage rate (APR) between 3% and 5%, attracting institutional funds seeking stable returns.

Bitcoin Unexpectedly Outflows, Market Sentiment Complex

In stark contrast to Ethereum's strong performance, Bitcoin recorded a net outflow of $175 million last week, a rare occurrence in recent times. Market analysts believe this outflow may be related to investors adjusting their expectations regarding the U.S. Bitcoin spot ETF, rather than a complete shift in market sentiment towards altcoin season.

The outflow of Bitcoin funds may be linked to investors taking profits at high levels and uncertainty regarding policies. Nevertheless, Bitcoin's long-term value storage attributes remain widely recognized. Its fixed supply cap of 21 million coins and decentralized nature make it a preferred safe-haven asset amid increasing global economic uncertainty.

ETH Operational Recommendations:

Candlestick Patterns:

- The daily chart shows that prices have been rising steadily, forming multiple bullish candles, indicating a trend of oscillating upward.

- On the 4-hour chart, prices show slight signs of retracement around 3890, but overall remain within an upward channel.

Technical Indicators:

- MACD: Both the daily and 4-hour charts are positive, with the DIF line crossing above the DEA line, and the momentum bars gradually increasing, indicating that the current market is in a bullish dominant state.

- RSI: The 4-hour RSI is close to 70 (68.76), entering the overbought zone, which may indicate short-term retracement pressure; however, the daily RSI is not fully overbought, and the trend remains strong.

- EMA: Prices are running above EMA7, EMA30, and EMA120, with EMA moving averages in a bullish arrangement, providing strong support. EMA7 (3855) can serve as a reference for short-term support.

Altcoin Performance Diverges, Solana and XRP Show Strong Momentum

In the altcoin market, Solana and XRP have demonstrated strong capital attraction capabilities. Solana attracted $311 million in inflows last week, while XRP recorded a net inflow of $189 million, indicating investor preference for high-performance blockchains and cross-border payment solutions. Solana's success is attributed to its explosive growth in meme coin trading and the DeFi sector. This growth is primarily driven by meme coin speculation and the activity of decentralized applications (DApps), with Solana's high throughput and low transaction costs making it the preferred platform for developers and users.

XRP's inflows are closely related to its legal and market developments. In July 2025, XRP reached an all-time high of $3.66, thanks to the nearing conclusion of its seven-year legal battle with the SEC. The market's optimistic expectations for Ripple's cross-border payment solutions have attracted significant institutional funds. Additionally, the approval of the XRP spot ETF has further enhanced its market liquidity, providing investors with more entry channels.

In contrast, the performance of other altcoins has been mixed. SUI recorded $8 million in inflows, showing market interest in its Move language ecosystem, but Litecoin and Bitcoin Cash experienced outflows of $1.2 million and $660,000, respectively. This may reflect a decline in investor enthusiasm for these "old-school" altcoins, especially in the absence of significant technological innovations or application scenarios.

Looking Ahead

The market trends for the second half of 2025 are worth watching. Ethereum's continued strength may push its price to challenge the resistance level of $4,000, while the ecosystem expansion of Solana and XRP may further attract capital inflows. For Bitcoin, the short-term outflows may signal a market adjustment, but its long-term value remains optimistic. Investors should closely monitor the upcoming altcoin ETFs, innovations in blockchain technology, and changes in the global macroeconomic environment to seize market opportunities.

This article is for informational sharing only and does not constitute investment advice for anyone.

Join our community to discuss this event

Official Telegram community: t.me/aicoincn

Chat room: Wealth Group

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。