Author: Tanay Ved

Source: Coin Metrics

Translation: Shan Oppa, Jinse Finance

Key Points:

Bitcoin's realized market cap has surpassed $1 trillion, reflecting the deepening capital commitment and confidence of long-term holders, while the total market cap of the entire crypto market is also approaching $4 trillion.

Demand for Bitcoin (BTC) and Ethereum (ETH) has exceeded the issuance of new coins, primarily driven by ongoing inflows into spot ETFs and increasing corporate treasury accumulation.

The market leadership pattern is beginning to spread, with Ethereum showing relative strength, and altcoins like SOL and XRP attracting more funds due to rising spot trading volumes.

The "GENIUS Act" establishes the first federal regulatory framework for fiat-backed stablecoins in the U.S., bringing compliance clarity and creating a larger participation space and competitive environment for the $250 billion stablecoin market.

Introduction

The crypto asset market is approaching the significant milestone of $4 trillion, marking an important milestone in the industry's development history. This round of growth is driven by a combination of structural and cyclical forces: from the continuous inflow of funds into spot Bitcoin and Ethereum ETFs, to the accelerated accumulation by treasury-type crypto asset companies, and key regulatory breakthroughs like the "GENIUS Act." It can be said that the "tailwinds" driving the crypto market are strengthening.

This article will break down the key market forces and on-chain capital flows driving this expansion.

Bitcoin's Realized Market Cap Surpasses $1 Trillion, Market Activity Continues to Expand

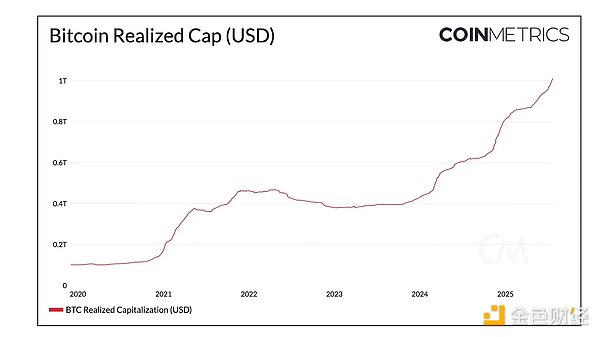

Bitcoin (BTC) reached a new high of $123,000, with its total market cap climbing to $2.38 trillion, and its realized market cap (the total value of each Bitcoin calculated at the price of the last on-chain transfer) also surpassing $1 trillion for the first time. This data indicates that even at high levels, a significant amount of capital continues to enter the market, highlighting increased confidence in Bitcoin's long-term role as a global asset, especially against the backdrop of growing ETF funds and institutional interest.

Market activity also shows early signs of "leadership diffusion." Ethereum (ETH) has begun to exhibit relative strength, with the ETH/BTC exchange rate rising by 73% since May, and ETH breaking through $3,900. This momentum is supported by record inflows into ETFs, accelerated corporate treasury adoption, and favorable developments for the Ethereum ecosystem (especially stablecoins) following the passage of the "GENIUS Act."

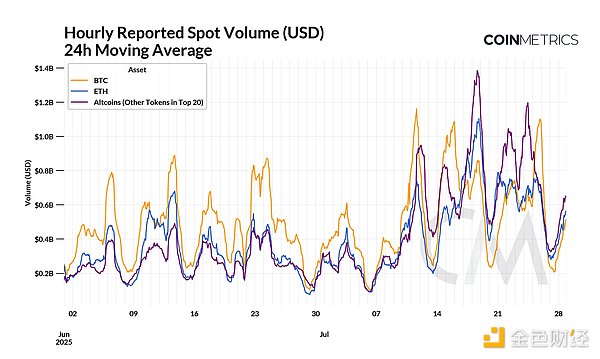

This "diffusion" trend is also reflected in spot trading data: not only is BTC trading volume still strong, but the trading volumes of ETH and large altcoins like SOL and XRP have also significantly increased in recent weeks. Meanwhile, Bitcoin's market dominance has dropped to 59%, while the total market cap of altcoins is approaching $1.6 trillion. Although there are initial signs of "leadership diffusion," it remains to be seen whether this trend will continue.

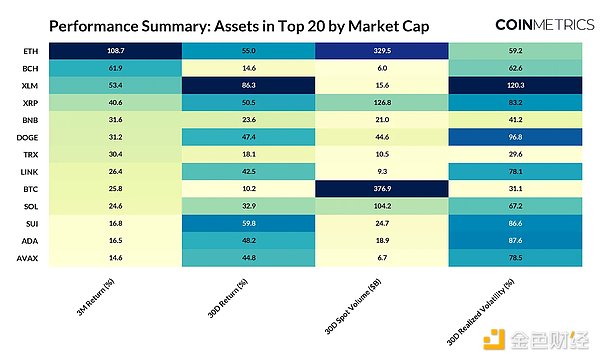

The table below summarizes the market statistics of the top 20 tokens by market cap, excluding stablecoins and other on-chain derivatives:

Accelerated Demand: Driven by ETFs and Corporate Treasuries

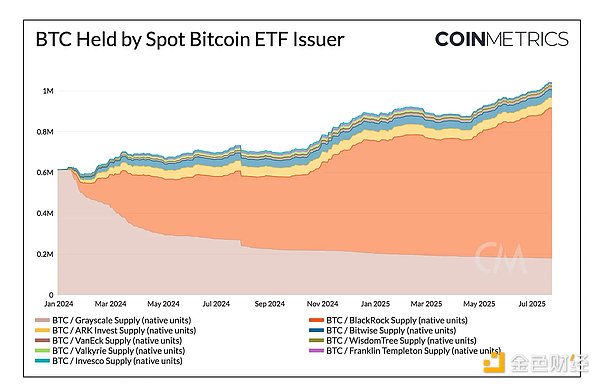

One of the key forces driving the growth in demand for Bitcoin (BTC) and Ethereum (ETH) is spot exchange-traded funds (ETFs). After a brief slowdown in March and April, inflows into Bitcoin ETFs accelerated again in May, pushing the total holdings of U.S. spot Bitcoin ETFs to over 1.27 million BTC (approximately 6.4% of total supply). Among these, BlackRock's iShares Bitcoin Trust (IBIT) remains the largest holder, currently holding about 735,000 BTC (worth approximately $87 billion).

Ethereum (ETH) is also experiencing a similar surge in demand. In recent weeks, spot Ethereum ETFs have seen consecutive net inflows, at times even surpassing Bitcoin's inflows. The total holdings of ETH ETFs have reached 5.8 million ETH, approximately 4.8% of the total ETH supply, with most of the growth concentrated in recent months—despite these ETFs being launched over a year ago.

The demand for ETH is also supported by an increasing number of corporate treasuries focused on Ethereum, causing the accumulation of ETH to outpace new issuance. Unlike corporate treasuries that passively hold BTC, ETH treasuries earn native yields through staking and DeFi, a model that is currently expanding to other large token ecosystems like Solana (SOL), Tron (TRX), and Ethena (ENA).

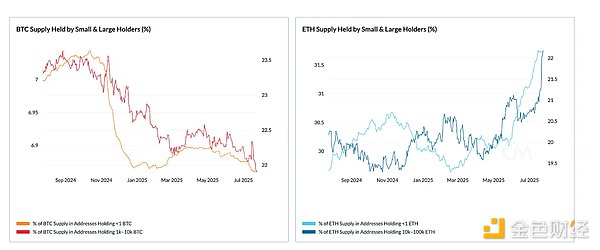

On-Chain Holdings: Divided by Address Balance

As shown in the figure above, the supply held by small Bitcoin holders (1 BTC) and large holders (1,000–10,000 BTC) has gradually decreased over the past year, indicating that as prices rise, the market is entering a distribution phase. In contrast, ETH shows signs of re-accumulation, especially among large holders (10,000–100,000 ETH), whose supply share has risen to over 22%. The supply held by small ETH holders (1 ETH) is also continuously increasing, a trend that has not been interrupted since 2021.

The "GENIUS Act" Opens a New Era for Stablecoins

The "GENIUS Act" was officially signed into law on July 18, establishing the first federal regulatory framework for fiat-backed stablecoins in the U.S. This act creates a fair competitive environment for stablecoin issuers, requiring:

Full reserve backing

Reserve assets must be low-risk, short-term U.S. Treasury securities or cash

Conduct regular audits

Issuers must obtain a license

This has a similar impact to the approval of spot Bitcoin ETFs, bringing regulatory clarity and legitimacy to the U.S. dollar-denominated stablecoin market.

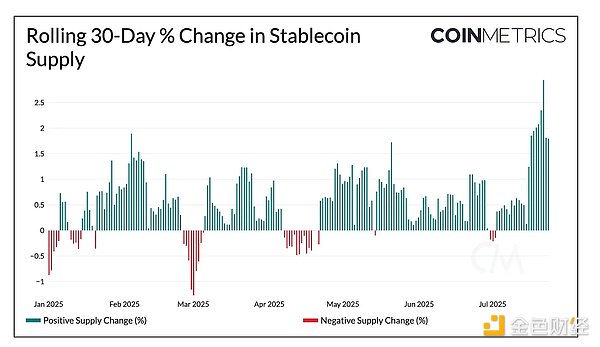

Recently, the supply of stablecoins has noticeably accelerated, as seen in the 30-day rolling supply changes, with the total supply now exceeding $255 billion.

This regulatory framework is expected to enhance public trust in fiat-backed stablecoins, lower the barriers for new entrants, and bring more competition to the payment market. From existing issuers (like Tether and Circle) to potential new participants (like regulated banks and fintech companies), this competition is likely to drive down transaction costs, enhance the payment experience for consumers and businesses, and further strengthen global demand for the U.S. dollar.

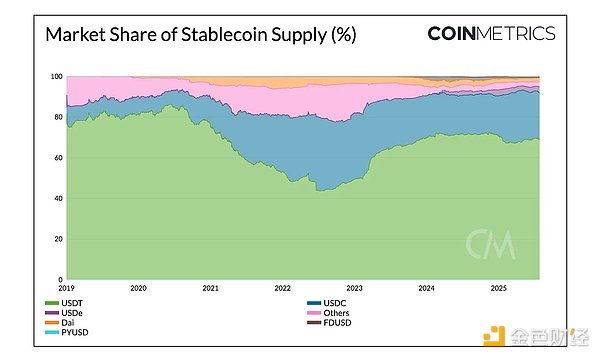

Among existing stablecoin issuers, Circle and Paxos appear to be best positioned to meet the requirements of the "GENIUS Act," as USDC and PayPal USD (PYUSD) have already adopted full reserve backing and provide regular audit reports. Circle is actively applying for a federal trust bank license from the Office of the Comptroller of the Currency (OCC) to fully comply with the GENIUS Act and provide custody services to institutional clients. Other major issuers are also undergoing structural adjustments to meet the new legal requirements.

For example, the federally licensed crypto bank Anchorage Digital has partnered with Ethena Labs to launch USDtb through its stablecoin issuance platform. With Anchorage providing federal oversight and reserve management, Ethena's USDtb becomes one of the first stablecoins fully compliant with the GENIUS Act. This issuance model provides a one-stop compliance solution for projects wishing to continue operating in the U.S. market.

In contrast, Tether (USDT), which occupies about 68% of the stablecoin market, faces a more complex adjustment path. USDT has long operated outside the U.S. regulatory framework, and its reserve assets include assets that do not meet GENIUS standards, such as Bitcoin and precious metals. In response, Tether plans to launch a compliant stablecoin for institutional payments and interbank settlements that will adhere to all the requirements of the GENIUS Act. The existing $162 billion USDT will continue to operate overseas, primarily serving emerging markets.

Stablecoin issuers have three years to meet the compliance requirements of the GENIUS Act. After that, only stablecoins that meet GENIUS standards will receive support from exchanges and custodians, providing ample adjustment time for all parties.

Conclusion

The recent surge in the total market cap of the crypto market to $4 trillion reflects the increasing market confidence in the entire asset class. Demand from ETFs and corporate treasuries continues to exceed new supply, further improving the supply-demand structure for BTC and ETH. Valuation metrics such as the market cap to realized value ratio (MVRV) for Bitcoin indicate that the market is not yet overheated.

Although the market is still dominated by strong ETF inflows and long-term holders, the leadership in the market is showing a gradual trend of diffusion.

Additionally, the passage of the "GENIUS Act" marks a key turning point in U.S. crypto regulation: it not only brings a clear regulatory framework for stablecoins but also paves the way for a competitive landscape and deeper integration with traditional finance. While there may still be volatility in the short term, the combination of solid structural demand, clear regulatory prospects, and an expanding range of participants suggests that the market will continue to strengthen in the future.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。